Ureteroscope Market Size, Share & Industry Analysis, By Product (Flexible, Semi-flexible, and Rigid), By Application (Urolithiasis, Urothelial Carcinoma, and Others), End User (Hospitals, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

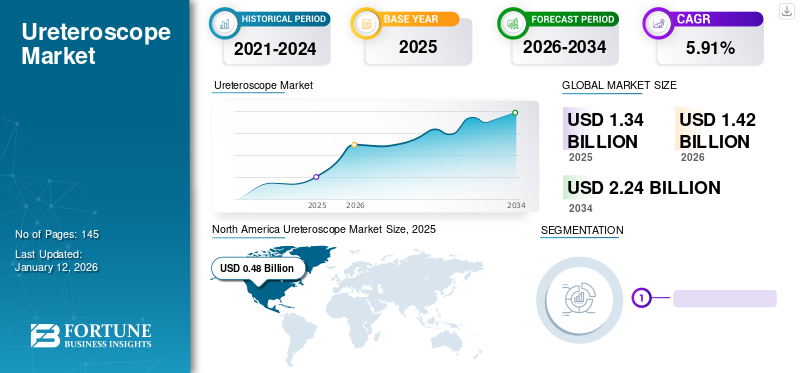

The global ureteroscope market size was valued at USD 1.34 billion in 2025. The market is projected to grow from USD 1.42 billion in 2026 to USD 2.24 billion by 2034, exhibiting a CAGR of 5.91% during the forecast period. North America dominated the ureteroscope market with a market share of 36.03% in 2025.

Growing prevalence of urolithiasis and urothelial cancer, increasing adoption of minimally invasive procedures, growing healthcare spending, and increasing innovations in product designs are projected to drive the market growth. For example, in April 2019, Dornier MedTech announced launch of New AXIS single-use flexible digital ureteroscopes at the American Urology Association Annual Meeting. This single- use product is designed to avoid cross contamination between patients by offering a clean and sterile ureteroscope for every patient, every time. Urinary stone disease is a rising concern globally, with estimated prevalence of 15%. Changes in lifestyle, growing consumption of alcohol, global warming, and improper diet are projected to contribute to rising incidence of urinary calculi.

Disruption of Supply Chain Caused by COVID-19 to Hamper Market Growth

The COVID-19 pandemic has adversely impacted the ureteroscopy market growth owing to disruption of supply chains, slowdown in economies, reduced production outputs, and ban on elective surgical procedures. The pandemic has hit about 213 countries globally as of July 2020. According to the Worldometer update, as of July 2020, there are 10,609,666 cases of COVID-19, out of which 4,277,327 are active cases. Thus, the attention of healthcare facilities is centered towards the care of COVID patients. Thus, the pandemic has decreased the number of Ureteroscopy procedures, as per the current market insights.

Ureteroscope Industry Landscape Overview

Market Size & Forecast:

- 2025 Market Size: USD 1.34 billion

- 2026 Market Size: USD 1.42 billion

- 2034 Forecast Market Size: USD 2.24 billion

- CAGR: 5.91% from 2026–2034

Market Share:

- North America dominated the ureteroscope market with a 36.03% share in 2025, driven by the high prevalence of urolithiasis, developed healthcare infrastructure, widespread adoption of minimally invasive procedures, and strong healthcare spending.

- By product type, flexible ureteroscopes held the largest market share in 2024 due to their efficacy in stone removal and advancements in fiber optics and digital technologies.

- In terms of application, the urolithiasis segment dominated, reflecting the growing global prevalence of urinary stones and the preference for ureteroscopy over other stone removal methods.

Key Country Highlights:

- United States: The growing number of kidney stone cases, supported by data showing approximately 9% prevalence in the population, drives demand for advanced ureteroscopic procedures. Developed healthcare infrastructure and increased healthcare spending boost market growth.

- Japan: Presence of leading players like Olympus Corporation and advancements in flexible ureteroscope technology foster market expansion. Increasing elderly population with urological disorders adds to demand.

- China & India: Rapid healthcare expenditure growth, increasing prevalence of urolithiasis, and expanding presence of major ureteroscope manufacturers contribute to accelerating market growth in Asia Pacific.

