Vitamin B12 Market Size, Share & Industry Analysis, By Type (Cyanocobalamin, Methylcobalamin, Adenosylcobalamin, and Hydroxocobalamin), By Application (Food Grade, Pharmaceutical Grade, and Feed Grade), By End-user (Pharmaceutical Industry, Food & Nutraceuticals Industry, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

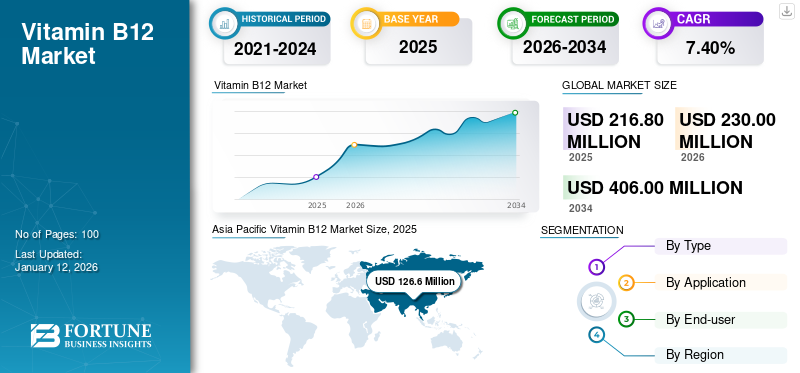

The global vitamin B12 market size was valued at USD 216.8 million in 2025 and is projected to grow from USD 230 million in 2026 to USD 406 million by 2034, exhibiting a CAGR of 7.40% during the forecast period. Asia Pacific dominated the vitamin b12 market with a market share of 58.40% in 2025.

Vitamin B12, or cobalamin, is a water-soluble vitamin that is involved in the synthesis of DNA, red blood cell formations, fatty acids, and amino acids. In addition, it is one of the factors that maintain the health of the nerve cells. The deficiency of this vitamin typically results in anemia, neurological symptoms, and homocysteine and methanoic acid impairment.

Animal products such as milk, meat, eggs, and fish are the primary and natural sources of these vitamins and plant foods generally do not contain significant amounts. As a result, vegetarians and vegans are at higher risk of deficiency and have to rely on supplements or fortified foods.

The growing prevalence of vitamin B12 deficiencies and neurological conditions are some of the key factors driving the market growth globally. In addition, growing awareness of overall health and the popularity of plant-based diets are the trends that are increasing the adoption of these supplements. The new production technologies and R&D investments are anticipated to increase the production volume to meet the growing demand.

- For instance, in December 2023, Quadram Institute and the University of Kent developed a new technology for sustainable and huge quantity cobalamin production, reducing heavy metals such as cyanide and cobalt usage.

Furthermore, various product launches in the food and pharmaceutical sectors are expected to propel the market growth.

- For instance, in June 2023, VÖOST, a vitamin boost brand from Procter & Gamble, launched pomegranate citrus-flavored vitamin B12 gummies to support cellular energy and metabolism.

Overall, the increasing prevalence of these vitamin deficiencies and neurological conditions and rising awareness of these vitamins in health & wellness are resulting in the growth of the global market.

The COVID-19 pandemic catalyst the growth of the market in 2020. The vitamin B12 products demand across the globe was increased as these are considered one of the immune boosting nutrition. The players manufacturing these supplement had procured large amount of API and the market witnessed growth. The demand has reduced in 2022 and 2023 due to the accumulation of the API in the previous year. However, the market is anticipated to witness a growth in the coming years due to increasing awareness of healthcare supplements.

Global Vitamin B12 Market Key Takeaways

Market Size & Forecast

- 2025 Market Size: USD 216.8 million

- 2026 Market Size: USD 230 million

- 2034 Forecast Market Size: USD 406 million

- CAGR: 7.40% from 2026–2034

Market Share

- Regional Insights: Asia Pacific dominated the global vitamin B12 market with a 58.16% share in 2024, driven by a high prevalence of diabetic neuropathy, rising geriatric population, and increasing awareness of dietary supplements, especially in China, India, and Southeast Asia.

- By Type: Cyanocobalamin held the largest market share in 2024 due to its high stability, wide availability, and cost-effectiveness. It is extensively used to treat B12 deficiency, particularly in pharmaceutical and fortified food applications.

Key Country Highlights

- China: Largest producer and consumer of cyanocobalamin; accounts for nearly 90% of global production. High prevalence of diabetic neuropathy (approx. 19.5 million affected) is increasing demand for cobalamin-based treatments.

- United States: Rising prevalence of neural conditions and strong presence of nutraceutical brands like VÖOST (Procter & Gamble) support growing supplement demand. The market is driven by preventive healthcare awareness and elderly B12 deficiency rates of 6–20% in older adults.

