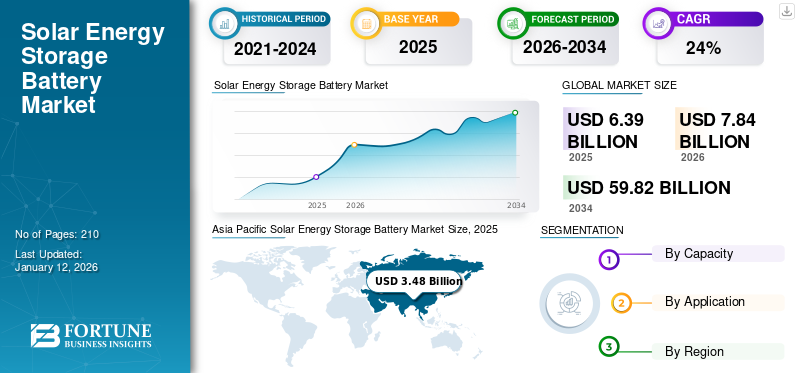

Solar Energy Storage Battery Market Size, Share & COVID-19 Impact Analysis, By Capacity (Below 10kWh, 10-19kWh, 20-29kWh, and Above 30kWh), By Application (Residential, Commercial, and Industrial) and Regional Forecast, 2026-2034

Solar Energy Storage Battery Market Size

The global solar energy storage battery market size was valued at USD 6.39 billion in 2025 and is projected to grow from USD 7.84 billion in 2026 to USD 59.82 billion by 2034, exhibiting a CAGR of 28.93% during the forecast period. Asia Pacific dominated the solar energy storage battery industry with a market share of 54.40% in 2025.

The solar energy storage battery is a crucial component of renewable energy systems. It allows for the efficient capture and storage of excess electricity generated by solar panels for use during periods of low or no sunlight. These batteries, often based on lithium-ion storage technology, store the energy and release it when needed, reducing reliance on the grid and maximizing self-consumption. Solar battery storage systems provide numerous benefits, including increased energy independence, grid resilience, and cost savings by avoiding peak electricity rates. They contribute to the transition towards a cleaner and more sustainable energy future, enabling individuals and businesses to harness the sun's power even when it's not shining.

COVID-19 IMPACT

Disruption in Supply Chain & Slow Down in Commercial Sector Slowed Market Growth

The COVID-19 pandemic has positively and negatively impacted the solar energy storage battery industry. On the negative side, COVID-19 poses a risk to investments made by individuals and small-scale to medium-sized enterprises in renewable energy sources. These investments run a higher risk of delay or cancellation. However, the impact of COVID-19 has highlighted the importance of reliable & resilient energy systems, driving interest in solar systems and battery storage. More people working from home and spending more time indoors resulted in demand for residential solar and battery storage systems. While COVID-19 initially presented challenges, it also created opportunities for the solar energy battery storage industry to adapt, innovate, and contribute to a more sustainable and resilient energy future.

LATEST TRENDS

Download Free sample to learn more about this report.

Global Movement Towards Renewable Energy and Grid Modernization to Spur Market Opportunities

Broad support for renewables and carbon emissions reduction also drives the adoption of solar battery storage solutions. The critical role that batteries can play in offsetting the intermittency of renewables and reducing curtailment is well known. Still, the strength and pervasiveness of the desire for clean energy among all types of electricity customers resulted in a rise in market demand. For example, In November 2021, Panasonic launched EverVolt 2.0, the next-generation solar energy battery storage system. The battery has AC- and DC-coupled, allowing the battery to work on both new and existing solar energy systems. It offers a weatherproof design helping in the easy installation and flexible placement.

Moreover, many developed countries use grid modernization programs to boost resilience in severe weather events, reduce system outages linked to aging infrastructure, and improve overall efficiency. These programs often involve deploying smart technologies within established electrical grids to enable two-way communication, advanced digital control systems, and integration of distributed energy resources.

DRIVING FACTORS

National Policy Framework across Key Countries Aids Market Growth

Additional opportunities for battery storage providers are arising from national policies to further various strategic objectives. Many countries see renewables plus storage as a new way to lessen their dependence upon energy imports, fill gaps in their generation mix, enhance the reliability and resiliency of their systems, and move toward environmental goals and de-carbonization targets. Some nations, such as Italy and Japan, are actively subsidizing and promoting energy storage as part of broad restructuring efforts to ensure reliability and reduce dependency on international energy companies and imports. These factors promise significant opportunities for solar energy storage battery market growth.

Financial Incentives Provided By Government Entities to Propel Market Growth

The widespread availability of government-sponsored financial incentives in the nations has further reflected policymakers’ growing awareness of the benefits battery storage solutions can deliver throughout the electricity value chain. These incentives appear to be particularly generous in countries that have energy security concerns, such as Italy, which offered a 50 percent tax deduction in 2017 for residential storage installations, or in nations that have an economic stake in battery manufacturing, such as South Korea, where government-supported investment in energy-storage systems.

RESTRAINING FACTORS

High Prices and Lack of Standardization Likely to Hinder Market Growth

Like any technology, battery storage is not always economical, and costs are often too high for a particular application. That is to be expected. The problem is that inaccurate perceptions of high costs can block batteries from being considered in the solution set. However, costs have been dropping so quickly that price declines are expected to continue regarding the cost of the battery technology and balance-of-system components. Although these supporting technologies do not generally garner as much press attention, they are just as important as the batteries themselves, and they could represent the next big wave of cost reductions.

Participants in early-stage markets often have to contend with diverse technical requirements and varied processes and policies. Battery suppliers are no exception. This disparity adds to complexity and costs throughout the value chain, making lack of standardization a significant roadblock to further deployment. Standardization could be particularly important to the proliferation of battery storage because of battery balance of charge issues. In other words, they can’t be discharged too far, or they will damage the units; network operators need to know how much power generation is left in a battery at a given time, and recharge/cycle times are different depending on the type of battery employed.

SEGMENTATION

By Capacity Analysis

Below 10kWh to Dominate Global Solar Energy Storage Battery Market Share Owing to Wide Adoption in Commercial Application

Based on the capacity, the market segments include below 10kWh, 10-19kWh, 20-29kWh, and above 30kWh. Solar energy battery storage with a capacity of up to 10 kWh with a share of 52.92% in 2026 and 10-19 kWh holds the dominant global market share owing to their wide adoption in the commercial and residential sectors that meet the store the desired amount of access energy production through solar energy which they can further use for their various applications.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Commercial Application Holds Dominating Market Size Owing to Increasing Installation

Based on the application, the market can be segmented into residential, commercial, and industrial applications. Commercial applications dominate the global market share 48.53% in 2026. Factors such as the increasing focus of businesses to reduce energy costs, achieve long-term energy savings, and store energy from emergency cases is driving the segmental global solar energy storage market trend.

Followed by commercial application, the residential sector holds a substantial market share for solar energy battery storage as it allows homeowners to store excess solar energy generated during the day for use during the evenings or in the event of a power outage. This increased energy independence and resilience appeal to homeowners who want to reduce their reliance on the grid, further driving the demand for solar energy storage. Subsequently, solar energy battery storage is also experiencing significant demand in the industrial sector owing to its reliable power supply to ensure uninterrupted operations.

REGIONAL INSIGHTS

Asia Pacific Solar Energy Storage Battery Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

The global solar energy storage battery market analysis has been conducted across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

In North America, the U.S. market is projected to reach USD 1.29 billion by 2026, supported by the increasing adoption of solar energy, rising demand for energy cost savings, grid resilience requirements, and strong government support and incentives.

Asia Pacific

Asia Pacific dominates the solar energy storage battery market, with the China market projected to reach USD 1.72 billion by 2026, the Japan market reaching USD 0.42 billion, and the India market reaching USD 0.24 billion, driven by the rapid expansion of solar power projects, growing energy demand, grid reliability concerns, and proactive government initiatives promoting renewable energy and storage technologies.

Europe

In Europe, the Germany market is projected to reach USD 1.09 billion by 2026, while the UK market is projected to reach USD 0.16 billion, with regional growth supported by a strong focus on renewable energy generation, energy independence goals, grid stability requirements, and favorable policies and incentives encouraging the adoption of solar and energy storage solutions.

Latin America and Middle East & Africa

Furthermore, in Latin America and the Middle East & Africa, demand for solar energy battery storage continues to grow, driven by the need for energy security, improved grid stability, reduced reliance on fossil fuels, and government initiatives promoting renewable energy deployment.

KEY INDUSTRY PLAYERS

Key Players Concentrate on Enhancing their Product Capabilities to Meet Customer Demand

The competitive landscape of the solar energy storage battery industry is dynamic and evolving. Several established companies and emerging players are vying for market share. Here are some notable players in the industry. Tesla, LG Chem Solutions, Enphase, Sonnen, SENEC, and others are major players operating in the market. Apart from these major players, numerous regional and emerging companies contribute to the competitive landscape. Product quality, cost-effectiveness, technology differentiation, market reach, and customer support influence companies' competitive positioning in the solar energy battery storage industry. For example, in November 2020, BYD Energy provided advanced energy storage batteries for the California solar power plant with the partnership of Canadian Solar Inc. BYD delivered the lithium-ion batteries storage solution, which acts as the full system integrator of the storage retrofit.

LIST OF TOP SOLAR ENERGY STORAGE BATTERY COMPANIES:

- Tesla (U.S.)

- LG Energy Solution (South Korea)

- Sonnen (Germany)

- Huawei (China)

- BYD (China)

- Panasonic (Japan)

- SENEC (Germany)

- Enphase Energy (U.S.)

- VARTA AG (Germany)

- E3/DC Corporation (Germany)

- BMZ Group Corporation (Germany)

- Pylontech (China)

- Generac (U.S.)

- AlphaESS (Singapore)

- Solax Power (China)

- SimpliPhi Power Corporation (U.S.)

- Victron Energy (Netherlands)

KEY INDUSTRY DEVELOPMENTS:

- March 2023 - LG Energy Solution announced an investment of USD 5.5 billion to build a battery manufacturing complex in Arizona (U.S.). It will consist of two manufacturing units one is for lithium iron phosphate (LFP) pouch-type batteries for energy storage systems (ESS), and the other is for cylindrical batteries for electric vehicles (EV).

- January 2023 - LG Energy Solution signed a memorandum of understanding (MoU) with three companies of the Hanwha Group to expand the battery business. With this, LG Energy Solution will make a joint investment to establish ESS production lines in the United States.

- January 2023 - Enphase Energy, Inc. announced today a partnership with Enerix to expand Enphase product offerings in Europe. Enerix will offer Enphase Energy Systems, powered by IQ Microinverters and IQ Batteries, to its network of more than 100 franchise partners across Germany and Austria through this partnership.

- October 2022 - Tesla (TSLA) announced that its energy storage division delivered a record number of batteries in Q3 2022. Tesla Energy is the company’s energy division that installs solar panels, solar roofs, and stationary energy storage products, like Powerwall and Megapacks. Energy storage deployment was at a record high of 2.1 GWh last quarter, truly an impressive deployment of batteries.

- December 2021 – Sonnen launched a new residential battery system for the Australian and New Zealand markets. The lithium-ion battery is the first outdoor home battery solution of Sonnen.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The solar energy storage battery report's market research presents a comprehensive industry assessment by offering valuable insights, facts, industry-related information, and historical data. Several methodologies and approaches are adopted to make meaningful assumptions and views to formulate the market research report. Furthermore, the report covers a detailed analysis of market segments, including applications and regions, helping our readers get a comprehensive global industry overview.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 28.93% from 2026 to 2034 |

|

Unit |

Value (USD Billion) & Volume (MW) |

|

Segmentation |

By Capacity, By Application, and By Region |

|

Segmentation |

By Capacity

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per Fortune Business Insights, the global market was valued at USD 6.39 Billion in 2025.

The global market is projected to grow at a CAGR of 28.93% over the forecast period.

The market size of Asia Pacific was valued at USD 3.48 Billion in 2025.

Based on application, the commercial application segment holds the dominating share in the global market.

The global market is expected to reach USD 59.82 Billion by 2034.

The key market drivers are the growing adoption of renewable and green energy targets that fuel investments in the solar industry.

The top players in the market are Tesla, LG Chem Solutions, Enphase, Sonnen, and SENEC, among others players.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us