Vehicle Telematics Market Size, Share & Industry Analysis, By Application (Information and Navigation, Safety and Security, Fleet/Asset Management, Insurance Telematics, Infotainment System, and Others), By Technology (Embedded, Tethered, and Integrated), By Sales Channel (OEM and Aftermarket), By Vehicle Type (Passenger Cars and Commercial Vehicles), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

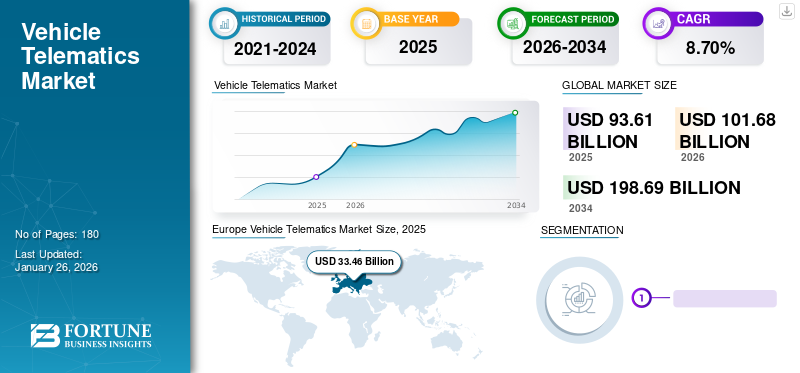

The vehicle telematics market size was valued at USD 93.61 billion in 2025 and is projected to grow from USD 101.68 billion in 2026 to USD 198.69 billion by 2034, exhibiting a CAGR of 8.70% during the forecast period. Europe dominated the global market with a share of 35.74% in 2025.

The vehicle telematics market in the U.S. is projected to grow significantly, reaching an estimated value of USD 26.15 billion by 2032, driven by the greater demand for telematics system samong the consumers. Additionally, Faster rate of deployment of new technology in the country further fuels the market demand in U.S.

Vehicle telematics is a technology that pools informatics, telecommunications, computer science, electrical engineering, and vehicular technologies to build a system that functions to gather and derive insights from the data collected from vehicle telematics. This ultimately improves the efficiency and safety of drivers. The data collected is further used for the analysis and improvement of various applications including driver safety, vehicle performance, maintenance, and others.

The increasing focus of various auto manufacturers on integrating a vehicle telematics system in passenger cars and commercial vehicles is one of the leading reasons for their increasing adoption in various regions. Additionally, greater consumer awareness regarding the benefits and improved insights into the vehicle’s performance and behavioral patterns of drivers are further influencing fleet owners and vehicle fleet managers to implement telematics systems into their vehicles. Increasing consumer awareness and rising product & technology penetration, with these systems being sold by OEMs and aftermarkets, is further boosting the vehicle telematics market growth.

The COVID-19 pandemic had a huge impact on the automotive industry in 2020 owing to the lockdowns imposed to curb the spread of the virus. These restrictions in many countries resulted in limited production and transportation delays. Due to supply chain disruptions during the pandemic, the manufacturing process slowed down, thereby impacting the vehicle sales. The slowdown in manufacturing and decrease in automotive component sales indirectly impacted the demand for automotive telematics in 2020.

Vehicle Telematics Market Trends

Growing Demand for Connected Vehicle Solutions to Boost Market Growth

Connectivity solutions have gained immense popularity over time in the automotive industry. Consumers are more than willing to adopt newer connected vehicle technologies to enjoy various features and seamless connectivity. Leading automotive manufacturers are introducing telematics systems for different types of vehicles to engage with customers and educate them in terms of the wide variety of applications supported by vehicle telematics systems.

Vehicle manufacturers are keen on integrating Internet of Things (IoT) solutions to enhance performance and improve the safety features of vehicles. Additionally, substantial developments in aftermarket telematics systems is further helping various customers depend on tailored aftermarket telematics solutions for their needs. Various major players in the industry are working in partnership with carrier network providers, such as Vodafone and Verizon to introduce new fleet operation management systems. These systems are combined with telecommunication and informatics to provide detailed analytics including location mapping, driver monitoring, optimized driving routes, and various other similar features.

Download Free sample to learn more about this report.

Vehicle Telematics Market Growth Factors

Heightened Demand for Vehicle Safety, Security, and Navigation Applications to Drive Market Growth

Increasing vehicle fatalities is one of the major concerns for car owners, governments, and vehicle manufacturers. Thus, governments across various countries are focused on implementing stringent road and vehicle safety laws to limit these fatalities. Simultaneously automobile manufacturers are actively working toward creating active and passive vehicle safety systems in next generation vehicles.

The increased focus on developing connected vehicle and navigation systems to provide users with advanced route optimization options and live traffic updates are some of the features which will drive consumers to choose vehicles with telematics and connected vehicle systems. Additionally, increased awareness regarding driving patterns and vehicle health further provides the fleet operators, vehicle manufacturers, and drivers with a better understanding of vehicles, thereby boosting the product’s demand.

Higher Demand for Fleet Assessment and Management Applications to Fuel Market Growth

The demand for telematics devices is increasing significantly across various automotive segments. Within various applications, the fleet management and monitoring telematics services are witnessing higher demand from vehicle fleet operators, who are opting for third party and OEM-fitted telematics system for their vehicles to gain insights on various features. These include driver monitoring, driving patterns, optimized fuel & route selection, and others. Furthermore, fleet operators are actively recruiting skilled telematics operators for accurate monitoring of operations to induce efficiency in various fleet operations. The major players in the telematics market are witnessing this rapid demand from fleet owners as they are implementing additional services for customers to further increase the technology penetration in various markets. Thus, the increasing demand for vehicle telematics systems from various fleet operators and fleet managers is further supporting the growth of vehicle telematics systems worldwide.

RESTRAINING FACTORS

Major Security Concerns in Terms of Data Leaks and Cybersecurity Breaches to Hamper Market Growth

The risk of unauthorized access of vehicle data or breaches into a vehicle's connectivity system is one of the leading concerns for automakers due to rising vehicle data breaches and attempt to tap into the personal data of vehicle users. Vehicle Cybersecurity is one of the prime concerns for the telematics market. A telematics system includes Bluetooth, software, hardware, and apps, which can be meddled with or hacked to get access into private information about the driver.

Rising Cybersecurity breaches, unauthorized vehicle access, and increasing data hacking-related threats are some of the major concerns which might affect the widespread adoption of telematics technology during the forecast period. For instance, in January 2023, seven security researchers exposed several vehicle vulnerabilities from 16 car manufacturers, which consisted of bugs that permitted them to control the car functions and start or stop the engine. Also, in March 2023, customer information from Skoda Auto India's 20+ databases and leads from Skodalive.co. were leaked on a hacker forum.

Vehicle Telematics Market Segmentation Analysis

By Application Analysis

Increasing Vehicle Threats and Rising Safety Concerns Among Vehicle Owners Drove Demand For Insurance Telematics Applications

By application, the vehicle telematics market is categorized into insurance telematics, information & navigation, safety & security, fleet/asset management, infotainment system, and others.

The insurance telematics segment accounted for a dominant market share 24.07% in 2026. The increasing penetration of Usage-Based Insurance (UBI) solutions across the automotive domain is predicted to fuel the segment’s growth. Insurance-based telematics services monitor a person’s driving behavior, and gather and store vehicular data regarding their actions. Typically, it acts as a mini GPS installed in the vehicle. Similarly, major players in the segment are reducing the pricing of standard premiums based on the real-time monitoring of drivers to attract consumers and further promote the adoption of telematics in the insurance domain.

The safety & security segment is predicted to grow significantly owing to increasing focus of various automakers on implementing and integrating numerous vehicle safety features, such as ADAS, anti-locking braking system, and a few others with telematics systems.

The fleet/asset management segment is estimated to grow steadily during the forecast period. The segment offers solutions such as GPS tracking, vehicle data reporting, fuel management, on-road assistance, emergency applications, and several others which are helping in rapid demand of segment across consumers. The rising demand for fleet management software and hardware systems from commercial vehicle owners is further anticipated to propel the segment’s growth.

