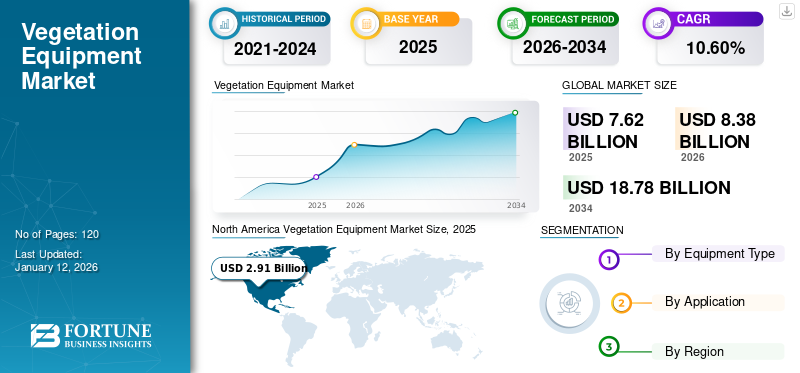

Vegetation Equipment Market Size, Share & Industry Analysis, By Equipment Type (Tree Cutters, Brush Cutters, Chippers and Grinders, Mowers, Bucket Trucks, Pruning Machine, Herbicide Applicators, Aerial Equipment, Hand Tools, and Others), By Application (Forestry, Rangeland & Pastureland, Roads & Railways Infrastructure, Electric Utilities & Pipelines, Industrial Facilities, and Others), and Regional Forecast, 2026 – 2034

Vegetation Equipment Market Size

The global vegetation equipment market size was valued at USD 7.62 billion in 2025. The market is projected to grow from USD 8.38 billion in 2026 to USD 18.78 billion by 2034, exhibiting a CAGR of 10.60% during the forecast period. North America dominated the global market with a share of 38.10% in 2025.

Vegetation equipment is a set of tools and equipment used to control and maintain vegetation in different environments. A wide range of equipment, including mowers, brush cutters, and hand tools, are used for managing and harvesting forested areas. Vegetation management is largely required at bridges, roads, airports, power generation, and transmission facilities. The growing demand for asset management for utility companies is further anticipated to bolster the vegetation equipment market growth. Unwanted vegetation causes structural damage, surging the vegetation equipment market share and allowing the elimination of weeds, bushes, and branches across facilities.

Maintenance of utility networks, roads and railways, forestry, and industrial facilities has become necessary for the consistent function of commercial and industrial spaces. Urbanization and heavy investments in infrastructure projects are generating strong need for vegetation maintenance along roadways, power lines, and railways. For instance, the Indian Government has sanctioned an investment of about USD 250 million for National Highway Projects in 2022. Several industrial facilities are subjected to regulations regarding vegetation management to ensure environmental protection, safety, and compliance with land use laws. These prominent factors are surging vegetation equipment market growth across countries.

The COVID-19 pandemic had a considerable impact on the market owing to supply chain disruptions, reduced demand, temporary halts across industries, and remote working trends. However, the market for vegetation equipment remained positive post-pandemic due to the rising need for agricultural productivity, infrastructure maintenance, and sustainable land management.

Vegetation Equipment Market Trends

Vegetation Management at Utility Facilities With Advanced Technology Adoption to Surge Market

The utility vegetation management has been gaining traction for the past few years. According to the U.S. Energy Information Administration, the U.S. has millions of low-voltage power lines and more than 160,000 miles of high-voltage power lines connecting over 145 customers. More than 7,300 power plants are expected to bolster the market demand for vegetation equipment. Vegetation equipment allows prevention of power outages and fire accidents. Utility companies can reduce risks, ensure safety, and enhance the reliable operation of their facilities benefiting customers and the environment.

Manufacturers are also launching vegetation management solutions owing to their growing needs. For instance, Terex Group announced the launch of its new brand, Green TecTM, which offers comprehensive tree care and vegetation management solutions, in April 2024. The products include chippers, shredders, mulchers, and tree care handlers.

Download Free sample to learn more about this report.

Vegetation Equipment Market Growth Factors

Transportation and Infrastructure Development Projects to Propel Market Growth

Urbanization and increasing investment in infrastructure development are largely boosting the demand for vegetation equipment. Infrastructure development projects, including highways, road widening, and railway expansion, all require equipment to clear out unwanted vegetation. Vegetation equipment, such as mowers, mulchers, and herbicide applicators are used to manage vegetation in these areas, contributing to increased demand. For instance, ASEAN countries planned over 850 new infrastructure investments in 2019, with 50% of the investment made in transportation, which includes road, rail, and airports.

