Voice Biometrics Market Size, Share & Industry Analysis, By Type (Active and Passive), By Deployment Mode (On-premises and Cloud-Based), By Enterprise Type (Small and Medium-sized Enterprises (SMEs) and Large Enterprises), By Vertical (BFSI, Healthcare, Government & Defense, IT & Telecom, Retail & E-commerce, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

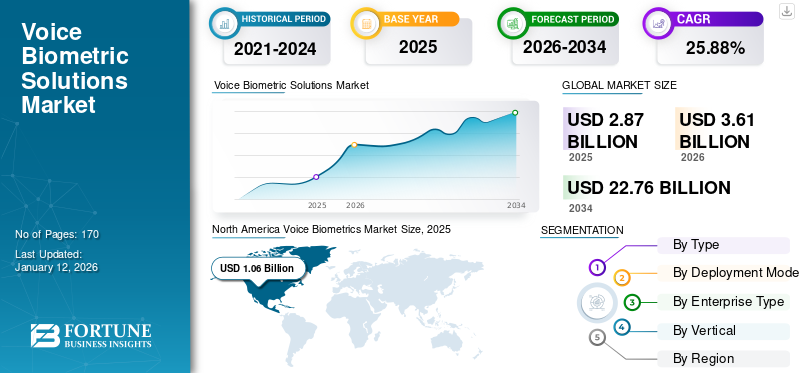

The global voice biometrics market size was valued at USD 2.87 billion in 2025 and is projected to grow from USD 3.61 billion in 2026 to USD 22.76 billion by 2034, exhibiting a CAGR of 25.88% during the forecast period. North America dominated the voice biometrics market with a market share of 36.92% in 2025.

The science of utilizing an individual's voice to authenticate them is known as voice biometrics. Access to both virtual and physical spaces is increasingly being granted by this biological characteristic in addition to fingerprint, face, and palm characteristics. For speaker verification, voice biometrics technology plays a pivotal role. To obtain two-factor authentication for accessing protected sites, buildings, and materials, a voice recognition technique can be used in conjunction with an ID and a password or PIN.

The market’s growth is majorly augmented by the increasing demand for secure authentication techniques in call centers, and growing adoption of voice-activated devices. Voice biometrics offers a convenient user authentication method, mainly for phone banking, remote access to systems, and customer service calls. Organizations increasingly use biometrics technologies to enhance user experience by offering voice identification and verification methods. The Biometrics Survey 2021 by ID R&D suggests that around 73% of surveyed organizations used biometrics technology to ensure good customer and user experience. In addition, 2023 Digital-First Banking Report by Entrust Cybersecurity Institute revealed that over 72% of surveyed respondents are comfortable or extremely comfortable with banks using biometrics technology.

In addition, according to the Reserve Bank of India (RBI), the number of financial frauds in the card and internet segment increased to 12,069 cases in the first half of fiscal year 2024 as against 2,321 cases in the same period of last year. To address the increasing concern of financial crimes, banks are using biometrics technology for user authentication purposes. For instance,

- In April 2023, City Union Bank Limited (CUB), an Indian private sector bank, launched voice biometrics for new customers to log in to a mobile banking app. The bank introduced this feature to secure their customers from fraudsters.

The coronavirus pandemic rapidly increased fraudulent activities, such as identity theft and account takeover attacks across the globe. During the outbreak, voice biometrics technology became a crucial solution due to its ability to identify users based on their voice patterns uniquely.

IMPACT OF GENERATIVE AI

Artificial Intelligence (AI) Integration with Voice Biometric Technology to Propel the Market Growth

Generative AI has both positive and negative impacts on the market. AI is radically shaping the future of voice technology. It is becoming increasingly difficult to distinguish artificial voices from real voices due to the extraordinary advancements in AI. In recent times, recording and uploading an individual’s voice to create a voice clone and using it for their benefit has become easy. However, AI is also improving voice recognition systems' accuracy and security by continuously learning from a variety of voices and responding to changing threats. While generative AI holds promise for augmenting the market, it also creates new challenges that need to be addressed to ensure the security of authentication systems.

Voice Biometrics Market Trends

Rising Prevalence of Deepfake Technology to Augment the Market Growth

Deepfakes are an increasingly complex and serious challenge that is developed using AI to generate synthetic images, videos, or sounds. Deepfakes can be used to breach systems and compromise the data of organizations as well as individuals. The State of Biometrics in 2023 survey by Regula suggests that over 37% of organizations have faced synthesized voice fraud. This, in turn, is expected to increase the requirement for more robust and sophisticated voice recognition solutions capable of detecting and mitigating deepfake attacks. Furthermore, it is anticipated to drive the development of advanced anti-spoofing technology to strengthen voice biometric systems’ defense against Ai-generated voice replicas. For instance,

- In January 2024, ID R&D, a voice biometrics company, announced the launch of a voice deepfakes detection tool to combat AI-driven fraud.

Download Free sample to learn more about this report.

Voice Biometrics Market Growth Factors

Increasing Demand for Robust Fraud Detection and Prevention Systems across BFSI Sector to Boost the Market Growth

Fraud, a complex and multi-layered phenomenon, presents a significant challenge to financial institutions. Recent statistics from the Federal Trade Commission (FTC) highlight the need to tackle this issue. It showcases that, in 2023, 2.6 million consumers reported being victims of fraudulent activity, with recorded losses reaching USD 10 billion. The increasing rate of financial fraud demands better and more effective defense solutions such as voice biometrics with robust Machine Learning (ML), data analytics, and predictive capability. Rapid developments in biometrics may no longer require users to answer security questions. Instead, automated and fraud-free systems can be achieved with the high accuracy of voice recognition and biometric technologies. This, in turn, can help financial institutes protect their customers, employees, and reputation while also improving the resilience of the financial system.

RESTRAINING FACTORS

High Cost Along with Less Adoption in Developing Economies to Hinder the Market Growth

Implementing voice recognition solutions involves upfront costs and can be costly, especially for Small and Medium-Sized Enterprises (SMEs) with limited resources. These solutions often deliver errors in recognition accuracy, mainly in noisy environments or with speakers who have unique speech or accent patterns. Additionally, there is less or slow adoption of biometric identification and verification solutions in developing nations owing to low digital literacy, infrastructure challenges, and financial constraints. This, in turn, hinders the adoption of voice recognition solutions. However, the businesses that manage to implement robust identification and verification solutions highly benefit in terms of customer experience and security.

Voice Biometrics Market Segmentation Analysis

By Type Analysis

Passive Segment to Thrive with Rising Demand for User-friendly and Non-intrusive Authentication

Based on type, the market is bifurcated into active and passive.

The passive segment accounting for 67.60% of the market share in 2026 as this method is user-friendly. With the passive method, the user does not need to set their voiceprint actively. Their voiceprint is produced based on their vocal traits and characteristics during conversation. Regardless of the words or language spoken by the caller, this identification technique is effective. In the active method, users are required to say a predetermined passphrase every time they want to get authenticated, which is not needed by the passive method.

The active segment is poised for the highest growth rate due to the rising demand for more secure authentication methods in sectors such as BFSI, healthcare, and e-commerce. This method offers a high level of security by requiring users to participate in the authentication process actively.

By Deployment Mode Analysis

Cloud Biometric Solutions to Register Fastest Growth with its Growing Adoption Due to its Scalability and Accessibility

By deployment mode, the market is segmented into on-premises and cloud-based solutions.

The cloud biometric solution poised to show highest growth rate during the study period. This approach helps businesses to utilize the scalability delivered by cloud deployment. Enterprises can control costs and easily incorporate data with IT systems and mobile applications using cloud solutions.

The on-premises segment dominated the market with a 70.96% share in 2026. It enables organizations to maintain complete control over their sensitive data and authentication processes, hence reducing the risk of unauthorized access as well as data breaches.

By Enterprise Type Analysis

Small and Medium-Sized Enterprises (SMEs) to Depict Swift Growth Owing to Robust Digitalization

By enterprise type, the market is segmented into SMEs and large enterprises.

During the forecast period, SMEs are poised to grow with the highest growth rate. Digitalization significantly impacts SMEs and presents ample amount of growth opportunities. Cutting-edge technology adoption enables SMEs to secure their employees' personal and business assets and also, sustain the competition.

Additionally, large organizations accounted for 72.91% of the market share in 2026 owing to the rapid adoption of identification verification solutions to comply with regulations, protect data, and enhance customer trust. The adoption of robust verification solutions helps large enterprises protect sensitive data from unauthorized access, ensuring confidentiality, integrity, and availability.

By Vertical Analysis

To know how our report can help streamline your business, Speak to Analyst

BFSI Dominates with Financial Institutions Adopting Security Solutions Owing to Rising Threats

By vertical, the market is classified into BFSI, government & defense, healthcare, IT & telecom, retail & e-commerce, and others.

The BFSI vertical represented the largest sub-segment, holding a 41.95% share in 2026. Financial institutions are realizing the importance of proactive security measures to prevent various threats to individuals as well as systems. As voice biometrics use unique vocal characteristics of users for identification and authentication, financial institutions can offer seamless and secure customer interactions.

The retail & e-commerce segment is predicted to depict the fastest growth rate during the study period. Online retailers are rapidly stepping up their efforts to guarantee that transactions are safe and that customers are genuine due to the rise in identity fraud. Online retailers are using verification solutions extensively to onboard new customers, safeguard current customers from account takeovers, and mitigate fraudulent transactions—all while adhering to strict data standards.

REGIONAL INSIGHTS

The global market is classified across five regions, North America, Europe, the Asia Pacific, South America, and the Middle East & Africa.

North America Voice Biometrics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America accounted for USD 1.06 billion in 2025 due to the strict regulatory environment, increased instances of identity theft, and robust adoption of biometric authentication and identification. As per the "Annual Data Breach Report 2022" by IRTC, the U.S. faced the second-highest number of data breaches in a year, impacting at least 422 million individuals. All these factors have fueled the adoption of advanced verification solutions in this region.

Asia Pacific

The Asia Pacific region is projected to depict the highest CAGR on account of the increasing need for robust cybersecurity measures and rapid digitization. The augmentation of online services generates a strong demand for verification solutions in the Asia Pacific to enable secure access to online systems and services. The Japan market reaching USD 0.11 billion by 2026, the China market reaching USD 0.18 billion by 2026, and the India market reaching USD 0.10 billion by 2026.

Europe

Digital identity initiatives mainly augment Europe’s voice biometrics market growth. Numerous countries in European Union (EU) require a precise legal framework for enterprises to gain higher security for digital transactions.

South America

The rise of mobile banking and online transactions expected to augment market growth across the South America region. The increased digitalization offers lucrative opportunities across the Middle East & Africa to enable safe online interactions.

KEY INDUSTRY PLAYERS

Key Players Launch New Products to Strengthen Market Position

The market is dominated by some of the leading companies such as Nuance Communications, Inc., ID R&D, LumenVox, AccuraScan, ValidSoft Group, Phonexia, VERIDAS, Aware, Inc., Fortra, LLC., and 3SC, among others. These market players are increasingly strengthening their market position by adopting various strategies, including acquisitions, mergers, collaborations, and product launches. For instance, in September 2021, Gnani.ai announced the launch of armor365, a voice biometric solution with advanced features such as replay attack detection, anti-spoof layer, and one enrollment.

LIST OF TOP VOICE BIOMETRICS COMPANIES:

- Nuance Communications, Inc. (U.S.)

- ID R&D (U.S.)

- LumenVox (U.S.)

- AccuraScan (India)

- ValidSoft Group (U.S.)

- Phonexia (Czech Republic)

- VERIDAS (Spain)

- Aware, Inc. (U.S.)

- Fortra, LLC. (U.S.)

- 3SC (India)

KEY INDUSTRY DEVELOPMENTS:

- July 2023: Smartz Solutions, an employee engagement software development firm, announced the launch of a new voice biometric platform to fight the rise of fraud across the world in the BFSI sector.

- June 2023: Glia and Illuma Labs announced the partnership to streamline voice authentication and identification for customer service interactions, enhance operational efficiency, and prevent fraud in the BFSI sector.

- April 2023: Biometric Vox and Antolin developed a voice-enabled biometric system for vehicle access. By authorizing the driver, the car can set customized driver settings, such as favorite music and seat placement.

- March 2023: SK Telecom and Pindrop, a provider of voice security solutions, announced the partnership to introduce voice authentication and liveness detection solutions to the Korean market.

- December 2022: ValidSoft announced a new digit-based voice biometrics solution to offer robust identity assurance in enterprise remote applications, such as PAM, IAM, and ZTNA.

REPORT COVERAGE

An Infographic Representation of Voice Biometric Solutions Market

To get information on various segments, share your queries with us

The report provides a comprehensive analysis of the market and focuses on key aspects such as prominent companies, product/service types, and leading applications of the product. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021 – 2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026 – 2034 |

|

Historical Period |

2021 – 2024 |

|

Growth Rate |

CAGR of 25.88% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Deployment Mode

By Enterprise Type

By Vertical

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market is predicted to reach USD 22.76 billion by 2034.

In 2025, the market value stood at USD 2.87 billion.

The market is projected to record a CAGR of 25.88% during the forecast period.

The BFSI is leading the vertical segment in the market.

Increased adoption of mobile and cloud technologies, along with a surge in digitalization, is anticipated to aid the market growth.

Some of the top players in the market are Nuance Communications, Inc., ID R&D, and LumenVox.

Asia Pacific is expected to show the highest CAGR due to the rapid digitalization, favorable government initiatives, and expansion of the e-commerce sector.

By type, the active segment is expected to show the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic