Vessel Sealing Devices Market Size, Share & Industry Analysis, By Product (Electro-Thermal Vessel Sealer Devices {Bipolar Devices and Monopolar Devices}, Ultra Coagulation Shears, and Hybrid), By Component (Generators, Instruments, and Accessories), By Surgery Type (General Surgery and Laparoscopic Surgery), By Application (Urology, Gynecology, Cardiothoracic, Gastroenterology, and Others), By End-user (Hospitals & ASCs, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

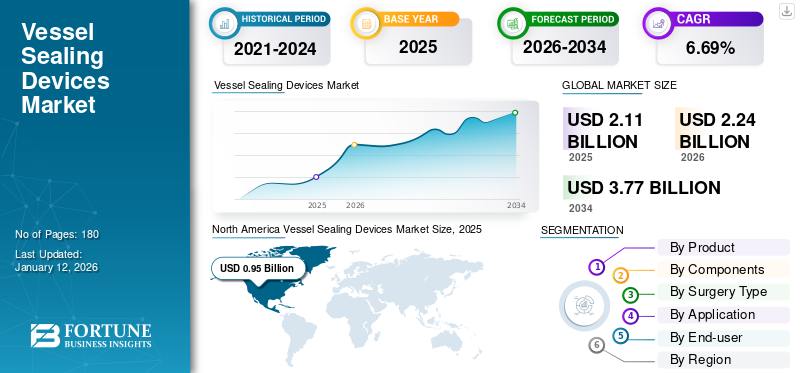

The global vessel sealing devices market size was valued at USD 2.11 billion in 2025. The market is projected to grow from USD 2.24 billion in 2026 to USD 3.77 billion by 2034, exhibiting a CAGR of 6.69% during the forecast period. North America dominated the vessel sealing devices market with a market share of 44.82% in 2025.

Vessel sealing devices refer to the products used to seal arteries and veins during surgical procedures among the patient population. These devices include electro-thermal bipolar vessel sealers and ultrasonic shear devices used to seal blood vessels during laparoscopic and open surgeries. The increasing number of surgical procedures among the population, along with a rising preference for minimally invasive surgical equipment, are expected to boost the demand for vessel-sealing devices in the market.

- According to a 2020 article published by the National Center for Biotechnology Information, it was reported that approximately 310.0 million major surgeries are performed every year worldwide. In addition, it was reported that more than 45.0 million major surgeries are performed every year in the U.S.

Along with this, the increasing focus of key players on the research and development activities to develop novel devices that are minimally invasive and effective for surgical procedures is expected to spur market growth.

Global Vessel Sealing Devices Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 2.11 billion

- 2026 Market Size: USD 2.24 billion

- 2034 Forecast Market Size: USD 3.77 billion

- CAGR: 6.5% from 2026–2034

Market Share:

- North America dominated the vessel sealing devices market with a 44.82% share in 2025, driven by the increasing prevalence of chronic diseases, high surgical procedure rates, and strong healthcare infrastructure supporting advanced surgical devices.

- By product, Electro-thermal Vessel Sealer Devices are expected to retain the largest market share, owing to the increasing number of product launches, approvals, and widespread adoption across laparoscopic and open surgeries due to their efficiency in sealing vessels.

Key Country Highlights:

- United States: Growing number of surgical procedures, robust healthcare expenditure, and strong focus on R&D activities by leading players is boosting demand for advanced vessel sealing devices.

- Europe: Increased regulatory approvals and product launches, along with strategic efforts by key players to expand their geographic footprint, are supporting market growth.

- China: Rising aging population and growing prevalence of disorders requiring surgeries, combined with increasing awareness initiatives among surgeons, are driving demand for vessel sealing devices.

- Japan: Rapid adoption of minimally invasive surgical procedures and continuous technological advancements in surgical instruments are key factors fostering market expansion.

COVID-19 IMPACT

Lower Number of Surgeries During the Pandemic Resulted in Slower Growth of the Market

The pandemic impacted the vessel sealing devices market growth negatively. The restrictions imposed, along with the shifted focus of healthcare staff on catering to COVID-19 patients during the pandemic, are some of the major factors that contributed to the slower market growth in 2020.

The restrictions imposed by government authorities worldwide resulted in the postponement of elective surgical procedures and the complete utilization of hospitals for the treatment of COVID-19 patients. This further resulted in the reduced demand for these products among hospitals, ambulatory surgery clinics, and others across the globe.

