Water Treatment Chemicals Market Size, Share & Industry Analysis, By Type (pH Conditioners, Coagulants & Flocculants, Disinfectants & Biocidal Products, Scale & Corrosion Inhibitors, Antifoam Chemicals, and Other Chemicals), By Application (Municipal and Industrial), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

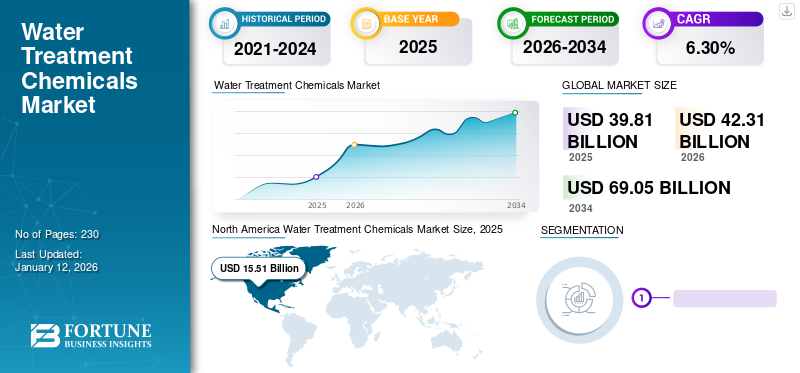

The global water treatment chemicals market size was valued at USD 39.81 billion in 2025. The market is projected to grow from USD 42.31 billion in 2026 to USD 69.05 billion by 2034, exhibiting a CAGR of 6.30% during the forecast period. North America dominated the water treatment chemicals market with a market share of 39% in 2025. Moreover, the water treatment chemicals market in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.14 billion by 2034, driven by the increasing demand for treated water from the power generation, pharmaceuticals, and food and beverage industries.

Chemicals are used in the process of water treatment in order to make water more acceptable for end-use such as drinking, cooking, irrigation, and other industrial processes. Some of the chemicals are sodium metabisulfite, ferric chloride, and Sodium Hexametaphosphate (SHMP). The chemical industry uses various water treatment methods involving both physical and chemical methods to remove substances such as sand, minerals, bacteria & viruses, and others. Water, being an essential resource for households and has numerous uses in end-use industries, has created a high demand for water treatment in order to reuse and recycle. The increasing need for water consumption due to the growing population and industrial use is expected to drive the market globally.

The demand for water treatment chemicals, equipment, and services across all regions was significantly impacted during the COVID-19 pandemic due to supply chain disruption, shortage of chemicals & inventory, short-term production halt, economic slowdown, trade restrictions, changing consumer behavior, and other reasons. Due to supply chain disruption across key consuming countries across all regions, in 2020, the year-on-year growth rate of the global market considerably dropped as compared to 2019. However, on account of mitigation strategies and business continuity plans adopted by leading manufacturers and suppliers, backed by respective government initiatives to recover the economy, the market is projected to recover slowly in the upcoming years.

GLOBAL WATER TREATMENT CHEMICALS MARKET OVERVIEW & KEY METRICS

Market Size & Forecast:

- 2025 Market Size: USD 39.81 billion

- 2026 Market Size: USD 42.31 billion

- 2034 Forecast Market Size: USD 69.05 billion

- CAGR: 6.30% from 2026–2034

Market Share:

- North America led the global water treatment chemicals market in 2025 with a share of 39%, driven by strong demand from the power generation, pharmaceutical, and food and beverage industries.

- By type, coagulants & flocculants dominated the market due to their crucial role in sedimentation and sludge treatment. Disinfectants and biocidal products also held a significant share owing to rising awareness of waterborne diseases and stricter water quality regulations.

- By application, the municipal segment held the largest share in 2024, supported by growing water usage in agriculture and residential sectors. The industrial segment is expected to grow substantially due to stricter environmental regulations and the adoption of advanced treatment technologies.

Key Country Highlights:

- United States: Projected to reach USD 20.11 billion by 2032, with over 95% wastewater recycling in place, driven by increasing demand from core sectors and ongoing water reuse initiatives.

- China: Industrial expansion and environmental regulations are fueling demand for advanced water treatment technologies, particularly in power, chemical, and municipal sectors.

- India: Rapid urbanization and government investment in sanitation and water infrastructure are supporting the growth of chemically treated water across multiple industries.

- Germany: Aging infrastructure and strict environmental compliance laws are encouraging renovation and upgrades in municipal water treatment systems.

- Brazil: Government-led initiatives and infrastructure development in wastewater treatment are stimulating chemical demand across water management systems.

- Saudi Arabia: Scarcity of groundwater and rising reuse of treated water in industries and urban centers are driving chemical adoption, especially in desalination and reuse systems.

Water Treatment Chemicals Market Trends

Urbanization and Population Growth in Emerging Economies Provides Beneficial Market Opportunities

Urbanization and population growth result in increased municipal water requirements. Municipalities need to treat water to ensure its safety for consumption, and water treatment chemicals are integral to this process. Moreover, growing urban areas contribute to higher levels of industrial and domestic wastewater, necessitating advanced water treatment solutions. Urbanization is often accompanied by a surge in population and a subsequent rise in water consumption for various purposes such as domestic use, commercial activities, and public services. As cities expand, there is a greater need to ensure sustainability and safety for the growing urban population.

Moreover, municipalities are tasked with providing clean and safe drinking water to residents. This influx of people into urban areas amplifies the challenges associated with sourcing, treating, and distributing water. Water treatment chemicals are vital components of municipal water treatment processes, helping to eliminate contaminants and pathogens from the water supply. Thus, urbanization and population growth create a heightened demand for water treatment chemicals as municipalities strive to ensure a secure and clean water supply for their residents, manage wastewater effectively, and address the environmental and public health implications of urban expansion. North America witnessed a water treatment chemicals market growth from USD 13.97 billion in 2023 to USD 14.69 billion in 2024.

Download Free sample to learn more about this report.

Water Treatment Chemicals Market Growth Factors

Growing Demand for Chemically Treated Water in Various End-use Industries Will Aid Market Growth

As industries expand, there is a parallel increase in water consumption. Sectors such as manufacturing, power generation, and chemical processing require substantial amounts of water for their operations. Effective water treatment chemicals become essential to maintain water quality, reduce pollutants, and meet environmental standards. In addition, growing awareness of water scarcity issues prompts industries to adopt sustainable water management practices. Water treatment chemicals enable the recycling and reuse of water, reducing overall water consumption and minimizing environmental impact. Moreover, in developing economies such as China, India, Japan, Mexico, and Brazil, increased industrialization and urbanization have led to a surge in the demand for water chemicals. These countries are investing in water infrastructure and treatment solutions to address water quality challenges associated with rapid economic growth.

RESTRAINING FACTORS

Presence of Alternative Water Treatment Technology Aid to Hamper Market Growth

The growing number of processes of water treatment and the presence of alternative treatment technologies will hamper the growth of the market. At the same time, the need for sustainable formulations and susceptibility to copying patents will challenge its growth. Alternative water treatment technologies encompass innovative and eco-friendly approaches to water purification, such as advanced filtration systems, membrane technologies, and emerging non-chemical treatment methods.

These alternatives often attract industries and municipalities seeking sustainable and cost-effective solutions, steering away from traditional chemical-based water treatment. Membrane filtration, for instance, offers a chemical-free process that reduces environmental impact. Additionally, ultraviolet (UV) and electrochemical methods are gaining traction for their efficacy in disinfection without relying on chemical additives.

Water Treatment Chemicals Market Segmentation Analysis

By Type Analysis

Coagulants & Flocculants Segment Accounted for the Largest Share Due to its Treatment Techniques

Based on type, the market is segmented into pH conditioners, coagulants & flocculants, disinfectants & biocidal products, scale & corrosion inhibitors, antifoam chemicals, and other chemicals.

The coagulants & flocculants segment is expected to account for 43.75% of the market in 2026, as they are vital chemicals required for causing sedimentation in sludge treatment techniques. These chemicals aid the removal of impurities by causing particles to clump together, facilitating easier filtration and purification of water. This is particularly vital in wastewater treatment and ensuring the supply of clean water for various applications.

Disinfectants & biocidal products held a significant market share during the forecast period due to the increasing awareness of waterborne diseases and the need for safe and clean water sources driving the demand for effective disinfectants & biocidal solutions. Additionally, stringent regulations and standards for water quality in various industries and public water supplies further drive the water treatment chemicals market growth.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Municipal Segment Accounted for the Largest Share Due to its High Demand

Based on application, the market is segmented into municipal and industrial.

The municipal segment is projected to dominate the market with a share of 76.65% in 2026, propelled by agriculture, which constitutes over 30% of global water demand. Additionally, increased wastewater production from residential buildings, including water usage in adventure parks and swimming pools, is expected to drive demand for advanced treatment solutions. For example, the Central Public Health & Environment Engineering Organization (CPHEEO) report indicates that approximately 70-80% of water supplied to domestic applications is converted to wastewater after use.

The industrial segment is expected to experience considerable growth during the forecast period. This is owing to the imposition of more stringent regulations expected to be enforced in developing countries. Advancements in technologies such as ozone treatment and bioremediation developed by Culligan Industrial Water and Suez Worldwide, amongst others, will be critical factors for the segment’s growth.

REGIONAL INSIGHTS

Based on geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America Water Treatment Chemicals Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

In 2024, North America accounted for the largest share of 39.2% in the global market. In North America, the U.S. is a prime market for water & wastewater management. Over 95% of wastewater collected is treated and then recycled in North America, which represents a potential growth opportunity for water treatment chemical suppliers. Treated water’s increasing demand from the power generation, pharmaceuticals, and food and beverage industries is significantly boosting market growth. The U.S. market is projected to reach USD 1.16 billion by 2026.

