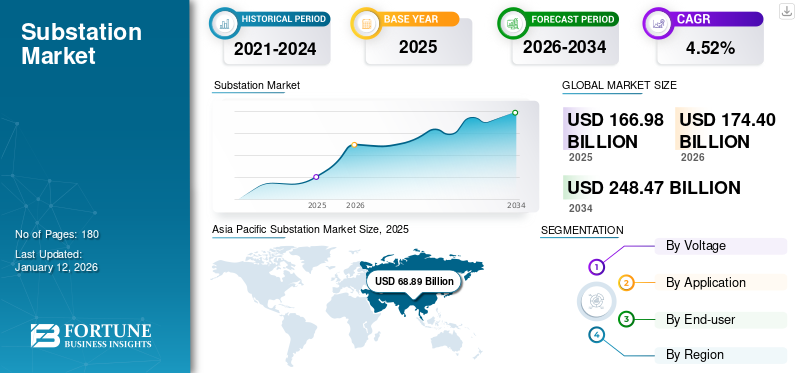

Substation Market Size, Share, and Industry Analysis, By Voltage (Low, Medium, and High), By Application (Transmission and Distribution), By End-user (Utilities and Industrial), and Regional Forecast, 2026-2034

Substation Market Size

The global substation market size was valued at USD 166.98 billion in 2025 and is projected to be worth USD 174.4 billion in 2026 and reach USD 248.47 billion by 2032, exhibiting a CAGR of 4.52% during the forecast period. Asia Pacific dominated the global market with a share of 41.26% in 2025. The Substation market in the U.S. is projected to grow significantly, reaching an estimated value of USD 47.78 billion by 2032.

A substation is an electrical set-up with a high-voltage capacity that can be used to control the generators, circuits, and systems. The set-up is majorly used to convert AC to DC and is available in different sizes & voltage and also consists of an inbuilt transformer along with related switches. Some huge substations are built with different transformers, circuit breakers, switches, and other equipment.

The global impact of COVID-19 has been unprecedented and staggering, with witnessing a negative impact on demand shock across all regions amid the pandemic. Almost every industry vertical, from power generation and oil & gas to manufacturing, mining, railway, and construction. The power generation, transmission, and distribution segments have faced adverse impacts due to unprecedented situations. Various power transmission and distribution projects were halted due to the nationwide lockdown and declining power demand from industrial and commercial sectors. Several upcoming projects were also halted, and the industry suffered from investment issues due to COVID-19.

Substation Market Trends

Growing Demand for Uninterrupted Power Supply Provides Growth Opportunity

Power consumption in most of the world has surged significantly in recent years. Robust economic development, increasing population, and industry establishment have increased power consumption. The penetration of electrically powered equipment is also increasing worldwide. Several economies are witnessing increased power demand due to the development of new energy infrastructure and the expansion of existing ones. Rapid urbanization and the rising living standards of people increase the demand for uninterrupted electricity supply generation. Several countries are increasing their power generating capacity and grid investment for efficient transmission and distribution to overcome the surging power demand.

Download Free sample to learn more about this report.

Substation Market Growth Factors

Expansion of Micro-Grids Network to Propel Growth in Market

Microgrids are expanding worldwide as the investment in power grid networks is widely increasing. Governments are also keenly interested and constantly working on the grid expansion in several countries. The investment in cross-border grid networks is also increasing globally. The increasing power consumption increases the demand for network infrastructure for the transmission and distribution of electricity worldwide. The investment in smart grid networks is also rapidly increasing across the world. The above factors are responsible for substation market growth during the forecast period.

According to the World Bank Multi-Tier Framework, over 25% of the global population (over 2 billion people) suffers from energy poverty or lack of access to power. World Bank's "Mini Grids for Half a Billion People" report estimates that universal access will require more than 217,000 microgrids by 2030, costing USD 127 billion, which will provide 430 million people with first-time access (USD 105 billion) and 60 million people with improved access to electricity (USD 22 billion). For instance, in 2022, Japan announced a USD 155 billion fund to encourage investment in new power grid technologies, including microgrid systems, energy-efficient homes, and other carbon footprint-reduction technologies.

Rising Retrofit and Refurbishment of Existing Grid Infrastructure Augmented Growth in the Market

Several developing and developed countries worldwide have started investing in refurbishment or replacement work in the existing power grid infrastructure. The aging infrastructure is increasing, disrupting the smooth and efficient operation of electrical systems. This increases the demand for electrical infrastructure retrofitting across various countries. The refurbishment and retrofit of the existing infrastructure help extend its life and achieve maximum efficiency.

