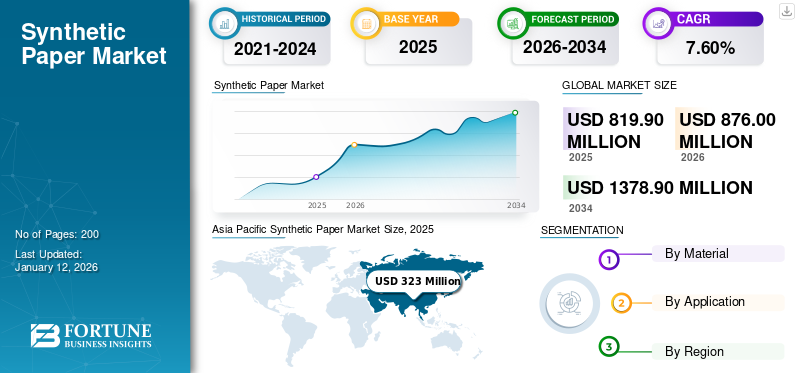

Synthetic Paper Market Size, Share & Industry Analysis, By Material (Polypropylene, Polyethylene Terephthalate, and Others), By Application (Labelling and Non-labelling), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global synthetic paper market size was valued at USD 819.9 million in 2025 and is projected to grow from USD 876 million in 2026 to USD 1378.9 million by 2034, exhibiting a CAGR of 7.60% during the forecast period. Asia Pacific dominated the synthetic paper market with a market share of 39.00% in 2025.

Synthetic paper is a durable substrate engineered to provide the properties of traditional paper while offering enhanced durability, water resistance, and tear resistance. It is mainly composed of synthetic resins, such as polypropylene (PP) or polyester, and is produced through a combination of extrusion, coating, and calendaring processes. The growing demand for this paper in applications, such as printing, packaging, and labeling, owing to its ability to withstand harsh environmental conditions along with its durability, makes it a preferred choice. Additionally, advancements in manufacturing technologies have led to improvements in printability, recyclability, and cost-effectiveness, further driving product adoption across industries.

The plastic industry experienced mixed effects of the COVID-19 pandemic. High demand for PPE kits resulted in a boost in the production of propylene and other polymers. However, the lower availability of raw materials for non-emergency products, including synthetic paper production, impacted the market.

Global Synthetic Paper Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 819.9 million

- 2026 Market Size: USD 876 million

- 2034 Forecast Market Size: USD 1378.9 million

- CAGR (2026–2034): 7.60%

Market Share:

- Asia Pacific dominated the market with a 39.00% share in 2025, owing to a large plastic manufacturing base and favorable economic conditions.

- Europe followed due to increasing substitution of PVC in packaging and sustainability initiatives.

Regional Insights

- Asia Pacific: Leading region due to abundant raw material availability, low labor costs, and industrial infrastructure in China, India, South Korea, and Japan.

- Europe: Driven by sustainability goals; strong push to replace PVC with synthetic alternatives in packaging.

- North America: Steady demand for durable applications; strong manufacturing presence.

- Latin America: Competitive against cellulosic paper due to high import duties; slower growth.

- Middle East & Africa: Modest growth expected with rising demand from healthcare and industrial sectors.

Synthetic Paper Market Trends

Increasing R&D to Develop Better Products is the Latest Trend in Market

Synthetic paper is generally manufactured using polymers, such as Biaxially Oriented Polypropylene (BOPP) and Polyethylene Terephthalate (PET). However, new research suggests the use of fillers and other polymers to increase the workability and durability of papers. For instance, a mixture of liner low-density polyethylene and polystyrene with 40% filler contents is suitable for synthetic paper applications. Fillers are composed of 80% dolomite and 20% talc. The additions of these fillers reduce the tensile strength, folding strength, and dart impact, which makes it able to behave like paper. Employing fillers and low amounts of incompatible polymers helps the material attain paper-like properties. Moreover, the easy availability and lower cost of these fillers and polymers are among the benefits for manufacturers.

Download Free sample to learn more about this report.

Synthetic Paper Market Growth Factors

Increasing Demand for Labels to Propel Market Growth

Synthetic papers are majorly employed in manufacturing labels that are used on all sorts of products, including pharmaceuticals, food & beverage containers, cartons, convenience food packets, and daily-use commodities. Excellent properties of these papers, such as durability, printability, tear resistance, and resistance to chemicals, oil, and water are expected to drive their demand. Additionally, these papers provide a broad range of functionalities for pharmaceuticals, cosmetics, printing, labelling, and packaging applications. These papers can be tough and durable and can support high-quality printing. High demand from multiple end-use sectors for labeling and printing is expected to drive synthetic paper market growth in the coming years.

RESTRAINING FACTORS

Product Disposability May Hamper Market Growth

Synthetic papers are mainly manufactured from polymers. Most of the polymers are non-decomposable or take time to decompose. Though many polymers are recyclable, a very small amount of the plastics is recycled. For instance, according to Plastics Europe data, in 2022, only 8.9% of overall plastic produced was recycled, and most of the plastic is discarded in the environment. The increasing awareness among consumers regarding the disposability of plastic is likely to hamper the synthetic paper market growth over the forecast period.

Synthetic Paper Market Segmentation Analysis

By Material Analysis

To know how our report can help streamline your business, Speak to Analyst

Polypropylene Segment to Hold the Key Share Attributed to Easy Availability

Based on material, the market is segmented into polypropylene, polyethylene terephthalate, and others.

The polypropylene segment is expected to hold the largest synthetic paper market share due to easy availability, lower cost, and superior properties. Furthermore, the growing expansion of packaging industry will further boost the demand for polypropylene paper.

The polypropylene (PP) segment showed significant growth in 2026, accounting for 68.72% of the market with a size of USD 602 million. Rising demand in the manufacturing of water bottles, shopping bags, and videotapes will boost the segment growth.

By Application Analysis

Labelling Segment to Hold Significant Share due to its Characteristics

Based on application, the market is segmented into labelling and non-labelling.

The labelling application segment dominated the market in 2026, accounting for 76.51% of the market with a size of USD 670.2 million. The high demand for labels from multiple end-use sectors is likely to drive the segment growth. The rising demand for synthetic labels and stickers, as they offer excellent durability and provide resistance to outdoor and chemical environments, will fuel its demand in many industries including healthcare and packaging.

The rising adoption of printed media and the increasing use of signage and banners will propel the demand for non-labelling products, as they offer resistance to tearing and moisture, thereby making them suitable for outdoor and rugged environments.

REGIONAL INSIGHTS

Asia Pacific Synthetic Paper Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Based on region, the synthetic paper market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The market in Asia Pacific was valued at USD 323 million in 2025. The growth is attributed to the large manufacturing base for plastic in countries, such as China, India, South Korea, and Japan. Additionally, the availability of raw materials and lower labor costs are the prime factors expected to drive market growth over the forecast period. The Japan market is projected to reach USD 62.3 million by 2026, the China market is projected to reach USD 117.9 million by 2026, and the India market is projected to reach USD 96.4 million by 2026.

Europe is one of the key global markets. The drive of consumers to replace PVC in the packaging industry is the prime factor boosting product demand. For instance, in Europe, the multiwall sacks used for pet food are being replaced by synthetic papers from Harrier packaging which is made of three-layer HDPE. The UK market is projected to reach USD 40.3 million by 2026, while the Germany market is projected to reach USD 53.9 million by 2026.

North America is expected to grow steadily owing to the high demand for durable paper for applications, including maps, posters, game boards, menus, and manuals. The presence of ample number of manufacturers is also likely to boost regional growth. The US market is projected to reach USD 161.3 million by 2026.

Latin America and Middle East and Africa are expected to show sluggish growth. Synthetic paper in Latin America is cost-competitive to wood-pulp paper due to the high duty charges on cellulosic paper. However, increasing industrialization and improving living standards are expected to exhibit growth.

To know how our report can help streamline your business, Speak to Analyst

Key Industry Players

Top Players Focus on Strategic Agreements to Boost Their Market Positions

The market is consolidated in nature with a large number of global players. PPG Industries, Yupo Corporation, DuPont, Cosmo Films, and American Profol, are some of the leading companies in the market. Major market participants work primarily on the basis of the product's cost and application appearances. Many top producers are continuously implementing several tactics to stimulate their market revenue and gain a competitive advantage. They focus on strategic agreements to strengthen brand image and sales.

List of Top Synthetic Paper companies:

- PPG Industries (U.S.)

- Yupo Corporation (Japan)

- DuPont (U.S.)

- Seiko Epson Corporation (Japan)

- AGFA-Gevaert N.V. Corporation (Belgium)

- Cosmo Films (India)

- American Profol Inc. (U.S.)

- Mobil Chemical Films Div. (U.S.)

- Granwell Products (U.S.)

- Formosa Plastics (Taiwan)

- HOP Industries Corp (U.S.)

- Toyobo Co. Ltd. (Japan)

- Neenah (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2021 – Cosmo Films launched opaque, non-tearable synthetic paper for lamination, flexible packaging, and labeling applications. This has increased the company's product offerings.

- January 2021- AGFA launched a new product under the brand name SYNAPS XM110, in the synthetic paper product portfolio. The paper has a thickness of 100 microns and is the thinnest amongst SYNAPS XM.

REPORT COVERAGE

The global market report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, applications, and Materials. Also, the report offers insights into market trends and highlights vital industry developments. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.60% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation

|

By Material

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 819.9 million in 2025 and is projected to reach USD 1378.9 million by 2034.

In 2025, the Asia Pacific market size stood at USD 323 million.

Growing at a CAGR of 7.60%, the market will exhibit steady growth during the forecast period.

Based on application, labelling is the leading segment.

Growing demand for labels is expected to drive the market.

PPG Industries, Yupo Corporation, DuPont, Cosmo Films, and American Profol are major players in the global markets.

Asia Pacific held the highest share of the market in 2025.

High demand from the packaging and healthcare industries is an important market trend.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us