Vaccines Market Size, Share & Industry Analysis, By Type (Live Attenuated, Inactivated, Recombinant, mRNA Vaccine, Viral Vectors Vaccines, Toxoid), By Route of Administration (Parenteral & Oral), By Disease Indication (Viral Diseases {Hepatitis A, Hepatitis B, Polio, RSV, Influenza, HPV, Measles/Mumps/Rubella, Rotavirus, Shingles (Herpes Zoster)} & Bacterial Diseases {Pneumococcal Disease, Diphtheria, Meningococcal Disease}), By Age Group (Pediatric & Adults), By Distribution Channel (Hospital & Retail Pharmacies, Government Suppliers), & Regional Forecast, 2026-2034

Vaccines Market Size Overview

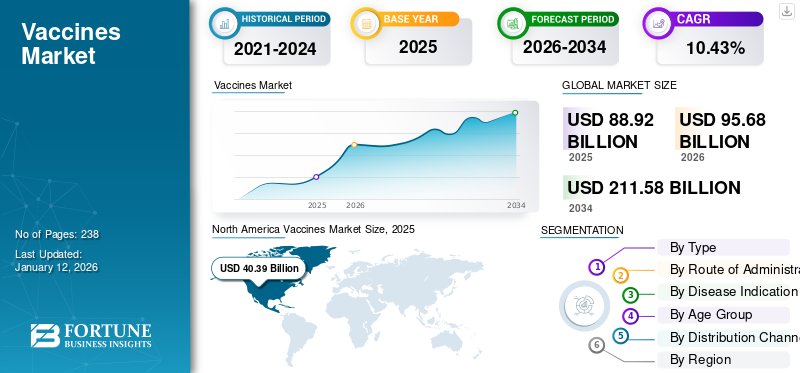

The global vaccines market size was valued at USD 88.92 billion in 2025 and is projected to grow from USD 95.68 billion in 2026 to USD 211.58 billion by 2034, exhibiting a CAGR of 10.43% during the forecast period. North America dominated the vaccines market with a market share of 45.42% in 2025.

Vaccines are the most powerful and cost-effective way to protect billions of people worldwide from harmful diseases. Their development has the potential to transform public health by eliminating the burden of life-threatening infectious diseases, especially in developing nations.

The market is witnessing significant growth due to the rising prevalence of infectious diseases and increasing demand for immunization programs to decrease the spread of these diseases. Additionally, the initiation of free vaccination programs by various health regulatory agencies for increasing immunization amongst people is also leading to the market growth.

- For instance, in November 2024, the Ministry of Health and Family Welfare announced World Immunization Day, to be observed annually on November 10th. The event aims to raise awareness about the importance of vaccines in preventing infectious diseases and safeguarding public health. India’s Universal Immunization Programme (UIP) is one of the country’s most extensive public health initiatives, striving to deliver these essential products to millions.

Moreover, Pfizer Inc., GSK plc, and Sanofi are some of the leading vaccine companies with varied product portfolios and strong research capabilities. Robust strategic initiatives and adopting advanced technologies for launching new products are also propelling market growth.

Vaccines Industry Landscape Overview

Market Size & Forecast:

- 2025 Market Size: USD 88.92 billion

- 2026 Market Size: USD 95.68 billion

- 2034 Forecast Market Size: USD 211.58 billion

- CAGR: 10.43% from 2026–2034

Market Share:

- North America dominated the vaccines market with a 45.42% share in 2025, driven by strong public health policies, high immunization awareness, robust healthcare infrastructure, and presence of key manufacturers like Pfizer, Merck & Co., and GSK.

- By Type, the Recombinant/Conjugate/Subunit vaccine segment held the largest market share in 2024 due to its strong efficacy, favorable safety profile, ease of large-scale production, and increased product approvals like VIMKUNYA by Bavarian Nordic.

Key Country Highlights:

- Japan: Market growth supported by strong government-led immunization drives and rising R&D investments. For example, the Japanese government supports pediatric immunization programs with broad coverage under national insurance.

- United States: The U.S. leads regional growth through major investments in vaccine R&D and public health funding. CDC’s expansion of RSV vaccine usage (e.g., ABRYSVO and Penmenvy) and FDA approvals are boosting innovation and adoption.

- China: Strong government initiatives like HPV vaccine programs and expansion of public health schemes for pediatric vaccinations contribute to substantial market potential, especially with growing birth rates and urbanization.

- Europe: The European region is witnessing growth due to new product approvals (e.g., CSL & Arcturus’ KOSTAIVE), strong regulatory frameworks, and high immunization coverage supported by public healthcare systems.

MARKET DYNAMICS

Market Drivers

Rising Incidences of Diseases Globally to Fuel Market Growth

One of the most critical drivers positively impacting the vaccine market growth is the surge in bacterial and viral diseases globally.

- For instance, as per the data published by the Centers for Disease Control and Prevention in March 2023, 422 cases of meningococcal disease were reported in the U.S., the highest since 2014. The rising number of preventable infectious diseases increases the demand for vaccinations and boosts market growth.

Moreover, the rising number of vaccine-preventable diseases impacts society’s well-being and places considerable strain on healthcare and social resources. Thus, these situations promote the importance of immunization and act as global vaccine market drivers.

Market Restraints

High Manufacturing and Development Costs of Vaccines May Restrict Market Growth

The growing incidence of chronic and infectious diseases is driving the market growth. However, high costs associated with per-dose vaccines are hampering market expansion. This higher cost is due to complex clinical processes, research, regulatory requirements, and longer timelines associated with manufacturing and production processes.

- For instance, in December 2024, as per the U.S. Assistant Secretary for Planning and Evaluation report, the mean development cost for a preventive vaccine is USD 132.7 million, including Phase 4 studies but excluding other significant costs, such as development of Chemistry, Manufacturing, and Controls (CMC), manufacturing plant design and building as well as costs associated with establishing supply and distribution chains. Such high production cost increases the final product cost, thus leading to decreased adoption among the lower-middle economic countries, eventually hampering the vaccines market growth.

Market Opportunities

Robust R&D Investments to Accelerate Development of Pipeline Candidates Creating Growth Opportunities

The rising prevalence of new bacterial and viral infections and growing demand for preventive measures increase the need for novel products and offer a lucrative opportunity for market growth. These diseases include hepatitis, dengue fever, Ebola, meningococcal disease, pneumococcal disease, diphtheria, and others.

Additionally, the outbreak of the COVID-19 pandemic has proved that vaccines can be developed faster in a very short period through large public investments, joint planning of clinical development, regulation, and manufacturing capacity, and leveraging innovative platforms.

Moreover, many key companies focus on research and development and clinical studies to launch novel product offerings to prevent infectious communicable diseases, leading to market growth over the forecast period.

- For instance, in June 2024, Dynavax Technologies announced that the first participant had been dosed in a Phase 1/2 clinical trial assessing the safety, tolerability, and immunogenicity of Z-1018, the company's investigational vaccine candidate aimed at preventing shingles (herpes zoster).

Market Challenges

Stringent Regulatory Guidelines and Logistics Issues Challenges Market Growth

Strict vaccine regulatory guidelines and logistical challenges pose significant hurdles for the vaccine market. Diverse regulatory requirements across countries complex the manufacturing process. These regulatory bodies require extensive clinical trials, safety data, and approval processes, which can delay vaccine development.

Additionally, these products require cold chain storage to preserve vaccine efficacy. Thus, supply chain disruptions, lack of infrastructure, and limited access to refrigeration facilities hinder timely and effective distribution. These challenges affect immunization programs and restrict the overall market growth.

Vaccines Market Trends

Gradual Shift of Manufacturers from Vials to Prefilled Syringes Vaccine Form to Determine Future Market Growth

Rising demand for these products and advancements in pharmaceutical technologies have shifted the manufacturer's focus from a vial to a prefilled syringe (PFS) form for easy administration. The prefilled syringes (PFS) offer diverse advantages in speed, disposal, wastage, and patient safety, owing to premeasured accurate doses that reduce dosing errors and risk of microbial contamination.

- For instance, in September 2022, BD launched the next-generation glass prefillable syringe (PFS) designed in collaboration with leading pharmaceutical companies to meet the complex and evolving needs of vaccine manufacturing.

Furthermore, many key pharma companies receive marketing approval for their vaccine-prefilled syringes, leading to market growth.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Recombinant/Conjugate/Subunit Segment Dominated the Market Due to Its Effectiveness

The type segment of the market is divided into live attenuated, inactivated, recombinant/conjugate/subunit, viral vectors vaccine, mRNA vaccine, toxoid, and others.

The recombinant/conjugate/subunit vaccine segment dominated the market in 2026 with a share of 46.88%. The appropriate immune response, long-term protection, and simplified large-scale manufacturing contribute to the segment's growth in the market. Additionally, the rising number of product launches for recombinant products also propels the segment’s growth in the market.

- For instance, in February 2025, Bavarian Nordic A/S received marketing authorization for VIMKUNYA (Chikungunya Vaccine, Recombinant) from the European Commission for active immunization and prevention of disease caused by chikungunya virus in individuals aged 12 years and older.

