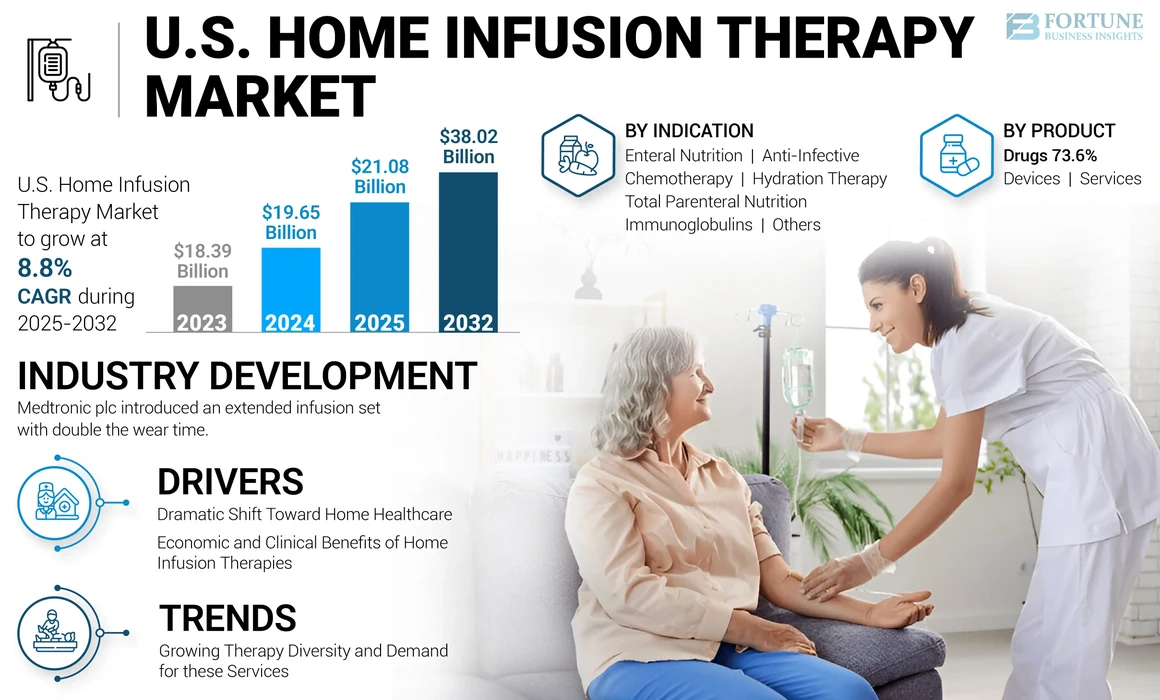

U.S. Home Infusion Therapy Market Size, Share & Industry Analysis, By Product (Devices, Drugs, and Services), By Indication (Enteral Nutrition, Anti-Infective, Chemotherapy, Hydration Therapy, Total Parenteral Nutrition, Immunoglobulins, and Others), and Forecast, 2025-2032

KEY MARKET INSIGHTS

The U.S. home infusion therapy market size was valued at USD 19.65 billion in 2024. The market is projected to grow from USD 21.08 billion in 2025 to USD 38.02 billion by 2032, exhibiting a CAGR of 8.8% during the forecast period.

Home infusion therapy involves intravenous or subcutaneous administration of medicines to an individual at home. The components that are required to perform this therapy at home include drugs, equipment, such as infusion pumps, and supplies, such as tubing and catheters. This type of therapy has been shown to be a safe and effective alternative for hospital treatment of patients. Also, it is anticipated that, in the coming years, the home healthcare industry will experience faster growth. For instance, as per the data provided by the National Home Infusion Foundation in October 2021, the home infusion therapy industry grew by 310% from 2010-2019.

The trend of medical care at home is anticipated to persist and gain momentum in the coming years. Several key factors driving this trend include the rising prevalence of chronic diseases, leading to an increased demand for such therapies at home, growing aging population, expansion of reimbursement codes for remote patient monitoring, and expensive nature of hospital stays. Furthermore, the increasing availability of therapies, growing pipeline of infusion drugs, and broadening clinical applications of existing therapies have also contributed to the overall expansion of this market.

The outbreak of COVID-19 had a favorable impact on the market. Key players operating in the market experienced considerable growth in their revenues from the home infusion therapy services business, leading to a significant rise in the number of patients receiving infusion therapy at home during the pandemic.

