U.S. Water Softening Systems Market Size, Share & Industry Analysis, By Softener Type (Salt-based Ion Exchange Softener and Salt-Free Water Softener), By Type (Mono Cylinder, Twin Cylinder, and Multi Cylinder), By Operation (Electric and Non-Electric), and By Application (Residential, Commercial, and Industrial), and Country Forecast, 2025 – 2032

U.S. Water Softening Systems Market Size

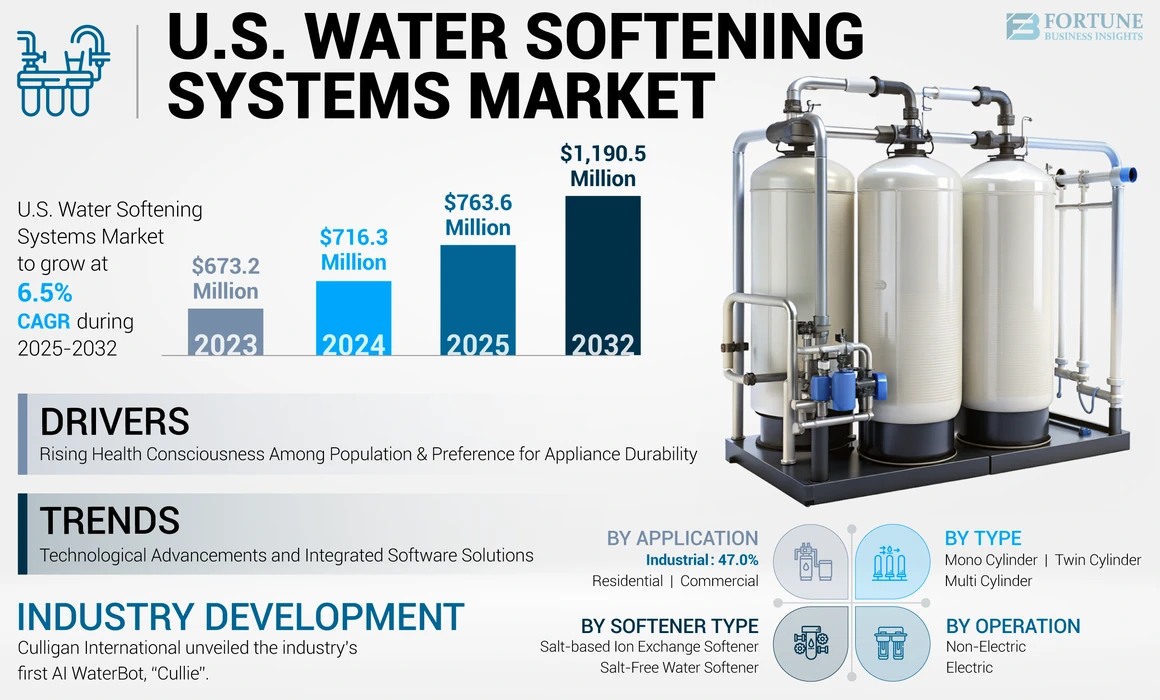

The U.S. water softening systems market size was valued at USD 716.3 million in 2024. The market is projected to grow from USD 763.6 million in 2025 to USD 1,190.5 million by 2032, exhibiting a CAGR of 6.5% during the forecast period.

Water softening systems are devices or equipment used across diverse industry sectors to remove heavy minerals, such as calcium and magnesium, from hard water. Access to good quality water is necessary across diverse sectors, including residential and commercial. Heavy metals and hard water minerals, such as calcium need to be treated before consumption, influencing the use of water softening systems at homes and other facilities. Water softening systems are gaining market traction owing to their benefits, such as equipment, pipeline, and appliance protection from scale build-up.

Water softness was shown to be the most critical component in washing machine stain removal, according to the Water Quality Research Foundation. Reducing the hardness of the water can remove stains up to 100 times more effectively than using more detergent or hot water when washing. Consumers are becoming increasingly aware of the health implications of consuming hard water, such as skin irritation and potential negative effects on hair and clothing. These factors drive the water softening systems market share that can eliminate these issues. Hard water can be found in around 90% of American homes, which can cause scaling in pipes and appliances, a buildup that clogs plumbing and forces appliances, such as water heaters, to utilize more energy. Poor water quality, characterized by high levels of minerals, necessitates water softening systems to lower scaling in pipes and appliances and protect plumbing infrastructure.

Manufacturing infrastructure development is booming post the pandemic period in the U.S. owing to significant investment in production facilities. For instance, real manufacturing construction spending has doubled post-2021, owing to an increase in overall spending by about 15%, according to the U.S. Census. Several government-supportive policies for manufacturing construction, such as the Inflation Reduction Act (IRA) and CHIPS Act, are further influencing the demand for manufacturing facilities. The CHIPS Act led to around 83 new semiconductor projects across the U.S. In addition, USD 447 million is planned in private investments across 25 states to increase domestic manufacturing capacity. The manufacturing process of semiconductors demands ultrapure water (UPW), water that has been purified to high levels of specification to prevent any impurities from impacting the performance or functionality of the final products, generating a strong demand for softening devices. Water treatment is crucial in semiconductor manufacturing, as it ensures product quality and reliability.

However, the COVID-19 pandemic further boosted the U.S. water softening systems market growth. Customer preference for online channels, especially post-pandemic, has diversified the availability across the country, boosting the demand for water softening systems.

U.S. Water Softening Systems Market Trends

Technological Advancements and Integrated Software Solutions to Augment Market Growth

Water softeners use cutting-edge technology to enhance the quality of water. The market is witnessing rapid advancements in regeneration technologies, including the hardness sensor, which offers significant savings in water and salt during the regeneration process by detecting the exact time required for regeneration. For instance, Atlas Sensor Technologies, Inc. offers a patented IoT sensor that effectively detects real-time hardness in water. This sensor substantially reduces salt and water consumption. Integration of Internet of Things (IoT) technology enables users to monitor and control water softeners remotely through smartphones or other devices, improving convenience and efficiency. Several such advancements collectively contribute to the notable growth in the water softening systems market.

Download Free sample to learn more about this report.

U.S. Water Softening Systems Market Growth Factors

Rising Health Consciousness Among Population and Preference for Appliance Durability to Boost Market

Consumers are becoming increasingly aware of the health implications of consuming hard water, such as skin irritation and potential negative effects on hair and clothing. This factor drives the demand for water softening systems that can eliminate these issues. Hard water can be found in around 90% of American homes. It can cause scaling in pipes and appliances, a buildup that clogs plumbing and forces appliances to utilize more energy. Hard water scaling causes showers and pipelines to lose their flow rate due to scale build-up in the inner parts. When it comes to cleaning dishes, soft water is more efficient at cleaning dishes as it does not increase the amount of detergent used. The analysis by the National Eczema Association has shown that long-term exposure to hard water aggravates symptoms of atopic dermatitis (AD) and may increase the chances of eczema in young children. Eczema patients are much more susceptible to the effects of hard water than people with healthy skin. The rising health awareness among consumers and preference for durable appliances will surge the U.S. water softening systems market growth.

RESTRAINING FACTORS

Regulatory Compliances to Hinder U.S. Water Softening Systems Market Growth

Water treatment plants lack resources to treat this type of water, thus, the wastewater stream turns saline. Repurposed water is essential in agriculture for irrigation but high-sodium water is harmful to crops. Residential automatic water softeners can account for around 40% of the chloride that enters wastewater treatment plants. The salt-filled solution is flushed into the sewage system by water softeners during their regeneration process. Owing to this concern, several cities in the U.S. are encouraging the prohibition of salt-based water softeners to preserve the integrity of wastewater and utilize it for agricultural purposes. Owing to several such factors, the water softening systems market might encounter challenges in its growth in the U.S.

