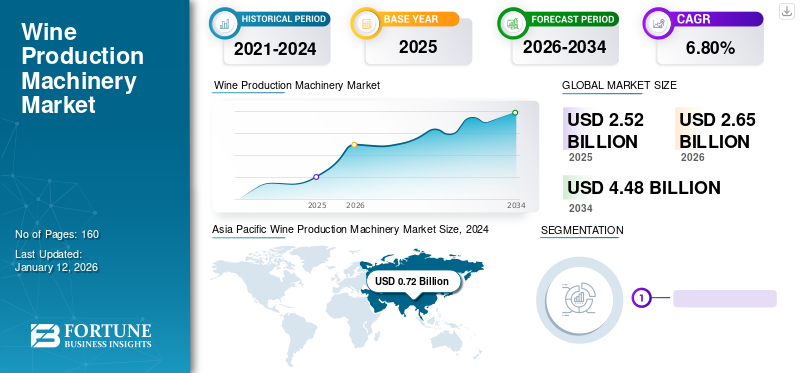

Wine Production Machinery Market Size, Share & COVID-19 Impact Analysis, By Wine Type (Red, White, Sparkling, and Fortified), By Equipment Type (Crushing & Pressing Equipment, Fermentation Equipment, Filtration Equipment, Bottling Equipment, Temperature Control Equipment, Storage Tanks, and Others), By Automation Level (Manual, Semi-automatic, and Automatic), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

The global wine production machinery market size was valued at USD 2.52 billion in 2025. The market is projected to grow from USD 2.65 billion in 2026 to USD 4.48 billion by 2034, exhibiting a CAGR of 6.80% during the forecast period. Asia Pacific dominated the global market with a share of 30.10% in 2025.

Wine production machinery encompasses the equipment and machinery used throughout the winemaking process. This includes various tools and machines utilized at different stages, starting from harvesting grapes to the final bottling of the wine. Common machinery includes grape harvesters, destemmers, crushers, fermentation tanks, presses, pumps, filters, and bottling lines. Each piece of machinery serves a specific role in the winemaking process. For instance, grape harvesters efficiently collect grapes from vines, while crushers and destemmers separate grape berries from stems and extract juice. Fermentation tanks facilitate the fermentation process, and presses extract the remaining juice from grape solids. Filtering equipment aids in wine clarification and bottling lines package the final product into bottles.

These machines streamline production, reducing time and labor costs. Efficient machinery enables higher production volumes without compromising quality. Additionally, winemaking's delicate nature demands precise control over factors such as temperature, fermentation, and aging. Machinery that ensures accurate and consistent control significantly contributes to the final product's quality.

COVID-19 IMPACT

Supply Chain Disruptions and Fluctuating Demand Affected Equipment Delivery and Production Levels

The COVID-19 pandemic exerted various impacts on industries worldwide, including the wine production machinery sector. It resulted in disruptions within the global supply chain, affecting the availability of raw materials and components necessary for manufacturing machinery. Consequently, production and delivery delays may have occurred, posing challenges for wineries in acquiring essential equipment. Additionally, movement restrictions and lockdowns in different regions led to labor shortages, impacting manufacturing facilities and slowing production.

As a result, the timely delivery of wine production machines was also affected. Furthermore, the pandemic altered consumer behavior, causing fluctuations in wine demand. Wineries likely adjusted their production levels in response to these market shifts, potentially impacting the need for new machinery. In essence, the wine production machinery sector encountered challenges linked to supply chain disruptions, labor shortages, and evolving market dynamics. Nevertheless, it also experienced an increased emphasis on technology adoption for resilience and efficiency.

LATEST TRENDS

Technology Adoption in Wine Production Machinery Manufacturing to Drive Market Growth

In recent years, the wine production industry has emphasized technology and innovation. Precision viticulture technology involves leveraging data and technology to optimize vineyard management. Sensors and drones monitor vine health, soil conditions, and grape ripeness, allowing for more precise and efficient grape growing. Furthermore, advancements in sorting technology facilitate the selection of only the highest-quality grapes for the wine production process. Automated harvesting machines have also become more sophisticated, reducing the need for manual labor during harvest.

Technology integration into fermentation tanks enables close monitoring and control of the fermentation process. This aids winemakers in achieving consistency and desired flavor profiles in their wines. Pruning, a crucial aspect of grapevine management, is also undergoing advancements. Robotic systems are being developed to automate this process, ensuring precision and efficiency in vineyard maintenance. These trends underscore the industry's commitment to efficiency, quality, and sustainability by integrating cutting-edge technology into the winemaking process, contributing to market growth.

Download Free sample to learn more about this report.