- According to 2021 data published by Healthium MedTech Ltd., it was reported that the total surgical procedures declined by approximately 15% globally owing to the postponement of surgeries due to restrictions imposed.

In addition, the disruption in the supply chain imposed a negative impact on the demand and production of these devices among the prominent companies operating in the market. They observed a decline in their revenues due to the supply-demand gap caused by the COVID-19 pandemic. The decline in the supply and demand of these vessel-sealing devices was also due to less availability of raw materials to manufacture these devices.

- For instance, according to 2022 data published by Medtronic, it was reported that the company witnessed a 5% decline in revenue due to difficulties in the procurement of raw materials, including semiconductors and resins.

However, the lifting of restrictions led to the resumption of surgical procedures in 2021, further resulting in increased demand for these devices, thereby contributing to the slow recovery of the market globally. In addition, various companies observed growth in their revenue in 2021 due to recovery of the market from the pandemic, along with increased demand for vessel sealing devices.

- CONMED EYLEA of Regeneron Pharmaceuticals Inc. generated a revenue of USD 9,384.7 million in 2021. Also, the company witnessed an increase of 18.7% as compared to the previous year.

Vessel Sealing Devices Market Trends

Preferential Shift Toward Minimally Invasive Surgical Procedures

The growing focus on minimally invasive surgical procedures among the patient population, owing to distinct advantages, including less pain, reduced length of hospital stay, and others, is augmenting the market growth. Along with this, faster recovery, lower risk of complications, and improved precision are some of the additional factors contributing to the rising adoption of these procedures among patients. According to a 2021 comparative study published by the National Center for Biotechnology Information (NCBI) on minimally invasive surgery (MIS) and open surgery in China, it was observed that patients who underwent MIS showed fewer complications than patients who had open surgery.

- For instance, according to the 2021 article published by MDPI, it was reported that approximately 15.0 million laparoscopic procedures are performed worldwide annually.

In addition, the increasing patient population preferring these procedures is driving the focus of healthcare organizations on research and development activities to make procedures less invasive and effective. Therefore, key players are focusing on launching advanced devices such as vessel sealing devices to cut and seal vessels effectively.

- For instance, in March 2018, Domain Surgical launched the multifunctional vessel sealing instrument FMsealer Laparoscopic Shears with an aim to provide fast and reliable vessel sealing in various laparoscopic procedures.

Moreover, the increasing initiatives by governmental and non-governmental organizations to increase awareness about the benefits of minimally invasive surgical procedures are expected to support the adoption of these devices in these procedures.

- For instance, according to a 2022 article published by the National Center for Biotechnology Information (NCBI), it was reported that energy devices are used in approximately 80% of laparoscopic procedures among patients worldwide.

Therefore, the launches of innovative devices, along with the challenges associated with open surgery, are resulting in the increasing adoption of these devices in minimally invasive procedures, thus supporting the growth of the market.

Download Free sample to learn more about this report.

Vessel Sealing Devices Market Growth Factors

Increasing Number of Surgical Procedures to Fuel Market Growth

The growing incidence of road accidents, trauma, and others is resulting in rising inpatient admissions in hospitals and clinics, further leading to a rising number of surgical procedures. Vessel sealing devices are often used in surgeries to cut, coagulate, and dissect blood vessels after surgeries among patients.

- For instance, according to a 2022 article published by Springer Nature, it was reported that about 330.0 million surgical procedures are performed every year worldwide.

The rising geriatric population is another major factor contributing to a larger number of inpatient admissions globally. The geriatric population is at high risk of gastrointestinal and cardiovascular disorders owing to the increasing vulnerability to irregular body function and others. Along with this, the rising number of trauma cases leading to spinal injuries among the general population is expected to fuel the demand and adoption of vessel-sealing devices in surgical procedures.

- According to 2023 data published by the Population Pyramid, it was reported that there were about 1.1 billion people aged 60 years and older worldwide in 2023.

The growing awareness regarding advanced surgical procedures among the general population, owing to the rising number of initiatives conducted by various government bodies, healthcare settings, and key players, is further increasing diagnosis and treatment rates among the patient population. Also, increasing healthcare expenditures and number of surgeons in developed and emerging markets are some of the factors supporting the demand for these products globally.

Thus, the aforementioned factors, along with the rising emphasis of the prominent players on developing and introducing novel devices, are anticipated to propel the demand for and uptake of these devices in the market during the forecast period.

Technological Advancements in Surgical Devices to Support Market Growth

The increasing adoption of these products among surgeons is fueling the research and development activities among the market players to develop and introduce new products with technological advancements to cater to the rising demand for the devices.

The introduction of technologically advanced surgical devices that can efficiently cut, coagulate, and dissect the vessels is helpful in avoiding surgery-related complications, including excessive bleeding during surgery and others.

- For instance, according to a 2023 study published by the National Center for Biotechnology Information (NCBI), it was observed that 24 patients who were treated with these devices reported less blood drainage than the other 54 patients in a non-VSS group.

Along with this, increasing demand is further driving the focus of key players on launching advanced energy devices that use ultrasound energy to seal vessels. These devices, which are associated with advanced energy, such as bipolar devices and ultra-coagulating shears, allow better sealing of blood vessels among patients.

Moreover, some players are focusing on introducing hybrid energy devices with both bipolar and ultrasound energy for tissue management, including hemostatic cutting and dissection, in laparoscopic surgery and open surgery. Thus, the growing efforts of companies in the R&D activities to design novel devices for the treatment of various surgeries are anticipated to exhibit a higher demand for these devices in the market during the forecast period.

RESTRAINING FACTORS

High Price Associated with these Devices May Limit their Adoption in Emerging Countries

There are many clinical advantages of vessel sealing devices such as higher effectiveness and safety. However, there are certain limitations, including the higher cost of these devices, higher out-of-pocket spending, and others. The high cost of these devices, along with costs associated with their approvals and development, is a crucial factor restricting the adoption of these devices in emerging countries.

- According to a 2023 article published by Cureus, a single electrothermal device costs around USD 1,440.0 with disposable electrode, and each new pair of new blades for LigaSureTM Max Hand Switching Reusable Instrument costs around USD 180.0 per pair. Single electrodes can be used for upto 8 procedures, so each procedure costs about USD 64.0.

Another challenge for the healthcare system, mainly in emerging nations such as Brazil, China, Mexico, and Africa, is lower awareness of these devices among surgeons. Therefore, the growing gap between the patient population and the higher out-of-pocket expenditure is contributing to the unaffordability of electrothermal bipolar devices, which is further expected to slow the adoption of these devices in emerging countries.

Furthermore, recent recalls of the devices by certain players in the market due to reasons such as insufficient sealing and others are also likely to hamper market growth. Thus, the rising efforts of the market players in the R&D activities to develop novel devices for the treatment of various surgeries are expected to exhibit a higher demand for these devices in the market during the forecast period.

- For instance, according to a 2022 news published by the U.S. FDA, the Cass 2 Device Endowrist Vessel Sealer Extend has been recalled from the market due to the placing of excessive tissue, leading to insufficient seals during surgeries.

Therefore, the lack of awareness pertaining to energy devices among surgeons in emerging countries, such as Saudi Arabia, Mexico, and other African countries, are some of the other factors expected to impede the vessel sealing devices market share in these nations during the forecast period.

Vessel Sealing Devices Market Segmentation Analysis

By Product Analysis

Electro-thermal Vessel Sealer Devices Segment Dominated Owing to Increasing Number of Product Launches

The Electro-Thermal Vessel Sealer Devices segment is projected to dominate the market with a share of 66.68%in 2026. By product, the market is divided into electro-thermal vessel sealer devices, ultra-coagulation shears, and hybrid. The electro-thermal vessel sealer devices segment is further bifurcated into bipolar devices and monopolar devices.

The electro-thermal vessel sealer devices segment dominated the market owing to the rising number of approvals and launches of electro-thermal monopolar and bipolar devices by the key players. This, along with rising applications of these devices in various types of open and laparoscopic surgeries, is leading to the rising adoption of these devices among patients and is another factor contributing to the growth of the segment.

- In October 2020, Applied Medical launched a new advanced Voyant Intelligent Energy System – a new algorithm to enhance clinical performance and patient outcomes. The device is also incorporated with the key to store activation data from each vessel or tissue during the procedure, which helps ensure a successful procedure.

The ultra-coagulation shears segment is expected to grow at the highest CAGR during the forecast period. This is owing to its increasing adoption among surgeons due to several benefits such as lower heat generation, minimal tissue charring and desiccation due to no usage of electric current in these devices. These key benefits of ultrasonic devices are resulting in new entrants in the market and further driving the focus of existing key players to diversify their portfolio by collaborating with the other players in the market.

The hybrid segment is expected to grow in the market during the forecast period owing to the rising focus of the market players on developing innovative hybrid products that work with both ultrasonic and bipolar energy. Thus, the increasing patient population, along with the rising demand for advanced surgical tools among surgeons, is leading to a growing focus of the players to launch novel devices, thus contributing to the growth of the segment in the market.

By Components Analysis

Rising Number of Surgeries to Foster the Instruments Segment Growth

On the basis of components, the market is segmented into generators, instruments, and accessories. The Instrument segment is projected to dominate the market with a share of 78.77% in 2026.

The instruments segment dominated in 2026 and is poised to register the highest CAGR during the forecast period. The growing number of surgeries is resulting in the increasing adoption of instruments in vessel sealing devices among the patient population. Growing adoption and further demand for these instruments are driving the focus of key players to launch innovative products, thus supporting the growth of the segment.

The generators segment is expected to grow during the forecast period owing to the increasing number of hospitals worldwide. This is leading to the rising number of hospitals adopting generators for their vessel sealing instruments, further leading to growing demand, which is expected to boost segmental growth.

The accessories segment is growing due to increasing demand for these accessories, aligned with the shorter use time limit of pens, needles, and other products, further increasing the focus of key players to launch these products, thus supporting the growth of the segment.

By Surgery Type Analysis

Rising Preference Toward Minimally-invasive Surgical Procedures to Drive the Laparoscopic Surgery Segment Growth

On the basis of surgery type, the market is segmented into general surgery and laparoscopic surgery.

The laparoscopic surgery segment held the largest share in 2024 owing to the rising healthcare expenditure per capita, along with increasing awareness about less painful and effective surgical procedures. This, along with certain advantages such as reduced postoperative complications and minimally invasive, among others, are some additional factors that are contributing to the growth of the segment worldwide.

- According to a 2023 study including 66,517 patients, published by the National Centre for Biotechnology Information (NCBI), it was reported that about 6,998 patients underwent laparoscopic emergency bowel surgery and observed reduced length of critical care stay, overall length of hospital stay, among others.

The prevalence of chronic diseases and the growing number of inpatient admissions requiring surgery among the patient population are important factors responsible for the rising demand for these devices. Along with this, the research and development activities resulting in growing technological advancement for these devices are driving the growth of the segment.

On the other hand, the general surgery segment is expected to register the highest CAGR during the forecast period owing to factors such as an increasing patient pool suffering from traumatic injuries and chronic disorders, including cardiovascular diseases and others, which require general surgery among these patients.

- For instance, according to data published by The American Association for Surgery of Trauma, it was reported that there are over 3 million non-fatal injuries per year in the U.S.

The increasing prevalence of cardiovascular disorders, among others requiring surgery, along with the rising diagnosis rate of these conditions among the population, is resulting in a growing demand for open surgical procedures in the region. The use of vessel sealing products for hemostasis helps to conduct safe and effective surgery among patients. In addition, bleeding is most common during open surgeries, leading to the increasing use of these devices in these surgeries, thus supporting segmental growth.

- According to data published by Healthgrades in 2021, there are about 1.3 million pregnant women who undergo C-sections every year in the U.S., and it is one of the major surgical procedures included in open surgery.

Along with this, the rising number of key players launching specific products for open surgeries, such as POWERSEAL and others, is contributing to the growth of the segment globally. Moreover, the cost-effectiveness of open surgeries for various conditions is resulting in a number of patients inclined toward open surgeries.

- In January 2023, according to a blog published by Healio Gastroenterology, it was reported that the unit costs for initial surgery were USD 8,087 for laparoscopic total gastrectomy, while it was USD 6,554 for open total gastrectomy among patients.

By Application Analysis

Growing Prevalence of Cardiothoracic Diseases to Augment Segment Growth

By application, the market is bifurcated into urology, gynecology, cardiothoracic, gastroenterology, and others. The Cardiothoracic segment is projected to dominate the market with a share of 28.80% in 2026.

The cardiothoracic segment held the highest market share in 2026. The growing prevalence of cardiothoracic diseases such as heart failure, heart attack, peripheral artery disease, and others among the patient population is resulting in a growing patient admissions. Additionally, the rising focus on inorganic strategies to spread awareness regarding these conditions among patients is leading to an increasing diagnosis rate and further growing demand for technologically advanced products for surgeries.

- For instance, according to 2023 data published by the Centers for Disease Control & Prevention (CDC), it was reported that about 805,000 people suffer from heart attack in the U.S.

The gastroenterology segment is anticipated to grow at the highest CAGR during the forecast period owing to the increasing focus of the prominent players on developing and introducing advanced high-quality vessel sealing devices for open and laparoscopic surgeries, thus contributing to the growth of the segment.

The gynecology segment is growing during the forecast period due to the increasing prevalence of gynecological conditions, including cervical dysplasia, endometriosis and fibroids, among others, especially in the geriatric population. The increasing patient population suffering from these conditions globally is a major factor expected to spur the demand for surgeries among patients.

- According to an article published in 2021 by IntechOpen, it was reported that the incidence of cervical cancer is about 4.5% worldwide.

The urology segment is growing owing to the adoption of advanced devices for the coagulation and sealing of blood vessels during open and laparoscopic surgeries among the patient population. This, along with the increasing prevalence of urological conditions, is further leading to the rising focus of the market players on developing and introducing novel and effective devices for the sealing of vessels.

To know how our report can help streamline your business, Speak to Analyst

By End-user

Growing Number of Inpatient Admissions to Drive the Hospitals & ASCs Segment Growth

On the basis of end-user, the market is segmented into hospitals & ASCs, specialty clinics, and others.

The Hospital & ASCs segment is projected to dominate the market with a share of 87.80% in 2026. The hospitals & ASCs segment dominated the market in 2026 and is expected to register the highest CAGR during the forecast period. The rising number of inpatient admissions to hospitals for the treatment of various disorders, traumatic injuries, and others is one of the major reasons contributing to the growth of the segment. Increasing number of surgeries in hospitals and ambulatory surgical centers is resulting in rising adoption of vessel-sealing devices for cutting and sealing blood vessels during surgeries and is an important factor contributing to the growth of the segment.

- For instance, according to 2021 data published by the National Center for Biotechnology Information (NCBI), it was reported that 100% utilization of medical energy devices, including advanced energy, conventional smoke mitigation options (e.g. ventilation, masks), and single-use disposable dispersive electrode devices are used per 10,000 annual procedures in hospitals.

The specialty clinics segment is expected to grow during the forecast period owing to the increasing number of specialty clinics worldwide. This is leading to a rising number of surgeries, further leading to growing demand, which is anticipated to propel the segmental growth.

The others segment, including academic institutes and others, is also growing owing to the increasing number of academic institutes, resulting in a rising number of surgeries performed in these institutes. This, along with technological advancements for these devices, is likely to foster the growth of the segment in the market.

REGIONAL INSIGHTS

Geographically, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Vessel Sealing Devices Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America held the lion’s share and generated a revenue of USD 0.95 billion in 2025. The regional dominance is owing to certain factors, such as the increasing prevalence of various diseases, including cardiovascular, gastrointestinal, and others, coupled with increasing diagnosis and surgical procedure rates. Moreover, increasing per capita healthcare expenditure and the presence of adequate reimbursement policies for various surgical procedures are promoting the adoption of novel vessel sealing products during surgeries in the region. The United States market is expected to reach USD 0.91 billion by 2026.

- According to the 2021 blog published by debt.org, the U.S. expenditure on health care is around USD 4.3 trillion, with more than 31% of that spent on hospital services.

In addition, increasing research and development activities for various hand-held surgical devices to use in surgical procedures, coupled with rising acquisitions and mergers among key players, are some other factors contributing to the growth of the market.

- In November 2021, Hologic, Inc. acquired Bolder Surgical for USD 160.0 million with an aim to expand its surgical franchise in the U.S.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe accounted for a considerable share of the market in 2024. The increasing number of product launches for accurate sealing of blood vessels, the rising number of regulatory approvals for these devices, and increasing efforts among the market players to expand their geographical footprint, and others are some of the factors contributing to the growth of the market. The United Kingdom market is expected to reach USD 0.11 billion by 2026, while the Germany market is expected to reach USD 0.10 billion by 2026.

- In September 2021, Bolder Surgical received CE approval for the CoolSeal Vessel Sealing Platform. This helped the company to increase its brand presence in Europe.

Asia Pacific

Asia Pacific is witnessing growth during the forecast period due to the rising aging population, leading to the growing prevalence of certain disorders, including cardiovascular, among others, which require surgery. Rising strategic initiatives among government and key players to raise awareness among surgeons about new treatments are some factors supporting the adoption of these devices in the market. Along with this, increasing focus on receiving regulatory approvals for these devices is expected to further contribute to the market growth in the region. The Japan market is expected to reach USD 1.29 billion by 2026, the China market is expected to reach USD 0.75 billion by 2026, and the India market is expected to reach USD 0.52 billion by 2026.

- For instance, according to a 2022 article published by the Economic and Social Commission for Asia and the Pacific, it was reported that the Asia Pacific population is aging faster than any other region in the world. In addition, there are now 630.0 million people aged 60 years or over, representing 60% of the total world’s geriatric population.

Furthermore, Latin America and the Middle East & Africa are expected to grow during the forecast period. The rising incidence of various traumatic injuries and the growing efforts of the key players to launch new devices are a few factors responsible for market growth in the region.

- According to a 2022 article published by National Center for Biotechnology Information, the incidence of traumatic brain injuries was 65.54 per 100,000 inhabitants from 2008 to 2019.

Also, the increasing number of collaborations and acquisitions coupled with the development of healthcare infrastructure among the major market players in order to improve access to these novel surgical products and others are a few major factors supporting the growing adoption of vessel sealing devices in Latin America and Middle East & Africa region. Thus, aforementioned factors are likely to support the market growth in these regions.

Key Industry Players

Medtronic to Lead the Market with Strong Product Portfolio

The competitive landscape demonstrated a consolidated market comprising a few prominent players with a wide range of products, including electro-thermal devices as well as ultra-coagulation shears. The increasing adoption of vessel sealing products, including Ligasure and others, is one of the major reasons contributing to the growing market share of Medtronic in this market. In addition, the rising focus on R&D activities to launch novel devices is another factor contributing to the higher market share of the company.

Olympus Corporation is increasing its focus on the approval and introduction of the devices globally with strategic mergers and acquisitions. Along with this, strong emphasis on launching hybrid vessel sealing devices such as Thunderbeat with bipolar and ultrasound energy to cater the rising demand of the population is expected to contribute to the company’s market hold.

- In September 2021, Olympus Corporation launched POWERSEAL Advanced Bipolar Surgical Energy Devices with an aim to offer physicians improved performance during surgeries. The POWERSEAL 5mm Curved Jaw Tissue Sealer and Divider, Double-Action devices deliver consistent sealing reliability in a multifunctional design that promotes procedural efficiency.

On the other hand, the increasing focus of other players, including Ethicon, B. Braun SE, among others, in expanding their product portfolio by launching advanced products is resulting in a growing number of pipeline candidates for the approval of these devices. These factors are expected to increase the market share of these companies in the future.

- For instance, in June 2021, Ethicon expanded its advanced bipolar energy portfolio with the launch of Enseal X1 Curved Jaw Tissue Sealer to increase procedural efficiency.

List of Top Vessel Sealing Devices Companies

- Medtronic (Ireland)

- Johnson & Johnson Services, Inc. (U.S.)

- Olympus Corporation (Japan)

- B. Braun SE (Germany)

- Intuitive Surgical (U.S.)

- CONMED Corporation (U.S.)

- OmniGuide Holdings, Inc. (U.S.)

- BOWA-electronic GmbH & Co. KG (Germany)

KEY INDUSTRY DEVELOPMENTS

- October 2022: Medtronic received approval for its Hugo robotic assisted surgery system for various surgical procedures, including urology and gynecology, among others, with an aim to increase its brand presence

- September 2022: Olympus Corporation launched Thunderbeat Energy Device for open surgery. This device supports safer procedures and can work with bipolar patients as well as with ultrasound energy during surgeries as needed, thus contributing to efficiency in the operating room.

- March 2022: CONMED Corporation received U.S. FDA approval for ElectroSurgical Cutting and Coagulation Device and Accessories with an aim to cater to the increasing demand for advanced surgical instruments among surgeons.

- January 2021: Bolder Surgical launched CoolSeal generator with an aim to provide instruments for general, urological and gynecological surgery among patients.

- December 2019: Intuitive Surgical received U.S FDA approval for robotic system sealing instrument power generator with an aim to increase its product offerings globally.

REPORT COVERAGE

The global market research report covers a detailed analysis and overview. It focuses on key aspects such as competitive landscape, product, application, type, end-user, and region. Besides this, it offers insights into the market drivers, market trends, market dynamics, COVID-19 impact on the market, and other key insights. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.69% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Components

|

|

|

By Surgery Type

|

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 2.24 billion in 2026 to USD 3.77 billion by 2034.

In 2025, the market value stood at USD 0.95 billion.

The market is expected to exhibit steady growth at a CAGR of 6.69% during the forecast period (2026-2034).

By product, the electro-thermal vessel sealer devices segment held the largest share in 2025.

Rising number of surgical procedures, increasing research and development activities by the major market players, along with increasing technological advancements for vessel sealing devices are the key factors driving market growth.

Medtronic, Olympus Corporation, Ethicon, and B. Braun SE, among others, are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us