Virtual Reality (VR) Market Size, Share & Industry Analysis, By Component (Hardware and Software), By Technology (Semi & Fully Immersive and Non-Immersive) By Device Type (Head Mounted Display (HMD), VR Simulator, VR Glasses, Gloves, and Others), By End-user (Consumer and Commercial/Enterprise), and Regional Forecast, 2026-2034

Virtual Reality (VR) Industry Analysis

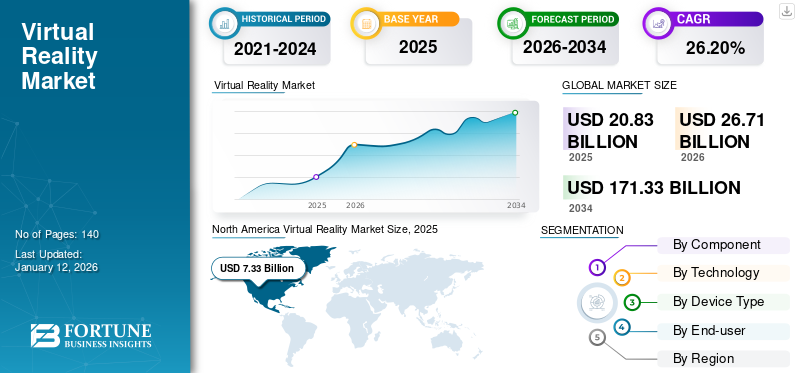

The global virtual reality (VR) market size was valued at USD 20.83 billion in 2025 and is projected to grow from USD 26.71 billion in 2026 to USD 171.33 billion by 2034, exhibiting a CAGR of 26.20% during the forecast period. North America dominated the VR market with a market share of 35.60% in 2025.

The market analysis includes devices and software, such as Google Cardboard, Move Motion Controller & PlayStation Headset, Quest 2, Unity Virtual Reality Development Software, and Microsoft HoloLens 2. VR offers simulated customer experience and vast applications to healthcare, gaming, retail, automotive, and entertainment industries. Organizations are implementing this technology to conduct virtual training, engineering & maintenance, marketing, designing, assistance, and simulation events with their workers and employees. In addition, the major players in the market are focused on providing advanced hardware and content to enhance customer experience. For instance:

- As per Industry Insights 2023, 98 million individuals used VR hardware in 2023. By 2027, both VR and AR are anticipated to have exceeded 100 million users globally.

The manufacturing of devices, equipment, components, and other hardware products was negatively impacted due to the COVID-19 pandemic. Thus, initially, in 2020, with the limited stock of Virtual Reality products and services, the market witnessed a decline in its year-on-year growth.

However, in many industries, technology played a key role in addressing the challenges posed by the pandemic. There was a high need for Virtual Reality in healthcare, gaming, education, manufacturing, entertainment, military, retail, and defense industries. For instance, in 2020, the Kansas City University Center for Medical Education Innovation incorporated technology for medical students' training using simulations. Thus, the demand for VR in commercial industries increased significantly during the pandemic.

Impact of Generative AI

Implications of Generative AI Within Virtual Reality to Fuel Market Progress

Generative AI can enhance virtual reality by adapting to user behavior, predicting their preferences, and generating more responsive and dynamic scenarios in the real world. The incorporation of artificial intelligence and VR can potentially renovate various industries by aiding their core development procedures.

Various use cases of generative AI in VR include personalized advertisements, realistic environments in virtual showrooms and events, product visualization, gamified marketing campaigns in VR, avatar-replicated social interactions in VR, and many more. Advancements and investments in GenAI for new innovations can create numerous market opportunities. For instance,

- In June 2024, ARuVR announced the launch of the ARuVR GenAI portfolio, which helps auto-generate 3D assets, voice-over audio, and 360-degree images in real time. The suite has been developed to fast-track the development of Virtual Reality (VR), Augmented Reality (AR), and Mixed Reality (MR) content and solutions in a reduced timeline, which is from months to minutes.