U.S. Water Softening Systems Market Segmentation Analysis

By Softener Type Analysis

Salt-based Ion Exchange Softeners Led Market Owing to its Low Cost and Efficient Elimination of Hard Minerals

By softener type, the market is segmented into salt free water softener and salt-based ion exchange softener.

The salt-based softener dominated the market for water softening systems in 2023. Salt-based ion exchange softeners are commonly found owing to their efficient removal of heavy minerals from hard water. However, few states in the U.S. have regulated the usage of salt-based ion exchange softener due to environmental concerns, thereby witnessing steady growth during the forecast period. The salt-based water softener segment captured the largest revenue market share in 2023 owing to its benefits, such as enhanced water quality and increasing durability of appliances and water infrastructures.

The salt-free water softener system segment witnesses a strong growth as it allows the passing of hard water through the filtration tank without adding salt to it. In addition, government initiatives and regulatory policies will support the use of salt-free softening devices.

By Type Analysis

Twin Cylinder to Cater Highest Market Share Owing to Their Enhanced Efficiency and Diverse Industry Application

By type, the market is further classified into three segments: mono cylinder, twin cylinder, and multi cylinder.

The twin cylinder segment accounts for a leading revenue share in the water softening systems market. Twin cylinder water softeners are becoming largely popular across industrial, commercial, and residential facilities, making it the largest revenue market shareholder. Inconsistent water usage across sectors and overall enhanced efficiency are a few of the several benefits offered by twin cylinder water softening systems, making it the most preferred solution across the U.S. These systems will also experience considerable growth during the forecast period as a result of increasing applications across commercial and residential sectors.

Mono-cylinder and multi-cylinder water softening system segments will showcase steady growth during the forecast period owing to their growing residential and industrial applications across geographies.

By Operation Analysis

Non-Electric Softening Systems Lead Market Due to Reduced Water Wastage and On-Demand Water Regeneration

By operation, the market is diversified into electric and non-electric.

Non-electric water softening systems to dominate the market demand in 2023. The non-electric softening system segment dominates the market as it eliminates water wastage and regenerates water on-demand, reducing the overall electricity consumption for end users. Non-electric systems do not use electricity and regenerate water with the help of mechanical water meters.

The electric water softening system segment will witness strong growth during the forecast period. Building automation and technology-integrated solutions are experiencing significant growth across the U.S. For instance, Pentair Plc offers a ConnectMySoftener app that allows users to remotely access softener settings and get valuable insights regarding water usage. This app uses the water meter within Pentair-connected softeners to estimate the historical consumption of water.

By Application Analysis

Rising Investment in Industrial Facilities to Boost Water Softening Systems Market

By application segment, the market is categorized into residential, commercial, and industrial.

The industrial segment will lead the U.S. water softening systems market share throughout the forecast period. Rising capital investment across diverse industrial facilities, including semiconductor fabrication and thermal power plants, is accelerating the growth of water-softening systems in industrial settings. According to the Council of Economic Affairs, establishments and expansion of existing facilities have attracted foreign direct investment, which grew by 247% in 2022 compared to 2021. For the U.S., manufacturing accounted for about 66% of the total Foreign Direct Investment in 2022. Investment in computer and electronic products, including semiconductor manufacturing, attracted the largest investment of about USD 1.8 million in 2022.

Industrial facilities, such as power plants, food and beverages manufacturing facilities, and healthcare, and pharmaceutical facilities require huge amounts of softened water to prevent scale buildup in boilers, steamers, medical equipment, sterilization equipment, and other machinery. Increasing demand for water and wastewater treatment systems is further encouraging the market for water softening systems. Rising health awareness among the population and the development of effective water softeners are propelling the growth of water softening systems across residential sectors. Thereby, the residential segment is expected to experience the highest growth in the market.

Water is consumed for several purposes in residential spaces, including drinking, washing, flushing washrooms, gardening, and watering lawns. According to the National Environmental Education Foundation, on average 27.4 million gallons of water is consumed per day for residential use in the U.S. Soft water for domestic use is anticipated to grow during the forecast period, generating strong demand for softening systems in residential buildings. Furthermore, heavy investment in residential infrastructure development will boost the demand for machines protecting the appliances and pipelines. For instance, according to the U.S. Census Bureau, around USD 907.4 billion was invested in the residential construction sector in November 2023. Higher incomes may also lead to increased home ownership, which often correlates with greater spending on home improvement products and technologies.

To know how our report can help streamline your business, Speak to Analyst

KEY INDUSTRY PLAYERS

Expansion and Collaborative Strategies to Aid Key Participants to Penetrate in Market

The U.S. water softening systems market is moderately fragmented with a considerable number of players competing in the market. Key market players are focused on providing integrated solutions to enhance efficiency and limit operational costs for end users. Through authorized dealer networks and distributor networks, prominent players are penetrating across the U.S. region. The companies are establishing strong distribution networks to ensure the widespread availability of products and efficient supply chain management. In addition, players are offering excellent customer support, warranties, and maintenance services to enhance customer satisfaction and loyalty. Companies operating in the market are incorporating advanced technology into water softening systems to enable remote monitoring, predictive maintenance, and data analytics for better efficiency and performance optimization. Several market participants are expanding their presence by widening their product portfolio offering enhanced features across residential, commercial, and industrial facilities. Market contenders are also focusing on new product launches and providing installation services to expand their presence across the U.S.

List of Top Water Softening Systems Companies in U.S./ List of Top Water Softening Systems Companies:

- A. O. Smith Corporation (U.S.)

- AmeriWater LLC (U.S.)

- Applied Membranes, Inc. (U.S.)

- Axel Johnson, Inc. (U.S.)

- Berkshire Hathaway Inc. (U.S.)

- Culligan International (U.S.)

- Pentair Plc (U.K.)

- Marlo Incorporated (U.S.)

- Watts Water Technologies, Inc. (U.S.)

- 3M Company (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Fortune Brands Innovations, an American manufacturer of home and security products, announced the acquisition of SprinWell Water Filter Systems, a provider of residential water filtration and softening solutions, via direct-to-consumer channels.

- June 2023: Culligan International unveiled the industry’s first AI WaterBot, “Cullie”. This bot uses ChatGPT conversational capabilities to improve the customer experience by offering round-the-clock educational support and website interactions.

- March 2023: EcoWater Systems, LLC and Phyn LLC, a water solutions company, announced a partnership to offer Phyn’s smart water monitoring solutions to EcoWater’s North American dealer network.

- December 2022: Culligan International and Waterlogic Group Holdings Limited, a firm that manufactures and sells drinking water dispensers, have signed an agreement to work together to offer clean and sustainable drinking water solutions and services.

- March 2021: Rheem Manufacturing, a company that produces residential and commercial water heaters and boilers, announced the launch of water softeners with technology that analyzes water usage patterns in real-time. This allows users to utilize soft water for homes and save electricity costs.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.5% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Softener Type

By Type

By Operation

By Application

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach a valuation of USD 1,190.5 million by 2032.

In 2024, the market was valued at USD 716.3 million.

The market is projected to record a CAGR of 6.5% during the forecast period.

Salt-based water softening systems are dominating the market owing to their wide range of industry applications.

Rising health consciousness among the population and preference for appliance durability are the factors driving the market growth.

Culligan International, Berkshire Hathaway (EcoWater Systems LLC), Pentair plc, A.O. Smith, and Watts Water Technologies Inc. are a few of the top players in the market.

Twin cylinder water softeners lead the market owing to their efficient utilization across industries, including residential, commercial, and industrial.

The residential segment accounts for the highest CAGR and the industrial segment accounts highest revenue share in the U.S. market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us