Wearable Medical Devices Market Size, Share & Industry Analysis, By Product (Diagnostic & Monitoring Devices {Fitness Bands, Smartwatches, Smartclothing, and Others} and Therapeutic Devices {Wearable Defibrillators, Drug Delivery Devices, Pain Management Devices, Hearing Aids, and Others}), By Application (Remote Patient Monitoring & Home Healthcare and Sports & Fitness), By Grade (Consumer Grade and Clinical Grade), By Distribution Channel (Retail Pharmacies, Online Distribution, and Hypermarkets & Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

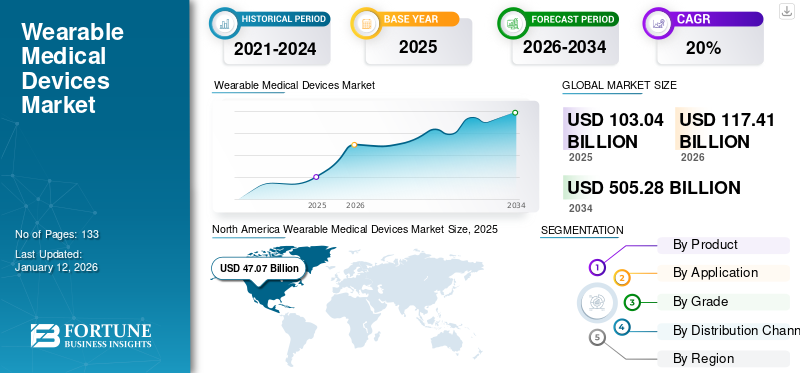

The global wearable medical devices market size was valued at USD 103.04 billion in 2025. The market is projected to grow from USD 117.41 billion in 2026 to USD 505.28 billion by 2034, exhibiting a CAGR of 20% during the forecast period. North America dominated the global wearable medical devices market with a market share of 45.70% in 2025.

Wearables in healthcare encompass medical devices that customers can wear, such as activity trackers and smartwatches. They are specifically designed to monitor and collect real-time data on a user’s health and fitness. According to an article published by mHealth Intelligence in 2023, around 40% of U.S. adults are using healthcare-related applications, and 35% are utilizing wearable healthcare devices.

Recent technological advancements in wearable devices and the growing need among the population to enhance their health have motivated several market players to develop more smart devices, such as Fitbit, biosensors, and hearing aids. In addition, the increasing prevalence of chronic diseases and lifestyle-related disorders is one of the major factors anticipated to propel the sales of wearable medical devices during the forecast period.

- For instance, according to the data published by the Institute for Health Metrics and Evaluation in June 2023, it was reported that more than half a billion people are living with diabetes worldwide, and this number is expected to reach 1.3 billion people in the next 30 years.

The outbreak of the COVID-19 pandemic had an overall positive impact on the market. Manufacturers of diagnostic devices reported significant growth in their revenues during this period due to a strong demand for wearable medical devices among the population. These devices were utilized for self-monitoring the symptoms of COVID-19.

Global Wearable Medical Devices Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 103.04 billion

- 2026 Market Size: USD 117.41 billion

- 2034 Forecast Market Size: USD 505.28 billion

- CAGR: 20% from 2026–2034

Market Share:

- North America dominated the wearable medical devices market with a 45.70% share in 2025, driven by favorable reimbursement policies, high adoption of advanced technology, and continuous product innovation by key players.

- By product type, Diagnostic & Monitoring Devices are expected to maintain their dominance due to the rising prevalence of chronic diseases and increasing demand for self-monitoring and patient monitoring solutions.

Key Country Highlights:

- United States: Increasing consumer preference for smart health monitoring devices and a strong ecosystem of advanced diagnostic infrastructure are driving the adoption of wearable medical devices.

- Europe: The rising geriatric population and increasing prevalence of chronic diseases are fostering demand for wearable medical technologies focused on remote monitoring and home healthcare.

- China: Government initiatives to reduce hospital stays and focus on digital health transformation are accelerating the adoption of wearable medical devices among healthcare providers and consumers.

- Japan: The growing elderly demographic and increasing investment in advanced health-monitoring wearables are contributing to the expansion of the market in the country.

Wearable Medical Devices Market Trends

Growing Shift Toward Health Consciousness Among General Population

There is a growing awareness toward prioritization of health and well-being among the general population. Healthcare wearables, including smartwatches and fitness bands, among others, are becoming popular owing to their versatility and convenience among the general population.

- For instance, according to the 2023 data published by Watch Faces, it was reported that there are approximately 1.2 billion users owning a smartwatch globally.

Major market players are currently focusing on introducing advanced wearable devices in the market to cater to the growing needs of customers.

- For instance, in February 2024, Samsung launched a new fitness band with an aluminium frame with an aim to strengthen its presence in the Philippines market.

In addition, in May 2020, Koninklijke Philips N.V. received the U.S. FDA and CE clearance to use Biosensor BX100 in monitoring COVID-19 patients in hospitals. The biosensor was a single-use wearable patch specially designed to be integrated with a scalable hub to monitor patients across hospital rooms. This product could also be incorporated into existing clinical workflows for mobile viewing and notifications.

Download Free sample to learn more about this report.

Wearable Medical Devices Market Growth Factors

Growing Prevalence of Chronic Diseases to Boost the Growth of the Market

There is an increasing prevalence of chronic diseases, including hypertension, diabetes, and others, owing to sedentary lifestyle among patients, further imposing a financial burden on the healthcare systems. The growing prevalence of these chronic disorders is further driving the focus toward the provision of timely and routine diagnosis among the patient population.

Moreover, governmental organizations and healthcare agencies have been actively promoting routine diagnosis through various campaigns and awareness programs. These initiatives have resulted in an increased awareness of products and devices for diagnosing and monitoring vital signs among the general population.

The aforementioned factors, coupled with the introduction of vital sign monitoring devices that measure heart rate, SpO2, and blood glucose levels by market players, have led to a significant rise in demand for these devices among the general population and patients.

- For instance, in May 2024, Fitbit, Inc., launched the Fitbit ACE LTE smartwatch with interchangeable straps and 16 hours of battery life for kids. Thus, the growing number of product launches for smartwatches and fitness bands, among others, is likely to boost the adoption and thereby surge the wearable medical devices market growth.

RESTRAINING FACTORS

High Cost of Maintenance of Wearable Devices May Limit Their Adoption

There is a vast advancement in the technology of wearable devices, boosting their adoption among the general population. However, the high cost associated with the maintenance of these wearable devices is anticipated to limit their adoption in the market. The periodic replacement of chips, sensors, batteries, and other accessories equipped in these devices increases their overall cost among the population. These factors, coupled with limited reimbursement policies for these devices, have contributed to their limited adoption in both developed and emerging countries.

Wearable Medical Devices Market Segmentation Analysis

By Product Analysis

Increasing Prevalence of Chronic Diseases Globally to Boost Use of Diagnostic & Patient Monitoring Devices

By product, the market is bifurcated into diagnostic & monitoring devices and therapeutic devices.

The diagnostic & monitoring devices segment dominated the global wearable medical devices market share 33.76% in 2026. The growing prevalence of chronic diseases, including diabetes, cardiac disorders, among others, is further driving the growing focus of key players to introduce new advanced products for diagnosis and patient monitoring, thus supporting segmental growth. This, along with increasing disposable income among the population, is further likely to support the growth of the segment in the market.

- For instance, according to the World Heart Report 2023, it was reported that more than half a billion people are affected by cardiovascular diseases globally.

On the other hand, the therapeutic devices segment is expected to grow significantly during the forecast period. The growth is due to the distinct benefits offered by these devices, such as ease of use, precise dosing, and the ability to perform multiple functions at a time.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Advent of New and Advanced Wearable Devices to Boost Their Use in Sports & Fitness

By application, the market is categorized into remote patient monitoring & home healthcare and sports & fitness.

The sports & fitness segment dominated the market share 23.55% in 2026. The growth is due to increasing awareness about the certain benefits associated with these wearable medical devices used for sports & fitness activities, such as efficient and easy tracking of heart rate, among others, further resulting in the rising adoption of these devices among the population. This, along with a growing preferential shift toward sports & fitness activities, is resulting in the rising focus of key players to launch advanced products in the market, thereby contributing to the growth of the segment in the market.

- For instance, in May 2024, Samsung announced the launch of the Samsung Galaxy Watch 7 series with advanced features such as AI-powered health tracking, among others with an aim to strengthen its global presence in the market. Thus, a growing number of launches of advanced wearable devices is likely to support the rising adoption of these products in the market.

On the other hand, the remote patient monitoring & home healthcare segment held the second-largest share in 2023. The growing geriatric population in both developed and emerging countries, coupled with the increasing prevalence of chronic diseases among elderly patients, is anticipated to surge the growth of this segment during the forecast period.

By Grade Analysis

Consumer Grade Segment Dominated the Market Owing to Increasing Adoption of These Products

Based on grade, the market is divided into consumer grade and clinical grade.

The consumer grade segment held the largest market share 29.08% in 2026. The growth is due to certain factors, such as increasing demand for consumer-grade products such as fitness bands, smartwatches, and smart clothing, among others, resulting in the rising adoption of these products in the market. This, along with an increasing number of players in the wearable medical devices market focusing on product launches, collaborations, and mergers among the key players to strengthen their presence, is likely to support the growth of the segment in the market.

- For instance, in April 2024, Lava launched the Lava ProWatch Zn smartwatch with impressive features such as AMOLED display, health monitoring sensors, among others, with an aim to increase its brand presence in the market.

On the other hand, the clinical grade segment is expected to grow with the highest CAGR during the forecast period. The growth is due to a rising focus on regulatory approvals, resulting in a growing number of product launches in the market for clinical-grade wearables.

By Distribution Channel Analysis

Retail Pharmacies Segment Led Due to High Demand for Self-Monitoring Diagnostic Devices

In terms of distribution channel, the market for wearable medical devices is segmented into retail pharmacies, online distribution, and hypermarkets & others.

The retail pharmacies segment held a dominant share of the global market share 25.55% in 2026 and is likely to record a higher CAGR during the forecast period. The segmental dominance is attributed to the increasing demand for self-monitoring, non-invasive monitoring, and diagnostic devices among the population. The strong focus of market players on retail channels in emerging countries is further driving the segment growth.

The online distribution segment is expected to register a significant CAGR during the forecast period owing to the increasing shift of customers in metropolitan cities toward e-commerce platforms for purchasing wearable devices.

REGIONAL INSIGHTS

By region, the market for wearable medical devices is divided into Europe, North America, the Asia Pacific, and the rest of the world.

North America Wearable Medical Devices Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 47.07 billion in 2025 and USD 53.37 billion in 2026. The growth is due to certain factors, including adequate reimbursement policies, higher per capita expenditure on advanced technologies, coupled with the constant focus of market players on the introduction of innovative wearable devices in the U.S. This, along with well-established diagnostic infrastructure and strong adoption of technologically advanced products by end-users in the region is contributing to the market growth. The U.S. market is projected to reach USD 38.78 billion by 2026.

Asia Pacific

The Asia Pacific is anticipated to record the highest CAGR during the forecast period, especially in developing countries such as India, South Korea, Australia, and China. This is primarily due to the increasing focus of governments and NGOs in China and Japan on reducing patients’ hospital stays. The Japan market is projected to reach USD 4.97 billion by 2026, the China market is projected to reach USD 5.31 billion by 2026, and the India market is projected to reach USD 3.29 billion by 2026.

Europe

On the other hand, the Europe market for wearable medical devices is also expected to grow during the forecast period. The growth is due to the rising geriatric population, resulting in the growing prevalence of chronic disorders, including diabetes, cardiovascular disorders, among others. The rising prevalence of these disorders, along with the growing demand for wearable devices, is driving the focus of key players on R&D activities to launch advanced products in the market. The UK market is projected to reach USD 6.25 billion by 2026, and the Germany market is projected to reach USD 8.58 billion by 2026.

- For instance, according to the 2023 article published by NCBI, it was reported that approximately 6.4% of women and 12.3% of men are suffering from coronary heart disease in Germany.

Latin America and the Middle East & Africa

The rest of the world accounted for a comparatively lower market share in 2024, as it is a vast and untapped market. However, improvement in healthcare expenditure and increasing adoption of advanced wearable devices in Latin America and the Middle East & Africa are expected to lead this market to future growth prospects.

KEY INDUSTRY PLAYERS

Apple Inc. Held Dominant Market Share Due to Its Robust Portfolio of Smart Products

The competitive landscape of the global wearable medical devices market is highly competitive, with the presence of major players such as Apple Inc., SAMSUNG, Fitbit Inc., and Sonova, among others. With its robust portfolio of activity trackers and smartwatches, Apple Inc. accounted for a dominant share of the global market in 2024. In addition, through various collaborations and acquisitions, key players are strengthening their market positions.

- For instance, in September 2023, Apple Inc., introduced the advanced new Apple Watch Series 9 with an aim to strengthen its presence in the market globally.

- In addition, in April 2021, NeuroMetrix, Inc. partnered with Pacific Northwest-based Premera Blue Cross to launch the new Quell wearable device to treat pain caused by chronic ailments.

Other players operating in this market include Sonova, OMRON Corporation, BD, and NeuroMetrix Inc. These companies are continuously focusing on the development of advanced therapeutic wearables and expanding their distribution channels globally to establish their foothold in emerging countries.

LIST OF TOP WEARABLE MEDICAL DEVICES COMPANIES:

- BD (U.S.)

- Ypsomed (Switzerland)

- Fitbit, Inc. (U.S.)

- Apple Inc. (U.S.)

- Sonova (Switzerland)

- NeuroMetrix, Inc. (U.S.)

- SAMSUNG (South Korea)

- OMRON Healthcare, Inc. (Japan)

- AiQ Smart Clothing (Taiwan)

- Koninklijke Philips N.V. (Netherlands)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Fitbit Inc., collaborated with Quest Diagnostics, one of the leaders in diagnostic information services, with an aim to advance their research on the use of wearable devices to improve metabolic health among the general population.

- January 2024: Concha Labs announced the launch of an enhanced OTC hearing aid, SoundScope, featuring hearing personalization technology designed to help people hear more clearly.

- October 2023: Medtronic received approval from the U.S. FDA for wearable Aurora EV-ICD MRI SureScan extravascular implantable cardioverter-defibrillator and Epsila EV MRI SureScan defibrillation lead offering defibrillation among patients.

- June 2023: STAT Health launched a first-in-ear wearable that measures blood flow to the head and enables patients to understand their body conditions.

- April 2023: Noise launched ColorFit Ore smartwatch with always-on-display, 7-day battery life, and other advanced features with an aim to strengthen its presence in the wearable devices industry.

REPORT COVERAGE

The report provides a detailed analysis of the wearable medical devices market and focuses on key aspects, such as leading companies, applications, products, grade, and distribution channels. Moreover, it offers insights into the latest market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 20% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product

|

|

By Application

|

|

|

By Grade

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 103.04 billion in 2025.

In 2025, the North America market value stood at USD 47.07 billion.

The market is slated to exhibit a CAGR of 20% during the forecast period.

By product, the diagnostic & monitoring devices segment dominated the market in 2025.

The increasing prevalence of chronic diseases and growing awareness regarding self-monitoring and diagnosis are the key drivers of the market.

Apple Inc., Fitbit Inc., and Sonova are the top players in the market.

North America dominated the global wearable medical devices market with a market share of 45.70% in 2025.

The continuous introduction of novel products and optimization of existing products for diagnosis and self-monitoring devices around the globe are expected to drive the adoption of wearable medical devices.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us