Time-Sensitive Networking Market Size, Share & Industry Analysis, By Component (Hardware and Solution & Services (By Platform (IEEE 802.1AS/IEEE 1588, IEEE 802.1Qbv, IEEE 802.1Qcc)), By End-User Industry (Healthcare, Manufacturing, Agriculture, Government/Defense, Transportation, IT & Telecom, Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

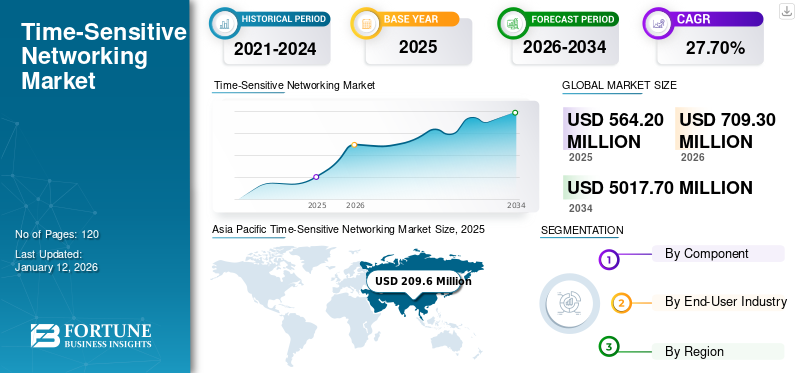

The global time-sensitive networking market size was valued at USD 564.2 million in 2025 and is projected to grow from USD 709.3 million in 2026 to USD 5,017.70 million by 2034, exhibiting a CAGR of 27.70% during the forecast period. Asia Pacific dominated the time-sensitive networking market with a share of 37.10% in 2025.

Time-Sensitive Networking (TSN) has been an evolving technology with important applications across numerous industries, such as manufacturing, automotive, communications, and healthcare. TSN refers to a fixed standard industrialized to enable real-time communication over Ethernet networks, which makes it ideal for complex applications where accurate timing and low dormancy are critical, such as autonomous vehicles, industrial automation, multimedia streaming, and telecom broadcasting.

The global market has been experiencing steady development driven by several factors that include the growing demand for industrial automation in industries, such as oil & gas, manufacturing, and broadcasting. Other utilities are gradually adopting TSN to enable real-time monitoring and control of industrial processes, leading to boosted efficiency, decline in downtime, and enhanced productivity. Furthermore, efforts by leading research and standard organizations, such as the IEEE Time-Sensitive Networking Working Group and the Industrial Internet Consortium (IIC) to advance and endorse TSN standards are aiding their implementation by ensuring interoperability and compatibility across different vendors' products.

The COVID-19 pandemic has positively impacted the dynamics of the TSN market owing to the transition of the technology to the revolutionary 5G network services which has boosted the demand for TSN equipment in the IoT connected applications.

Time-Sensitive Networking Market Trends

Vertical-specific Applications and Expansion in Evolving Segments to Drive Market Trends

TSN technology is a crucial element in revolutionizing and safeguarding critical infrastructure that includes transportation systems, power grids, and healthcare amenities, leveraging opportunities for merchants to provide custom-made solutions. Also, modifying TSN solutions to cater to specific industry verticals, such as energy, healthcare, and mobility can help merchants address the distinct necessities and challenges confronted by various industries. This will also help them crack new revenue streams. Thus, assimilating TSN in various Internet of Things (IoT) and user-specific requirements will help the global time-sensitive networking market share grow progressively during the forecast period.

Download Free sample to learn more about this report.

Time-Sensitive Networking Market Growth Factors

Integration with 5G Networks and Rising Adoption of Industrial IoT (IIoT) to Boost Product Demand

Time-sensitive networking equipment is being integrated with 5G networks to enable ultra-dependable, low-dormancy communication capabilities, opening up new prospects for real-time applications, such as connected self-driving vehicles, remote healthcare, industrial IoT, and smart grids. Additionally, with the extensive use of actuators, sensors, and other connected devices in industrial automation, there is an increasing need for consistent and low-latency communication networks to back real-time data interchange and decision-making, boosting the demand for TSN solutions. Additionally, automotive industrialists are integrating more electronic systems and IoT features into automobiles. There is a growing demand for Ethernet solutions-enabled automotive, with TSN playing a vital part in enabling precise and deterministic communication for Advanced Driver Assistance Systems (ADAS), self-governing driving, and in-vehicle infotainment. These are the prime time-sensitive networking market demands during the forecast period.

RESTRAINING FACTORS

Security Concerns and High Initial Set up Cost Are Prime Market Restraints

Incorporating time-sensitive networking into existing Ethernet networks and legacy systems can be multifaceted and laborious, necessitating careful planning and synchronization to ensure smooth processing and compatibility. Additionally, security concerns arise with using TSN-enabled networks. As TSN technology becomes more connected and manageable, ensuring strong cybersecurity procedures to safeguard the technology against threats, such as unlawful access, data breaches, and cyber-attacks becomes more critical. Also, the preliminary investment required for installing the TSN infrastructure, which includes various equipment, such as TSN switches, servers, routers, and network management software, can be substantial, especially for Small and Medium-Sized Enterprises (SMEs) that have low budgets. This factor can act as a major restraint for the adoption of TSN.

Time-Sensitive Networking Market Segmentation Analysis

By Component Analysis

Need for User-Driven Solutions & Services to Drive Revenue Flow for TSN Market

Based on component, the market is classified into hardware and solution & services.

The solution & services is projected to grow progressively and attain the largest share of 74.55% in 2026, as many industrial organizations and sectors gradually adopt the TSN solutions & services for their field automation, and IoT connected devices for better operational efficiency. In contrast, solutions/services providers focus on offering software, consulting, training, and managed services that will drive the market growth and minimize the efforts of stakeholders to train and manage the technical aspects that include various TSN protocol platforms (IEEE 802.1AS/IEEE 1588, IEEE 802.1Qbv, IEEE 802.1Qcc) of the technology. Hardware merchants only cater to TSN-compatible switches, routers, gateways, NICs, controllers, and embedded systems, which minimizes their potential.

By End-User Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Advanced Technology and Need for Optimized Automation to Drive Adoption of TSN in Manufacturing Industry

Based on end-user industry, the market is divided into healthcare, manufacturing, agriculture, government/defense, transportation, IT & telecom, and others.

The manufacturing segment dominates the market share of 30.77% in 2026, for Time-Sensitive Networking (TSN) due to the increasing adoption of TSN equipment to boost up embedded system connectivity range and capabilities. These embedded devices include Programmable Logic Controllers (PLCs), edge computing devices, and industrial computing PCs, which are crucial for enabling real-time control and monitoring in industrial automation and IoT applications. Additionally, innovations in emerging hardware technologies, such as System-on-Chip (SoC) solutions, Field Programmable Gate Arrays (FPGAs), and Application-Specific Integrated Circuits (ASICs), are creating exciting opportunities for agriculture industry.

Also, growing use of TSN servers and other TSN equipment for the ADAS feature and AI driverless driving in Transportation further boosts the possibilities for TSN market in the long term. The demand for TSN-enabled embedded systems is expected to rise in industries such as healthcare, defense, and telecom owing to the emphasis on digital revolution and Industry 4.0 programs.

Thus, the growing adoption of Time-Sensitive Networking (TSN) is helping hardware retailers develop advanced TSN-specific chips and embedded components enhanced for low latency, high consistency, and determinism.

REGIONAL INSIGHTS

The market is analyzed across regions including North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

Asia Pacific Time-Sensitive Networking Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific dominated the market with a valuation of USD 209.6 million in 2025 and USD 270.3 million in 2026. Asia Pacific is predicted to dominate the global industry and is projected to be a profitable market for TSN technology, powered by rapid urbanization, industrialization, and government-backed initiatives aimed at endorsing advanced technologies for manufacturing and smart infrastructure. China is observed to hold the major share in the Asia Pacific region because of its dominant presence of manufacturing facilities in the country with high reliance of the suppliers on China for sourcing of TSN components. Further, India, Japan, Taiwan, and South Korea are expected to be key contributors to the market’s growth in this region as of growing investments and emphasis on local manufacturing and removing dependencies. The Japan market is projected to reach USD 52.8 million by 2026, the China market is projected to reach USD 101.4 million by 2026, and the India market is projected to reach USD 33.1 million by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is anticipated to witness substantial growth due to the existence of key players, growing investments in Industry 4.0 technologies, and implementation of TSN in industry verticals, such as manufacturing, mobility, and healthcare. The U.S. market is projected to reach USD 81.8 million by 2026.

Europe

Europe is an essential and prominent market for the Time-Sensitive Networking (TSN) technology, with France, Germany, and the U.K. being the leading adopters of IoT technologies and industrial automation. The region's robust industrial base and stress on digital revolution are boosting the demand for TSN solutions. The UK market is projected to reach USD 31.3 million by 2026, and the Germany market is projected to reach USD 34.7 million by 2026.

South America and Middle East & Africa

South America and the Middle East & Africa are observing a notable growth in the implementation of Time-Sensitive Networking (TSN) technology, principally in sectors, such as telecommunication, oil & gas, utilities, and mobility. This is due to the launch of various government initiatives to develop infrastructure and the need for innovation.

Competitve Landscape

Custom-Made Solutions to Cater User Specific Needs Are Focus Areas of Key Market Players

Key players operating in the market are focusing on segregating their offerings by designing solutions that are custom-made for specific time-sensitive networking use applications and industry necessities, such as ruggedized switches for severe industrial environments or mounted automotive-compliant components for in-vehicle applications. This technological advancement will drive the time-sensitive networking market growth during the forecast period.

List of Key Companies Profiled:

- PROFIBUS Nutzerorganisation e.V. (Germany)

- Cisco Systems Inc. (U.S.)

- Texas Instruments Incorporated (U.S.)

- NATIONAL INSTRUMENTS CORP. (U.S.)

- Advantech Co., Ltd. (Taiwan)

- HMS Networks (Sweden)

- Belden Inc. (U.S)

- TTTech Group (Austria)

- Mitsubishi Electric (Japan)

- Spirent Communications. (U.K.)

- Mouser Electronics (U.S.)

- Microchip Technology (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: Tech Group launched the world’s first time-sensitive network configuration software that eliminates the vendor's need in the installation and configuration process. The user-friendly model is used for model topologies, deploying configurations, and creating schedules for the TSN networks.

- November 2023: Fiberroad, a pioneering technology company, announced the launch of industrial Ethernet switches. The innovative offering utilizes a new Time Sensitive Network (TSN) switch that can be integrated with the IEEE 1588 Precision Time Protocol (PTPv2).

- January 2023: Planet Technology USA, a networking technology company, announced the launch of the new industrial L3 TSN Switch. The switch is designed for exceptionally fast delivery in heavy industrial automation network environments.

- January 2022: Microchip Technology launched a new range of TSN Switches that deliver IEEE standard-compliant features. The product enables lower latency data flows, minimizing traffic and increasing clock accuracy.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, key components, and top end-use industries. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 27.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By End-User Industry

By Region

|

Frequently Asked Questions

The market is projected to reach a valuation of USD 5,017.70 million by 2034.

In 2025, the market was valued at USD 564.2 million.

The global market is estimated to have a remarkable CAGR of 27.70% from 2026 to 2034.

The software & solutions segment is expected to lead the market.

Integration with 5G networks and rising adoption of Industrial IoT (IIoT) are the key factors driving the market growth.

PROFIBUS Nutzerorganisation e.V., Cisco Systems Inc., Texas Instruments Incorporated, NATIONAL INSTRUMENTS CORP., Advantech Co., Ltd., HMS Networks, Belden Inc., TTTech Group, Mitsubishi Electric, Spirent Communications., Mouser Electronics, and Microchip Technology are the top players in the market.

Asia Pacific dominated the time-sensitive networking market with a share of 37.10% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us