- North America witnessed a growth OF USD 15.51 Billion in 2025.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is poised for significant growth, driven by substantial investments from Southeast Asia, India, and China aimed at enhancing water quality and sanitation services. Industries in the region are prioritizing the development of activated sludge process-based effluent treatment to meet regulatory standards set by environmental authorities, thereby fueling market expansion. The Japan market is projected to reach USD 0.35 billion by 2026, the China market is projected to reach USD 1.4 billion by 2026, and the India market is projected to reach USD 0.51 billion by 2026.

Government and private sector initiatives to renovate the current old-age water treatment facilities are the key driving factors for the growth of the market in European economies. The strict government regulations are increasing the demand for advanced and more efficient wastewater treatment services in the region.

Europe

The UK market is projected to reach USD 0.25 billion by 2026, while the Germany market is projected to reach USD 0.31 billion by 2026.

In Latin America, government initiatives, along with the increasing investment in establishing the water & wastewater treatment infrastructure in Brazil, Columbia, and Argentina, are expected to push the demand for all wastewater treatment market segments in the near future.

The Middle East & Africa is expected to witness significant growth in the market due to rapid industrialization, rising population, and changing climatic conditions, which have increased the consumption of water and triggered the necessity to reuse wastewater in the Middle East. Groundwater scarcity and contamination also significantly contribute to the reuse of treated water. All these factors are collectively aiding the market growth in the region.

KEY INDUSTRY PLAYERS

Key Players are Adopting Strategies to Expand their Market Position

The global market share is fragmented, with key players operating in the industry, such as BASF SE, Ecolab, Kemira, Kurita Water Industries Ltd., and Air Products and Chemicals, Inc. Most manufacturers are expanding their businesses to gain competency in the industry and alleviate new entrants’ threats. Market participants are fiercely competing with international and regional players with extensive distribution networks, regulatory know-how, and suppliers. In addition, companies sign contracts, acquisitions, and strategic partnerships with other market leaders to expand their existing markets.

List of Top Water Treatment Chemicals Companies:

- BASF SE (Germany)

- Ecolab (U.S.)

- Kemira (Finland)

- Kurita Water Industries Ltd. (Japan)

- Air Products and Chemicals, Inc. (U.S.)

- American Water Chemicals, Inc. (U.S.)

- Lenntech B.V. (Netherlands)

- Thermax Limited (Netherlands)

- Hydrite Chemical (U.S.)

- Dow (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2023: Solenis, a global producer of specialty chemicals for water-intensive industries, acquired CedarChem LLC. In this acquisition, CedarChem offers a full suite of water and wastewater treatment products for industrial and municipal markets, primarily in the southeastern U.S. The acquisition aligns with Solenis’ direct go-to-market strategy to provide customers with improved chemical and wastewater treatment product and service offerings.

- January 2022: Veolia Water Technologies delivered a compact and sustainable AnoxKaldnes Moving Bed Biofilm Reactor (MBBR) solution as part of the upgrading project at the Tokoroa wastewater treatment plant in South Waikato, New Zealand. The South Waikato District Council will be able to accomplish a high degree of nitrogen removal using the MBBR design, as well as utilize existing tanks on the site, making this a very sustainable project strategy.

- January 2022: SUEZ won a long-term contract with VinyThai Public Company Limited to design and build water treatment, wastewater recycling, and waste recovery systems. They will offer a package that will consist of SUEZ’s Poseidon Dissolved Air Flotation System, PROFlex Brackish Water Reverse Osmosis system, ZeeWeed 500D Membrane Bioreactor, and filter press for biological waste and polyvinyl chloride (PVC) waste.

- December 2021: Ecolab Inc. closed its previously announced acquisition of Purolite, a leading and fast-growing global provider of high-end ion exchange resins for the separation and purification of solutions for pharmaceutical and industrial applications.

- November 2021: Kemira has expanded its production capacity for water treatment chemicals in the U.K., particularly in Goole, where the annual production of ferric-based water treatment chemicals will increase by over 100,000 tons annually. Additionally, in January 2021, the company increased production of aluminum-based water treatment chemicals in Ellesmere Port by 30,000 tons.

REPORT COVERAGE

An Infographic Representation of Water Treatment Chemicals Market

To get information on various segments, share your queries with us

The research report provides both qualitative & quantitative insights on water treatment chemicals across the world. Quantitative insights include market sizing in terms of value (USD Billion) across each segment, sub-segment, and region profiled in the scope of study. In addition, it provides market analysis and growth rates of segments and key counties across each region. Qualitative insight covers the elaborative analysis of key market drivers, restraints, growth opportunities, and industry trends related to the market. The competitive landscape section covers detailed company profiling of the key players operating in the industry.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2025-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 6.30% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market size was USD 39.81 billion in 2025 and is projected to reach USD 69.05 billion by 2034.

Growing at a CAGR of 6.30%, the market will exhibit steady growth in the forecast period.

By application, the municipal segment leads and held the largest market share in 2025.

The growing demand for chemically treated water in various end-use industries is a key factor driving market growth.

North America held the largest market share in 2025.

In 2025, the North America market size stood at USD 15.51 billion.

BASF SE, Ecolab, Kemira, Kurita Water Industries Ltd., and Air Products and Chemicals, Inc. are leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic