Surgical Sutures Market Size, Share & Industry Analysis, By Product Type (Absorbable and Non-absorbable), By Form (Natural and Synthetic), By Application (Gynecology, Cardiology, Orthopedics, General Surgery, and Others), By End-user (Hospitals & ASCs and Specialty Clinics), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

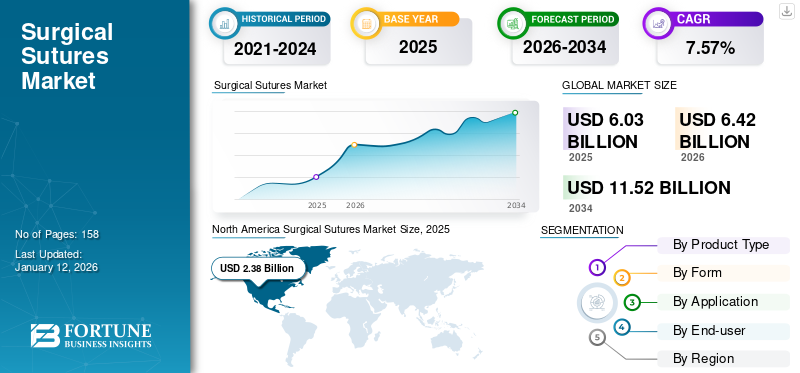

The global surgical sutures market size was valued at USD 6.03 billion in 2025. The market is projected to grow from USD 6.42 billion in 2026 to USD 11.52 billion by 2034, exhibiting a CAGR of 7.57% during the forecast period. North America dominated the surgical sutures market with a market share of 39.44% in 2025.

Surgical sutures are surgical equipment used to close open wounds and ligate blood vessels during or after surgical procedures such as orthopedic surgery. These are mainly used for wound closure in major surgeries, such as cesarean section (C-section), joint replacement, cardiovascular surgery, and many others, and minor surgeries, including dental restorations and cataract surgery. The increasing incidence of road accidents and chronic diseases has resulted in more patients undergoing different surgeries, including ankle arthroplasty, hip replacement, bypass surgery, and many more.

- For instance, according to the Health and Safety Executive (HSE), in 2022/2023, around 561,000 individuals suffered from non-fatal injuries at work in Great Britain, some resulting in bone fractures, ankle arthroplasty, and other bone surgeries.

- Additionally, according to an article published in the NCBI in February 2022, an 18.3% increase was registered in the total volume of surgical procedures compared with those in 2020.

Such factors are expected to positively influence the demand for this product in the coming years and, in turn, are predicted to boost the surgical sutures market growth during the forecast period.

The COVID-19 pandemic had a negative impact on the global market. This was majorly due to the postponement of elective surgeries as the healthcare resources were reserved for COVID-19-related emergencies by the governments of many countries during the pandemic.

However, in 2021, the market experienced a noteworthy recovery owing to a resurgence in the volume of surgeries in major categories, bringing them to pre-pandemic levels. This factor helped the market recover to a certain extent.

Global Surgical Sutures Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 6.03 billion

- 2026 Market Size: USD 6.42 billion

- 2034 Forecast Market Size: USD 11.52 billion

- CAGR: 7.57% from 2026–2034

Market Share:

- North America dominated the surgical sutures market with a 39.44% share in 2025, driven by the rising prevalence of chronic diseases, a high volume of surgeries, and the presence of key players launching advanced suturing technologies.

- By product type, absorbable sutures are expected to retain the largest market share, supported by their widespread use in wound management, high tensile strength, faster healing, and regulatory endorsements encouraging their adoption.

Key Country Highlights:

- United States: Increasing surgical volumes across orthopedic, cardiovascular, and gynecological procedures, along with continuous product innovation by leading companies, is driving market growth.

- Europe: A robust healthcare infrastructure, rising number of joint replacement surgeries, and growing adoption of advanced suture technologies are supporting market expansion.

- China: Rapid rise in surgical procedures due to increasing chronic disease prevalence and growing penetration of advanced suturing solutions by global and domestic players is accelerating market growth.

- Japan: High demand for technologically advanced suturing devices for minimally invasive surgeries and growing aesthetic surgical procedures are propelling market growth.

Surgical Sutures Market Trends

Introduction of Advanced Sutures to Cater to Unmet Needs is a Vital Trend

Knotless, elastic, and electronic sutures are gaining popularity among healthcare providers owing to the clinical benefits offered by these products compared to conventional sutures. These surgical sutures can deliver drugs on the targeted tissue, measure the wound site's temperature, detect infection, provide heat for primary healing, and stitch the deeper wounds more efficiently.

Several established players, such as Smith & Nephew, and new entrants are growing in this market by focusing on these new trending products.

- For instance, in June 2022, the U.S. FDA provided 510(k) clearance for the Anika Therapeutics’s X-Twist knotless suture fixation system.

- Similarly, in December 2021, the U.S. FDA gave a 510(k) clearance to Acuitive Technologies’ CITREFIX Knotless Suture Anchor System.

- Also, , in September 2020, Smith & Nephew launched the HELICOIL knotless suture that operates through the bone marrow and associated stem cells, boosting the healing process.

Thus, these advanced sutures allow key players to grow in this market while focusing on conventional absorbable and non-absorbable products.

- North America witnessed a surgical sutures market growth from USD 2.11 Billion in 2023 to USD 2.24 Billion in 2024.

Download Free sample to learn more about this report.

Surgical Sutures Market Growth Factors

Increasing Number of Surgical Procedures to Boost Market Growth

The increasing number of knee replacement procedures, hip replacement procedures, hysterectomies, bypass surgeries, and cosmetic surgeries is boosting the adoption of this device to stitch up wounds quickly.

- For instance, according to data by the American College of Rheumatology, updated in February 2023, approximately 790,000 total knee replacement surgeries and over 450,000 hip replacement procedures are performed yearly in the U.S.

- According to the NCBI data updated in April 2023, around 400,000 CABG surgeries are performed annually worldwide, making them the most commonly performed major surgical procedure.

- Additionally, according to data provided by the Centers for Disease Control and Prevention (CDC), in 2021, the number of cesarean deliveries in the U.S. was 1,174,545, which accounted for 32.1% of all deliveries.

Furthermore, the growing geriatric population is augmenting the adoption of these products due to the rising number of surgeries, such as angioplasty, joint replacement, and organ transplant among older patients. This leads to a higher demand for advanced devices globally in healthcare settings.

- For instance, as per a study published by the NCBI, it was observed that around 30% of older people fall every year due to difficulty in walking. This has increased the number of patients undergoing knee replacement surgeries.

The above factors, along with the growing demand for automated suturing devices due to their efficiency during surgical intervention, are boosting the uptake of these devices by healthcare professionals and will subsequently drive market growth during the forecast period.

Introduction of Technologically Advanced Devices to Boost Market Growth

Growing awareness of advanced surgical interventions has prompted the market players to strongly focus on R&D and launch innovative products. Additionally, the rapid influx of new and automated sutures with improved features has boosted the preference for these devices among surgeons globally.

- For instance, in January 2023, Able Medical Devices introduced Valkyrie Looped Sternotomy Sutures. The new product is expected to provide a more robust sternal closure.

The market growth is further augmented by advancements in the material and tip of the suture, which has revolutionized the suturing procedure during surgery. Increasing usage of advanced materials by manufacturers, which are biocompatible in nature and known for reducing the healing time of the wound, has led to higher demand and adoption of these sutures in the market.

- For instance, in September 2020, Smith & Nephew launched the HEALICOIL KNOTLESS suture anchor, made up of REGENESORB material. Distinct advantages of this bio-composite material are that it accelerates the wound healing time and facilitates the implant to be absorbed and replaced by bone within 24 months.

RESTRAINING FACTORS

Presence of Alternative Wound Care Management Products and Post-surgical Complications to Limit Market Growth

The availability of a high number of alternative wound care management products, such as surgical staplers, is restricting the growth of this market. Despite these devices' technological advancements, a few drawbacks limit their surgical use. Some of the limitations, including cross-hatched marks, surgical site infection, and high cost of antibacterial devices, restrict the adoption of sutures among surgeons.

- For instance, according to data published by the National Center for Biotechnology Information (NCBI), every year, approximately 5% of patients undergoing various surgeries develop surgical site infections later on due to the presence of bacteria in the sutures.

- The high rate of surgical site infections (SSIs) is due to the lack of proper maintenance of sterile conditions in the operating room. The SSIs in developing economies are rapidly increasing. This is associated with a dramatic increase in patient morbidity and mortality.

- For instance, SSIs rates in developing countries, the cumulative incidence ranged from 0.4 to 30.9 per 100 patients and from 1.2 to 23.6 per 100 surgical procedures, while the pooled cumulative incidence was 11.8 per 100 patients.

On the other hand, surgical staplers can be quickly placed at the wound site, possess better wound healing capability, and are also cost-effective. Therefore, all the above factors and lack of reimbursement policies for wound management in emerging countries resulting in lower surgery rates may subsequently limit the adoption of surgical sutures.

Surgical Sutures Market Segmentation Analysis

By Product Type Analysis

Absorbable Dominated the Market Owing to its Widespread Use in Wound Management

Based on product type, the market is segmented into absorbable and non-absorbable.

Among product types, the absorbable segment accounting for 64.30% market share in 2026, due to their widespread use in deep and delicate wounds. The main advantages of these surgical sutures are that they can support the wound due to high tensile strength and heal in less time and efficiently. Additionally, increasing adoption of these sutures due to support from regulatory bodies will further support the segment growth.

- For instance, in June 2021, the National Institute for Health and Care Excellence (NICE) recommended using absorbable stitches with antibacterial protection for NHS use. According to NICE estimates, on average, USD 17 (£13.62) per patient can be saved using these sutures.

The non-absorbable segment is also expected to grow with a moderate CAGR due to the required follow-ups to remove stitches manually and higher post-operative care.

By Form Analysis

Synthetic Segment Captured Highest Market Share in 2024 Owing to the Higher Adoption by Healthcare Professionals

Based on form, the market is bifurcated into natural and synthetic.

The synthetic segment captured the highest surgical sutures market share 78.31% in 2026. The dominance of this segment is attributed to the comparatively lower chances of hypersensitivity reactions using synthetic sutures during wound closure.

- For instance, according to a report by the NCBI in 2020, the chances of hypersensitivity reaction were less in surgical procedures when synthetic absorbable sutures, such as nylon, polyglactin 910, and polyamide 6/6, were used.

Furthermore, introducing innovative products in synthetic form by the key players will also support the market.

- For instance, in April 2021, Dolphin Sutures launched new non-absorbable Polytetrafluoroethylene sutures to expand its portfolio of dental products. The synthetic TEFLENE product line includes dense PTFE (Polytetrafluoroethylene).

The natural segment is expected to register a comparatively lower CAGR during the forecast period due to its nature of reacting to the surrounding tissues after wound closure.

By Application Analysis

Orthopedics Segment Held Dominant Position due to High Number of Orthopedic Procedures among the Population

Based on application, the market is segmented into gynecology, cardiology, orthopedics, general surgery, and others.

The orthopedics segment held a dominating market share of 27.40% in 2026, followed by the gynecology segment. This is attributed to the increasing prevalence of orthopedic disorders among the geriatric population and the rising number of patients going through orthopedic surgeries globally.

- The Gynecology segment is expected to hold a 25.2% share in 2024.

- For instance, according to an article published in Agappe in November 2022, between 260,000 to 300,000 individuals are estimated to be hospitalized each year for hip fractures in the U.S. By 2040, the number is estimated to reach 500,000.

- For instance, according to a report by ResearchGate, globally, the incidence of arthritis was 203 per 10,000 individuals.

The cardiology segment is expected to grow at a comparatively higher CAGR over the forecast period due to the rising incidence of different coronary artery diseases and arrhythmia, leading to a higher number of bypass surgeries and increased use of surgical sutures. Also, the general surgery segment is expected to register a significant CAGR over the forecast period, owing to increasing number of road accidents and general surgical procedures. On the other hand, the others segment is expected to register a moderate CAGR during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Hospitals & ASCs Segment Held Dominant Share Owing to Large Number of Surgical Procedures Performed in these Settings

Based on end-user, the market is categorized into hospitals & ASCs and specialty clinics.

The hospitals & ASCs segment dominates the market with share 71.15% in 2026 and is expected to retain its position during the forecast period. This is due to the occurrence of a large number of surgical procedures in hospitals & ASCs and favorable reimbursement policies offered for those procedures in emerging and developed countries. Moreover, the presence of experienced surgeons and the development of advanced technologies for complex surgical procedures in hospitals and ASCs will help this segment grow.

The specialty clinics segment is expected to register a significant CAGR during the forecast period. This is due to the specialized treatment offered by these settings, comparatively lesser waiting time, and rising number of specialty clinics in China and India.

REGIONAL INSIGHTS

North America Surgical Sutures Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 2.38 billion in 2025 and USD 2.53 billion in 2026. This is due to the rising prevalence of chronic diseases, which has increased the number of patients undergoing surgeries, leading to a rise in demand for surgical sutures. For instance, according to an estimation by the U.S. Centers for Disease Control & Prevention (CDC), around 1 in 4 adults have arthritis in the U.S. and the number is expected to reach 78 million by the end of 2024. Along with this, the leading players in the U.S., including Ethicon U.S. LLC are constantly introducing technologically advanced devices. This, in turn, is increasing the adoption of these products among healthcare settings and helping the regional market grow. The U.S. market is projected to reach USD 2.34 billion by 2026.

Europe

This market is expected to record a significant CAGR in Europe due to a developed healthcare infrastructure in Germany and the U.K. Many key players in this region, such as Smith & Nephew, are introducing advanced suturing devices, helping the regional market to expand. According to a report by the National Joint Registry, approximately 160,000 hip and knee replacement surgeries are performed annually in England and Wales. Thus, the increasing number of surgeries in Europe is further boosting the adoption of surgical sutures. The UK market is projected to reach USD 0.2 billion by 2026, and the Germany market is projected to reach USD 0.3 billion by 2026.