The inactivated segment held the second-largest share of the market. The segmental growth is attributed to the increasing prevalence of preventable infectious diseases such as typhoid, cholera, hepatitis A virus, plague, rabies, influenza, and new product launches by key players.

- For instance, in April 2024, Sanofi launched Verorab, an inactivated rabies vaccine in the U.K. for pre-exposure and post-exposure rabies prophylaxis in all age groups. These factors collaboratively are expected to boost the segment growth.

The mRNA vaccine segment is expected to grow with the highest CAGR during the forecast period. Growing advancements in vaccine technologies and the shift of key companies toward developing and launching mRNA-based vaccines are driving the segment’s growth. In contrast, these vaccines had a strong growth during the pandemic due to the presence of COVID-19 vaccines; however, companies are currently focusing on expanding the indication areas for these products.

- For instance, in August 2024, Pfizer Inc. and BioNTech reported top-line results from a Phase 3 clinical trial that evaluated the mRNA vaccine candidate against influenza and COVID-19 in healthy individuals aged between 18-64 years. These developments help to boost the segment’s growth during the forecast period.

Live attenuated and toxoid segments are predicted to witness steady growth during the forecast period owing to lower revenue generation than other types.

By Route of Administration

Presence of a Large Number of Products in Parenteral Form to Boost the Segment Growth

Based on route of administration, the market is segmented into parenteral and oral.

The increasing prevalence of bacterial and viral diseases leads to the segment's dominance during the forecasted timeframe. The maximum supply and sales of the parenteral route vaccines across the globe have led to the generation of larger revenue from parenteral products in 2024. Additionally, key players are focused on receiving regulatory approvals for their parenteral vaccines to boost the segment’s growth in the market.

- For instance, in March 2023, Merck & Co., Inc. received approval from the U.S. FDA to administer M-M-R II, VARIVAX, and ProQuad vaccines through the intramuscular (IM) route.

The oral segment is expected to grow slower over the forecast period owing to challenges faced in developing countries. To achieve effectiveness, these must overcome the harsh gastrointestinal environment and avoid tolerance induction. Addressing these challenges is a pharmaceutical obstacle for companies planning to enter the market. This segment is likely to register a considerable CAGR of 13.13% during the forecast period (2025-2032).

- The parental segment is foreseen to gain 85.18% of the market share in 2026.

By Disease Indication

Viral Diseases Segment Dominated Owing to Launch of Key Products

The market is divided into viral diseases and bacterial diseases based on disease indication. The viral diseases segment is further sub-segmented into hepatitis A, hepatitis B, polio, RSV, influenza, human papillomavirus, measles/mumps/rubella, rotavirus, shingles (herpes zoster), and others.

The viral diseases segment dominated the global vaccines market share in 2024 and is anticipated to grow with a moderate CAGR during the forecast period. This growth is driven by the rising prevalence of viral infectious diseases and rising awareness programs through various government organizations to decrease the spread of vaccine-preventable diseases. The segment is poised to attain 66.01% of the market share in 2026.

- For instance, the European Centre for Disease Prevention and Control initiated a Flu Awareness Campaign in October 2024. The program aimed to raise awareness among people for seasonal influenza, the importance of vaccination and increase the uptake of vaccines by underlying risk factors.

The bacterial diseases segment is sub-segmented into meningococcal disease, pneumococcal disease, diphtheria/tetanus/pertussis, and others.

The bacterial diseases segment is expected to grow with significantly higher CAGR of 11.27% during the forecast period (2025-2032), owing to the increasing prevalence of bacterial infections and rising demand for vaccines as newborns' first-line immunization and as booster doses for pediatrics. Additionally, the increasing incidence of bacterial infections due to the spread of antibiotic-resistant bacteria further drives the need for bacterial vaccines. This allows immediate approvals from regulatory bodies, which is expected to boost segment growth during the forecast timeframe.

- For instance, in March 2025, Merck & Co., Inc. received approval from the European Commission for CAPVAXIVE, an active immunization to prevent invasive disease and pneumonia in individuals 18 years and older.

To know how our report can help streamline your business, Speak to Analyst

By Age Group

Increase in Pediatric Injection Doses Fueled Pediatric Segment Dominance

Based on age group, the market is classified into pediatric and adults.

The pediatric vaccines segment holds a maximum portion of the market. This segment's growth potential mainly depends on two factors: a worldwide growing birth cohort and increasing pediatric vaccination doses. Moreover, the increasing number of vaccination programs for the pediatric population across the globe and the rising number of product launches by key players boost the growth of the segment. This segment is expected to dominate the market with a share of 52.74% in 2026.