By Technology Analysis

Increasing Demand for Connectivity Within Vehicles to Support Adoption of Embedded Telematics

Based on technology, the market is divided into embedded, tethered, and integrated.

The embedded segment is expected to dominate the market over the forecast period, holding a significant market share by 2032. Embedded telematics offers an in-built system that helps monitor vehicle performance and ensure continuous connectivity. Similar to smartphones, a cellular modem is installed within the vehicle. This modem allows the car to connect with other devices through a cellular network, such as cell phones. Almost every vehicle manufacturer provides embedded telematics in most of their vehicle models. In the U.S., for instance, around 80% of new vehicles are installed with embedded telematics.

The integrated segment is expected to grow significantly during the forecast period. The demand for integrated telematics is growing due to its increasing use in applications, such as quick response to crashes, breakdowns, emergencies, rapid response to road-side assistance, and other similar applications. The demand for integrated telematics is rising as this form of telematics system creates a bridge between the headquarters and the fleet on and off the road. The increasing demand for such kinds of applications is enhancing the market’s expansion.

To know how our report can help streamline your business, Speak to Analyst

By Sales Channel Analysis

Higher Efforts to Introduce Advanced Telematics Systems in Upcoming Vehicle Models to Drive Product Use in OEMs

Based on sales channel, the vehicle telematics market is split into OEM and aftermarket.

The OEM segment is projected to dominate the market with a share of 62.75% in 2026. The OEM segment is likely to showcase a significant growth rate during the forecast period. The hassle-free and low-cost benefits of factory-fitted telematics devices is expected to propel the segment’s growth. Furthermore, software and applications are also playing a vital role in pushing the growth of OEM telematics segment.

The aftermarket segment also accounted for a decent market share in 2023. The aftermarket segment is expected to grow at the fastest growth rate during the forecast period. The demand for aftermarket telematics services is increasing as major players in the fleet management & operations industry and large mining and oil corporations are keen on gaining additional vehicle insights. Vehicle telematics is expected to have a huge growth opportunity in the aftermarket as these fleet management solutions can be customized according to the owners' needs. Stolen vehicle tracking, fuel management, engine monitoring system, and in-vehicle monitor system are some of the applications offered at lesser price than the OEM. The increasing demand for telematics applications from fleet operators is likely to support the growth of aftermarket segment.

By Vehicle Type Analysis

Higher Demand for Private Vehicle Ownership Drove Product Use in Passenger Cars

Based on vehicle type, the market is divided into passenger cars and commercial vehicles.

The passenger cars segment held the leading market share 62.71% in 2026. The consumers’ shift toward more advanced vehicles and preference for telematics systems providing innovative applications, such as roadside assistance, emergency applications, real-time vehicle tracking, vehicle maintenance alerts, engine health, and other detailed vehicle insights is expected to fuel the segment’s growth. Additionally, the rising inclination of consumers toward electric cars with new features is further expected to drive the segment’s growth.

The commercial vehicle segment is expected to record the highest growth rate over the forecast period. Commercial telematics refers to the solutions and applications implemented for controlling and monitoring commercial vehicles through telecommunication devices. The increasing demand for telematics for commercial vehicles owing to the rising need for better fleet tracking & observation, vehicle & driver safety, driver behavior monitoring, and real-time engine diagnostics is fueling the segment’s expansion.

REGIONAL INSIGHTS

Europe Vehicle Telematics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Rapid Deployment of Telematics by Vehicle Manufacturers Drove European Market Growth

Europe

Europe dominated the market with a valuation of USD 33.46 billion in 2025 and USD 36.3 billion in 2026. Europe dominated the global vehicle telematics market share in 2023. The growing focus of governments and automotive manufacturers on the prevention of accidents and safety & security of passengers and drivers is propelling market’s growth in the region. Moreover, the strategic collaborations among market players to strengthen their positioning is anticipated to further drive the market’s growth in this region. The United Kingdom market is projected to reach USD 5.58 billion by 2026. The Germany market is projected to reach USD 9.95 billion by 2026.

North America

North America held the second position in terms of market share in 2023. Increase in the sales of electric vehicles in the U.S. is one of the major factors driving the market’s growth in the region. Moreover, rising government support to adopt vehicle fleet management technologies is fueling the regional market’s growth. The United States market is projected to reach USD 16.74 billion by 2026.

Asia Pacific

Asia Pacific and the rest of the world are also expected to grow significantly during the forecast period owing to rising consumer awareness and high demand for telematics systems for various applications. Furthermore, increasing deployment of telematics systems in newer vehicle models that are being launched in the Asian markets is expected to propel the market’s growth of these regions during the forecast period. The Japan market is projected to reach USD 4.92 billion by 2026. The China market is projected to reach USD 8.39 billion by 2026. The India market is projected to reach USD 4.76 billion by 2026.

List of Key Companies in Vehicle Telematics Market

Major Industry Players to Focus On Increasing Capabilities of Vehicle Telematics for Several Applications

Webfleet Solutions B.V. (TomTom), a renowned provider of vehicle telematics solutions, fleet management, and connected cars. The company is focusing on the introduction of innovative products and services to further capture a greater market share for its telematics products to serve the automotive industry. The Webfleet software is accessible to all major and start-up businesses. The company provides software and services, which includes mileage logbook, workflow management, vehicle tracking, fleet optimization, and fleet management. The company also serves rental, insurance, and leasing industries. Similarly, other major players are focused on forming partnerships with major carrier network providers to strengthen their vehicle-to-infrastructure connectivity to further attract different customer segments and grow their share in the telematics industry.

LIST OF KEY COMPANIES PROFILED:

- Robert Bosch GmbH (Germany)

- Webfleet Solutions B.V. (Netherlands)

- Mix Telematics (South Africa)

- Trimble (U.S.)

- Verizon (U.S.)

- Zonar Systems (U.S.)

- Octo Group S.p.A (Italy)

- Microlise Telematics Pvt. Ltd. (U.K.)

- Harman International (U.S.)

- AT&T (U.S.)

- TomTom N.V. (Netherlands)

- Visteon Corporation (U.S.)

- Telefonica S.A (Spain)

- Aptiv PLC (Ireland)

- Geotab Inc. (Canada)

KEY INDUSTRY DEVELOPMENTS

- October 2023: Cummins partnered with Eclipse Foundation, Microsoft, and other industry partners to introduce telematics software for commercial vehicles. The Open Telematics Framework is being designed to allow companies to accelerate time to market and reduce costs.

- September 2022: Cambridge Mobile Telematics, one of the leading vehicle telematics application providers, launched DriveWell Crash & Claims, which is claimed to be a highly efficient solution for vehicle insurance claims.

- August 2022: IDEMIA, a leading manufacturer of identity technologies, completed its Automotive Connectivity Manager Platform, considered the automotive industry's first large-scale remote SIM access campaign. The company partnered with Mercedes-Benz AG to handover over 700,000 automobiles using over-the-air applications from one mobile network application provider to another.

- July 2022: Edelweiss General Insurance, one of the leading insurance companies, launched SWITCH on-demand comprehensive motor insurance products in India under the initiative of IRDIA’s Sandbox. SWITCH is a mobile telematics-based vehicle policy which automatically detects motion and activates insurance while driving the vehicle.

- June 2022: Geotab, a well-known IoT and connected transportation solution provider, declared a collaboration with Renault to integrate vehicle telematics technologies with the fleet management platform, MyGeotab.

REPORT COVERAGE

The report provides detailed market analysis and focuses on key aspects, such as leading companies, applications, and products. Besides this, it offers insights into the latest market trends and highlights vital industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

An Infographic Representation of Vehicle Telematics Market

To get information on various segments, share your queries with us

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application

|

|

By Technology

|

|

|

By Sales Channel

|

|

|

By Vehicle Type

|

|

|

By Geography

|

Frequently Asked Questions

A study by Fortune Business Insights says that the market was valued at USD 93.61 billion in 2025 and is projected to reach USD 198.69 billion by 2034.

The market is expected to register a CAGR of 8.70% during the forecast period.

Higher demand for fleet assessment and management applications is expected to fuel the markets growth.

Europe led the market in 2025.

Verizon, Trimble, and Robert Bosch are the leading players in the market.

Passenger cars segment held the dominant market share in 2026.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic