Web Application Firewall (WAF) Market Size, Share & COVID-19 Impact Analysis, By Type (Network, Host, and Cloud), By Enterprise Type (SMEs and Large Enterprise), By Industry (BFSI, Healthcare, Government, IT & Telecom, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

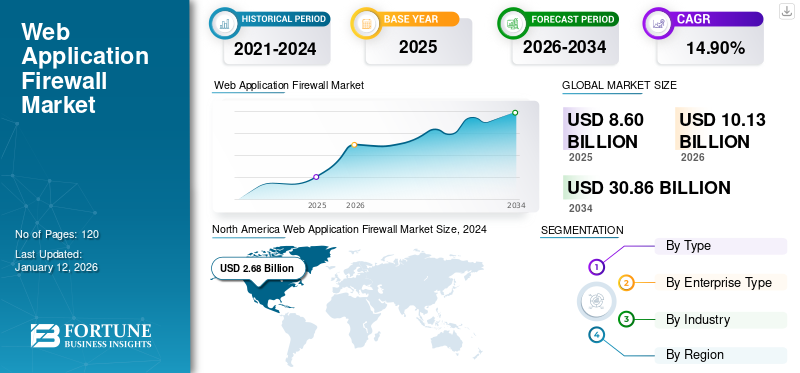

The global web application firewall (WAF) market size was valued at USD 8.60 billion in 2025 and is projected to grow from USD 10.13 billion in 2026 to USD 30.86 billion by 2034, exhibiting a CAGR of 14.90% during the forecast period. North America dominated the market with a share of 36.10% in 2025.

In the scope of work, we have included solutions offered by companies such as Barracuda Networks, Inc., F5, Inc., Palo Alto Networks, Check Point Software, Cisco Systems, Inc., Imperva, Citrix, Cloudflare, Inc., Qualys, Inc., Akamai and others.

A WAF (Web Application Firewall) aids in safeguarding web applications by monitoring and filtering HTTP traffic between web applications and the internet. It shields web applications from various attacks, including cross-site scripting (XSS), file inclusion, SQL injection, and cross-site forgery. The deployment of a WAF can vary based on the application's deployment location, necessary services, management protocols, and the desired level of architectural flexibility and performance.

COVID-19 IMPACT

Increased Digital Transformation and Cloud Migration Processes Fueled Market Growth

The pandemic brought a positive impact on the WAF market. COVID-19 accelerated the digital transformation of numerous enterprises, driving the migration of infrastructure, applications, and assets to public cloud environments. This surge in security solution adoption significantly increased the demand for web application firewall solutions. For example, many companies shifted their security focus to work-from-home system endpoint security. Moreover, enterprise security teams faced resource shortages in addressing diverse web application security issues, further driving the demand for efficient web application firewall solutions. Additionally, market changes greatly benefited data center services, cloud computing, and other online support sectors.

Web Application Firewall Market Trends

Growing Adoption of Cloud Computing in Major Companies Recognized as a Significant Trend

The rising popularity of cloud computing is fueling the market growth. Cloud-based WAF offers organizations a cost-effective means to secure their web applications. This surge in cloud-based technologies and social media platforms is propelling market expansion. Cloud technology is now widely adopted across all businesses, delivering cost-effective security solutions. With cloud computing, teams can work from anywhere, anytime. Additionally, leveraging the cloud enables companies to integrate complementary infrastructure technologies, such as software-defined perimeters, creating a robust and highly secure platform. Hence, the increased adoption of cloud computing solutions is a significant trend in this market.

Download Free sample to learn more about this report.

Web Application Firewall Market Growth Factors

Surge in Penetration of IoT among Users and Technological Proliferation to Augment Market Growth

As the world becomes more interconnected, various industries are embracing technologies such as the Internet of Things (IoT). There's a growing need for heightened awareness and protection of web applications and networks. Numerous devices—such as televisions, mobile devices, and printers—are connected to the internet. Businesses increasingly integrate connected devices into their operations to streamline processes. However, with the proliferation of devices and associated applications comes a host of cyber threats and vulnerabilities. To counter these challenges, most IoT technology and development companies advocate for and implement advanced security solutions such as next-generation firewalls, WAFs, and runtime application self-protection to safeguard business infrastructure. This surge in security needs is driving the growing demand for WAFs in the market.

RESTRAINING FACTORS

Unused Applications and Budget Constraints among Companies May Hamper Market Growth

Numerous studies highlight an alarming trend: despite the escalating frequency of data breaches and cybercrimes, information security, especially cybersecurity, isn't receiving adequate funding or attention in the workplace. Moreover, companies often maintain thousands of applications that remain unused beyond critical business functions such as ordering products or conducting payment-related activities. These dormant business-critical applications pose a risk as they aren't regularly updated. Some small businesses fear that investing in these applications might lead to financial losses. Research by Shred-it indicates that 62% of CIOs and cybersecurity professionals identify budget constraints as their primary challenge in implementing application security. Hence, budget limitations within SMBs stand as significant barriers to the growth of this market.

Web Application Firewall Market Segmentation Analysis

By Type Analysis

Cloud Segment Dominated Owing to Optimal Protection and Easy Access

Based on type, the market is divided into network, host and cloud.

The cloud segment is projected to dominate the market with a share of 54.58% in 2026, and is anticipated to exhibit significant growth at a considerable CAGR in the coming years. The increased adoption of cloud-based services has resulted in an upsurge in the number of WAFs, expected to drive the global market size in the forecast period. Cloud-based WAF solutions are available as software sets, encompassing a comprehensive suite of threat prevention technologies that offer robust protection against vulnerabilities like malware, ransomware, phishing, and emerging cyber threats. Additionally, a cloud-based WAF solution safeguards the network even when the user isn't connected to a VPN. Furthermore, cloud services offer control, access to threat intelligence, caching, bot identification and enforcement, virus detection, API security, distributed denial of service (DDoS) mitigation, and more, enhancing cloud adoption in the market.

By Enterprise Type Analysis

Need of WAF in Large Enterprises to Increase Awareness against Security Incidents to Foster Segment Growth

Based on enterprise type, the market is classified into SMEs and large enterprises.

The large enterprises segment led the market accounting for 55.62% market share in 2026. The need to safeguard IT assets, protect data, and raise awareness against security incidents is propelling market growth among large enterprises, necessitating WAF security integration within overall security measures. Key factors such as the presence of sandbox technology, ease of deployment, and advanced detection capabilities contribute to the increased adoption of WAFs in large enterprises. Moreover, WAFs offer advantages over next-generation network firewalls (NGFWs) and intrusion prevention systems (IPS), providing advanced protection for internal internet-facing websites, business-critical applications, and web services, thereby driving market growth.

The SMEs segment is projected to grow at the highest CAGR during the forecast period. This growth is attributed to the increasing demand for web application security solutions across various industries, including BFSI, IT and telecom startups, retail, travel & transportation, among others.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Strict Cybersecurity Laws in Reputed Nations to Propel the BFSI Segment Growth

By industry, the market is categorized into BFSI, healthcare, government, IT & telecom, and others (retail, travel & transportation, and others).

The BFSI segment claimed the largest web application firewall market share in 2024. Stringent cybersecurity regulations in reputable countries, designed to ensure the security of banking, financial services, and insurance, are expected to create numerous opportunities in the global market. BFSI organizations prioritize WAF security solutions, especially for services such as internet banking, smart banking, and mobile banking, driving growth within this segment.

The healthcar segment is anticipated to hold a dominant market share of 32.36% in 2026. Firewalls play a crucial role in securing electronic health records (EHRs) and protected health information (PHI) from malware and other online threats, serving as the primary defense for hospital networks. Healthcare facilities accommodate more devices than just mobile phones and PCs that access the network. Wi-Fi-connected medical devices leverage the network for collecting patient data and monitoring health status, making them susceptible to cyber-attacks by hackers. Given the value of EHR and clinical data and the various potential network vulnerabilities, firewalls in the healthcare sector need to offer more comprehensive protection compared to other sectors.

REGIONAL INSIGHTS

By region, the market has been analyzed across five major regions, namely North America, South America, Europe, the Middle East and Africa, and Asia Pacific.

North America Web Application Firewall Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 3.11 billion in 2025 and USD 3.63 billion in 2026. North America is the most advanced region in terms of cybersecurity technology usage and infrastructure. The region dominates the world's WAF business in terms of technological advancement and usage. In addition, North American companies have well-equipped infrastructure and financial resources to provide WAF solutions. The U.S. market is projected to reach USD 2.13 billion by 2026.

Europe is impacted by increasing digital transformation across all sectors, including finance, retail and government, with the volume of data traffic contributing to demand in the European market. The increasing use of cloud and network-based application firewalls is also considered a growth factor. The UK market is projected to reach USD 0.42 billion by 2026, while the Germany market is projected to reach USD 0.54 billion by 2026.

Asia Pacific market is expected to grow at a significant CAGR during the forecast period. The region is witnessing an increase in application security risks such as ransomware attacks, data breaches, and insider threats. Businesses are increasingly aware of potential threats and are proactively storing sensitive data. Various countries in the Asia Pacific region are experiencing significant digital transformation, with businesses adopting cloud computing, mobile technologies, and remote working approaches, which are driving regional growth.

The Japan market is projected to reach USD 0.68 billion by 2026, the China market is projected to reach USD 0.88 billion by 2026, and the India market is projected to reach USD 0.41 billion by 2026.

South America market for web application firewall is expected to grow at the highest CAGR during the forecast period owing to security vendors focusing on developing new application security products. Small and medium-sized enterprises in the region may be forced to adopt WAF solutions and services due to increased business complexity, increased consumer knowledge about the benefits of WAF products, and increased internet usage.

The Middle East & Africa market is influenced by increased technology adoption, entry of new industry players, investment data security, and a large-scale acceptance of cloud technology.

List of Key Web Application Firewall Market Companies

Market Players are Focusing on New Product Launches to Attract and Retain Customers

Major corporations are actively broadening their global presence through the implementation of specialized solutions tailored to specific industries. These companies strategically collaborate with local partners to establish robust regional influence. Moreover, key market players are introducing novel products aimed at enticing and retaining customers. Hence, by embracing these strategies, entities can uphold their competitiveness within the market.

List of Key Companies Profiled

- Barracuda Networks, Inc. (U.S.)

- F5, Inc. (U.S.)

- Palo Alto Networks (U.S.)

- Check Point Software (U.S.)

- Cisco Systems, Inc. (U.S.)

- Imperva (U.S.)

- Citrix (U.S.)

- Cloudflare, Inc. (U.S.)

- Qualys, Inc. (U.S.)

- Akamai Technologies, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- October 2023: Radware announced the expansion of its cybersecurity partner program and its offerings for managed security service providers (MSSPs). The updated program is designed to provide MSSPs with a portfolio of cutting-edge, high-margin applications, DDoS protection, and web application firewall services.

- June 2023: SecureIQLab announced the third testing version of its Web Application Firewall (WAF 3.0). This includes first-of-its-kind API security test cases. WAF 3.0 assesses the ability of security solutions to address today's complex cyber threat landscape.

- April 2023: Akamai Technologies Inc. announced a partnership with Neosec for an API detection and response platform powered by data and behavioural analytics. Neosec's API security solutions help to improve Akamai's visibility into the evolving API threat landscape and complement Akamai's application and API security products.

- April 2023: AWS announced AWS WAF Ready specialization with software products integrated with AWS Web Application Firewall. The AWS WAF Ready specialization provides customers with a simple solution for maintaining and deploying application-level security solutions using products from AWS WAF Ready partners.

- March 2023: Cloudflare announced that it will be offering a free web application firewall to its free plan subscribers. WAF provides access to the WAF user interface with a set of rules that can automatically block known threats.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects such as prominent companies, product/service types, and leading applications of the product. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights says that the market is projected to reach USD 30.86 billion by 2034.

In 2025, the market stood at USD 8.60 billion.

The market is projected to grow at a CAGR of 14.90% during the forecast period.

By type, the cloud segment led the market in 2025.

The surge in penetration of IoT among users and technological proliferation is expected to augment the market growth.

North America holds the largest market share.

By industry, the healthcare segment is expected to grow at the highest CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us