- For instance, in March 2024, Merck & Co., Inc. launched Bakxneuvance, a 15-valent pneumococcal conjugate vaccine (PCV), in South Korea as part of the government's pediatric National Immunization Program (NIP).

The adult segment is anticipated to grow with a considerable CAGR of 10.34% during the forecast period. The increasing prevalence of infectious diseases in adults, such as cervical cancer due to HPV, tuberculosis, and Mpox increases the demand for vaccination in adults. Additionally, the rise in research & development and product launches targeted at adults will likely drive the segment’s growth during the forecast period.

- For instance, in March 2024, Bavarian Nordic received approval for JYNNEOS, the Swiss Agency for Therapeutic Products, Swissmedic, to treat smallpox and Mpox viruses in individuals aged 18 years and older.

By Distribution Channel

Hospital & Retail Pharmacies Segment Leads Due to Growing Demand for Smaller Institutions for Vaccinations

Based on distribution channel, the market is segmented into hospital & retail pharmacies, government suppliers, and others.

The government suppliers held a dominant global vaccine market share in 2024. Suppliers such as the Global Alliance for Vaccines and Immunization (GAVI), the United Nations Children's Fund (UNICEF), the Pan American Health Organization (PAHO), and others are focused on achieving a sustainable supply of products globally. These organizations obtain vaccine doses in large volumes from the manufacturers in millions and mainly focus on supplying to countries having a lesser reach. Moreover, rising vaccine approvals and distribution by government suppliers boost the segment's growth. this segment is expected to record a CAGR of 10.75% during the forecast period (2025-2032).

- For instance, in April 2025, Valneva announced the approval of live attenuated single-dose chikungunya vaccine (Ixchiq) by the Brazilian Health Regulatory Agency (ANVISA), which is to be manufactured and distributed by the Instituto Butantan, an official distributor in Brazil under the Ministry of Health's National Immunization Program—such scenarios aim to boost the segment's growth in the market.

In terms of revenues generated, the hospital & retail pharmacies segment is anticipated to hold the second-largest market share. Patient preferences and easy availability of desired vaccinations boost the shift of patients toward these settings. Additionally, hospital and retail pharmacies globally are under government surveillance to ensure they meet the demand and maintain adequate stock levels. The segment is anticipated to dominate with a share of 48.1% in 2025.

Vaccines Market Regional Outlook

Based on geography, the market is analyzed across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Vaccines Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America generated a revenue of USD 40.39 billion in 2025 and USD 43.82 billion in 2026 and is anticipated to dominate the global market over the forecast period. The dominant share of the region is due to adequate awareness about vaccination, the presence of key manufacturers, and secure government policy regarding health welfare.

U.S.

The U.S. dominated the North American region, owing to significant investments in R&D and public health funding for adequate vaccination in the population. Additionally, the country is equipped with strong research and development infrastructure for the launch of advanced products for different indications. The U.S. market is projected to reach USD 36.92 billion in 2026.

- In April 2025, Pfizer Inc. reported the expansion of the recommended use of Respiratory Syncytial Virus (RSV) vaccines by the U.S. Centers for Disease Control and Prevention's (CDC) Advisory Committee on Immunization Practices (ACIP). The vaccine is approved for adults aged 50-59 at increased risk of RSV-associated Lower Respiratory Tract Disease (LRTD).

Asia Pacific

Asia Pacific is the second leading region poised to be valued at USD 22.14 billion in 2025, registering a CAGR of 13.36% during the forecast period (2025-2032). Asia Pacific held the second-largest share of the market owing to the expanding birth rate and the presence of leading manufacturers and suppliers of these products. The Chinese market is expected to reach USD 2.68 billion in 2026. Along with these, government initiatives to encourage vaccination drives in the region are also boosting the market's growth.

- For instance, in May 2025, the Indian Science, Technology, and Innovation portal reported the push for HPV vaccination by the Government of India to combat cervical cancer in girls aged 9 to 14 years old.

India is foreseen to grow with a value of USD 2.46 billion in 2025, while Japan is predicted to be valued at USD 12.10 billion in the same year.

Europe

Europe is the third leading region expected to gain USD 19.07 billion in 2025. The European market is expected to grow steadily, with high-growth countries, such as Germany and France, likely to contribute to the expansion. The U.K. market continues to grow, projected to reach a market value of USD 2.85 billion in 2025. Furthermore, the region’s strong healthcare infrastructure and rising regulatory approvals for new products boosts the market growth in the region.

- For instance, in February 2025, CSL and Arcturus Therapeutics received marketing authorization from the European Commission for its mRNA COVID-19 vaccine, KOSTAIVE (ARCT-154), for individuals aged 18 years and older.

Germany is anticipated to hold USD 5.11 billion in 2025, while France is likely to gain USD 4.36 billion in the same year.

Latin America and the Middle East & Africa

Latin America is the fourth largest market anticipated to reach USD 5.95 billion in 2025. Latin America and the Middle East & Africa are expected to witness growth prospects owing to the rising prevalence of chronic diseases leading to increasing demand for immunization, especially in African countries. Moreover, the government's launch of immunization implementation programs is also likely to boost market growth.

- For instance, in November 2024, the World Health Organization (WHO) announced the allocation of 899,000 Mpox vaccine doses to the 9 African countries affected by the Mpox surge in Africa.

The GCC market is projected to stand at USD 0.53 billion in 2025.

Competitive Landscape

Key Industry Players

GSK plc and Pfizer Hold Prominence due to their Strong Product Portfolio

Companies such as GSK plc, Sanofi, Pfizer Inc., and Merck & Co., Inc. hold a prominent share of the market. A strong product portfolio and continuous research activities for new product launches supports their market share.

- In April 2024, GSK plc announced that the U.S. FDA accepted its biologics license application (BLA) seeking approval for its MenABCWY candidate, a 5-in-1 meningococcal ABCWY vaccine.

Other prominent players, such as AstraZeneca and Dynavax Technologies, Moderna, Inc., and Bavarian Nordic, held a significant market share. A strong focus on R&D initiatives for global approvals and launches of new products leads to their consistent leading position in the market.

LIST OF KEY VACCINES COMPANIES PROFILED

- Bavarian Nordic (Denmark)

- GSK plc (U.K.)

- EMERGENT (U.S.)

- Merck & Co., Inc. (U.S.)

- Inovio Pharmaceuticals, Inc. (U.S.)

- Pfizer Inc. (S.)

- Sanofi (France)

- CSL (Australia)

- AstraZeneca (U.K.)

KEY INDUSTRY DEVELOPMENTS

- April 2025: Pfizer Inc. announced the amendment in the marketing authorization for ABRYSVO (RSV vaccine) that reported the extension of indication, including prevention of Lower Respiratory Tract Disease (LRTD) caused by RSV.

- April 2025: GSK plc announced that the CDC’s Advisory Committee on Immunization Practices (ACIP) has voted to endorse the inclusion of Penmenvy (Meningococcal Groups A, B, C, W, and Y Vaccine) in the adolescent meningococcal vaccination schedule.

- February 2025: Zydus Lifesciences launched India's first flu protection influenza virus vaccine, which is effective against the new strain of influenza virus.

- January 2023: Bharat Biotech launched an indigenously made nasal COVID-19 vaccine, iNCOVAC, for people older than 18 years.

- August 2022: GSK acquired Affinivax, Inc., a clinical-stage biopharmaceutical company known for developing novel next-generation pneumococcal vaccines. Through this acquisition, the company aims to strengthen its product portfolio.

- August 2022: Takeda Pharmaceutical Company Limited received approval from the Indonesia National Agency for Drug and Food Control for its dengue tetravalent vaccine, QDenga, for individuals aged 6 to 45 years.

REPORT COVERAGE

The global market report comprises of detailed industry overview and a study of market dynamics. The report includes an analysis of the market drivers, restraints, opportunities, challenges, and trends. The report also highlights the prevalence of key infectious diseases, pipeline analysis and key developments within the industry, as well as discusses the launch of new products by major players in the market. Furthermore, the report explores the impact of tariffs on the industry and provides an overview of the impact on the market situation during the forecast period.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.43% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Route of Administration

|

|

|

By Disease Indication

|

|

|

By Age Group

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 88.92 billion in 2025 and is projected to reach USD 211.58 billion by 2034.

In 2025, the market in North America stood at USD 40.39 billion.

Growing at a CAGR of 10.43%, the market will exhibit remarkable growth over the forecast period (2026-2034).

Viral diseases are the leading segment based on disease indication.

Strong supplies of the products in emerging nations, robust R&D for the introduction of novel products, competitive pipeline candidates, and powerful government support and funding are key factors driving the market.

GSK plc., Merck & Co., Inc., Sanofi, and Pfizer, Inc. are the major players in the market.

North America dominated the vaccines market with a market share of 45.42% in 2025.

Increased awareness about the importance of immunization among the population, implementation of vaccination programs across the nations, and rising vaccination coverage are expected to drive the adoption of the product.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us