Technical Textiles Market Size, Share & Industry Analysis, By Product Type (Agrotech, Buildtech, Clothtech, Geotech, Hometech, Indutech, Meditech, Mobiltech, Packtech, Protech, Sportech, and Oekotech), By Fiber Type (Natural and Synthetic), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

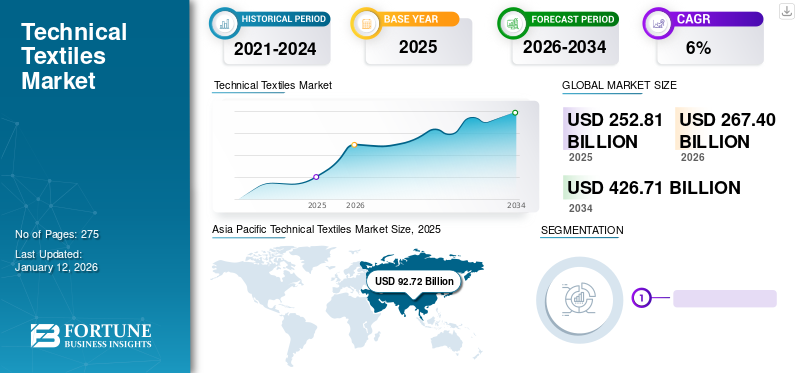

The global technical textiles market size was valued at USD 252.81 billion in 2025. The market is projected to grow from USD 267.4 billion in 2026 to USD 426.71 billion by 2034, exhibiting a CAGR of 6% during the forecast period. Asia Pacific dominated the technical textiles market with a market share of 37% in 2025. Moreover, the technical textiles market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 85.30 billion by 2032, driven by higher engagement of the country in developing new next generation textile materials.

Textile materials, which are manufactured to meet technical and performance requirements rather than decorative or aesthetical requirements, are generally known as technical or industrial textiles. The main application areas for these textile materials are agriculture & horticulture, construction & civil engineering, footwear & clothing, household furniture & coverings, cleaning & conveying industrial equipment, automotive industry, environmental protection, packaging industry, personal protective equipment, sports, and leisure.

Considering the bright scope of different industrial textiles in the near future, bigger players are focusing on business expansion by improving their product portfolio & distribution networks. For instance, in July 2021, Asahi Kasei launched its cellulosic nonwoven, continuous-filament, and ultra-sustainable fabric named Bemliese in the North American market. This fabric has been certified as biodegradable by TÜV AUSTRIA Belgium NV for agricultural applications.

GLOBAL TECHNICAL TEXTILES MARKET SNAPSHOT & HIGHLIGHTS

Market Size & Forecast:

- 2025 Market Size: USD 239.01 billion

- 2026 Market Size: USD 252.80 billion

- 2034 Forecast Market Size: USD 391.75 billion

- CAGR: 6% from 2026–2034

Market Share:

- Asia Pacific led the global technical textiles market in 2025 with a 37% share, rising from USD 92.72 billion in 2025 to USD 98.65 billion in 2026. Growth is fueled by rising demand from key industries including automotive, construction, healthcare, and industrial sectors, along with government support and expanding manufacturing capacity.

- By product type, the mobiltech segment held the largest share in 2024, driven by its wide use in automotive, aerospace, and railway applications.

- By fiber type, synthetic fibers dominated the market due to their superior durability, strength, and versatility across various industrial applications.

Key Country Highlights:

- United States: The U.S. technical textiles market is projected to reach USD 85.30 billion by 2032, supported by innovation in next-generation textile materials and widespread adoption in Meditech, protech, and mobiltech sectors.

- China: The country’s large-scale industrialization, infrastructure expansion, and domestic manufacturing are boosting demand across buildtech, indutech, and geotech applications.

- India: Government schemes such as the National Technical Textiles Mission and rising adoption in agrotech and meditech sectors are driving growth.

- Germany: As a key player in the European automotive and machinery industries, Germany sees robust demand for mobiltech and indutech textiles.

- Brazil: Growth in healthcare and construction sectors is fostering demand for Meditech and buildtech segments in Latin America.

- Saudi Arabia: Rapid industrial expansion and rising demand for protech and indutech textiles are fueling market growth in the Middle East & Africa region.

COVID-19 IMPACT

Restricted Global Trade of Textile Materials Amid Pandemic Hampered Market Growth

Core industries mainly consume technical textile materials. The outbreak and progression of the COVID-19 resulted in a complete or partial halt in production operations in almost all countries. Major textile-producing countries, such as China, India, Bangladesh, Italy, Brazil, and others, were negatively impacted by the COVID-19 pandemic. The production of industrial textiles went down, and the economic slowdown in end-use industries further declined the demand. According to a survey conducted by the International Labor Organization (ILO), exports from Asia to major consuming regions, such as Europe and North America, fell by more than 50%.

Moreover, the shortage of raw materials during this time impacted the textile production. This, in turn, disturbed the entire supply chain and negatively affected the growth of the market. However, the economic recovery backed by the mitigation strategies adopted by major producers and the overall global market is expected to indicate a slow recovery in the coming years.

Technical Textiles Market Trends

Growing Importance of Geotextiles to Strengthen Market Growth

In modern civil engineering applications, geotextiles are widely adopted to improve soil structure. It improves soil stability and reduces soil erosion due to wind or water. Geotextiles are widely adopted to perform functions, such as filtration, drainage, sealing, protection, and reinforcement. They can be considered ideal materials for the construction of roads, dams, bridges, and other infrastructures. Also, the growing trend of sustainability in the construction industry drives the demand for eco-friendly fibers, such as jute and coir. These materials can be opted as a reliable and cost-effective geotextile for road development. Thus, with the increasing public-private investment in large-scale infrastructure projects, the construction industry is expected to create growth opportunities for geotextiles over the forecast period. Asia Pacific witnessed a technical textiles market growth from USD 81.90 billion in 2023 to USD 87.14 billion in 2024.

Download Free sample to learn more about this report.

Technical Textiles Market Growth Factors

Multiple Advantages Coupled with Constant Evolving Technology to Drive the Market Growth

Growing technological advancements coupled with the rising consumption of technical textiles owing to their several benefits have augmented market growth. Compared to conventional textiles, these textiles are durable, lightweight, high strength, versatile and can be customized as per requirements. Also, these textiles are flexible and offer high absorption & insulating, and mechanical, chemical, and thermal resistance properties. Moreover, with constantly evolving technology and product innovations in the manufacturing sectors, the scope of technical textiles is expanding.

Textile manufacturers nowadays are adopting several technologies, such as knitting machines, pleating, and digital printing, to meet the industry's needs globally. For instance, in the medical industry, the need for biocompatible, implantable, durable, and lightweight material over time has excelled in a wide array of Meditech applications, from simple bandages to permanent body implants. The need for 3D printing technology in the textile industry is also rising globally, indicating even more rapid market development. The constantly expanding fashion industry has accelerated the advancement of this technology. For instance, Nike is experimenting with 3D printing to create revolutionary shoes that would seem more attractive when used with soft clothing.

In recent years, nanotechnology has played an important role in developing new textile materials by improving existing textile properties. For instance, in the construction industry, nano-fibers and nano-tubes are used to manufacture lighter & stronger concrete material to withstand a long period. Additionally, nanotechnology allows the textile industry to make products with lower energy thresholds, which further contributes to offering a sustainable solution and helps meet stringent environmental regulations. Hence, increasing adoption of such technologies, growing modernization, and supporting regulations will help to fuel the technical textiles market growth to newer heights.

RESTRAINING FACTORS

High Manufacturing Costs to Hinder the Market Growth

Higher manufacturing costs act as a major restraint for market growth. In comparison with conventional textiles, the cost of technical products is extremely high. Technical textile-based products are manufactured to meet specific technical requirements, and more precise manufacturing procedures are followed in the production of these textiles. This leads to a rise in the overall product cost as the demand for skilled labors and expensive machinery increases. The high raw material procurement costs inevitably increase the total cost of the finished product, thereby leaving producers with limited opportunities for profit margin. To deal with these restraints, manufacturers can consider alternative materials and supply chain strategies to manage material costs. Additionally, investment in training and certification programs is necessary to ensure a skilled workforce capable of maintaining a high-quality installation, ultimately mitigating the challenges mentioned above and supporting market growth.

Moreover, low awareness amongst consumers pertaining to the beneficial characteristics of technical textiles and the availability of cheap quality fabrics at a lower price in the market has surged the demand for conventional textiles. Hence, such factors restrict product adoption in several applications, such as transport, construction, medical, agriculture, hygiene, and sports. However, the performance that these textiles offer cannot be attained by normal conventional textiles. Therefore, the impact of this restraint is low, where high standard material is required to meet the end quality of products.

Technical Textiles Market Segmentation Analysis

By Product Type Analysis

Mobiltech Segment Held Largest Share Due to its Increased Demand from Several Industries

In terms of product type, the market is segmented into agrotech, buildtech, clothtech, geotech, hometech, indutech, meditech, mobiltech, packtech, protech, sportech, and oekotech.

In 2024, the mobiltech segment held the largest technical textiles market share with a share of 21.28% in 2026. The high segmental growth was due to the increasing use of fabrics in automobiles, aerospace, railways, and other mobility applications. The increasing use of these textiles in automobile sector such as seating upholstery, seat belts, tire cords and linear, and others components is expected to propel the demand for technical textiles in automobiles.

The oekotech segment is expected to be the fastest-growing segment over the forecast period. Increasing research and development of cellulose nanocrystals, bacterial cellulose, biocomposite, keratin substrates, natural tannins, and nanocomposite hydrogel for eco-coloration and other applications is expected to drive the segment growth.

Indutech and sportech segments are expected to grow significantly and are used in a broad range of applications, including printing, filtering belting, and processing. The indutech segment is expected to hold a 16.4% share in 2022.

To know how our report can help streamline your business, Speak to Analyst

By Fiber Type Analysis

Synthetic Segment to Be the Fastest-Growing Segment due to its Superior Properties

On the basis of fiber type, the market is segmented into natural and synthetic.

The synthetic segment held the largest share with a share of 78.16% of the market in terms of value and volume in 2026. Technical textiles are made of natural and synthetic materials. Natural fibers, such as cotton, flax, jute and sisal are traditionally used in applications ranging from tarpaulins and tents to sailcloth, ropes, and sacking. Synthetic fibers include fibers made of polymers, metals, minerals, and other materials. Synthetic fibers have superior qualities than simple manmade fibers including durability, strength, stretching and strain tolerance, and others. Hence, they are widely used in the various industries, not only for the apparel use but also for other applications including consumer products and automobile components.

Natural fibers are generally used for textiles such as medical sutures, geotextiles, protech, and others. Natural fibers in the form of paper strips, wood shavings, jute nets, or wool mulch are used as geotextiles. In certain soil reinforcement applications, they are generally used for controlling soil erosion until the establishment of vegetation on the surface.

REGIONAL INSIGHTS

Geographically, the global market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific Technical Textiles Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific held the largest share in 2025 and generated a value of USD 92.72 billion in 2025. Asia Pacific region is anticipated to be the fastest growing during the forecast period. This growth is accredited to sectors, such as healthcare, construction, automotive, and industrial development, apart from improved government focus and growing application cognizance toward technical textiles in the region. The Japan market is valued at USD 17.25 billion by 2026, the China market is valued at USD 35.11 billion by 2026, and the India market is valued at USD 24.25 billion by 2026.

- In Asia Pacific, the indutech segment is estimated to hold a 16.7% market share in 2022.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is the second largest contributor to the market. The increasing use of products in automobile applications is one of the primary driving factors.The UK market is valued at USD 4.06 billion by 2026, while the Germany market is valued at USD 16.38 billion by 2026.

North America

North America increasing innovation and adoption of niche technology coupled with trade relationships developed under prevailing and upcoming free trade agreements will drive product demand. The U.S. market is valued at USD 57.56 billion by 2026.

Latin America

Latin America is set to grow significantly by the end of the forecast period. Growing demand for technical textiles, such as Meditech, indutech and protech, are driving the market.

Middle East & Africa

Rising demand for protective textiles from various end-use sectors, including mining, oil & gas, chemical and others, is expected to drive the regional market in Middle East & Africa.

List of Key Companies in Technical Textiles Market

Business Expansion is a Strategic Initiative Implemented by Companies to Gain Competence

Freudenberg Group, Asahi Kasei Company, and others are some of the key producers operating in this market. The majority of the players operating in the market are involved in product innovation, capacity improvement, acquisition, and collaborations.

For instance, in July 2021, Germany-based Freudenberg Group developed an eco-friendlier version of its Evolon RE high-performance textile from recycled polyester. Moreover, large companies are entering into strategic partnerships with small players to strengthen their networks and establish new technical centers to understand consumer trends.

LIST OF KEY COMPANIES PROFILED:

- DuPont de Nemours, Inc. (U.S.)

- Freudenberg Group (Germany)

- TenCate Fabrics (Netherlands)

- Asahi Kasei Company (Japan)

- Milliken & Company (U.S.)

- SKAPS Industries (U.S.)

- DELCOTEX DELIUS TECHTEX GMBH & CO. KG (Germany)

- Terram (Berry Global) (U.K.)

- International Fibres Group (U.K.)

- Officine Maccaferri S.P.A (Italy)

- Strata Geosystems (India)

- HUESKER Group (Italy)

- SRF Limited (India)

- Arrow Technical Textiles Private Limited (India)

- Johns Manville (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- November 2022 - Asahi Kasei Corporations product category Bemberg launched a new range of products & partnerships enriching its smart fashion offer. This new launch helps to expand the company’s applications for the luxury and fashion industry, including knitwear, casualwear, and jerseys.

- October 2022- DuPont launched a new global portfolio of Kevlar-engineered yarns. These new products are helpful for manufacturers to increase the level of protection without significantly increasing thickness and weight. Such a new launch increases DuPont's presence in the market.

- May 2021- The BontexGeo Group acquired 100% stakes in U.K.-based ABG Ltd., which is the market leader and specialized in the sale of U.K. geosynthetic systems. The BontexGeo Group is already a leader in the manufacturing and sale of geotextiles in Europe. With this acquisition, the company further strengthened its network in the U.K. market.

- February 2021- The Freudenberg Group launched a variety of highly elastic & breathable textiles for sports and outdoor applications. These products were designed with recycled polyester with excellent processing properties and are suitable for making stretchy & breathable sportswear.

- October 2021- Milliken & Company entered an acquisition of Encapsys, LLC from the Cypress Performance Group LLC. The acquired company is involved with providing innovative solutions to various end users, such as textiles, personal care, home care, agriculture, and more. Such acquisition helps the company to enhance its product portfolio in the textile market.

REPORT COVERAGE

The research report provides detailed market analysis and focuses on crucial aspects such as leading companies, types, applications, end-user industries and products. Also, it provides quantitative data regarding volume and value, market analysis, research methodology for market data, and insights into market trends, as well as highlights vital industry developments and competitive landscape. In addition to the abovementioned factors, the report encompasses various factors contributing to the market's growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2034 |

|

Unit |

Value (USD Billion), Volume ( Kiloton) |

|

Growth Rate |

CAGR of 6% during 2026-2034 |

|

Segmentation |

By Product Type

|

|

By Fiber Type

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 252.81 billion in 2025 and is projected to reach USD 426.71 billion by 2034.

In 2025, the market value stood at USD 252.81 billion.

Growing at a CAGR of 6%, the market will exhibit rapid growth over the forecast period (2026-2034).

In 2025, the mobiltech segment was the leading product type in the market.

Multiple advantages of technical textiles coupled with constantly evolving technology to drive the market.

The Asia Pacific held the highest share of the market in 2025.

DuPont de Nemours, Inc., Freudenberg Group, SRF Limited, Terram, and Asahi Kasei Company are some of the key producers operating in the market.

The growing importance of geotextiles to create new opportunities for the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us