Spinal Cord Stimulation Market Size, Share & COVID-19 Impact Analysis, By Product (Rechargeable and Non-rechargeable), By Disease Indication (Failed Back Surgery Syndrome (FBSS), Degenerative Disc Disease (DDD), Complex Regional Pain Syndrome (CRPS), Arachnoiditis, and Others) By End User (Hospitals, Ambulatory Surgery Centers, and Specialty Clinics), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

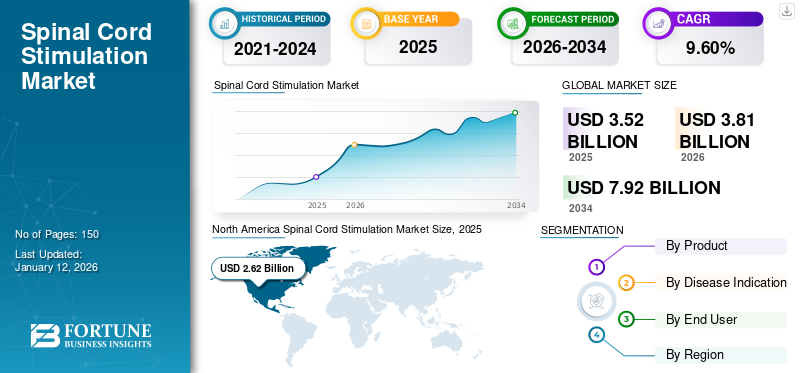

The global spinal cord stimulation market size was valued at USD 3.52 billion in 2025. The market is projected to grow from USD 3.81 billion in 2026 to USD 6.48 billion by 2032, exhibiting a CAGR of 9.1%. North America dominated the spinal cord stimulation market with a market share of 74.44% in 2025.

The global impact of COVID-19 has been unprecedented and staggering, with spinal cord stimulation witnessing a negative demand shock across all regions amid the pandemic. Based on our analysis, the global SCS market will exhibit a huge decline of -16.3% in 2020. The sudden rise in CAGR is attributable to this market’s demand and growth, returning to pre-pandemic levels once the pandemic is over.

Neuromodulation is an emerging therapy involving targeted delivery of electromagnetic or chemical stimulation to a specific neurological area in the body. One of the neuromodulation techniques is spinal cord stimulation, which consists of delivering electrical stimuli to the spinal cord resulting in masking of pain. SCS is receiving increased worldwide attention, which can be attributable to the technological advancement, emerging government guidelines for SCS procedures, and rapid adoption of minimally invasive therapies.

Apart from this, the increasing number of SCS implantations is propelling the market. According to the Centers for Disease Control and Prevention, around 50 million adults in the U.S. are estimated to suffer from chronic pain that provides a massive opportunity for the SCS market. Growing attention towards spinal cord stimulators, as they reduce the intake of opioids and other pain-relieving drugs is boosting the market during the forecast period.

Postponement of Non-compulsory Surgeries to Negatively Impact Market During COVID-19

The COVID-19 pandemic has disrupted the healthcare environment. From ICUs to the general ward, the hospitals are flooded with patients increasing the burden on healthcare providers and resources. Hence, in order to re-allocate the healthcare resources for the management of COVID-19 patients, the government decided to postpone all the elective and non-urgent surgeries. According to COVIDSurg, around 28.4 million surgeries were canceled or postponed during the peak of 12 weeks of disruption due to COVID‐19.

Surgical procedures were classified from 1, which stood for emergency procedures such as heart transplants, to 5, which stood for truly elective procedures such as cataract surgeries. With the spinal cord stimulation procedures being classified as level 5 procedures, many implantations got deferred, in-turn declining the demand for stimulators.

The impact of the pandemic on the SCS market was evident from the performance of the major companies operating in this market. For instance

- Abbott’s neuromodulation segment reported a 30.1% decline in the global revenues during the first quarter of 2020 when compared to the same period in 2019.

- The neuromodulation segment of Boston Scientific Corporation witnessed a 24.6% decline in sales globally during the first six months of 2020 when compared to the same period in 2019.