Moreover, medical devices, such as infusion pumps also observed high demand in 2021, similar to that in 2020. Similarly, the use of infusion pumps for COVID-19 patients and authorization for emergency use of these pumps for mAb therapies by the U.S. FDA resulted in an augmented demand for these devices in 2021. These changes in legislation are expected to increase the use of these products and services, which witnessed continued growth till 2024.

U.S. Home Infusion Therapy Market Trends

Growing Therapy Diversity and Demand for these Services to Aid Market Expansion

The concept of at-home infusion therapy, which has taken hold across a number of therapeutic areas, including oncology, has driven the U.S. home infusion therapy market growth over the past few years. Several oncology centers in the U.S. have launched and expanded their home infusion cancer treatment programs as a result of the COVID-19 pandemic. Furthermore, the shift to home care is supported by more therapies moving into this setting.

- For instance, the Penn Center for Cancer Care Innovation offered home oncology treatments for around 1,500 patients in 2020.

Furthermore, the integration of advanced technologies, such as wearable infusion devices and smart infusion pumps for better patient monitoring and patient management is considered a significant market trend. Several market players are focusing on the launch of advanced infusion systems to enhance patient care at their homes.

- For instance, in January 2024, Infuzamed, a medical devices company, launched a wearable infusion pump with advanced remote monitoring capabilities in the U.S. market.

Moreover, the clinical application of currently available infusion therapies is also increasing. As per the data provided by the BioSupply Trends Quarterly Magazine in July 2020, the overall sales of IV immunoglobulin grew ten times since 1990. This showed a higher demand for intravenous immunoglobulin therapies among patients. Therefore, the rise in demand for home infusion therapy in recent years is estimated to boost the market growth during the forecast period.

Download Free sample to learn more about this report.

U.S. Home Infusion Therapy Market Growth Factors

Dramatic Shift Toward Home Healthcare to Boost Market Proliferation

The healthcare industry is rapidly evolving by shifting patient care from hospitals to homes. This is largely driven by factors, such as growth in aging population, particularly in countries, such as the U.S.

- For instance, as per the U.S. Census Bureau’s Population Projections, the population of individuals aged 65 and above in the U.S. is projected to double from 52 million in 2018 to 95 million by 2060. This age group is anticipated to represent 23% of the country’s population by 2060. These demographic shifts are forecasted to drive the market expansion in the coming years.

Moreover, according to data from the Centers for Disease Control and Prevention (CDC), 70% of those receiving care at home are aged 65 and older. Additionally, the Medicare Payment Advisory Commission predicts a growth of over 50% in Medicare enrollment over the next 15 years, with the number of beneficiaries expected to exceed 80 million by 2030, up from 54 million in 2015.

Furthermore, the market has seen the rise of companies offering portable devices for patients in homecare environments and the introduction of flexible payment and rental arrangements. These initiatives aim to support and accommodate the increasing transition of patients from hospitals to home healthcare, contributing to the growth of the market.

Economic and Clinical Benefits of Home Infusion Therapies to Boost Their Demand

The promotion of infusion therapy services to patients in home care settings has been given considerable attention by the government and other healthcare agencies. Furthermore, growing number of patients in the U.S. are choosing to receive care at home is one of the factor driving market growth.

Additionally, these therapies are cost effective as compared to those provided in the hospital settings. Homecare reduces various expenses, including hospital visits, examination fees, inpatient stays, and other miscellaneous charges, such as those for drugs and devices.

- For instance, as per the data provided by the National Center for Biotechnology Information (NCBI) in July 2022, approximately 40% of infusion services can be effectively provided at a patient’s home.

Moreover, home infusion therapies provide several benefits. Hence, this increases their adoption among a large number of patients.

- For instance, as per the data provided by the BioMatrix Specialty Pharmacy in March 2023, home infusion therapy is associated with several benefits, such as lesser risk of infection and better physical & mental well-being of patients. Home infusion reduces costs and saves money for both patients and payers by reducing the burden of paying for more expensive facilities.

Significantly lower costs per episode for infusion therapy at homecare settings is facilitating the shift of patients toward homecare settings. This is also driving the growth of the market in the U.S.

RESTRAINING FACTORS

Resistance by Healthcare Professionals to Home Infusion Therapies Due to Safety Concerns Will Restrict Market Growth

Despite the significant and continuously increasing number of patients benefiting from these services, several factors can hinder the market growth in the U.S. These factors encompass resistance from physicians, safety apprehensions linked with therapy administration, and potential effects on community healthcare practices. Both physicians and patients have expressed apprehensions about these therapies. Moreover, risk management of at-home care is particularly problematic as all the required healthcare workplace protection for both patients and caregivers may not be easily available.

In addition, treatment at home has become the desirable site of care for many patients due to the lower costs of infusion services. However, there are still problems with coverage and appropriate payment for home infusion therapy.

- For instance, as per the data provided by Amerisource Bergen, Medicaid coverage for home infusion is available under the home health benefit but is restricted to specific situations. To qualify for this, the patient must meet the Centers for Medicare & Medicaid Services criteria for being homebound and have an established home care plan.

Hence, limited insurance coverage and reimbursement policies for home infusion therapy can hinder patients’ access to this therapy.

In addition, concerns were expressed by the American Society of Clinical Oncologists regarding the safety of routinely administered anti-cancer medicinal products at patients' homes. Hence, market growth is likely to be hindered throughout the forecast period due to the combination of these factors.

U.S. Home Infusion Therapy Market Segmentation Analysis

By Product Analysis

Drugs Segment Dominated Market Owing to Increasing Regulatory Approvals

Based on product, the U.S. home infusion therapy market is divided into devices, drugs, and services.

The drugs segment accounted for the highest market share in 2024 and is anticipated to exhibit a significant CAGR throughout the forecast period. The dominance of this segment is associated with the increasing incidences of chronic diseases, such as cancers, autoimmune diseases, and multiple sclerosis. In addition, the rising number of regulatory approvals for infusion products, strong pipeline of products from key market players, and high risk of hospital acquired infections among the hospitalized population are some of the factors contributing to the segment’s growth.

- For instance, as per the data published by the National Cancer Institute, approximately 2 million people were diagnosed with cancer in 2023 in the U.S.

- Similarly, in June 2020, the U.S. FDA approved Phesgo for the treatment of breast cancer in combination with chemotherapy. Only a certified healthcare professional can administer this medicinal product to patients at home.

The services segment is anticipated to witness significant growth during the forecast period. This growth of the segment is mainly attributed to the expansion of service offerings and robust efforts by key industry players and healthcare organizations to provide home infusion therapy for several types of diseases.

- In April 2023, Option Care Health Inc. announced the establishment of a nationwide home infusion nursing network and clinical platform, Naven Health, Inc. The platform will primarily focus on providing specialized and exceptional infusion care.

To know how our report can help streamline your business, Speak to Analyst

By Indication Analysis

High Prevalence of Gastrointestinal Diseases Enabled Enteral Nutrition Segment to Hold Major Market Share

Based on indication, the market is classified into enteral nutrition, anti-infective, chemotherapy, hydration therapy, total parenteral nutrition, immunoglobulins, and others.

The enteral nutrition segment captured the highest market share in 2024. The growing patient population suffering from chronic diseases, such as diabetes and gastrointestinal diseases needing enteral feeding has mainly driven the segment's growth.

- For instance, as per an article published by the NCBI in July 2020, in the U.S., the prevalence of home enteral nutrition increased from 463 per million citizens in 1995 to 1,385 per million citizens in 2017.

Also, several companies are entering partnerships to provide infusion pumps for home care settings.

- In July 2021, Baxter International Inc. entered an agreement with Micrel Medical for the distribution of the Micrel Mini Rythmic PN+ infusion pump. It is an ambulatory infusion pump that supports individuals who have parenteral nutrition in home care settings. As a part of this agreement, the company holds the sole distributorship rights of this infusion pump and its accessories across Australia and New Zealand.

The second most dominant segment is the anti-infective segment. The growth of the segment is attributable to the higher incidences of infectious diseases, increasing regulatory approval for anti-infective drugs, ease of set-up for anti-infective infusion therapy, and low cost.

- For instance, in November 2023, Omnix Medical disclosed that the planned phase II trial for its novel anti-infective medication, OMN6, had been approved by the U.S. FDA.

The chemotherapy segment is estimated to witness the highest growth rate during the forecast period. The growth of the segment is driven by the growing prevalence of cancer across the U.S., along with various initiatives by government authorities, key industry players, and healthcare organizations to provide chemotherapy infusion therapy services at patients’ homes.

- For instance, in January 2021, CVS Health announced its partnership with the Cancer Treatment Centers of America to increase the availability of chemotherapy at home for eligible patients. The main factors in this treatment were the Coram infusion model and chemotherapy-trained personnel.

Other indications include hydration therapy, Total Parenteral Nutrition (TPN), immunoglobulins, and others. These segments are anticipated to witness steady growth throughout the forecast period.

Key Industry Players

Option Care Health Inc. Led Market in 2024 with Strong Focus on Collaborations & Partnerships

Companies, such as Option Care Health Inc., Optum Inc., and CVS Health accounted for a large U.S. home infusion therapy market share in 2024. The competitive landscape of this market is partially concentrated. Option Care Health Inc. is one of the major players operating in this market. The prominent position of the company is primarily due to its strong emphasis on some strategic initiatives, such as mergers & acquisitions, new product launches, and partnerships with key players with an objective to enhance its product portfolio. In addition, the company’s strong market share is attributed to its extensive network of home infusion services across the U.S.

- For instance, in April 2023, Option Care Health Inc. announced the establishment of a nationwide home infusion nursing network and clinical platform, Naven Health, Inc. This platform primarily focuses on providing specialized and exceptional infusion care

- Similarly, in December 2022, Option Care Health Inc. announced its collaboration with WellSky to provide innovation in home infusion technology. This partnership brought new capabilities to WellSky’s CareTend through an infusion & specialty pharmacy platform.

Optum Inc. held a notable market share in 2024. The company bolstered its market presence through the introduction of advanced home infusion therapy services to expand its brand visibility. Additionally, Optum Inc. placed a strong emphasis on partnerships and acquisitions with other major players to broaden its portfolio and enhance brand awareness.

- For instance, in August 2022, OptumRx entered a partnership with Ringmaster Technologies to provide an advanced healthcare stop-loss procurement process. This partnership aimed to offer enhanced connectivity and increased transparency between third-party administrators, OptumRx and MGUs.

LIST OF TOP U.S. HOME INFUSION THERAPY COMPANIES:

- Option Care Health Inc. (U.S.)

- Optum Inc. (U.S.)

- CareCentrix Inc. (U.S.)

- CVS Health (U.S.)

- KabaFusion (U.S.)

- Promptcare Respiratory (U.S.)

- Baxter (U.S.)

- InfuSystem Holdings, Inc. (U.S.)

- Moog Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2023 – Amedisys, a provider of infusion services, finalized a merger agreement with Optum Inc., valued at USD 3.60 billion, which was completed in the latter half of 2023

- April 2023 – KabaFusion received an investment from Houston-based Memorial Hermann Health System, leading to the expansion of its home infusion services throughout the U.S.

- November 2022 – Medtronic plc introduced an extended infusion set with double the wear time. This set has a wear time of up to 7 days.

- September 2022 - CarepathRx and Orlando Health signed a multi-year infusion management service agreement to offer high-quality home infusion services. The new service is convenient and cost-effective for patients.

- August 2022 – KabaFusion acquired the pharmacy/infusion care assets from Coram Infusion Services. This move expanded its footprint in patient-focused infusion services.

REPORT COVERAGE

The report provides an in-depth analysis of the market. It focuses on segments, such as leading products and indications. Besides this, it offers insights related to the impact of COVID-19, market trends, and highlights the technological advancements in this market. Additionally, the report consists of several factors that have contributed to the growth of this market. The report also provides the competitive landscape of the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 8.8% from 2025 to 2032 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product

|

|

By Indication

|

Frequently Asked Questions

Fortune Business Insights says that the market value stood at USD 19.65 billion in 2024 and is projected to reach USD 38.02 billion by 2032.

The market is projected to record a CAGR of 8.8% during the forecast period of 2025-2032.

By product, the drugs segment led the market.

Dramatic shift toward home healthcare settings, economic & clinical benefits of these therapies, and growing geriatric population, coupled with the logistical simplicity of these therapies are some factors driving the market.

Option Care Health Inc., CVS Health, and Optum Inc. are the major players in the market.

Surge in the demand for care at home and growing therapy diversity are some of the factors expected to drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us