Intracranial Aneurysm Market Size, Share & Industry Analysis, By Product Type (Aneurysm Therapeutic Devices {Clips, Coils, Intravascular Devices, and Flow Diverters}, Embolization Devices {Occlusion Catheters, and Embolic Agents}, Aspiration Devices {Aspiration Catheters and Clot Retrieval Stents}, and Access Devices {Micro Catheters and Guidewires}), By Type (Saccular Aneurysm, Fusiform Aneurysm, and Mycotic Aneurysm), By End-User (Hospitals, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

Intracranial Aneurysm Market Size

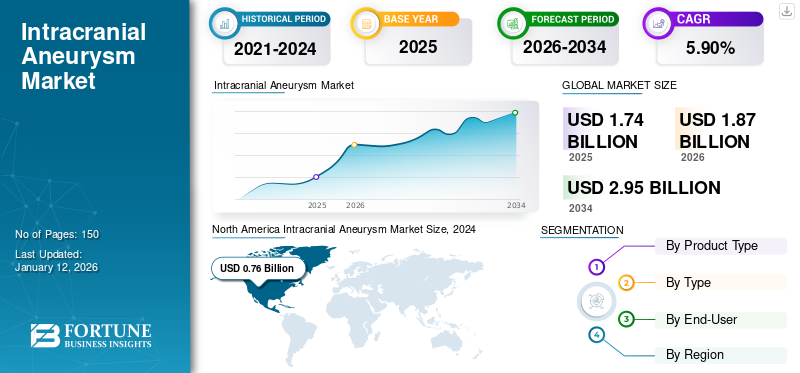

The global intracranial aneurysm market size was valued at USD 1.74 billion in 2025. The market is projected to grow from USD 1.87 billion in 2026 to USD 2.95 billion by 2034, exhibiting a CAGR of 5.90% during the forecast period. North America dominated the intracranial aneurysm market with a market share of 43.70% in 2025.

An intracranial aneurysm or cerebral aneurysm is a balloon-like growth of blood vessels caused by the weakening of blood vessel walls. Leaks or ruptures of these aneurysms cause life-threatening bleeding. Treatment for these aneurysms includes medication to control high blood pressure and procedures to prevent a future rupture. Treatment includes microsurgical clipping and flow diversion with stents and endovascular coiling. The increasing awareness about these procedures among the patient population drives the demand for cerebral aneurysm treatment. This demand is further surging due to the rising number of patients suffering from cerebrovascular diseases. To address this growing demand, market players are actively investing in their research and development activities to introduce novel products that are likely to support the treatment of this disease.

- According to the 2023 Fact Sheet of the Brain Aneurysm Foundation, an estimated 6.7 million people in the U.S. have an unruptured brain aneurysm, which is 1 in 50 people.

Moreover, public and private entities are focusing on enhancing funding for aneurysm research to increase screening, diagnosis, and medical assistance toward brain aneurysm treatment. These active research studies offer the prospective launch of new devices anticipated to broaden the range of products used for treating cerebrovascular diseases, subsequently driving the global intracranial aneurysm market growth.

During the COVID-19 pandemic, the market’s growth was negatively impacted due to a decline in the volume of intracranial aneurysm procedures. This disrupted the supply and demand of medical devices required for intracranial aneurysm procedures.

Global Intracranial Aneurysm Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 1.74 billion

- 2026 Market Size: USD 1.87 billion

- 2032 Forecast Market Size: USD 2.95 billion

- CAGR: 5.90% from 2026–2034

Market Share:

- North America dominated the intracranial aneurysm market with a 43.70% share in 2025, driven by the presence of advanced healthcare infrastructure, strong awareness programs, and active R&D by key players. Public initiatives such as the Brain Aneurysm Foundation’s campaigns and government-backed research grants have significantly boosted early diagnosis and treatment rates in the region.

- By product type, aneurysm therapeutic devices held the largest market share in 2025. This includes coils, clips, flow diverters, and intravascular devices widely used in minimally invasive procedures. The segment’s dominance is attributed to their high clinical efficacy and growing adoption in endovascular treatments.

Key Country Highlights:

- Japan: Japan shows high prevalence and rupture risk for cerebral aneurysms, with studies indicating that Japanese patients are 2.8 times more likely to experience a rupture compared to Westerners. This drives early screening and treatment demand. The country's strong medical imaging infrastructure and government emphasis on preventive diagnostics further contribute to growth.

- United States: With an estimated 6.7 million individuals having unruptured brain aneurysms, the U.S. represents a high-demand region. Initiatives like the Brain Aneurysm Foundation’s funding of USD 30,000 for predictive research and increased adoption of minimally invasive procedures such as coiling and flow diversion are boosting market growth. Stryker, Medtronic, and Terumo dominate the competitive landscape with ongoing clinical trials and new device launches.

- China: Rapid urbanization, an expanding aging population, and improved healthcare access are supporting market expansion. Key players such as MicroPort Scientific Corporation and increasing clinical trial activity in neurovascular disorders are advancing market potential. Government initiatives focused on neurological disorder management are also helping the Chinese market evolve.

- Europe: Market growth is supported by EU-funded research projects and startups like Oxford Endovascular securing grants for innovation in aneurysm treatment. Strong adoption of embolization technologies and access to advanced imaging systems support the expansion of minimally invasive intracranial aneurysm treatments in major markets like Germany, France, and the U.K.

Intracranial Aneurysm Market Trends

Growing Preference Toward Minimal Invasive Procedure Led to Technological Advancement

Surgery has always been an option for certain types of intracranial cerebral aneurysms. However, in recent years, minimally invasive procedures have greatly reduced physical trauma and recovery time. Earlier, craniotomy was the primary treatment option in which a small metal clip is placed across the base of the aneurysm bulge that cuts off blood flow to the ballooned blood vessel. However, modern advances have made this major procedure less common.

Recently, the patient population prefers minimal invasive procedures, such as coiling and stenting. They divert the blood flow away from the aneurysm, making it less likely to rupture, and they are performed without opening the skull.

- According to a study published by Stroke: Vascular and Interventional Neurology in December 2022, flow diversion has revolutionized the treatment of intracranial aneurysms, although it has decreased the coil and stent usage rate. Flow diverters have demonstrated a safe and effective profile, and their use has gradually expanded from giant wide‐necked aneurysms to small and medium‐sized lesions and even for aneurysms located on small vessels.

The positive outcomes demonstrated by these novel devices are influencing patient preference toward minimally invasive procedures. Moreover, the surge in demand for these devices is encouraging market players to introduce more technologically advanced products in the market.

Download Free sample to learn more about this report.

Intracranial Aneurysm Market Growth Factors

Increasing Prevalence of Cerebral Aneurysm is Likely to Augment Market Growth

One of the vital factors driving the demand for intracranial aneurysm devices is the rising prevalence rate of cerebral aneurysms globally. Technological advancements in imaging techniques, such as 3-D angiography and magnetic resonance angiography, contribute to the timely diagnosis of aneurysms. This is anticipated to drive the diagnosis rate and increase the patient population seeking viable treatment options. Moreover, the positive outcomes demonstrated by devices, such as coils, flow diverters, and intravascular devices or WEB devices used in minimally invasive procedures, are expected to drive market growth.

- As per an article published by Scientific Reports in September 2023, the prevalence of asymptomatic unruptured cerebral aneurysms in the Japanese adult population ranges from 2 to 6%, with a rupture rate of 0.95% per year in Japan. The risk of rupture in Japanese individuals is 2.8 times higher than in Westerners, and it emphasizes the importance of early detection through brain screening in Japan.

Strong Emphasis on Brain Aneurysm Research is Likely to Drive Market Growth

Another factor contributing to the market growth is the growing support of public and private organizations toward brain aneurysm research. Government entities are supporting aneurysm-related studies by approving research grants and sanctioning funds. On the other hand, market players are actively conducting clinical studies to check the clinical outcomes of devices likely to be used to treat aneurysms. These initiatives are anticipated to offer a lucrative opportunity for the prospective launch of medical devices and are likely to propel the demand owing to positive clinical outcomes.

- In May 2023, researchers at the University of Cincinnati, Department of Neurosurgery received USD 30,000 from the Brain Aneurysm Foundation to uncover a more accurate way to predict whether an aneurysm will rupture.

- In July 2023, MicroVention, Inc., a subsidiary of Terumo Corporation, published WEB-IT 5-year follow-up data and the addition of two sizes to its WEB Aneurysm Embolization System. With this five-year clinical trial data, WEB is the most well-studied intrasaccular device available in the market, with seven Good Clinical Practice (GCP) studies and over 200 peer-reviewed publications.

As a result, the market players increased their emphasis on developing and introducing novel products that are anticipated to be used in treating intracranial aneurysms. This is expected to escalate the demand and adoption in the market over the study period.

RESTRAINING FACTORS

Misdiagnosis and Associated Cost May Restrict Market Growth

Even though brain imaging is now widely available to diagnose a ruptured aneurysm, patients often get misdiagnosed or are delayed in diagnosis when they first seek care. In addition, the cost of treating a ruptured aneurysm is much higher than an unruptured one.

- According to the Brain Aneurysm Foundation 2023 Data, surgical clipping aneurysms more than double the cost after rupturing. Endovascular coiled aneurysms increase in cost by approximately 70% after rupturing.

- Moreover, there is a lack of established clinical guidelines for early and efficient neurovascular disease diagnosis in emerging countries. The rate of misdiagnosis or delayed diagnosis is higher in developing countries due to limited awareness and access to well-established healthcare infrastructure. These are some of the factors that may limit the adoption or penetration rate of these solutions, subsequently limiting the market’s growth.

Intracranial Aneurysm Market Segmentation Analysis

By Product Type Analysis

Aneurysm Therapeutic Devices Segment Dominated the Market Due to Higher Adoption

By product type, the market is segmented into aneurysm therapeutic devices, embolization devices, aspiration devices, and access devices.

The aneurysm therapeutic devices segment dominated the global intracranial aneurysm market share 44.39% in 2026. It further includes clips, coils, intravascular devices, and flow diverters. Most of these devices are used in minimally invasive procedures performed for treating brain aneurysms, and the positive clinical outcomes demonstrated by these devices have led to their higher adoption. Therefore, this drives the demand for these medical devices and subsequently augments the segment’s growth.

- As per a study published by the Korean Society of Interventional Neuroradiology in February 2022, a total of 67 aneurysms in 64 patients were identified within the Australian population and were treated using WEB devices, with an overall successful deployment in 98.5% of intracranial aneurysm cases.

The embolization devices segment held the second-largest share of the market in 2024. It includes occlusion catheters and embolic agents, which prevent blood flow into the aneurysm and blood vessels. The segment's growth is mainly driven by occlusion catheters due to their higher precision exhibited during endovascular procedures. The aspiration devices and access devices segment held a comparatively lower market share in 2024. These devices are designed to remove clots and provide access to the treatment areas. The growth of these segments is attributed to their limited usage while carrying out a procedure.

By Type Analysis

High Patient Population Suffering from Saccular Aneurysm Led to its Dominance in the Market

Based on type, the market is segmented into the saccular aneurysm, fusiform aneurysm, and mycotic aneurysm.

The saccular aneurysm segment captured the largest share 90.91% of the global market in 2026. The segment’s growth is attributed to the higher patient population suffering from saccular aneurysm. According to an article published by the University of Texas Health Science Center, saccular aneurysms are the most common type of aneurysm, accounting for 80% to 90% of all brain aneurysms. This is anticipated to increase the demand for these medical devices to treat saccular aneurysms, driving market growth.

The fusiform aneurysm and mycotic aneurysm segments are estimated to grow at a comparatively lower CAGR due to limited clinical data available in these areas. Moreover, these aneurysms are quite rare and limit the adoption rate of these devices for their treatment.

To know how our report can help streamline your business, Speak to Analyst

By End-User Analysis

Higher Adoption of Aneurysm Therapeutic Devices Among Hospitals Setting Led to its Dominance

On the basis of end-user, the market is segmented into hospitals, specialty clinics, and others.

The hospitals segment held a dominant share 72.19% in 2026. The segment’s growth is attributed to the higher adoption of these medical devices in these settings. The increasing number of hospitals globally is anticipated to drive the demand for technologically advanced equipment to provide better care. Moreover, the availability of skilled healthcare professionals in these settings increases patient preference toward hospital settings. For instance, more than 700 cerebrovascular procedures are performed each year by neurosurgeons at RUSH Oak Park Hospital. Each year, this number is over 450 minimally operative procedures. These are brain aneurysm and arteriovenous malformation procedures.

The specialty clinics segment held a comparatively lower share of the global market in 2024. In developing and under-developed countries, there is a lack of well-established clinical settings with skilled healthcare professionals to perform these procedures, which limits the demand for these medical devices. The other segment includes research and academic institutes where clinical studies are performed at a smaller scale, and hence, the requirement for these devices is limited in these settings.

REGIONAL INSIGHTS

Geographically, the global market is analyzed across North America, Europe, Asia Pacific, Latin America and the Middle East & Africa.

North America Intracranial Aneurysm Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market and accounted for a revenue of USD 0.76 billion in 2025. The growth of this region is attributed to the strong presence of market players offering aneurysm therapeutic products and the availability of technologically advanced products. The continuous initiatives by public and private entities to promote early diagnosis and treatment of this disease are surging the demand for aneurysm therapeutic products. Moreover, the growing government initiatives toward brain aneurysm research are expected to expand the treatment options for healthcare professionals in this region, subsequently driving market growth across the region. The Brain Aneurysm Foundation launched a campaign called "STOP Pop" in September 2023 to raise awareness of the prevalence and impact of brain aneurysms and the need for continued investment into innovation, detection, and treatment.The U.S. market is projected to reach USD 0.79 billion by 2026.

Europe held a notable market share in 2024. The increasing funding for clinical research is especially surging the demand for aneurysm therapeutic products across the region. In April 2021, Oxford Endovascular, a U.K.-based MedTech company, raised USD 10 million in a Series A funding round to develop treatment for brain aneurysms. The company has previously won funding from the European Union’s Horizon 2020 SME instrument and the U.K.’s grant program, Innovate UK. These investments made by private and public organizations are expected to boost market growth in the region over the study period.The UK market is projected to reach USD 0.08 billion by 2026, while the Germany market is projected to reach USD 0.17 billion by 2026.

The Asia Pacific intracranial aneurysm market is projected to expand at the highest CAGR during the forecast period. The prevalence of intracranial aneurysms is high among countries of this region. In addition, the surgery cost is comparatively lower in India, which is anticipated to surge the demand for these devices across this region. According to Narayana Health, around 76,000 to 200,000 cases of cerebral aneurysms are reported to have occurred every year in India. The medical attention patients receive depends significantly on their access to adequate, affordable healthcare and their awareness of this condition.The Japan market is projected to reach USD 0.18 billion by 2026, the China market is projected to reach USD 0.08 billion by 2026, and the India market is projected to reach USD 0.03 billion by 2026.

Latin America and the Middle East & Africa are expected to grow at comparatively lower CAGR during the forecast period. The lack of well-established healthcare infrastructure and clinical guidelines to promote early diagnosis and treatment of cerebral aneurysms is responsible for the market’s slower growth across these regions.

Key Industry Players

Stryker, Medtronic, and Terumo Corporation Dominated the Market with Strong Product Offerings

In terms of the competitive landscape, the global intracranial aneurysm market is dominated by Stryker, Medtronic, and Terumo Corporation, which have strong product offerings across the globe.

These companies are focused on strengthening their product portfolio by making strategic initiatives.

- In May 2023, Stryker acquired Cerus Endovascular Ltd. to expand Stryker’s current portfolio of aneurysm treatment solutions.

Some other prominent players, such as B. Braun SE, Integra LifeSciences, and MicroPort Scientific Corporation, are focused on expanding their product presence by making strategic collaborations and partnerships with well-established players. Certain emerging players in the market, including Evasc Neurovascular Enterprises and Penumbra, Inc., are actively investing in research and development activities to strengthen their product portfolio and establish their presence in the market.

- In October 2021, Evasc Neurovascular Enterprises launched a third-generation eCLIPs Bifurcation Flow Diverter in Canada.

LIST OF TOP INTRACRANIAL ANEURYSM COMPANIES:

- Medtronic (Ireland)

- B. Braun SE (Germany)

- Integra LifeSciences (U.S.)

- MicroPort Scientific Corporation (China)

- Stryker (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Terumo Corporation (MicroVention Inc.) (Japan)

- Evasc Neurovascular Enterprises (Canada)

- Penumbra, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2023 – Fluid Biomedical Inc. launched its first-in-human clinical study with ReSolv, the unique polymer-based flow-diverting stent designed to treat brain aneurysms.

- August 2022 – Wallaby Medical signed an exclusive distribution agreement with Japan Lifeline Co., Ltd. to distribute its 11 neurovascular treatment devices.

- June 2022 – Medtronic India launched a CE-marked flow diverter for endovascular treatment of brain aneurysms in India.

- June 2022 – Stryker partnered with Carmeda to combine Stryker’s flow diverter technology with Carmeda’s active heparin coating for treating brain aneurysms.

- December 2021 – Wallaby Medical, in partnership with Japan Lifeline Co., Ltd., launched the Avenir Coil System in Japan. Avenir is used in the intravascular embolization of intracranial aneurysms and other neurovascular malformations, along with arterial and venous embolization.

REPORT COVERAGE

The market report covers a detailed analysis and overview. It focuses on key aspects such as competitive landscape, product type, end-user, and region. Besides this, it offers insights into the market drivers, market trends, market dynamics, COVID-19 impact on the market, and other key insights. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.90% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Type

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

The global intracranial aneurysm market size was valued at $1.74 billion in 2025 & is projected to grow from $1.87 billion in 2026 to $2.95 billion by 2034

In 2025, the North America market value stood at USD 0.76 billion.

The market will exhibit rapid growth at a CAGR of 5.90% during the forecast period (2026-2034).

By type, the saccular aneurysm segment held a leading position in the market in 2025.

The rising incidence of brain aneurysms, coupled with growing awareness and government support towards its treatment, are some of the factors driving the demand for these devices.

Stryker, Medtronic, and Terumo Corporation are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us