Asia Pacific

Asia Pacific is expected to record a higher CAGR during the forecast period. Several factors drive growth in the regional market, including a rising incidence of gynecological and cardiovascular diseases, an increasing awareness of advanced surgical devices, and a growing commitment from major market players to introduce new products in emerging economies. The Japan market is projected to reach USD 0.37 billion by 2026, the China market is projected to reach USD 0.46 billion by 2026, and the India market is projected to reach USD 0.31 billion by 2026.

- For instance, according to the International Society of Aesthetic Plastic Surgery (ISAPS), in 2021, around 265,733 aesthetic or cosmetic surgeries were performed in Japan.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa are anticipated to register a moderate CAGR during the forecast period due to scarcity of trained healthcare professionals, limited access to advanced healthcare systems, and less per capita income. This has resulted in a lower number of elective surgeries. However, the increasing number of surgical procedures being performed in Brazil, Mexico, the U.A.E., and Saudi Arabia, combined with growing medical tourism in these countries, is poised to boost the demand for surgical sutures during the forecast period. According to the International Society of Aesthetic Plastic Surgery (ISAPS), around 1,634,220 cosmetic surgical procedures were performed in Brazil in 2021, with breast augmentation and liposuction leading in the number of procedures performed.

Key Industry Players

Presence of Technologically Advanced Products Enabled Medtronic and Other Players to Hold Dominant Market Shares

The global market was dominated by a few established players such as B. Braun SE, Ethicon U.S. LLC, and Medtronic in 2024. A robust focus on introducing new technology in suturing devices to perform complex surgeries and expanding production capacity has helped them retain their market positions.

- For instance, in December 2022, Stryker introduced the Citrefix Suture Anchor System for ankle and foot surgeries. The system uses a bioresorbable material that mimics the structure and chemistry of an original bone.

- Additionally, in April 2021, Medtronic launched a research and development center in India to support 15 of its operating units globally.

On the other hand, emerging players, such as DemeTECH Corporation, Apollo Endosurgery, Inc., and others, are focusing on developing new products in emerging and developed countries to gain notable market shares. The other key market players operating in this market are Smith & Nephew, Coloplast A/S, Apollo Endosurgery, Inc., Boston Scientific Corporation, DemeTECH Corporation, TEPHA INC., Internacional Farmacéutica, and Kono Seisakusho Co., Ltd.

List of Top Surgical Sutures Companies:

- B. Braun SE (Germany)

- Johnson & Johnson Services, Inc. (U.S.)

- Smith & Nephew (U.K.)

- Medtronic (Ireland)

- Coloplast A/S (Denmark)

- Apollo Endosurgery, Inc. (U.S.)

- Boston Scientific Corporation (U.S.)

- DemeTECH Corporation (U.S.)

- TEPHA INC. (U.S.)

- Internacional Farmacéutica (Mexico)

- Kono Seisakusho Co., Ltd. (Japan)

- CONMED Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- August 2023 – Healthium Medtech introduced a new range of sutures named TRUMAS for minimal access surgeries.

- September 2022 - Mesh Suture, Inc. received the U.S. FDA’s 510(k) clearance for its DURAMESH non-absorbable polypropylene mesh suture.

- March 2022 - Cynosure U.K. Ltd. launched the MyEllevate Surgical Suture System in the U.K. This innovative, minimally invasive surgical suture system helps suture the neck and jawline area.

- December 2020 – Apollo Endosurgery, Inc. received the U.S. FDA approval for its X-Tack Endoscopic HeliX tracking system. The company aimed to diversify the use of the new technology.

- October 2020 - Origami Surgical announced that the U.S. FDA had cleared StitchKit PARK, its novel device that enabled surgeons to preload the desired sutures for any surgical procedure.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, forms, applications, and end-users. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years. Moreover, the report also provides market share analysis for key companies.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.57% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation

|

By Product Type

|

|

By Form

|

|

|

By Application

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 6.42 billion in 2026 to USD 11.52 billion by 2034.

In 2025, the North America market value stood at USD 2.38 billion.

The market is predicted to exhibit a CAGR of 7.57% during the forecast period of 2026-2034.

The absorbable segment is set to lead the market by product type.

The key factors driving the market growth include the rising number of surgeries and technological advancements in surgical devices.

B. Braun SE, Johnson & Johnson Services, Inc., and Medtronic are the top players in the market.

North America dominated the surgical sutures market with a market share of 39.44% in 2025.

Increased number of surgical procedures, launch of technologically superior products, and surge in demand for these products in developing markets are some of the major factors expected to favor the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us