DRIVING FACTORS

Cost Effectiveness Coupled with Precision Technology Bolsters Market Growth

Several factors drive advancements in wine production machinery. Wineries constantly seek ways to enhance efficiency and reduce production costs. Machinery that automates time-consuming tasks, such as harvesting and sorting, significantly contributes to cost-effectiveness. Furthermore, modern consumers have high expectations for wine quality and consistency. Machinery allowing precision in vineyard management, fermentation control, and overall production helps achieve desired taste profiles and maintain consistency across batches.

The broader trend of technological advancement influences the wine industry. Winemakers prioritize adopting the latest technologies to stay competitive and produce high-quality wines. Increasingly popular are sensors, drones, and data-driven technologies in vineyard management. Winemakers gather and analyze data on soil conditions, grape ripeness, and wine health to make informed decisions, ultimately enhancing grape quality and yield.

These driving factors collectively shape the landscape of wine production machinery, propelling the industry toward a future where technology and tradition collaborate to produce exceptional wines and drive the wine production machinery market growth.

RESTRAINING FACTORS

High Initial Costs Along With Resistance to Change to Impede Market Expansion

The adoption of wine production machinery encounters constraints that hinder the process. Investing in modern machinery for wine production can be costly. The initial capital outlay for purchasing and installing advanced equipment can pose a significant barrier for smaller wineries or those with limited financial resources. Additionally, tradition holds substantial weight in the wine industry, and some winemakers may resist embracing new technologies. There's a deep cultural and historical attachment to traditional winemaking methods, making it challenging for some to transition toward automation.

SEGMENTATION

By Wine Type Analysis

Red Wine Segment Leads Due to its Higher Adoption and Popularity

By wine type, the market is classified into red, white, sparkling, and fortified.

The red wines segment holds the leading position in the market due to being a traditional favorite among many wine enthusiasts. Despite potential fluctuations in demand, the enduring popularity of classic red varieties such as Cabernet Sauvignon, Merlot, and Pinot Noir indicates that red wines will remain a significant part of the market.

The white wines segment is expected to experience substantial growth during the forecast period. Wines such as Sauvignon Blanc, Chardonnay, and Pinot Grigio continue to be popular choices, especially during warmer seasons. The trend toward lighter, crisper, and fruit-forward white wines aligns with consumer preferences for refreshing options.

The popularity of sparkling wines, including varieties such as Prosecco, Cava, and sparkling rosé, has been steadily rising. Consumers appreciate the celebratory nature of sparkling wines, elevating them beyond occasional treats. The trend toward casual and everyday consumption of sparkling wines may contribute to their sustained growth.

Fortified wines such as Port and Sherry occupy a niche market. While they might not undergo explosive growth, there remains a continued appreciation for these wines, particularly among connoisseurs and collectors. The distinct characteristics and aging potential of fortified wines contribute to their enduring appeal.

To know how our report can help streamline your business, Speak to Analyst

By Equipment Type Analysis

Crushing & Pressing Equipment Segment Set to Dominate due to its Precision Extraction Methods

By equipment type, the market is classified into crushing & pressing equipment, fermentation equipment, filtration equipment, bottling equipment, temperature control equipment, storage tanks, and others.

The crushing & pressing equipment led the market accounting for 35.09% market share in 2026. This equipment plays a crucial role in the initial stages of winemaking by extracting juice from grapes. The pursuit of high-quality wines may prompt the adoption of advanced crushing and pressing technology, particularly among wineries seeking precise control over extraction processes.

The fermentation equipment segment is expected to experience significant growth in the market. This growth is attributed to the importance of extracting juice from grapes in the early winemaking stages. The demand for high-quality wines could drive the adoption of advanced crushing and pressing technology, especially among wineries striving for precise control over extraction processes.

Filtration is gaining significant traction in the market as it serves as essential equipment to clarify and stabilize wines. The demand for clear and stable wines, coupled with a growing emphasis on sustainability, may drive the adoption of advanced filtration systems that are efficient and environmentally friendly.

As the trend shifts toward direct-to-consumer sales and personalized branding, wineries might invest in bottling equipment that provides flexibility in packaging sizes and designs. Efficient and precise bottling equipment plays a crucial role in maintaining product quality and meeting market demands.

By Automation Level Analysis

Semi-Automatic Machinery Gaining Preference among Wineries for Enhanced Efficiency Due to Flexible Automation Solutions

By automation level, the market is divided into manual, semi-automatic, and automatic.