Thus, the implications of generative AI tools within virtual reality will help boost the market progress.

Virtual Reality Market Trends

Growing Potential in Healthcare Industry to Fuel Market Expansion

According to the experts’ study, healthcare is projected to witness significant growth with increasing applications of VR. The technology has highlighted the potential to enhance planned surgeries, healthcare provisions, patient care systems, and medical training.

Its simulated experience of replicating the real-world environment is expected to increase the product’s demand for healthcare. Assisted robotic VR can play a key role in supporting healthcare workers during surgeries. It also offers surgical training to improve the skills of surgeons. For instance,

- In July 2024, MediSim VR announced the launch of the first VR-based center of excellence for medical training at SRIHER in Chennai.

Furthermore, the VR market has been dominant for the past few years due to major trends, such as increased end-user adoption, consistent & easier development of VR, greater improvements in hardware, growing enterprise applications, and huge availability of VR-tailored services. However, there are a few more trending factors that are expected to create a greater impact on the market in the coming years. A few of them are the emergence of hyper-realistic VR, immersive education transformation, integration of artificial intelligence (AI) in VR, socially available VR platform expansion, and adoption of VR by various businesses.

Thus, the increasing applications of Virtual Reality in healthcare will boost the virtual reality market growth.

Download Free sample to learn more about this report.

Virtual Reality Market Growth Factors

Increasing Demand for Live Virtual Entertainment to Drive Market Growth

The concept of live virtual entertainment is growing globally. Individuals prefer at-home entertainment by implementing various technologies to view live shows and events. As the technology provides users with a real-world environment, the demand for live events, live music concerts, and sports is rising considerably. For instance,

- In November 2023, BLACKPINK announced a collaboration with the Diamond Bros and Meta for an immersive VR concert. The users with Meta Quest VR headsets were able to secure priority seating in precise locations for the event in December.

- In April 2022, World-renowned rock band Foo Fighters conducted their event on the Meta virtual stage, providing 180-degree live streaming through the Meta Quest headset.

Virtual Reality uses computer technology to create a simulated environment, and prominent players in VR are Oculus Rift, PlayStation VR (PSVR), and HTC Vive, among others. VR technology is consistently evolving beyond entertainment purposes, and companies have now realized its importance in various sectors, such as science, healthcare, education, manufacturing, automotive, and retail, among others.

Thus, the rising demand for virtual live entertainment is expected to fuel the virtual reality market share.

RESTRAINING FACTORS

Health Concerns Due to Excessive use of VR Devices to Impede Market

Virtual reality technologies, especially VR headsets, are widely used for e-sports and gaming to provide a unique playing experience. However, the excessive use of VR headsets might lead to health concerns, such as dizziness, lethargy, lack of concentration, and eyesight & hearing issues. Thus, the excessive usage of these devices could lead to health concerns, which is expected to slightly impact the market dynamics.

Virtual Reality Market Segmentation Analysis

By Component Analysis

Growing Investments in Advanced Technologies Offerings to Drive Hardware Segment Dominance

The market share is segregated into hardware and software in terms of component.

The hardware segment will dominate the global market share 62.13% in 2026. by recording the highest revenue during the forecast period as major companies are investing in the technological advancements of VR hardware products. For instance,

- In August 2024, Microsoft announced its plans to introduce mixed-reality headsets. The company signed a supply agreement with Samsung Display to get hundreds and thousands of micro-OLED panels for the development of MR headsets.

The software segment will also gain traction due to the increasing demand for VR technology. Growing applications, such as live events, entertainment, gaming, and others will increase the software demand. The content segment will likely witness steady growth during the forecast period owing to rising demand for interactive virtual sessions. Industries are demanding new content for applications, such as marketing, training, entertainment, gaming, and other sections.

By Technology Analysis

Increasing Usage of Non-Immersive Across Gaming and Entertainment to Boost Market Progress

By technology, the market is categorized into semi & fully immersive and non-immersive.

The non-immersive segment recorded the highest market revenue in 54.77% 20256owing to its larger usage in the entertainment and gaming industries. Video games, such as DOTA and Warcraft are some of the famous examples of non-immersive VR experiences. Also, such games rely prominently on a computer display, controller, keyboard, game console, and mouse, which increases their usage among gaming individuals.

The semi & fully immersive VR segment is projected to record the highest CAGR during the forecast period due to its advanced immersive technology features that provide users with a perception of being in a different world. The growing popularity of and demand for semi & fully immersive experiences will surge the market progress.

By End-user Analysis

Growing Usage of VR in Different Applications to Boost Consumer Segment Growth

Based on end-user, the market is bifurcated into consumer and commercial/enterprise.

The consumer segment holds the highest market share 32.48% in 2026 and is anticipated to register the highest CAGR during the forecast period owing to the growing usage of VR devices by individuals. Consumers use VR solutions in different sectors, including virtual showrooms, gaming, entertainment, and much more. For instance,

- As per industry experts, the VR and AR shipments for consumers are projected to grow from 17.81 million units in 2023 to 30.88 million units by 2026.

VR can be implemented across various applications such as tourism, B2B marketing, events, training, and many other applications. It helps businesses with remote examinations and audits, site surveys, and virtual tours, thereby increasing safety and efficiency for businesses.

By Device Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Ability to Offer Immersive Environment to Fuel Demand for Head-Mounted Display Devices

Based on device type, the market is segmented into Head Mounted Display (HMD), VR simulators, gloves, VR glasses, and others (smelling devices, controllers, etc.).

The head-mounted display segment accounted for the highest market share in 2024. The demand for VR headsets connected to smartphones is rising due to the availability of cost-effective options, such as Google's cardboard-based headset. HMDs are being increasingly used in aviation, marketing, entertainment, and training industries. For instance,

- Vajra and VRM Switzerland were certified by the European Union Aviation Safety Agency to offer virtual pilot training, providing a headset with human-eye resolution.

The VR simulator segment is predicted to record the highest CAGR during the forecast period. VR simulators are becoming popular in industries for training, design, and prototyping due to their cost saving feature. Additionally, the gaming and entertainment sectors are adopting VR treadmills and haptic gloves to enhance the customer experience. Thus, the increasing use of VR glasses in training and education will fuel the segment's growth.

REGIONAL INSIGHTS

The market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further categorized into leading countries.

North America Virtual Reality Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 7.33 billion in 2025 and USD 9.3 billion in 2026. North America is expected to dominate the market share over the forecast period. The significant presence of key players in the U.S. is driving the market growth in the region. In addition, various start-ups are entering the U.S. market and offering industry-specific solutions. The U.S. market is projected to reach USD 4.79 billion by 2026.

For instance,

- According to industry experts’ insights, in 2022, the U.S. ranked the highest in the usage of VR headsets, with 12% of users owning VR headsets, whereas 6% of users owning VR headsets were based in Canada.

The U.S. government is also investing in virtual technologies, which is likely to boost the market. For instance, the U.S. government and its army invested USD 11 billion in providing virtual, augmented, and mixed-reality training sessions to its officials.

Asia Pacific

Asia Pacific will register the highest growth rate during the forecast period due to the increasing demand for immersive technologies in emerging economies. China is likely to gain the maximum market share as it is one of the major distributors of head-mounted VR devices and other hardware. In addition, the developments in 5G networks and infrastructure in China are expected to boost the regional market growth. India is also likely to witness significant growth owing to government initiatives and funding. The Japan market is projected to reach USD 1.71 billion by 2026, the China market is projected to reach USD 2.60 billion by 2026, and the India market is projected to reach USD 1.45 billion by 2026.

Europe

Europe is likely to show significant growth during the forecast period. The region is an early adopter of virtual solutions in the automotive industry. European countries, including the U.K., France, Italy, and Denmark, among others, receive funding from the EU for AR and VR research projects. The U.K. market is projected to reach USD 1.70 billion by 2026, while the Germany market is projected to reach USD 1.35 billion by 2026.

For instance,

- In 2024, the European Parliament implemented two resolutions on virtual environments: the first concentrating more on virtual worlds’ inferences for the solitary market and the second dealing with company, civil, commercial, and intellectual property law issues linked to virtual worlds.

South America is expected to display steady growth owing to increasing government focus on advanced technologies and rapid installation of 5G infrastructure. The growing interest in virtual gaming and increasing number of entertainment users will boost the product demand in the Middle East & Africa.

KEY INDUSTRY PLAYERS

Rising Focus on Product Advancement with Emerging Technologies to Boost Market Share of Key Players

Major players in the market are developing new and advanced solutions for their customers. They are also focusing on improving their existing product portfolio to provide flexible solutions with unique characteristics. Additionally, they are entering collaborations, partnerships, and acquisitions to strengthen their product offerings.

List of Top Virtual Reality Companies

- Oculus (Meta Platforms, Inc.) (U.S.)

- Google LLC (Alphabet Inc.) (U.S.)

- Microsoft Corporation (U.S.)

- Sony Interactive Entertainment LLC (Japan)

- HTC Corporation (Taiwan)

- Samsung Electronics Co., Ltd. (South Korea)

- Unity Software Inc. (U.S.)

- Qualcomm Incorporated (U.S.)

- Nvidia Corporation (U.S.)

- HaptX Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- August 2024 – HTC VIVE announced the launch of VIVERSE Create, a range of tools that allows creators to develop and share collaborative multiplayer worlds over any device without the requirement of any coding skills.

- June 2024 – Apple announced the availability of Vision Pro in new countries and regions. Consumers in Mainland China, Japan, Singapore, and Hong Kong could pre-order the device on June 13, 2024, with mass availability beginning June 28, 2024. Customers in Australia, Germany, France, Canada, and the U.K. were also allowed to pre-order.

- February 2024 – Sony Corporation announced its plans to include PC compatibility in the PlayStation VR2 model. Currently, the company is testing its compatibility with PC, and in the future, this will allow PS VR2 players access to more VR games via their PC.

- December 2023 – Sony announced the launch of VR2, the second-generation VR headset PlayStation, in India. The PS VR2 comprises a smart eye-tracking mechanism, which makes use of two IR cameras to track players' eye movements for more accurate and individual in-game interactions.

- January 2023 – Apple announced that it would launch its mixed reality headset, which will feature augmented reality and VR capabilities to enhance user experience.

- April 2022 – Shenzhen MetaVision Tech Co. released new specifications and designs for its VR headset. In addition, the company will provide the world’s lightest device based on extended reality.

- March 2022 – Nvidia Corporation collaborated with cloud service suppliers for high-quality VR streaming. Moreover, users can access augmented, virtual, and extended reality from any location with the help of cloud-based streaming.

- March 2022 – Unity Software Inc. partnered with Insomniac Events, a live music creator, to switch to the virtual environment from the physical world. Furthermore, the organizations will focus on offering live entertainment to the next generation's potential audience.

REPORT COVERAGE

The study on the market comprises major areas globally to gain a better understanding of the industry. Additionally, the research offers insights into the most recent market trends and analysis of technologies implemented worldwide. Further, it highlights the growth factors and restrictions, allowing the reader to understand the market better.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 26.20% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Technology

By Device Type

By End-user

By Region

|

Frequently Asked Questions

The market value is projected to reach USD 171.33 billion by 2034.

In 2025, the market value stood at USD 20.83 billion.

The market is projected to register a significant CAGR of 26.20% during the forecast period.

By end-user, the consumer segment is likely to lead the market with the highest CAGR.

Increasing demand for live virtual entertainment will drive the market growth.

Google LLC, Oculus (Meta Platform, Inc.), Sony Corporation, Unity Technologies, HTC Corporation, Samsung Electronics Co. Ltd., Microsoft Corporation, and others are the top players in the market.

North America is expected to hold the highest market share.

Asia Pacific is expected to record the highest CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us