As per the International Energy Association, the EU action plan envisages investment of about USD 633 billion in the electricity grid by the end of 2030, of which around USD 434 billion has been earmarked for the distribution grid, including USD 184 billion for the digitalization of grid system. In January 2023, China's State Grid Corporation announced an investment of USD 329 billion over the 14th Five-Year Plan till 2025. China's Southern Power Grid is estimated to contribute USD 99 billion, which brings the total nationwide investment to USD 442 billion.

RESTRAINING FACTORS

Higher Dependency on Import May Hinder the Growth of the Market

The transmission & distribution lines and towers include raw materials such as cables, steel, and alloys. These alloys are majorly imported by several nations across the world. The substations also involve high use of components, which are majorly imported by the majority of countries across the world. The high dependency on imports hinders market growth as the import and export regulations fluctuate, impacting the overall cost of such equipment.

Substation Market Segmentation Analysis

By Voltage Analysis

Low Voltage Segment Dominated the Market in 2024

Based on voltage, the market is segmented into low, medium, and high. The low-voltage segment dominated the market in 2024. The demand for low voltage systems is high due to rising electricity supply-demand from the residential or commercial sector, with a share of 44.64% in 2026. The population around the world is increasing along with the increasing penetration of electronics across the globe. This increases the demand for an uninterrupted power supply. Thus, it could drive the growth of the low voltage segment during the forecast period. In 2020, as per the Central Electricity Authority, India added around 21.3 MVA capacity of 220 kV AC substations nationwide.

The medium segment is anticipated to record robust gains over 2019-2032. With urbanization and industrialization, the demand for higher voltage supply will increase across the industrial and commercial sectors. The number of data centers is also widely rising across the world. The prevailing trend could trigger the need for the medium voltage segment over the projected timeframe.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Distribution Segment Likely to Record Highest CAGR During 2025-2032

Based on application, the market share is broken down into transmission and distribution. The distribution segment is expected to hold a dominant market share of 65.02% in 2026. The electricity demand is soaring rapidly worldwide, which could trigger the demand for smooth distribution networks across the globe. The expansion of existing energy infrastructure, along with increasing demand for efficient electricity grids across several developing countries, drives the growth of the distribution segment of this market during the forecast period.

The transmission segment is likely to witness growth at a significant pace during the forecast period. The demand for efficient transmission networks is increasing widely across several countries due to increasing power consumption from end-users and increasing installation of power grids worldwide. The prevailing trends will likely boost the demand for transmission systems during the forecast period.

By End-user Analysis

Utilities Segment to Dominate the Market

Based on end-users, the market is segmented into utilities and industrial. The utilities segment dominated the market share of 74.17% globally in 2026. The utility segment is experiencing high demand with surging uninterrupted power supply and increasing installation of efficient power grids.

The industrial segment is likely to witness significant growth during the forecast period. The demand for uninterrupted electricity supply is widely increasing across the industrial sector due to rapid industrialization across developing countries. The paradigm shift from conventional to electric vehicles also increases the demand for smooth and efficient grids from transportation industries. This will likely drive growth in the industrial segment in the coming years.

REGIONAL INSIGHTS

Geographically, the worldwide substation market share is split into North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Substation Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

In 2024, the Asia Pacific region dominated the global market share and will continue to hold a notable share through 2032. This region's electricity demand is rapidly increasing due to the increasing population. Rapid urbanization and industrialization also increase the demand for an uninterrupted power supply. The investment in infrastructure development effective transmission and distribution systems is increasing across China, India, and Australia. Governments are increasing electricity generation within the region, which increases the demand for the installation of such systems. The surging capacity of renewable energy also increases the installation of such lines. In 2020, the region installed more than 55 GW of wind capacity. The Japan market is forecast to reach USD 5.91 billion by 2026, the China market is set to reach USD 27.12 billion by 2026, and the India market is likely to reach USD 18.66 billion by 2026.

North America

North America is expected to contribute significantly during the forecast period. This region is experiencing high power consumption and high penetration of electronic equipment. This increases the demand for effective power grids and regional transmission and distribution networks. The replacement work for aging infrastructure is also happening in this region, driving the market growth during the forecast period. The U.S. market is expected to reach USD 39.99 billion by 2026.

Europe

Europe is likely to grow at a significant pace during the forecast period. This region constantly expands its electricity generation capacity due to increasing demand for uninterrupted power supply. The investment in power grid infrastructure is also increasing. The abovementioned factors lead to the market expansion in Europe during the forecast period. The UK market is estimated to reach USD 9.35 billion by 2026, and the Germany market is anticipated to reach USD 12.85 billion by 2026.

Middle East & Africa

The Middle East & Africa is expected to witness a significant CAGR during the forecast period. The governments in this region are highly focused on expanding the transmission and distribution infrastructure across the region. Industrialization is also increasing across this region, increasing product demand. The rising demand for such systems drives growth in the Middle East & Africa during the forecast period.

Latin America

The region of Latin America is estimated to foresee growth during the forecast period. The demand for uninterrupted power supply is widely increasing within the region. The penetration of electronics is increasing rapidly within the region. Governments are highly investing in expanding power grids and such systems, which increases the establishment of a transmission network and drives growth in the region.

Key Industry Players

Key Players Increasing their Contracts and Updating their End-user and Products to Tap Markets

The global market is highly fragmented, with leading players across developed and emerging economies. Siemens, Hitachi ABB Power Grids, GE, Schneider Electric, Eaton, and L&T Electrical Automation dominate the market share. These market players are focusing on expanding their reach and securing new contracts. For instance,

- In 2020, GE announced it won a contract for a project in Benin. The contract is worth USD 47 million, and the company will supply four substations, including gas-insulated switchgear (GIS) and seven substation extensions for the project.

- In 2021, L&T announced that the company had been awarded a contract to design and build a 132/11 kV electrical substation in Dubai. The company will also provide the associated cabling and infrastructure works.

LIST OF TOP SUBSTATION COMPANIES:

- GE (U.S.)

- NR Electric Co., Ltd. (China)

- Siemens (Germany)

- Hitachi ABB Power Grids (Switzerland)

- Schneider Electric (France)

- Eaton (Ireland)

- Efacec (Portugal)

- Rockwell Automation (U.S.)

- Emerson (U.S.)

- Belden (U.S.)

- L&T Electrical & Automation (India)

- Texas Instruments Incorporated (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023- Siemens Energy received a contract from Iraq's Electricity Ministry to deliver five high-voltage substations on a turnkey basis in Iraq. These 400kV substations, with a capacity of 1,500MW each, are anticipated to be installed in Baghdad, Basra, Diyala, Najaf, and Karbala, starting from early 2024.

- June 2023- NR's largest set of single-capacity STATCOM, 2 × 150Mvar STATCOM, and 2 × 150Mvar STATCOM in ± 800kV, started operating in the Guangdong Shenzhen and Dongfang Converter Station. This series of projects is key for Southern Power Grid to prevent system operational risks and enhance Shenzhen's transient voltage stability.

- June 2022- Inch Cape Offshore Limited selected Siemens Energy and Iemants in collaboration to deliver Substations for Scotland's 1 GW Offshore Wind Project. Siemens Energy will design and build the onshore substation at the former power station site at Cockenzie, East Lothian, in Scotland.

- December 2021 – Iberdrola, via its subsidiary Neoenergia, has been selected by the ANEEL to build a 500 kV substation in the Brazilian state of Minas Gerais. The company will construct and commission the 500 kV substation in Ibiraci with an investment of over USD 113.15 million (Euro 100 million).

- November 2021– the National Grid awarded Burns & McDonnell USD 15.84 million (Euro 14 million) for Engineering, Procurement, and Construction contracts for designing, installing, supplying, and commissioning a 400 kV GIS substation in Suffolk.

REPORT COVERAGE

The substation market research report includes a detailed industry analysis and focuses on key aspects such as leading companies, end-users, and leading product applications. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several drivers that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.52% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Voltage

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says the global market size was 166.98 billion in 2025.

In 2025, the Asia Pacific market value stood at USD 68.89 billion.

The global market is projected to grow at a CAGR of 4.52% over the forecast period.

The utilities segment is expected to be the leading segment in this market.

The global industry is anticipated to reach USD 248.47 billion by 2034, growing at a substantial CAGR of 4.52% during the forecast period (2025 – 2032).

Expansion of micro-grids network will propel growth in the market

Asia Pacific dominated the market in terms of share 68.89 in 2025.

Siemens, Hitachi ABB Power Grids, GE, Schneider Electric, Eaton, and L&T Electrical Automation are the leading players in the market

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us