Global Spinal Cord Stimulation Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 3.52 billion

- 2026 Market Size: USD 3.81 billion

- 2034 Forecast Market Size: USD 7.92 billion

- CAGR: 9.60% (2026–2034)

Market Share Analysis:

- North America led the global spinal cord stimulation market with a 74.44% share in 2025, driven by high prevalence of chronic pain disorders, favorable reimbursement policies, and early adoption of advanced neuromodulation therapies.

- By Product, the Rechargeable segment held the largest share in 2026, owing to its cost-effectiveness, longer battery life, and fewer replacement surgeries.

Key Country Highlights:

- United States: Largest contributor globally, driven by increasing adoption of non-opioid therapies, a strong reimbursement framework, and presence of key players like Medtronic, Abbott, and Boston Scientific.

- Germany & U.K.: Major European markets with rising adoption of advanced SCS technologies and favorable clinical guidelines for chronic pain management.

- China & India: Emerging high-growth markets due to a growing geriatric population, rising awareness about neuromodulation therapies, and improving healthcare infrastructure.

- Latin America & Middle East & Africa: Underpenetrated but lucrative markets with increasing healthcare expenditure and growing prevalence of chronic pain disorders.

LATEST TRENDS

Download Free sample to learn more about this report.

Shift towards Non-opioid Alternative Therapies to Drive Market Growth

Opioids belong to the class of narcotic pain medication and hence are associated with serious side-effects. Heavy reliance on opioid painkillers in managing chronic pain has led to the dangerous trend of addiction among patients

- According to the CDC, a total of over 168 million opioid prescriptions were dispensed in the U.S. in 2018.

- More than 67,000 drug overdose deaths in the U.S. in 2018 were caused due to opioids, and prescription opioids were involved in 32% of these deaths.

Owing to these factors, the government in the U.S., Europe, and others has increased its efforts to reduce the dependence on opioids. This has resulted in a gradual shift towards non-opioid alternative therapies and rising demand for spinal cord stimulation devices. For instance, in 2018, the FDA received over 200 submissions from companies seeking a speedy approval process for devices that can be used in place of opioids for pain management. Hence, medical device companies such as Medtronic, Abbott, and Boston Scientific are continuously researching to introduce new products and utilize this opportunity.

DRIVING FACTORS

Technological Advancements in the Spinal Cord Stimulators to Favor Growth

The manufacturers have increased their research activities to minimize the size of the spinal cord stimulators. For example, the Freedom SCS system manufactured by Stimwave LCC is around 5% of the size of the current Implantable Pulse Generators (IPG) available in the market. This, combined with advancements in impulse generation, is driving the spinal cord stimulation market growth. The U.S. based company, Stimgenics, developed a novel SCS waveform called Differential Target Multiplexed (DTM) SCS. The company was acquired by Medtronic in January 2020. Results from a study comparing the Differential Target Multiplexed (DTM) SCS to conventional ones showed significant pain relief.

Another notable technology being used to generate the impulse is HF10 therapy, which has proved to be more effective than the traditional spinal cord stimulation therapies. Apart from this, the presence of platforms such as WaveCrest and Intellis that can be wirelessly connected with smartphones and tablets for adjusting the dosage settings is favoring the adoption of SCS.

Emerging Government Guidelines for SCS to Boost the Market

The emergence of guidelines for spinal cord stimulation therapy is one of the primary reasons for the growth of the market. Various government associations are developing guidelines for this therapy for the treatment of chronic pain and other disease indications. In January 2019, National Institute for Health and Care Excellence published guidelines and recommendations for the Senza SCS system, which delivers HF10 therapy to treat patients having neuropathic pain. Such positive recommendations by government associations are likely to boost the market.

RESTRAINING FACTORS

High Cost of Trials and Implantation Procedures to Hinder Growth

The average cost of implanting spinal cord stimulators in the U.S. ranges from USD 21,000 to USD 58,000. The cost of the procedure also depends on whether the patient is covered by private health insurance, public health insurance, or paying out-of-pocket. Apart from this, the patient also needs to pay annual maintenance costs, including the cost of the hardware, fees of healthcare personnel, replacement of pulse generators, hospitalization, etc.