Semi-automatic machinery dominated the market accounting for 49.81% market share in 2026. This is attributed to its offering of a cost-effective and flexible solution for wineries seeking to introduce automation into their processes. These machines provide a balance between manual control and the efficiency gains of automation, making them suitable for various winemaking operations, especially in smaller and medium-sized wineries.

Automatic machines are estimated to hold a major market share in the upcoming years. Automation reduces manual labor and accelerates the production process. Tasks such as grape sorting, crushing, pressing, and bottling can be automated, resulting in faster and more efficient production, further contributing to the growth of wine production machinery.

REGIONAL INSIGHTS

Based on geography, the market has been studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific Wine Production Machinery Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 0.76 billion in 2025 and USD 0.81 billion in 2026. Asia Pacific is leading the region’s wine industry due to substantial growth in recent years, accompanied by an increased interest in and adoption of machinery. Additionally, as wine consumption continues to rise in Asia Pacific, wineries are scaling up production to meet growing demand. This increased production often requires the use of advanced machinery to ensure efficiency and maintain quality. The Japan market is estimated to reach USD 0.23 billion by 2026, the China market is estimated to reach USD 0.25 billion by 2026, and the India market is estimated to reach USD 0.15 billion by 2026.

China has been rapidly expanding its manufacturing of wine production machinery, leading to a notable increase in the adoption of this machinery. The country is emerging as a notable wine-producing region, with areas such as Ningxia and Shandong gaining recognition for their wine quality. Wineries in these regions are investing in modern machinery to improve production processes and enhance the overall quality of Chinese wines.

To know how our report can help streamline your business, Speak to Analyst

North America wine market has experienced significant growth in recent years, witnessing an increase in the number of vineyards and wineries. The introduction of innovative winemaking techniques has propelled market expansion in the region. This growth has led to heightened demand for efficient and advanced machinery, contributing to the rise in the wine production machinery market share. The U.S. market is estimated to reach USD 0.34 billion by 2026.

In Europe, a historically prominent wine-producing region, there has been substantial growth in wine production machinery. European wineries are embracing technological advancements in winemaking processes. This includes the utilization of advanced machinery for grape harvesting, sorting, crushing, fermentation control, and bottling. The integration of technology aims to enhance efficiency and maintain the high quality for which European wines are renowned. The UK market is estimated to reach USD 0.10 billion by 2026, while the Germany market is estimated to reach USD 0.26 billion by 2026.

The Middle East & Africa and South America wine industry has experienced considerable growth due to increasing interest in machinery. The diversification of wine styles, encompassing the production of unique varietals and blends, is driving the adoption of specialized machinery in these regions.

KEY INDUSTRY PLAYERS

Leading Players Drive Industry Growth through Expansion and Technological Advancements

Key players in this market have been experiencing various trends and dynamics. Companies such as Adamark Air Knife Systems, Agrovin, and Criveller Group have engaged in consolidation activities and acquisitions in the market. This strategy aims to expand their product portfolios, enhance technological capabilities, and gain a stronger foothold in the global market. They are also expanding their global presence, recognizing the growth potential in emerging wine-producing regions.

List of Key Companies Profiled:

- Adamark Air Knife Systems (Canada)

- Agrovin (Spain)

- Criveller Group (U.S.)

- Dt Pacific Pty. Ltd. (Australia)

- G.W. Kent Inc. (U.S.)

- Love Brewing Limited (U.S.)

- Northern Brewer (U.S.)

- Paul Mueller Company. (U.S.)

- Grapeworks Pty Ltd. (Australia)

- Vitikit Ltd. (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- June 2023: Vitikit introduced the new Sraml winemaking equipment, optimizing key stages of winemaking to achieve exceptional outcomes while ensuring maximum efficiency.

- October 2021: A U.K.-based investment group, Investindustrial, acquired Ape Impianti, Permeare & Bertolaso for an undisclosed amount, aiming to strengthen its position as a market leader in the winemaking and beverage machinery market.

- November 2021: Northern Brewer & Minnesota Stars collaborated to create a beer kit in memory of the Stars' 2011 North American Soccer League championship.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2034 |

|

Growth Rate |

CAGR of 6.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Wine Type

By Equipment Type

By Automation Level

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 4.48 billion by 2034.

In 2025, the market was valued at USD 2.65 billion.

The market is projected to grow at a CAGR of 6.80% during the forecast period.

Cost-effectiveness coupled with precision technology drives market growth.

Adamark Air Knife Systems, Agrovin, Criveller Group, Dt Pacific Pty. Ltd., G.W. Kent Inc., Love Brewing Limited, Northern Brewer, Paul Mueller Company, Grapeworks Pty Ltd.

Asia Pacific is expected to hold the highest market share.

By wine type, red wine is expected to grow substantially during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us