U.S. Beef Market Size, Share & Industry Analysis, By Cut Type (Ground, Roast, Steak, and Others), By Distribution Channel (Retail, HoReCa, and Butcher Shops), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

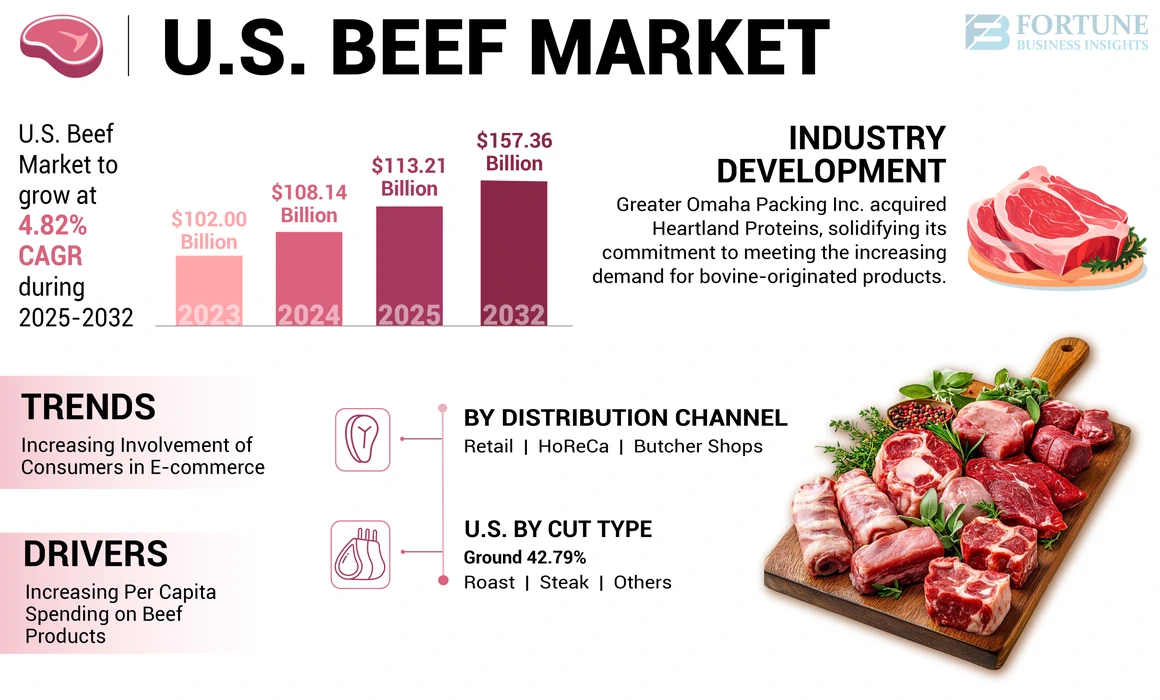

The U.S. beef market size was valued at USD 108.14 billion in 2024. The market is projected to grow from USD 113.21 billion in 2025 to USD 157.36 billion by 2032, exhibiting a CAGR of 4.82% during the forecast period.

The U.S. beef market is valued based on different cut types such as ground, roast, steak, and others, which are distributed through retail outlets, food service operators, and butcher shops. The country is one of the significant consumers of meat globally, and the product has an exponential share in the U.S. meat consumption. Furthermore, the U.S. has been one of the leading countries in beef exports, production, and consumption. The U.S. beef market growth is driven by its higher demand in the domestic market. For instance, as per the U.S. Department of Agriculture, the U.S. has been one of the leading producers since 2006 and is among the top three beef exporters globally. In addition, as per the report published by the U.S. Department of Agriculture, in 2021, the U.S. export of beef was valued at around USD 9.4 billion. Furthermore, as per the report, the demand for the product has seen a significant growth in 2021 compared to 2020.

Beef is one of the prominent meat products consumed in the country with a significant rising demand in foodservice outlets. With rising advancement in regulations and development of new parameters for grading the consumption of several cut types have shown an increase in demand. Furthermore, there has been a significant development in cattle marketing, resulting in substantial growth in the industry and rising awareness of high-quality cattle.

The spread of the COVID-19 pandemic drastically changed the world markets and significantly affected different industries, including the U.S. cattle industry. Owing to its rapid spread, the U.S. government imposed restrictions such as limiting public gatherings by closing food service outlets, supermarkets/hypermarkets, production facilities, and others to curb the spread, which differed from state to state. As per the International Monetary Fund, the U.S. economy recorded a 31.4% contraction in 2020. The supply chain saw a significant impact with a decline in the production due to lockdowns and a rise in demand as the markets started opening. In addition, the fresh meat has a shorter shelf life. Thus, few manufacturers established direct-to-consumer distribution channels through online portals. This created an immense opportunity for the manufacturers to capitalize on the changing market requirements and adopt new channels to reach end consumers.

U.S. Beef Market Overview & Key Metrics

Market Size & Forecast:

- 2024 Market Size: USD 108.14 billion

- 2025 Market Size: USD 113.21 billion

- 2032 Forecast Market Size: USD 157.36 billion

- CAGR: 4.82% from 2025–2032

Market Share:

- The U.S. beef market is segmented by cut types such as ground, roast, steak, and others, and distributed through retail, HoReCa, and butcher shops. In 2024, the HoReCa segment held the largest market share, driven by rising disposable incomes and growing demand for burgers and steaks. Ground beef led the market by cut type due to its affordability and use in staple food items like burgers and meatloaf. The retail segment also showed strong performance, particularly in ground beef sales, while butcher shops are seeing digital transformation with online expansion initiatives.

Key Country Highlights:

- United States: The U.S. remains one of the top global producers and exporters of beef, with strong domestic demand supported by regulatory frameworks like the Beef Promotion and Research Act of 1985. Online beef purchases surged from 15% in 2020 to 26% in 2021, driven by consumer trust in certified fresh meat through e-commerce. However, growing consumer interest in plant-based proteins poses a restraint, with major meat producers launching vegan alternatives in response to shifting dietary preferences.

U.S. Beef Market Trends

Increasing Involvement of Consumers in E-commerce to Support the Market Growth

The rising popularity of online channels is said to fuel the growth in demand for new innovative product ranges owing to their wide reach and advertising of item assortments and markdown plans. The growing trend of purchases through e-commerce has considerably driven sales through online retail stores.

Purchasing fresh cuts online ensures its quality and safety as the seller must demonstrate the product only when it is certified by specific U.S. food safety organizations. The internet has become an inseparable part of urban life today, and the growing familiarity of semi-rural areas and small cities with the Internet is paving new ways for e-commerce.

For instance, as per The Cattlemen’s Beef Board, the online purchase among consumers has seen a significant growth from 15% in 2020 to 26% in 2021.

Download Free sample to learn more about this report.

U.S. Beef Market Growth Factors

Increasing Per Capita Spending on Beef Products in the U.S. to Drive the Market Growth

The U.S. market has shown a significant growth in per capita beef consumption over the years. Furthermore, the increasing environmental impact has been causing an increase in cattle prices. The regulations implemented by the U.S. government include the Beef Promotion and Research Act of 1985, USDA Grades, and others. The introduction of these acts is to regulate the supply chain and increase consumer awareness.

For instance, as per the Cattlemen’s Beef Board, which is the administrating body of the Beef Promotion and Research Act, the act is part of the 1985 farm bill, designed to provide the base for the development of beef promotion and research with an aim to build and increase demand, both domestically and internationally.

The rising consumer disposable income and lifestyles, changing demographics, and shifting preferences due to new information about diet's health benefits contribute to the demand for beef products. At the same time, technological changes in processing production and structural change and growth in large-scale retailing, distribution, and expansion of trade in the U.S. have contributed to a rapidly changing market for food products. Hence, it increases the demand in the market.

For instance, as per The National Cattlemen’s Beef Board, the willingness to pay for one pound of steak in retail among consumers saw growth from USD 8.76 in 2020 to USD 8.96 in 2021.

RESTRAINING FACTORS

Escalating Inclination of Consumers Towards Plant-based Protein May Hinder the Market Growth

In recent years, a considerable percentage of the U.S. population has turned toward vegetarianism and veganism due to the increasing prevalence of dairy allergy, environmental concerns, health concerns, and others. Thus, this factor is negatively impacting sales in different demographics of the country.

The accelerated popularity of plant-based food among consumers has increased the number of plant-based meat producers. These market players are investing in vegetarian alternatives to traditional meat products and creating a vibrant vegan portfolio.

Beyond Meat, Morningstar Farms, and Impossible Foods are some of the pioneers in the plant-based meat industry. Inspired by the success of these firms, established animal product companies such as Tyson Foods, Hormel Foods, and others are also capitalizing on this trend and launching plant-based new products.

For instance, in 2019, Tyson Foods Inc., one of the biggest animal meat producers, announced the launch of its first plant-based product range, including burger patties, bratwurst, ground meat, and Italian sausage made from pea protein.

U.S. Beef Market Segmentation Analysis

By Cut Type Analysis

Rapid Growth in Demand for Premium Food Products among Individuals to Drive the Ground Segment Growth

On the basis of cut type, the market is segmented into ground, roast, steak, and others.

The ground segment holds the majority share in the U.S. market share owing to its lower price and growing consumer interest in food products such as meatloaf, burgers, and others. Ground beef is a staple food in the U.S. The rapid growth in the premiumization trend is one of the major factors driving the demand for ground beef products. The premium range is segmented based on grade certificates such as USDA Prime, Choice, Nature, Certified Angus Beef, and others. For instance, as per the Certified Angus Beef Brand, in 2022, the CAB prime sales recorded a growth of 17.7% compared to 2021.

After ground beef, the steak segment holds a significant share in the U.S. beef market. The significance of steak is owing to the increasing number of steak houses in the U.S. For instance, as per the 2022 consumer survey conducted by Linz Heritage Angus, one of the significant suppliers of beef, steak is one of the most preferred cuts among consumers.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel Analysis

Surging Sales of the Product in HoReCa to Fuel the Segment Growth

On the basis of distribution channel, the U.S. beef market is segmented into retail, HoReCa, and butcher shops.

The HoReCa segment held the largest market share in 2024, which is owing to the increasing disposable income of individuals. In addition, the growing sales in the HoReCa segment due to the rising consumption of food products such as burgers, steaks, and others significantly drive the segment growth. For instance, as per the Cattlemen’s Beef Association, beef consumption saw a growth of around more than 20% from 2021 to 2022, accounting for about 8825 million pounds.

The increasing number of steak houses, QSR chains, and burger outlets has been fueling the growth of the HoReCa segment. Furthermore, as per the Cattlemen’s Beef Board, the food service sector has shown an increasing demand for premium beef cow herd products.

The retail stores have witnessed remarkable growth over the years, which is owing to the higher demand for ground beef, which is said to be a staple food in the U.S.; thus, ground beef is one of the significant cut types purchased in retail outlets. Moreover, online stores are slowly gaining popularity among consumers as they provide the ease of buying products from the comfort of their homes.

The rising advancement among e-commerce platform providers is fueling the growth of the butcher shops segment. For instance, in July 2022, Promenade Group, an online store platform provider, announced that the platform will now include an all-new segment called as Promenade for Butchers, which is designed for independent butcher shops to scale up their online sales.

List of Key Companies in U.S. Beef Market

Market Players Focus on New Product Launches to Extend their Footprint

The market exhibits a moderately fragmented structure consisting of several small and large players competing against each other. Cargill Incorporated, Tyson Foods Inc., JBS SA, and National Beef Packing Company LLC. are a few of the significant players in the market. Market players such as Cargill Incorporated, Tyson Foods Inc., and JBS S.A., are some of the leading companies in the market, are focused on mergers, acquisitions, partnerships, and product innovation to increase their footprint in the U.S. market. They are also embarking on digitalization and base expansions to increase their prominence to meet the demand for e-commerce facilities.

LIST OF KEY COMPANIES PROFILED:

- American Foods Group, LLC (U.S.)

- AgriBeef Co. (U.S.)

- Cargill, Incorporated (U.S.)

- National Beef Packing Company, LLC. (U.S.)

- JBS SA (Brazil)

- OSI Group LLC (U.S.)

- Greater Omaha Packing Co. (U.S.)

- Harris Ranch Beef Company (U.S.)

- Certified Angus Beef (U.S.)

- Tyson Foods Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024 – Greater Omaha Packing Inc. announced the acquisition of Heartland Proteins, solidifying its commitment to meeting the increasing demand for bovine-originated products. This strategic move significantly expands Greater Omaha’s capabilities, allowing the company to serve a broader customer base better.

- September 2022 – American Foods Group, LLC (AFG) opened a new state-of-the-art beef processing facility in Warren County, Missouri. This major development will benefit Missouri's agricultural producers and consumers in getting products easily, with USD 94 billion contributing to its economy annually.

- November 2021 – AFG invested in a new beef processing facility to advance processing capacity and organically expand its portfolio to align with its growth strategy. As per the company, once fully operational, the facility should process around 2,400 cattle per day. The effort to bring the new AFG facility to Missouri has also included the Missouri Departments of Agriculture and Economic Development, Greater St. Louis, Inc., and the Missouri Partnership.

- August 2020 – Agri Beef Co. partnered with producers in the Jerome, Idaho area to build a new processing facility known as True West Beef. The partnership aims to provide processing solutions to companies affected by COVID-19 pandemic-induced disruptions.

- June 2020 – Harris Ranch Beef delivered premium USDA Choice steaks and ground beef. The company launched an online store that features its most popular hand-cut steaks, ground beef, and other unique selections. This online store helped the company increase its sales in the U.S. market.

REPORT COVERAGE

The research report provides a detailed analysis of the U.S. beef market share analysis and focuses on key aspects such as leading companies, cut type, and distribution channels. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.82% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Cut Type

|

|

By Distribution Channel

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 108.14 billion in 2024 and is expected to reach USD 157.36 billion by 2032.

The market is likely to grow at a CAGR of 4.82% over the forecast period (2025-2032)

By cut type, the ground segment leads the market.

The increasing per capita spending on beef products is poised to drive the market growth.

The American Foods Group, LLC, AgriBeef Co., Cargill Incorporated, National Beef Packing Company, LLC., JBS SA, and others are the major players in the market.

The growing disposable income is poised to bolster the product adoption, fueling the market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us