- Japan: Advanced health-conscious population and aging demographics increase fortified food and pharmaceutical-grade B12 consumption. Regulatory support and innovation in supplement delivery formats (like nasal sprays) fuel market adoption.

- Europe: Rapid growth due to innovation in nutrition and wellness sectors and increasing cases of pernicious anemia. Major European producers like EUROAPI are investing heavily in capacity expansion and sustainability (e.g., $25M biomass boiler in France).

Vitamin B12 Market Trends

Surge in Strategic Initiatives by Market Players to Boost the Market Growth

In recent years, the demand for dietary supplements and fortified food, including vitamin B12, has increased significantly. In addition, companies are strategically aligning their efforts to meet this demand with the growing awareness of vitamins in maintaining overall health.

Various initiatives to strengthen the market presence, enhance product offerings, and expand distribution networks are being witnessed in the market. Furthermore, the initiatives toward research and development to create novel formulations & fortification and enhance bioavailability are further propelling the market's growth.

Moreover, R&D initiatives by various organizations during COVID-19 to analyze the efficacy of the vitamin supported the competency of the product.

- For instance, according to the study published by Agência Brasil in August 2022, vitamin B12 reduces the inflammatory storm caused by the COVID-19 disease. It shows the efficacy of these vitamins in mitigating COVID-19.

Partnerships, collaborations, and acquisitions between market players operating in the market to strengthen the supply chains and product development are driving market expansion.

Download Free sample to learn more about this report.

Vitamin B12 Market Growth Factors

Growing Health Awareness and Rise in the Demand from the Food and Pharmaceuticals Industries to Propel the Market Growth

Globally, the rising awareness toward the health benefits of essential micronutrients has created a demand for products and supplements fortified with this vitamin type.

The launch of various associated campaigns further increases awareness, boosting the demand for these supplements and fortified products.

- For instance, in May 2023, Procter & Gamble launched a Nerve Health Awareness campaign to emphasize the importance of B vitamins (Vitamin B1, B6, and B12) in supporting healthy nerves. Such instances and various product launches are anticipated to drive the market growth.

The demand for these vitamins in the food, pharmaceutical, and feed industries has been constantly increasing in recent years. Growing demand for functional foods and beverages and the trend of fortifying vitamins and minerals in energy bars and beverages are expected to propel the market growth during the forecast period. Cobalamin deficiency continues to be a major public health challenge, and pharmaceutical companies are launching various products to address deficiencies. Owing to the product launches, the demand is anticipated to grow across the globe.

Overall, the introduction of pharmaceutical and functional food products containing these vitamins and growth in awareness of maintaining health is anticipated to drive the demand in the near future.

Increasing Prevalence of Vitamin B12 Deficiency to Increase the Product Demand, Fueling the Market Growth

Vitamin B12 is an essential vitamin for various physiological functions, and the deficiency impairs various physiological processes, including the formation of red blood cells, maintaining homocysteine levels, neurological function, and DNA synthesis, resulting in pernicious & megaloblastic anemia, nerve damage, dementia, depression, and seizures. Autoimmunity, malabsorption, and dietary insufficiency are the major factors responsible for cobalamin deficiency in individuals. In addition, aging and chronic conditions increase the chances of these vitamin deficiencies due to malabsorption.

Globally, the increasing prevalence of vitamin B12 deficiency increases the demand for dietary supplements and medication containing cobalamin. The vitamin is inevitable for nerve health and function, and the deficiency can exacerbate neuropathy and dementia in diabetics & Alzheimer's patients; hence, supplementation is essential for individuals with such conditions.

- For instance, according to the article published in Human Nutrition & Metabolism in March 2022, the prevalence of B12 deficiency in patients with chronic diseases such as type 2 diabetes was 17.5%.

As the prevalence of diabetes and Alzheimer's increases, the opportunities and the demand for these products are anticipated to grow in the coming years.

RESTRAINING FACTORS

High Dependency on China for Supply and High Costs May Hamper the Market Growth

Cyanocobalamin is one of the few nutrients that is produced by the fermentation process. According to various studies, a liter of culture suspension can produce 400mg of cobalamin. Fermentation is a long process and strains that produces cobalamin grow slowly. Such challenges in production require large bioreactors and a controlled environment for the stains to yield optimum cobalamin. China is the only region with a large production capacity that supplies a significant portion of these products to the global market. According to UK Research and Innovation (UKRI), China produces around 90% of the cyanocobalamin for the global market. However, high dependency on China for the supply can potentially hamper the supply during production and supply chain disruptions and changes in trade policies.

As the only source for commercial production of cobalamin, fermentation increases production costs. In addition, the dominance of a few key manufacturers in the market further increases the high price of these raw materials. Altogether, large dependence on China for the supply and the high cost are expected to impede the vitamin B12 market growth.

Vitamin B12 Market Segmentation Analysis

By Type Analysis

Cyanocobalamin Segment Held a Major Share Due to Its Wide Availability

By type, the market is segmented into cyanocobalamin, methylcobalamin, adenosylcobalamin, and hydroxocobalamin.

The cyanocobalamin segment accounted for the majority share of 60.22% in the market in 2026. Cyanocobalamin is the most stable form of vitamin B12 available on the market. Easy availability and cost-effectiveness are some of the advantages that increase the usage of cyanocobalamin. Furthermore, the rising prevalence of chronic diseases, pernicious anemia, and vitamin B12 deficiency are the factors contributing to the growth of the cyanocobalamin segment.

The methylcobalamin segment held the second-largest vitamin B12 market share in 2024. The superior bioavailability, pharmacological activities, enhanced neurological benefits, and suitability for individuals with genetic mutations are the major advantages that boost the growth of the methylcobalamin segment.

The adenosylcobalamin segment held considerable revenue in 2024. Increased accessibility and wide availability, coupled with advancement in production technologies, enhance the usage of adenosylcobalamin supplements, driving the segment growth.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Increasing Consumption of Fortified Food to Fuel the Food Grade Segment Growth

By application, the market is segmented into pharmaceutical grade, food grade, and feed grade.

The food grade segment dominated the market with share of 81.83% in 2026. The growth in the aging population, age-related complications, and increasing awareness of these supplements result in increased consumption of fortified food. In addition, the shift toward a vegan diet is expected to increase the demand for vitamin B12 supplements and fortified foods. Furthermore, the wide availability of fortified and functional foods and numerous supplement products are anticipated to drive the segment's growth.

The pharmaceutical grade segment is anticipated to grow significantly during the forecast period. The key advantages, such as safety and purity of the pharmaceutical grade, are expected to drive the segment's growth. In addition, the rising prevalence of peripheral neuropathy, macular degeneration, and atrophic gastritis is expected to fuel the use of cobalamin as adjuvant therapy and is expected to drive the segment growth in the near future.

- According to the article published in Nature Scientific Reports in July 2023, the prevalence of peripheral neuropathy among patients with diabetes in Pakistan is around 43.0% and is expected to increase the demand for cobalamin to improve neural function.

By End-user Analysis

Rising Demand for Health Supplements to Support the Food & Nutraceuticals Industry Segment Growth

By end-user, the market is categorized into pharmaceutical industry, food & nutraceuticals industry, and others.

The food & nutraceuticals industry segment dominated the market with share of 59.65% in 2026. The growing demand for nutrition products is a key factor that drives the segment growth. Increased usage of cobalamin as a fortifying agent in various products such as dairy, meat substitutes, and energy drinks and increasing demand for fortified food and beverages is expected to further drive the growth of the segment. Moreover, players' focus on launching bio-available supplements is significantly boosting the segment growth.

The pharmaceutical industry segment is anticipated to grow considerably during the forecast period. Neurological conditions and pernicious anemia are the key conditions that increase the demand for these products in the pharmaceutical industry.

- As per the National Institutes of Health (NIH) Office of Dietary Supplements (ODS) 2023 report, in the U.S, approximately 6.0% of adults over 60 years have a vitamin B12 deficiency, and the rate is around 20.0% in adults older than 60 years. Such strong prevalence is anticipated to drive the segment growth.

The others segments, including the cosmeceutical industry, CMOs, CDMOs, and R&D centers, are anticipated to grow considerably in the near future. Increased research activities to introduce new and effective technologies to increase these vitamins' production to cater to the growing demand are anticipated to drive the segment growth.

REGIONAL INSIGHTS

From the regional perspective, the market is divided into North America, Europe, the Asia Pacific, and the rest of the world.+

Asia Pacific

Asia Pacific Vitamin B12 Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific held the largest market share in 2025, generating a revenue of USD 126.6 million. The high prevalence of diabetic neuropathy, growth in the geriatric population, and rising awareness regarding health supplements are the factors anticipated to drive the region’s growth. Moreover, the presence of key players and their growing production capacities are poised to significantly contribute to the region’s market growth over projected years. The Japan market is projected to reach USD 21.6 million by 2026, the China market is projected to reach USD 66.9 million by 2026, and the India market is projected to reach USD 21 million by 2026.

- For instance, according to the article published in Nature in July 2023, approximately 19.5 million people with diabetes had diabetes neuropathy in China. A high prevalence of neuropathy is expected to increase cobalamin consumption to maintain neural health.

Europe

Europe region is anticipated to grow rapidly during the forecast period. The region’s development in research and innovation in the healthcare and nutrition industry and resources and infrastructure to support the production on a large scale, are the factors contributing to its growth. The high prevalence of pernicious anemia is further expected to propel the demand for cobalamin supplements in the near future. The UK market is projected to reach USD 3 million by 2026, while the Germany market is projected to reach USD 8.4 million by 2026.

North America

North America held a considerable share in the market in 2024. The growth can be attributed to an increase in the use of dietary supplements, the advanced healthcare sector focusing on preventative care, and the availability of a wide range of products in the region. In addition, the growing prevalence of neural conditions and gastrointestinal issues is leading to an increased consumption of cobalamin supplements in the region. The U.S. market is projected to reach USD 46.8 million by 2026.

- According to 2022 data from Parkinson's Foundation, nearly 90,000 people are being diagnosed with Parkinson's disease in the U.S. on an annual basis. A higher population suffering from neural diseases is expected to increase the demand for cobalamin supplements.

Rest of the World

The growth of the cobalamin market in the rest of the world can be attributed to the increase in awareness, rising prevalence of Neglected Tropical Diseases (NTDs), and micronutrient malnourishment.

KEY INDUSTRY PLAYERS

Hebei Yuxing Dominated Due to Robust Production Capacity

Among other companies, Hebei Yuxing dominated the market in 2023 with a significant market share. The company's strong production capacity enables it to dominate the global market. In addition, its focus on state-of-the-art facilities and geographical expansion is anticipated to drive the company’s growth in the coming years.

EUROAPI held a considerable share in the global market in 2023. The company holds a prominent position in the European market with a range of high-quality products in its portfolio. In addition, its emphasis on strategies, including acquisitions, mergers, and R&D investments, is expected to propel the company's growth in the coming years.

CSPC Pharmaceutical Holdings Group Co., Ltd.'s growth can be attributed to a strong product portfolio in the global market. Moreover, the constant focus on expanding production capacity and geographical reach by Ningxia Kingvit Pharmaceutical CO., LTD and other prominent companies is driving their growth.

LIST OF TOP VITAMIN B12 COMPANIES:

- EUROAPI (France)

- CSPC Pharmaceutical Group Co., Ltd. (China)

- Ningxia Kingvit Pharmaceutical (China)

- Pharmavit (Netherlands)

- NCPC INTERNATIONAL CORP. (China)

KEY INDUSTRY DEVELOPMENTS

- February 2024: Lupin Limited launched Cyanocobalamin Nasal Spray (500 mcg/spray, One Spray per Device) for patients with pernicious anemia in the U.S.

- November 2023: EUROAPI acquired BianoGMP to strengthen its CDMO expertise, including research and commercialization of vitamin B12.

- August 2023: EUROAPI invested USD 25.0 million to construct a state-of-the-art biomass boiler in its France facility to produce vitamin B12. This is to enable EUROAPI to increase its manufacturing capacity.

- August 2023: Subsidiaries of CSPC Pharmaceutical Holdings Group Co., Ltd. including CSPC Zhongnuo Pharmaceutical (Shijiazhuang) Co., Ltd. and CSPC Ouyi Pharmaceutical Co., Ltd. received GMP and GLP on-site certification by Colombia's National Food and Drug Surveillance Institute (INVIMA), that helps the company to internationalization of vitamin B12 API sales.

- April 2022: NCPC INTERNATIONAL CORP. secured FAMI-QS Certification system. The certification makes the company as a qualified supplier of feed ingredients including Vitamin B12 for European market.

REPORT COVERAGE

An Infographic Representation of Vitamin B12 Market

To get information on various segments, share your queries with us

The global vitamin B12 market report provides an in-depth analysis of the industry. It focuses on market segments, such as by type, application, and end-user. Besides this, it offers the global market forecast in relation to the market dynamics and the latest market trends. In addition, the report consists of several factors that have contributed to the market’s growth. The report also provides the competitive landscape of the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.40% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 216.8 million in 2025.

In 2025, the market value stood at USD 126.6 million.

The market is expected to exhibit a steady CAGR of 7.40% during the forecast period.

By type, the cyanocobalamin segment led in 2025.

The growing health awareness, rising demand from the food & pharmaceutical industries, and increasing prevalence of vitamin B12 deficiency are key factors driving the market growth.

EUROAPI, CSPC Pharmaceutical Group Co., Ltd., and Ningxia Kingvit Pharmaceutical are the major players in the market.

The Asia Pacific dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic