Solar Pile Market Size, Share & Industry Analysis, By Type (Helical Piles/Screw Piles and Driven Piles), By Material (Steel, Aluminum, and Others), By Application (Utility, Residential, and Commercial and Industrial), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

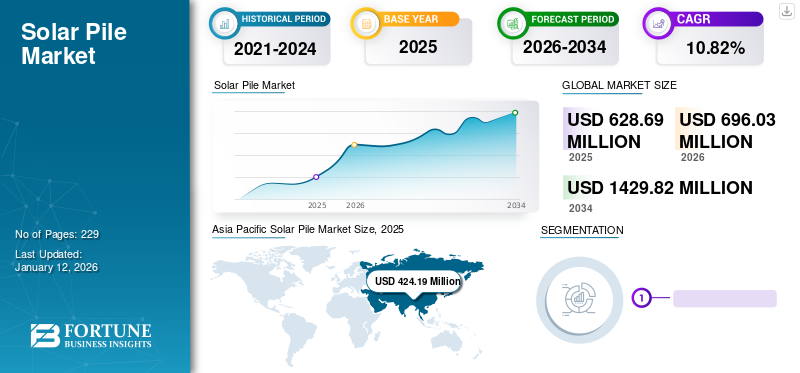

The global solar pile market size was valued at USD 628.69 million in 2025 and is projected to grow from USD 696.03 million in 2026 to USD 1429.82 million by 2034, exhibiting a CAGR of 10.82% during the forecast period. Asia Pacific dominated the global market with a share of 67.47% in 2025.

A solar pile refers to the structural support system used for the installation of solar panels. These piles, typically made from materials, such as steel or concrete, are installed into the ground to create a stable foundation for solar arrays. The design and installation of solar foundations play a crucial role in ensuring the durability and longevity of solar energy systems. It provides stability against environmental factors, such as wind loads, and ensures optimal alignment of solar panels for maximum energy capture. This technology is essential for the efficient deployment of solar energy projects, contributing to the sustainability and reliability of solar power generation. The market is increasing at a considerable rate duet to the robust expansion of solar projects across the globe.

COVID-19 has created challenges in the market. The challenges such as disruption in the production and supply chain. COVID-19 became a health threat globally, affecting several countries. In addition to supply chain disruptions, many piles equipment manufacturers had temporarily shut down their factories due to the pandemic. These shutdowns have led to a reduction in production capacity and delayed the delivery of orders.

Some of the international solar installation project decisions might have been delayed due to supply chain problems.

Solar Pile Market Trends

Technological Advancements in the Solar Industry to Boost Market Growth

Innovations in the solar industry, such as enhanced materials and design developments, have been continuously evolving to make solar energy more efficient and cost-effective. The continuous development of more cost-effective and sustainable solar power and solar pile-driving solutions, further positions the market to capitalize on technological advancements and cater to the changing needs of the solar energy sector. For instance, in 2023, Trimble and Mincon collaborated on a line of solar pile-driving solutions. They introduced a series of drilling attachments tailored for use with Mincon skid steers and excavators specifically designed for solar construction applications. Mincon's Solar Installation Drills and Pile Drivers are crafted to pre-drill through rocky terrain, set ground screws, and drive piles, catering to the needs of solar construction projects. Trimble Groundworks is a dedicated machine control solution that allows contractors to execute drilling & piling operations.

Furthermore, in the year 2023, Carlson Machine Control unveils two innovative pile driving programs tailored for the solar market. Carlson Machine Control, a firm with expertise in land development and associated machine programming, has introduced an automated solution for precise structural pile placement and an upgraded version of its PD Grade Solution, named PD Grade 3Z. The Pile Placement solution incorporates Carlson's specialized Grade software, offering operators real-time on-screen views for enhanced accuracy in pile placement.

Download Free sample to learn more about this report.

Solar Pile Market Growth Factors

Increasing Solar Farm Projects is leading the Market Expansion

A solar farm is one of the trending energy sources for so many applications driven by renewable energy. Moreover, rising solar farms also require solar equipment, such as piles, frames, PV winnowers, fences, and others subsequently, fostering the market growth.

For Instance, in 2023, the New South Wales Independent Planning Commission granted conditional approval for the development of a 215-MW solar park in the New England Renewable Energy Zone of the Australian State. Such a Project Might Surge the adoption of solar piles and drive the solar pile market growth.

The market is also driven by the rising solar energy responsiveness and increasing solar farm projects. Solar piles have become one of the most important tools to support the whole solar panel system. In addition, locals' adaptation of solar panels is driven by government initiatives and locals' awareness of the energy transition. This is also one of the major factors leading to the growth of the market worldwide.

For Instance, on April 20th, 2023, the Maharashtra Chief Minister decided to deliver a rent of Rs 1.25 lakh (USD 1,439.64) per year to farmers who lease out farms or land to the government for over 30 years to set up the solar system. The rent cost will increase by 3% annually.

Favorable Government Incentives and Policies Regarding Solar Energy Drives Market Growth

Solar energy is becoming one of the favorable renewable energy for several applications driven by awareness in businesses. In addition, many businesses and locals are installing solar panels for their use. However, installation of solar panels and farms is not easy as they must go through so many standards for solar panels, structures, piles, geotechnical surveys, and others. Government policies and standards advise LPAs (Layered Process Audits) to consider their possible impacts on the environment and the views of local communities when identifying suitable sites and installation equipment such as solar piles.

For instance, on March 9th, 2023, the Uttarakhand state government in India launched two agendas with the intention of providing self-employment opportunities to enterprising youth and farmers to meet the demand for energy in rural areas through the development of alternative energy sources such as solar.

Solar farms, in particular, necessitate planning and installation permissions, with the application being determined by the size of the solar farm in relation to its capacity. For instance, in the U.K., solar farms generating less than 50 megawatts (MW) require development permission from the local planning authority (LPA). Moreover, solar farms with a production capacity exceeding 50 MW necessitate development consent from the Secretary of State for Energy Security and Net Zero, given their classification as nationally significant infrastructure projects (NSIPs). The establishment of such initiatives and standards for businesses is crucial for the improved installation of solar panels.

RESTRAINING FACTORS

Imperfections in Designs and Challenges in Installation Testing & Inspection Hinder Market Growth

Utility-scale solar installations are increasing globally, offering consumers numerous advantages. However, they also present significant challenges, particularly in addressing issues, such as the design and ground-level installation of solar panels and piles. Det Norske Veritas DNV, an internationally accredited Registrar and Classification Society, has observed instances where piles settle or sink unpredictably shortly after the installation of load-bearing structures, such as trackers, panels, or modules, without exposure to crucial environmental loads.

Another limiting factor is that sub-surface conditions and solar power plant sites are susceptible to variable conditions that can harm solar projects. On a positive note, this challenge can be addressed in the upcoming years as technologies evolve to provide a more stable and reliable structure for solar systems.

Solar Pile Market Segmentation Analysis

By Type Analysis

Helical/Screw Piles Hold Maximum Share in the Market Owing to its Versatile Applications

Based on the type, the market is segmented into helical/screw piles and driven piles.

The helical/screw piles hold the larger share of 60.52% in 2026 the market owing to their surging applications in solar structures. Helical/screw piles are fastened deeply into the ground, section by section, if necessary. They are screwed into the ground till it is proven that the space can accurately hold the required bearing capacity of the solar structure.

Driven piles also hold a considerable share in the market as they are cost-effective, have high capacity, and show minimal disturbance during installation processes.

By Material Analysis

Aluminum is Projected to Grow Considerably Owing to its Corrosion Resistance and Cost-effectiveness

Based on material, the market is segmented into steel, aluminum, and others.

Among these, steel is the dominant segment in the market share of 58.27% in 2026, owing to its advantageous factors like strength & stability, and corrosion-resistant, which provides durable support for solar installations in a different environments. Steel-based are sturdy and long-lasting for heavy solar structures. Solar farms are one of the trending applications in which these steel piles are being used.

In addition, the aluminum segment is also gaining traction in the market and is also one of the fastest-growing segments. It is a cost-saving material, and at the same time, it delivers properties, such as corrosion resistance, lightweight, heat-conducting, and recycling. In addition, it also has a good strength-to-weight ratio, which implies that despite its lightweight nature, aluminum has a high strength-to-weight ratio. Aluminum-based piles can offer robust structural support while reducing the overall weight of the structure.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Utility Segment Dominates the Market Due to Large Installations of Solar Energy in this Sector

By application, the market is classified into utility, residential, commercial, and industrial.

The utility segment accounted for majority market share of 61.77% in 2026 as it covers large areas, often spanning several hectares or acres. The rising government investment and policies for the expansion of solar projects for supplying electricity to the consumers, results in the larger market share for utility segment. As a result, a substantial number of solar piles are needed to support the vast number of solar panels required to produce large amounts of electricity.

The commercial and industrial segments also hold a considerable share of the global market, which contributes to its growth. The growing requirement for electricity in the industrial sector and commercial sector and the goal of net zero are the key factors driving solar energy, further attributing the market growth.

REGIONAL INSIGHTS

Geographically, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Solar Pile Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 424.19 billion in 2025 and USD 478.87 billion in 2026. As per the rise in awareness of energy transition programs, Asia Pacific is expected to dominate the solar pile market share and would witness the fastest growth in the forecast years as well. Zero carbon emission, clean energy, and the boom in the adaptation of solar energy drive the demand for solar power. This factor is driving the market in countries, such as India and China. For instance, as per IRENA, China installed around 86,059 MW in 2022. The Japan market is valued at USD 45.29 million by 2026, the China market is valued at USD 305.31 million by 2026, and the India market is valued at USD 45.22 million by 2026.

North America

North America is also growing at a steady rate in the market after Asia Pacific owing to the government's goal to achieve net zero emissions. The U.S. government targeted to install an average of 30 GW of solar capacity per year between 2020 and 2025 and 60 GW per year from 2025-2030. The U.S. market is valued at USD 59.94 million by 2026.

Europe

Europe market would expand considerably due to the rising ambitious renewable energy goals to reduce carbon emissions and combat climate change. Additionally, the favorable policies, subsidies, and incentives for solar energy encourage investment in solar projects, fueling the growth of solar pile installations. For instance, in July 2023, The Dutch government proclaimed the latest list of projects to receive funding under its National Growth Fund, which comprises up to USD 391 Million invested into “circular solar panels.” The UK market is valued at USD 6.54 million by 2026, while the Germany market is valued at USD 13.56 million by 2026.

The Middle East & Africa is also one of the major regions due to the continued advancement of solar-based projects and meeting the economic vision targets of the GCC and other African countries.

List of Key Companies in Solar Pile Market

Market Players are Investing in Innovative Designs to Strengthen Their Product Portfolio

Leading market players Such as Skyline Steel LLC, Solar Pile International, Paco Steel, and others are offering solar piles for both large and small businesses globally to strengthen their market position. The companies are also investing in innovative pile designs and sustainable materials, enhancing installation efficiency, and collaborating with solar energy developers to meet evolving industry standards. Moreover, many are offering innovative solutions to suit varied terrain and project scales, ensuring broader adoption of solar technology.

Nucor Skyline's manufacturing and coating proficiency comprises spiral weld pipe, cold form sheet piling, welded pipe, threaded bar, and accessories in Illinois, Arkansas, New Jersey, Mississippi, Pennsylvania, Washington, and Ohio. Its products are used in numerous applications such as solar, water & sewer, and others.

- The Bear Creek Solar project, located in Richland County, WI, U.S., will connect to the electrical transmission grid directly via the local substation. Civil engineering has been completed, and Nucor Skyline piles, which anchor the solar array structures to the ground, are installed in this project. The site is completed in 2022.

LIST OF KEY COMPANIES PROFILED:

- Reliance Piles (U.S.)

- Solar Pile International (U.S.)

- Ram Jack (U.S.)

- Conte Company (U.S.)

- Paco Steel (U.S.)

- Skyline Steel, LLC (U.S.)

- Magnum Piering (U.S.)

- Unimacts (U.S.)

- Grid Structures (U.S.)

- Xiamen Enerack Technology Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS:

- October 2023 – Russell Marine utilized over 2,000 tons of Nucor Skyline pipe piles to develop a berth at the Port of Galveston that will be used as a new Royal Caribbean Cruise Terminal.

- July 2023 – Solar Pile International announced the successful completion of the final delivery of solar piles to the Glenrowan West Solar Farm. It delivered around 100 truckloads of H-Beams piles to the project site by mid-July.

- January 2023 – Burns & McDonnell, an engineering, architecture, and construction company, completed the development of three solar sites for Alliant Energy in Wisconsin. It announced the development of six additional solar sites for Alliant Energy. The total construction of the nine solar projects in the Bear Creek, Wood County, and North Rock sites requires around 7,273 tons of wide flange solar piles, which the company has been sourcing from Nucor Steel Berkeley mills and Nucor-Yamato Steel.

- November 2022 – Manufacturing company Zetwerk acquired Unimacts for about USD39 million. This acquisition enhances Zetwerk's business, facilitating additional expansion and diversification. It also grants immediate access to prominent customers in the solar and wind power sectors.

- June 2020 – Solar Pile International has revealed its nomination to supply the patented Solar X Wing Pile for an innovative utility-scale solar farm project in the U.S. This project is expected to generate over 215,000 MW-h of energy, providing sufficient electricity to power approximately 18,000 homes.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

An Infographic Representation of Solar Pile Market

To get information on various segments, share your queries with us

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.82% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Material

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights states that the global market was USD 696.03 million in 2025.

The global market is projected to grow at a CAGR of 10.82% over the forecast period.

The Asia Pacific solar pile market size stood at USD 478.87 million in 2026.

Based on application, the utility segment holds a dominating share of the global market.

The global market size is expected to reach USD 1429.82 million by 2034.

Increasing number of solar farm projects is propelling market growth.

Solar Pile International, Skyline Steel, and Unimacts are some of the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic