Telehealth Market Size, Share & Industry Analysis, By Type (Products and Services), By Application (Telemedicine {Teleradiology, Telepathology, Teledermatology, Telepsychiatry, Telecardiology, and Others}, Patient Monitoring, Continuous Medical Education, and Others), By Modality (Real-time (Synchronous), Store-and-forward (Asynchronous), and Remote Patient Monitoring), By End-user (Hospital Facilities, Homecare, and Others), and Regional Forecast, 2026-2034

Telehealth Market Size Overview

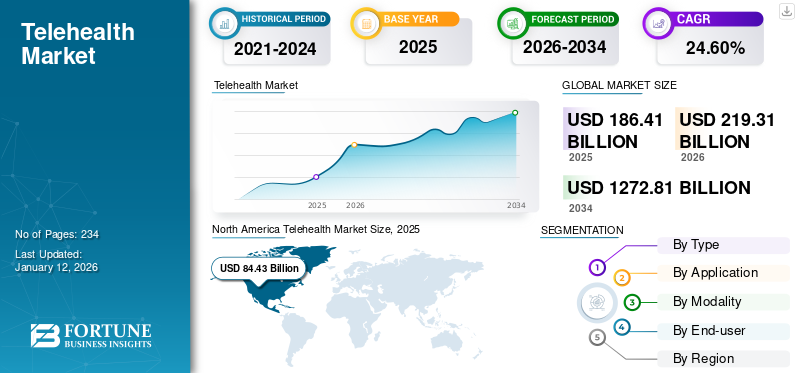

The global telehealth market size was valued at USD 186.41 billion in 2025 and is projected to grow from USD 219.31 billion in 2026 to USD 1,272.81 billion by 2034, exhibiting a CAGR of 24.60% during the forecast period. North America dominated the telehealth market with a market share of 45.29% in 2025.

Telehealth is a remote healthcare service that uses technology such as video conferencing and messaging to allow patients to consult with healthcare providers, receive medical advice, and access treatments without physically visiting a healthcare facility. It is convenient, cost-effective, and expands access to healthcare services, especially in situations where in-person visits are not possible. Its Adoption is at an all-time high, especially in radiology, cardiology, behavioral health, and online consultation. Start-up funding is increasing and new products are being launched, especially for virtual consultations. Besides, remote monitoring is booming in the market.

- For instance, in March 2023, Koninklijke Philips introduced a Virtual Care Management portfolio to increase its global telehealth market share. The program aims to reduce the workload of the hospital staff and lower the costs of care. Healthcare providers, through this program offer end-to-end solutions that incorporate virtual therapy and psychiatry coaching, as well as digital mental health services. The consultation takes place remotely.

These factors are expected to drive the growth of the global market.

The COVID-19 pandemic had a positive impact on the market. During the period, the demand for virtual consultations increased and people actively adopted teleconsultation and remote monitoring services.

Telehealth Industry Landscape Overview

Market Size & Forecast

- 2025 Market Size: USD 186.41 billion

- 2026 Market Size: USD 219.31 billion

- 2034 Forecast Market Size: USD 1,272.81 billion

- CAGR: 24.60% from 2026–2034

Market Share

- North America led the global telehealth market with a 45.29% share in 2025, driven by strong reimbursement frameworks, widespread digital infrastructure, and the presence of leading market players. Teleconsultation adoption soared post-COVID, with strategic launches like LillyDirect and expansion of services by Amazon Clinic and Teladoc Health reinforcing regional leadership.

- By type, the services segment dominated in 2024 due to growing adoption of virtual consultations, surge in start-up funding, reimbursement policies, and increasing outsourcing of services like teleradiology to emerging markets.

Key Country Highlights

- Japan: Government initiatives like the LINE Doctor platform and the integration of teleconsultation into public health systems are accelerating telehealth adoption, especially for aging populations and rural access.

- United States: Policy support, such as expanded Medicare coverage for telehealth and programs like Amwell’s partnership with the U.S. Defense Health Agency, have significantly bolstered telehealth services.

- China: Expansion of global players like GlobalMed through exclusive distribution agreements and demand from rural healthcare facilities is driving market growth.

- Europe: Growth is powered by initiatives like the EU’s Digital Health Action Plan and Germany’s Digital Healthcare Act, which allow digital prescriptions and widespread adoption of remote patient monitoring technologies.

Telehealth Market Trends

Flourishing Acquisitions, Partnerships, and Venture Capital Funding is a Prominent Trend

In current trends of the global market, care delivery extends beyond traditional healthcare settings. Online video or audio consultations with medical professionals are becoming the norm, driven by the cost-effectiveness of teleconsultations, reduced outpatient waiting times, and easy accessibility, contributing significantly to the substantial increase in the preference for e-visits. This has also attracted many start-up businesses and a significant rise in investments is boosting the global telehealth market growth.

- In October 2023, Good Doctor, a telehealth start-up in Indonesia, raised USD 10 million in a series A funding by MDI Ventures to expand across Indonesia. These funds are used to develop enterprise technology platforms and new products and services.

A few new providers are popping up with cutting-edge solutions and software for virtual consultations and remote monitoring. The incumbents are looking to add services such as mental health and cardiology, as well as dermatology and general medicine, among others. For example, in October 2019, Optum recently acquired a patient monitoring organization, Vivify Health, which offers cloud-based solutions for remote care platforms that are device-agnostic and connected to multiple ecosystems.

In addition, the market players are also working on strategic partnerships and collaborations to increase their market presence.

- For instance, in January 2023, Koninklijke Philips N.V. announced the expansion of its partnership with Masimo. This partnership aims to improve the telemonitoring capabilities of home telehealth patients with the help of Masimo w1, a high-tech health-tracking watch. The aim is to bring home telemonitoring of hospital patients with the aim of improving the quality of hospital care at home, which significantly contributes to the development of telemonitoring in this market.

Download Free sample to learn more about this report.

Telehealth Market Growth Factors

Supportive Government Activities to Promote Product Adoption to Drive Market Growth

Telehealth has overcome the hurdle of distance and made sure that healthcare is available even in the most remote places. A large portion of the population, particularly in underdeveloped nations, resides in rural areas lacking access to quality healthcare. Consequently, governments in numerous countries are directing their attention toward delivering healthcare services in rural areas via virtual care platforms.

In addition, these bodies are providing funds and developing pilot project policies, favoring the market growth.

- For instance, in October 2022, the Ministry of Health of Saudi Arabia recognized the importance of care digitization and supported the market growth in Saudi Arabia.

In addition, many governments encourage the use of e-ICUs for remote patient monitoring via 2-way cameras, broadband, and electronic devices. Thus, substantial government support and implementation of favorable policies encourage these solutions to propel the market growth during 2024-2032.

Augmentation of Healthcare Cost to Propel the Market Expansion

Healthcare costs have risen significantly due to the rise in chronic conditions and the aging of the population, driving the demand for services and driving market growth.

- In 2022, according to the Centers for Medicare and Medicaid Services (CMS), the U.S. national healthcare spending was USD 944.3 billion. That was a 5.9% increase compared to 2021. From 2021 to 2030, that spending is projected to increase by 5.4%. The same is true for many countries.

In order to keep up with rising treatment costs, technology-driven platforms are needed to provide high-quality healthcare to patients. Since these platforms meet the needs of the market, they are rapidly adopted in all healthcare settings, driving market growth.

RESTRAINING FACTORS

Lack of Reliable Digital Infrastructure and Budget Constraints Limit the Growth Prospects

Broadband connectivity is essential for seamless services. The U.S. Telehealth Association recommends that seamless services require a minimum bandwidth of at least 384 Kbps. One of the main reasons for their slow Adoption is the low reliability of the existing network.

- For example, a recent survey of healthcare leaders in the U.S. found that 15% of telehealth services fail due to a lack of bandwidth. In addition, 70% of respondents said they would use these services once they had access to a dependable digital infrastructure.

In addition, internet penetration is lower in low- and middle-income countries than in developed countries. Therefore, restrictions on access to these services are likely to prevent them from being adopted.

Telehealth Market Segmentation Analysis

By Type Analysis

Rise in Number of Virtual Visits to Propel the Services Segment’s Dominance

Based on type, the market is divided into services and products.

The services segment dominated the market in 2026. The segment growth can be attributed to a significant increase in virtual consultations, an increase in start-up financing, and the introduction of teleconsultation reimbursement policies.

- For instance, in September 2023, Apollo Telehealth started tele-emergence and intensive care unit (ICU) services at nine NTPC thermal power plants in India.

In addition, the growth in the number of care centers offering these services, as well as the growing trend of outsourcing services such as teleradiology to developing countries, has also contributed to this segment's dominance.

The products segment is expected to grow in the coming years. This is due to the growing popularity of tablets and other mobile devices and wearable patient tracking devices. The segment is expected to dominate the market share of 39.9% in 2025.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Telemedicine Segment Dominated the Market Due to High Usage of Virtual Consultation Apps

In terms of application, the market is segmented into patient monitoring, telemedicine, continuous medical education, and others.

The telemedicine segment dominated the market in 2024. The telemedicine segment is further segmented into teleradiology, telepathology, teledermatology, telepsychiatry, telecardiology, and others. The dominance of the segment is due to the growing number of doctors signing up for virtual consultation apps such as Practo and the increasing Adoption of telemedicine software. The segment is expected to dominate the market share of 60.1% in 2025.

- For example, nearly 90.0% of patients say they want telemedicine to be accepted as a form of medical treatment, according to a survey of medical journals conducted by the Multidisciplinary Digital Publishing Institute (MDPI).

In terms of the sub-segments of the telemedicine segment, the teleradiology dominates the global market in 2024. This is due to the strong utilization of these services, and launches of new innovative teleradiology services and solutions. These factors are expected to contribute to segmental growth.

- For instance, in May 2025, Konica Minolta Healthcare Americas, Inc. and NewVue announced the launch of their new product offering, the Exa Teleradiology. This new technology is designed to meet the complex and ever evolving needs of the various teleradiology groups and is designed to streamline and improve the reading process across various systems and facilities.

The patient monitoring segment is expected to grow substantially due to the increasing emphasis on continuous patient tracking for older adults, advances in medical data integration, and the introduction of wearable remote monitoring products. This segment is anticipated to forecast a CAGR of 29.55% during the forecast period.

For instance, about one million Americans are using remote cardiac monitors, according to a report from the American Teleprescribing Association (ATA), which should have a positive effect on the patient tracking segment.

These factors are expected to positively drive the patient monitoring segment.

As tele-education continues to grow, the continuous medical education segment will continue to grow as healthcare professionals are able to access remote locations and are trained to provide better care. Self-monitoring mobile applications and a growing emphasis on healthy lifestyles will continue to drive the second segment growth between 2024 and 2032.

By Modality Analysis

Growing Adoption Due to More Precise Diagnosis and Treatment Demands to Demonstrate Dominance of Store-and-Forward (Asynchronous) Segment

Based on modality, the global market is categorized into store-and-forward (asynchronous), remote patient monitoring, and real-time (synchronous).

The store-and-forward (asynchronous) segment accounted for a dominant share of the market in 2024. In this modality, the physician or patient collects images, medical history, and reports to send to a specialist physician for diagnosis. This modality does not require the patient and physician to communicate in real time. The utilization of digital images in teleradiology and telepathology for disease diagnosis and second opinions is expected to contribute to the expansion of the store-and-forward segment. Moreover, many radiologists are embracing teleradiology services to reach a more extensive patient base, boosting the growth of the store-and-forward segment. The segment is expected to dominate the market share of 26.8% in 2025.

- For example, in March 2023, OptraSCAN, an end-to-end provider of digital pathology solutions, launched the OnDemand Digital Pathology solution for the complete digital transformation of pathology laboratories in North America. OptraSCAN OnDemand Digital Pathology subscription service is utilized for telepathology applications. Such developments will help drive the growth of the segment during the forecast period.

The real-time (synchronous) segment held substantial share of the market in 2024. This is due to the increasing demand for e-visits and the cost-effectiveness of e-visit consultations compared to in-person visits. Furthermore, the expansion of clinics catering to common health conditions is driving the growth of the synchronous segment in the market. This segment is anticipated to forecast a CAGR of 23.59% during the forecast period.

- For instance, in August 2023, Amazon Clinic expanded its virtual healthcare platforms across 50 states in the U.S., along with Washington D.C. The move aims at providing messaging and video visits for approximately 30 common health conditions such as urinary tract infections, conjunctivitis, and erectile dysfunction. Patients are highly satisfied with the affordability, convenience, and trusted care offered by Amazon Clinic.

The remote patient monitoring segment is projected to experience significant growth. This is due to strategic partnerships, technological advancements, higher adoption rates, and the introduction of advanced solutions.

- For instance, in March 2023, Vijaya Hospital in Chennai, India, implemented Dozee an AI-based contactless Early Warning System (EWS) and Remote Patient Monitoring (RPM). Additionally, in January 2019, UnitedHealth Group acquired Vivify Health, Inc., a remote patient monitoring company, further driving the growth of this segment.

By End-user Analysis

Government Support Actively Promotes the Growth of Healthcare Facilities Segment

Based on end user, the market is categorized into healthcare facilities, home care, and others.

The healthcare facilities segment held the dominant market share in the global market in 2024. This can be attributed to various factors such as increased utilization of telemedicine to reduce the workload of healthcare professionals and government-funded initiatives. The segment is expected to dominate the market share of 49.5% in 2025.

- For instance, in January 2024, Aramark Healthcare+ launched a program connecting clinical nutritionists with hospital inpatients for nutrition services.

- In December 2020, LINE Healthcare Corporation introduced a telehealth service called LINE Doctor, which is available in select medical clinics in Japan.

The homecare segment is projected to experience significant growth fueled by the rising prevalence of chronic diseases and a shift toward home-based care. Partnerships and collaborations among industry players to provide homecare services further contributes to this segment's expansion. This segment is anticipated to forecast a CAGR of 22.86% during the forecast period.

- For instance, in April 2023, Omron Healthcare and Tricog collaborated in the remote home heart monitoring and management segment. The partnership demonstrated Omron Healthcare's commitment to expanding its presence in this market.

REGIONAL INSIGHTS

Based on geography, the market has been studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Telehealth Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America region dominated the global telehealth market and value of the North American market touched USD 98.00 billion in 2025, and in 2024, the market size stood at USD 73.98 billion. The regional market share is predicted to expand due to the increasing preference for teleconsultation, the strategic presence of key players, and favorable health reimbursement.

- For instance, a study by RAND Corporation found that Americans' willingness to use video telehealth increased by 11% between March 2019 and March 2021.

The U.S. market is expected to hit USD 81.11 billion in 2026. Additionally, the contribution of market players in the launch of new digital healthcare services contributed to the regional market growth.

- In January 2024, Eli Lilly and Company introduced LillyDirect, a novel digital healthcare platform catering to patients in the U.S. who suffer from obesity, migraine, and diabetes. This platform provides an array of resources for managing these conditions, grants access to services providers who operate independently and offers third-party pharmacy dispensing services.

Europe

Europe is anticipated to account for the second-highest market size of USD 57.36 billion in 2026, exhibiting the second-fastest growing CAGR of 22.75% during the forecast period. The Europe market is expected to grow due to favorable regulations, the rapid Adoption of remote monitoring devices, and sufficient infrastructure.

The market value in U.K. is expected to be USD 13.82 billion in 2026. On the other hand, Germany is projecting to hit USD 15.01 billion in 2026 and France is likely to hold USD 7.55 billion in 2025.

- For instance, in September 2022, 53 European countries adopted a digital health action plan to drive digital health transformation. Furthermore, Germany's Digital Healthcare Act now allows doctors to prescribe medications through apps.

Asia Pacific

Asia Pacific region is to be anticipated the third-largest market with USD 46.40 billion in 2026. The Asia Pacific market is likely to experience significant growth fueled by improving healthcare scenarios, technological advancements in digital imaging, and a high rural population. Additionally, the entry of GlobalMed Telemedicine in China through an exclusive distribution agreement is anticipated to boost the market in the country. The market value in China is expected to be USD 12.82 billion in 2026.

On the other hand, Japan is projecting to hit USD 12.42 billion and India is likely to hold USD 9.88 billion in 2026.

Latin America and the Middle East & Africa

In Latin America and the Middle East & Africa, the market growth is driven by high unmet patient populations and increasing healthcare spending. Latin America region is to be anticipated the fourth-largest market with USD 11.42 billion in 2026. The GCC market is expected to reach USD 2.21 billion in 2025.

KEY INDUSTRY PLAYERS

Substantial Client Base Helps Maintain Teladoc Health's Dominant Position

Teladoc Health has maintained its leading market revenue position by leveraging its extensive client base and enhancing online consultations and subscription-based memberships. The company's teleconsultations have experienced significant growth, driven by the presence of advantageous health reimbursement policies and the impact of the COVID-19 pandemic. Additionally, Teladoc Health is actively expanding its global presence by engaging in collaborations, further reinforcing its market position.

- For instance, in April 2023, Teladoc Health partnered with Koninklijke Philips N.V. and Mater in Queensland, Australia, where they jointly implemented a cutting-edge program utilizing virtual technology to offer neonatal care remotely. This program offers 24/7 support from senior neonatologists to people seeking medical care, guardians, and healthcare professionals located in Central Queensland.

Some other prominent players include Doctor on Demand Inc., American Well, and MDLIVE. These players are expanding their market share through various strategic activities such as acquisitions and mergers. Also, expanded product offerings are supporting its position in the market.

LIST OF TOP TELEHEALTH COMPANIES

- American Well (U.S.)

- MDLIVE (U.S.)

- Teladoc Health Inc. (U.S.)

- Doctor on Demand Inc. (U.S.)

- Dictum Health Inc. (U.S.)

- Grand Rounds Inc. (U.S.)

- OpenTeleHealth (Denmark)

KEY INDUSTRY DEVELOPMENTS

- January 2024- e& enterprise collaborated with Burjeel Holdings, a healthcare service provider in the MENA region. The collaboration aimed at launching a telemedicine services project in the UAE to improve patient access to medical services in the region.

- October 2023- The U.S. Defense Health Agency selects American Well’s Amwell and Leidos to provide digital, virtual, and automated care delivery for the Military Health System by using “Digital First”.

- October 2023- MDLIVE (Evernorth Health Services) acquired Bright.md, a provider of asynchronous care, triage, and health care navigation services. This acquisition would enhance the company's virtual care capabilities for patients with chronic conditions.

- August 2023- Palatin Technologies, Inc. announced a strategic partnership with UpScriptHealth. The partnership provided a platform for the awareness of hypoactive sexual desire disorder (HSDD) among premenopausal women. It increased the availability of Vyleesi for the patients on the women's telehealth platform.

- July 2023- Bupa HI Pty Ltd launched 24-hour virtual doctor services provided by Bula. The move was aimed at decreasing the pressure on the Australian healthcare systems by focusing on assisting patients with these services at any time of the day.

- April 2023- AristaMD launched a new unified care transition platform to enable primary care practices to minimize patient waiting time for consultation.

- January 2023- Teladoc Health, Inc. launched a digital application that delivers personalized whole-person care to individuals.

- February 2022- GlobalMedia Group, LLC announced that its eNcounter telehealth software suite, ClinicalAccess Station Lite, and several diagnostic examination cameras have received the C.E. mark, enabling the company to expand its services in the European Union.

REPORT COVERAGE

The global telehealth market report provides a comprehensive assessment of the global market, offering valuable insights, facts, industry-related information, and historical data. It employs various methodologies and approaches to derive meaningful assumptions and perspectives. Additionally, the report delivers a thorough analysis and information on market segments, enabling our readers to gain a comprehensive understanding of the global market. Moreover, it presents key insights on the prevalence of major chronic diseases, data on the aging population, recent product launches, regulatory and reimbursement scenarios for key players, statistical overview of internet users and penetration, and notable developments in the industry such as mergers, acquisitions, and partnerships.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 24.60% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Modality

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was at USD 186.41 billion in 2025.

The value of the market in North America was USD 84.43 billion in 2025.

The market is projected to rise at a CAGR of 24.60% during the forecast period (2026-2034).

The services segment held a dominant share in the market.

The rising healthcare costs and increasing government initiatives are the key factors driving the global market.

Teladoc Health Inc. and American Well are the top players in the global market.

North America holds the highest market share and dominated the global market in 2025.

The increasing number of start-up businesses, launches of innovative products and services, and robust Adoption in emerging regions are some of the factors expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us