Infrastructure development projects are subject to environmental regulations aimed at protecting sensitive habitats, wildlife, and water resources. Vegetation equipment is used to mitigate environmental impacts by controlling vegetation growth, preserving native vegetation, and preventing erosion in construction and utility maintenance activities.

RESTRAINING FACTORS

High Cost of Advanced Technology and Regulatory Concerns to Surge Market Progress

Adoption of remote technologies and data analytics requires a huge amount of capital expenditure. Implementation of integrated vegetation management will further impact the market for vegetation equipment. Budgetary constraints of companies for operation and maintenance activities will further impact the market growth. Regulatory policies limit the use of certain herbicides and pesticides in vegetation management, minimizing the demand for vegetation equipment across industries.

Vegetation Equipment Market Segmentation Analysis

By Equipment Type Analysis

Mowers Segment to Dominate Market Owing to Wide Array of Applications

By equipment type, the market is further classified as tree cutters, brush cutters, chippers and grinders, mowers, bucket trucks, pruning machine, herbicide applicators, aerial equipment, hand tools, and others. Others segments include shredders and mulchers.

Mowers will lead the market share 52.86% in 2026 terms of revenue during the forecast period. Mowers are largely used in landscaping, environmental conservation, utility, and other industrial facility maintenance. The growing focus on landscaping services and increased home gardening activities are likely to surge the demand for mowers for vegetation management. Rising investments in the upkeep of public spaces, such as parks and roadside green spaces are likely to spur the adoption of mowers. Mowers will experience strong growth during the forecast period owing to the launch of new and advanced product launches that offer improved fuel efficiency and ergonomic design.

Herbicide applicators will capture the second-highest market share in terms of revenue owing to the rising demand for efficient weed control and their long-term cost-effectiveness.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Electric Utilities and Pipelines Segment to Dominate Market Owing to Aging Infrastructure and Growing Vegetation

By application, the vegetation equipment market is further segmented into forestry, rangeland and pastureland, roads and railways infrastructure, electric utilities and pipelines, industrial facilities, and others. The others segment includes aquatic sites.

The electric utilities & pipelines segment will dominate the market share 31.38% in terms of revenue. Power lines malfunction and electricity disruptions have been common across regions owing to overgrown vegetation. Unprecedented climate change is further disrupting the electric utilities. For instance, in April 2022, power lines in Panjim, India were damaged due to thundershowers and lightning, creating heavy demand for vegetation management. Overgrown trees, branches, and bushes can excessively destroy power lines, causing damage to facilities. Therefore, several electric utility facilities focus on vegetation management by spending more on operations and maintenance activities.

The road and railway infrastructure development segment is also experiencing substantial growth as a result of significant investment in infrastructure projects. For instance, according to National Railway Policies Development Indonesia, over 80 urban rail projects are planned in the ASEAN region by 2033. A total investment of about USD 54.8 billion is required for the rail projects.

REGIONAL INSIGHTS

Based on region, the market is classified as North America, Europe, Asia Pacific, South America, and the Middle East & Africa. North America is expected to capture the highest market share throughout the forecast period.

North America Vegetation Equipment Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Vegetation equipment has gained significant attention in the North American market dominated the market with a valuation of USD 2.91 billion in 2025 and USD 3.2 billion in 2026.. A few of the prominent reasons include rising wildfire mitigation, utility maintenance, ecological restoration, agriculture practice, landscaping, and urban forestry. North American countries, such as Mexico are attracting foreign investment for the development of transportation infrastructure. For instance, the 10th Mexico Infrastructure Projects Forum, a two-day event, will be held in January 2025 in Monterrey, Mexico. Furthermore, the GO Expansion Project Rail Infrastructure Project in Canada was planned for 2023 and is expected to complete by 2025. The growing number of projects and increasing government investments in infrastructure development including roads, rails, and industrial facilities are predicted to boost the demand for vegetation equipment in the region.

Utilities that include power plants, pipeline companies, telecom companies, and operators require extensive vegetation management to ensure reliability and safety. The rising population and expansion of urban areas are surging the demand for utilities. As the demand for utilities grows and infrastructure ages, companies are undertaking expansion projects and maintenance activities. According to the U.S. Department of Energy, more than 70% of the transmission lines in the U.S. are more than 25 years old. Significant investments planned across the U.S. are generating strong demand for vegetation equipment across the country. For instance, in 2023, the Department of Energy announced an investment of about USD 3.5 billion for 58 projects across 44 states in the U.S.The U.S. market is projected to reach USD 2.61 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Investment in road networks and rail infrastructures across the European region has resulted in strong market growth. Road infrastructure development improves connectivity between rural and urban regions, facilitating mobility. Significant capital expenditure in several countries across the region has enhanced their spending on road development. For instance, according to the International Road Federation, Slovak Republic has increased their investment in road infrastructure by 91% between 2013 and 2018. Similarly, High-speed 2 (HS2) is a high-speed railway line that connects cities, such as London with Birmingham, Manchester, and Leeds and is expected to be completed by 2029. Thereby incurring heavy investments in vegetation management solutions across the region. Europe is estimated to experience steady growth in the vegetation equipment market.The UK market is projected to reach USD 0.43 billion by 2026, while the Germany market is projected to reach USD 0.58 billion by 2026.

Asia Pacific is expected to show the highest growth in the vegetation equipment market as a result of rising investment in the utility sector, infrastructure, and public transit development. The increasing farming activities and shrinking farmland sizes to further generate considerable market growth. The growing economies in the region and their increasing investment in energy-related projects are anticipated to boost the demand for equipment used for vegetation management. For instance, according to the IEA, the average energy investment in Southeast Asia accounted for about USD 70 billion between 2016 and 2020. In addition, the ASEAN annual financing for solar and wind projects reached about USD 15.1 billion in 2021. Several equipment, such as mowers, trimmers, pruning machines, and brush cutters are needed in renewable energy plants to minimize the risk of encroachment and potential fire hazards. The rising investment in new plant development will divert the capital toward operations and maintenance activities.The Japan market is projected to reach USD 0.41 billion by 2026, the China market is projected to reach USD 0.72 billion by 2026, and the India market is projected to reach USD 0.68 billion by 2026.

Expansion of renewable resources, climate diversity, and biodiverse regions are a few of the prominent factors impacting the demand for vegetation equipment. Effective removal of unwanted vegetation is gaining strong market traction for industrial plants and new infrastructure development is surging the market demand in South America.

The Middle East & Africa market will cater to significant demand, which results from urbanization and rising investment in infrastructure projects.

KEY INDUSTRY PLAYERS

Business Portfolio Expansion and Efficient Product Launches to Boost Presence of Key Players

The vegetation equipment market share is moderately consolidated owing to the presence of large players across industries. The established players in the market provide a wide range of product offerings for diverse industry applications. Market participants are investing in new product developments across exhibitions and conferences in varied geographic locations, which is further impacting the adoptions of vegetation equipment. Several market players are also focusing on expanding their product offerings across industries through a robust dealer and distributor network.

List of Top Vegetation Equipment Companies:

- Caterpillar (U.S.)

- John Deere (U.S.)

- Husqvarna Group (Sweden)

- STIHL (Germany)

- Kubota (Japan)

- Toro (U.S.)

- Vermeer ECHO Incorporated (U.S.)

- Prinoth Vegetation Management (Italy)

- Alamo Group (U.S.)

- IVM Solutions (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Vermeer introduced its low-speed shredder LS3600TX, which can be used in construction and demolition waste, municipal solid waste, and wood waste. The LS3600TX shredder has a powerful 456-hp Stage V engine, a tracked undercarriage, and enhanced durability.

- September 2023: Bruks Siwertell expanded its product portfolio by adding the Bruks 1006.3 RT industrial wood chipper. The new truck-mounted wood chipping machine has a flexible design and meets the EU Stage V regulatory standards. This vegetation equipment can be prominently used in remote forest locations and in other applications.

- April 2023: FELCO, a horticulture and pruning tools provider, expanded its product portfolio with a new range of gardening tools. The new gardening tools introduced by the company include a trowel, cultivator, and weeder made from sustainable materials.

- May 2022: Toro introduced its robotic mower vegetation equipment for the residential yard care category. The new robotic and battery-powered mower provides enhanced efficiency and carries safety certifications, wire-free navigation systems, and theft-proof features.

- September 2020: Honda India Power Products Limited, a manufacturer of power products, introduced the 1.3 hp 4 Stroke Backpack model UMR435T Brush Cutter. The rising demand for daily de-weeding activities, crop harvesting, and roadside maintenance tasks is surging the demand for brush cutters across the country. The new model has a flexible shaft and ergonomic design with cutting attachments suitable for landscapes.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Equipment Type

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to record a valuation of USD 18.78 billion by 2034.

In 2025, the market was valued at USD 7.62 billion.

The market is projected to record a CAGR of 10.60% during the forecast period.

The electric utilities & pipelines segment is leading the market in terms of revenue.

Vegetation management at utility facilities with the adoption of advanced technologies will drive the market growth during the forecast period.

Rising public transit and infrastructure development will boost the market for vegetation equipment during the forecast period.

Husqvarna Group, Toro, Caterpillar, and STIHL are a few of the key market participants.

North America led the market in terms of revenue in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us