- Europe: Large geriatric population with urological conditions, ongoing new product approvals, and rising awareness about minimally invasive urological treatments support steady market growth.

LATEST TRENDS

Download Free sample to learn more about this report.

Growing Adoption of Disposable Flexible Ureteroscope Owing to its Proven Efficacy of Stone Removal

The prevalence of urolithiasis is rising and thus the use of stone removal surgeries. With the advent in the technology, various types of single use flexible ureteroscopes are being launched in the market. These are favored options these days by the surgeons owing to their efficacy to remove stones from inner parts of the renal tubes. Despite high cost, the single use ureterocopes definitely are going to occupy dominant place in the market owing to their growing adoption globally. For example, according to the retrospective study of comparison between rigid and flexible by NCBI, the higher success and lower complications rate of F-URS make it the first line favorable option for treatment of proximal ureteric stone (PUS).

DRIVING FACTORS

Growing Cases of Urolithiasis to Drive Product Demand

Rising incidence of urolithiasis has been observed across developing as well as developed countries. Metabolic disturbances, genetic factors, urinary tract anomalies, changing lifestyles, and environmental factors such as global warming are resulting in increased cases of urinary stones. Moreover, increasing geriatric population susceptible to kidney dysfunctions is poised to fuel the incidence rate. Type 2 diabetes and coronary diseases are the risk factors for the stone development. According to the article by National Center for Biotechnology Information (NCBI), in the U.S. kidney stone affects approximately 9% of people and is estimated that 600,000 Americans suffer from urinary stones each year. Thus, increasing number of urinary stone cases are expected to increase the demand for ureteroscopy during the forecast period.

Technological Advancements and Improved Efficacy to Propel Adoption

Ureteroscopes are tube-like devices with illuminating light and camera that can be used for location of the calculi. They enable removal of kidney stones with more accuracy than the other techniques such as shockwave lithotripsy and percutaneous nephrolithotomy. Increasing research and development activities and new product launches are poised to increase demand for ureteroscopy procedures. The flexible products have shown proven efficacy over other techniques of stone removal. Advancements in the form of digital stone removing techniques, which offer immediate promise of better optics and visualization and durability, are likely to escalate the adoption of these devices globally.

RESTRAINING FACTORS

High Cost of Digital Ureteroscope and Limited Skilled Workforce to Restrain the Market Growth

They are comparatively more expensive than other options used in the management of urinary stones and cancer. High cost of the advanced variants of these devices has restricted their adoption in many developing countries due to limited healthcare spending and poor reimbursement structure. Extracorporeal shock wave therapy is still the first treatment option for stone management in these countries. Moreover, the use of these instruments requires highly skilled healthcare professionals. Limited healthcare resources in economically weak regions are projected to restrict the ureteroscopy market growth.

SEGMENTATION

By Product Analysis

To know how our report can help streamline your business, Speak to Analyst

Flexible Ureteroscopes Segment to Hold the Significant Share of the Global Market

Based on product type, the ureteroscope market is segmented into flexible, semi-flexible, and rigid. The flexible segment recorded highest market share in terms of value owing to high cost of the products and increasing number of procedures with fiber optics and digital flexible ureteroscope, accounting for a market share of 57.19% in 2026. According to a research study by NCBI, out of 100 ureteroscopic procedures performed in ambulatory surgery at University Hospital from June 2013 to February 2015, 44% were performed using flexible ones. Most of the kidney stones can be treated with flexible ureteroscopy with least complications. Increasing innovations in flexible and semi-flexible variants of these devices are likely to decrease utilization of rigid ureteroscopy in the near future.

By Application Analysis

Urolithiasis Segment to Hold Dominant Share in the Global Market

Based on application, the market is segmented into urolithiasis, urothelial cancer, and others. Among them, the urolithiasis segment held a dominant share of the market, contributing 74.79% of the global market in 2026, owing to the high prevalence of urinary stones and the growing importance of ureteroscopes over other stone removal techniques.

The urothelial cancer segment is projected to expand at a significant growth rate attributable to growing prevalence of urological cancer globally. Bladder cancer is known to mostly affect geriatric population. Increasing geriatric population leading to increased number of bladder cancer cases is poised to drive product demand throughout the forecast period.

By End User Analysis

Hospitals Segment to Drive the Demand for Ureteroscopic Procedures Worldwide

Based on end users, the ureteroscope market is segmented into hospitals, specialty clinics, and others. The hospitals segment is expected to lead the market, contributing 55.74% globally in 2026.. Patients generally prefer hospital settings to undergo ureteroscopy procedures on account of availability of skilled healthcare providers and favorable reimbursement policies. The specialty clinics segment is likely to gain market share owing to increasing number of specialty clinics across the globe and rising healthcare spending in the private sector.

REGIONAL INSIGHTS

North America Ureteroscope Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The market size in North America stood at USD 0.48 Billion in 2025, with the region accounting for a market share of 36.03%. Growing number of urolithiasis cases, high demand for minimally invasive procedures, developed healthcare infrastructure, affordability of advanced ureteroscopes are factors contributing to the regional market growth. According to National Health and Nutrition Examination Survey, the U.S. has witnessed an upward trend in the prevalence of kidney stones in the past 30 years.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe held second largest share of the market owing to presence of huge geriatric population base with urological disorders and increasing new product approvals in the region in flexible Ureteroscopy. The UK market is projected to reach USD 0.04 billion by 2026, while the Germany market is projected to reach USD 0.11 billion by 2026.

Asia Pacific

Asia Pacific is projected to expand at a substantially higher rate during the forecast period. Growing penetration of leading key players in developing countries such as China and India, presence of market giant such as Olympus Corporation in Japan, and growing healthcare expenditure are likely to drive the market in this region. The market in Latin America and the Middle East & Africa would gain momentum with growing number of urolithiasis cases. The Japan market is projected to reach USD 0.07 billion by 2026, the China market is projected to reach USD 0.09 billion by 2026, and the India market is projected to reach USD 0.03 billion by 2026.

KEY INDUSTRY PLAYERS

Product Innovation and Strong Global Presence are Key Growth Strategies of the Players

The ureteroscope market is consolidated with few major players holding major chunk of the market. The leading market players include Olympus Corporation, Boston Scientific Corporation, and Stryker, among others. Increasing investments in research and development of advanced stone removal devices and procedures and strengthening of foothold in developing regions are key strategies being followed by the market leaders.

LIST OF KEY COMPANIES PROFILED:

- Stryker (Michigan, United States)

- Olympus Corporation (Tokyo, Japan)

- Richard Wolf GmbH. (Illinois, United States)

- KARL STORZ (Tuttlingen, Germany)

- PENTAX Medical (Tokyo, Japan)

- Elmed Electronics & Medical Industry & Trade Inc. (Ankara, Turkey)

- AED.MD (CA, USA)

- Other Prominent Players

KEY INDUSTRY DEVELOPMENTS:

- May 2021 – UroViu Corporation announced that they received clearance from the U.S. FDA to commercialize its third device Uro-G, a flexible single use cytoscope. This device has a fully deflectable tip which would help physicians perform interventional and diagnostic procedures.

- April 2019 – Dornier MedTech announced that they have launched their new product AXIS single-use digital flexible ureteroscope along with stone management products in the U.S. region. The company also mentioned about the showcasing of these products in the 2019 American Urology Association Meeting in Chicago.

REPORT COVERAGE

The ureteroscope market report provides a detailed industry analysis and focuses on crucial aspects such as leading companies, product type, application, and end users. Also, the report offers insights into market trends and highlights the major industry developments. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the growth of the market over recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Unit |

Value (USD Million) |

|

Segmentation

|

By Product

|

|

By Application

|

|

|

By End User

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global ureteroscope market size was USD 1.34 billion in 2025 and is projected to reach USD 2.24 billion by 2034.

In 2025, the market value stood at USD 1.34 billion.

Growing at a CAGR of 5.91%, the market will exhibit steady growth in the forecast period (2026-2034).

The flexible segment is expected to be the leading segment by product during the forecast period.

The growing prevalence of urinary disorders is expected to drive market growth.

Olympus Corporation, Boston Scientific Corporation, and Stryker are few of the leading players in the global market.

North America dominated the global market share in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us