The annual maintenance cost is in the range of USD 5,000 to USD 21,000, depending on complications. The majority of health insurance plans require the patient to undergo trials to check if spinal cord stimulation is a good treatment option, which can cost around USD 8,000 before covering the cost of the implantation procedure. Thus, the high cost of the SCS implant is expected to hinder the market growth.

SEGMENTATION

By Disease Indication Analysis

To know how our report can help streamline your business, Speak to Analyst

Failed Back Surgery Syndrome Segment to Dominate the Market

Based on disease indication, the market is segmented into failed back surgery syndrome (FBSS), degenerative disk disease, complex regional pain syndrome (CRPS), arachnoiditis, and others. The FBSS segment dominated the market with a share of 47.22% in 2026, owing to the rising number of spinal surgeries. In 2017, Medtronic conducted a study from data collected from seventy-nine centers in North America, Europe, and South America. According to that study, out of 4,867 total SCS patients enrolled, 44.6% were implanted for the treatment of failed back pain. This is likely to favor the growth of the FBS segment.

Arachnoiditis is a rare disease and accounts for about 25,000 cases each year globally. As the disease does not have any specific treatment, SCS is available as an effective option for the management of the disease, in-turn favoring the segment growth. Increasing demand for minimally invasive surgeries and growing preference for SCS are prominent reasons responsible for the expansion of the CRPS and other segments.

Degenerative Disk Disease (DDD) segment, on the other hand, is anticipated to showcase lucrative growth during the forecast period. High growth is attributable to the rising prevalence of DDD and the increasing geriatric population.

By Product Analysis

Rechargeable Segment held the Maximum Portion of the Market

Based on product, the market is categorized into rechargeable and non-rechargeable. The rechargeable segment dominated the market with share of 64.27 in 2026 and is projected to witness remarkable growth during the forecast period. This can be attributable to the significant cost-saving with the use of rechargeable stimulators when compared to non-rechargeable ones.

Based on a study, the rechargeable spinal cord stimulator can save up to USD 100,000 over a patient’s lifetime compared to a non-rechargeable device. The other advantage of a rechargeable device is that it requires fewer surgeries and reduces patient discomfort and complications. These key factors are estimated to foster the segment’s growth.

The non-rechargeable segment is anticipated to grow owing to the rising prevalence of chronic back pain and the increasing number of failed back surgeries. Apart from this, increased efforts to increase the battery life of non-rechargeable stimulators are expected to drive the segment’s growth. For instance, in September 2019, Abbott announced the launch of the Proclaim XR recharge-free SCS system, which can last up to 10 years.

By End User Analysis

Rising number of SCS Implantations to Render Leading Position to the Hospitals Segment

In terms of end-user, the market can be bifurcated into hospitals, ambulatory surgery centers, and specialty clinics.

Hospitals accounted for more than half of the market with share of 52.73% in 2026 and are expected to dominate the market throughout the forecast period. SCS being a surgical procedure is predominantly done in hospitals, which is an important factor driving the growth of the hospital segment. Furthermore, favorable health reimbursement policies and increasing patient pool are likely to surge the segment growth

The ambulatory surgical centers' segment is expected to grow owing to the increasing number of minimally invasive surgeries being performed in ASCs. The rising prevalence of DDD and failed back syndrome and growing efforts of manufacturers to increase the penetration of SCS among patients in the U.S. are factors contributing to the expansion of the specialty clinics segment.

REGIONAL INSIGHTS

North America Spinal Cord Stimulation Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The market size in North America stood at USD 2.62 billion in 2025. Emerging government guidelines and favorable health reimbursement are the factors responsible for the expansion of the market in North America. Furthermore, the strategic presence of key players in the U.S. and new product launches are propelling the market in North America. The U.S. market is projected to reach USD 2.59 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is anticipated to be the second most prominent region in terms of revenue in 2019. The launch of Spectra WaveWriter spinal cord stimulator system by Boston Scientific in January 2019 is poised to surge the growth of the market in Europe. Besides, the rising prevalence of degenerative disc diseases and chronic pain is anticipated to boost the market in Europe. The UK market is projected to reach USD 0.07 billion by 2026, while the Germany market is projected to reach USD 0.12 billion by 2026.

Asia Pacific

Asia Pacific is projected to register the highest CAGR during the forecast period. The region is anticipated to grow owing to the rapid adoption of neuromodulation therapies and the high presence of the geriatric population in this region. The Japan market is projected to reach USD 0.09 billion by 2026, the China market is projected to reach USD 0.1 billion by 2026, and the India market is projected to reach USD 0.05 billion by 2026.

Middle East & Africa and Latin America

The rest of the world, which includes the Middle East & Africa and Latin America, and others, holds huge growth potentials and is anticipated to emerge as a lucrative segment. The rising prevalence of chronic back pain and rising demand for minimally invasive therapies are factors contributing to the expansion of the market in the rest of the world.

KEY INDUSTRY PLAYERS

High Preference for Medtronic’s SCS Products to Render it a Leading Position

In terms of market revenue, Medtronic dominated the market owing to the company’s strong focus on R&D as well as key acquisitions that will assist it in developing innovative devices to manage chronic pain. Spinal cord stimulators offered by the company have long battery life, easy to use with better clinical outcomes, and good customer support services, and hence are having a high preference among healthcare providers.

On the other hand, Boston Scientific and Abbott are in close competition. In January 2017, Abbott completed the acquisition of St. Jude Medical, Inc., which marketed its entry into the SCS market. However, new players such as Nevro Corp, with its proprietary HF10 therapy are also witnessing remarkable growth in the market and are anticipated to give tough competition to established players.

LIST OF KEY COMPANIES PROFILED

- Boston Scientific Corporation (Massachusetts, U.S.)

- Medtronic (Dublin, Ireland)

- Abbott (Illinois, U.S.)

- Nevro Corp (California, U.S.)

- Nuvectra (Texas, U.S.)

- Stimwave LLC (Florida, U.S.)

- Other prominent players

KEY INDUSTRY DEVELOPMENTS:

- January 2020 – Medtronic plc acquired Stimgenics LLC, a leading company that has pioneered a novel spinal cord stimulation waveform known as Differential Target Multiplexed SCS.

- November 2019 – Nevro Crop received FDA approval for Senza Omnia Spinal Cord Stimulation (SCS) System in the U.S.

- September 2019 - Abbott announced the launch of Proclaim XR recharge-free SCS system, which can last up to 10 years

- January 2019 – Spectra WaveWriter SCS system was launched by Boston Scientific for the treatment of chronic pain in Europe.

- January 2017 - Abbott completed the acquisition of St. Jude Medical, Inc., which marketed its entry into the SCS market.

REPORT COVERAGE

The spinal cord stimulation market research report offers an in-depth analysis of the market. It further provides details on the adoption of SCS across several regions. Information on trends, drivers, market opportunities, threats, and restraints of the market can further help stakeholders to gain valuable insights into the market. The report offers a detailed competitive landscape by presenting information on key players, along with their strategies, in the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTES |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.60% from 2021-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Product

|

|

By Disease Indication

|

|

|

By End User

|

|

|

By Geography

|

Frequently Asked Questions

The value of the global market was USD 3.52 billion in 2025.

Fortune Business Insights says that the market is projected to reach USD 7.92 billion by 2034.

The value of the market in North America was USD 2.62 billion in 2025.

The market is projected to rise at a CAGR of 9.60% during the forecast period (2026-2034).

The Failed Back Surgery Syndrome (FBSS) is the leading segment in this market.

The technological advancements in spinal cord stimulators and emerging government guidelines for SCS are the key factors driving the global market.

Medtronic, Boston Scientific Corporation, and Abbott are the top players in the global market.

North America dominated the spinal cord stimulation market with a market share of 74.44% in 2025.

The shift towards non-opioids alternative therapies is a key trend in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us