Intraoral Imaging Market Size, Share & Industry Analysis, By Type (X-ray Systems, Intraoral Sensors, Intraoral Photostimulable Phosphor Systems, Intraoral Cameras, and Intraoral Scanners), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

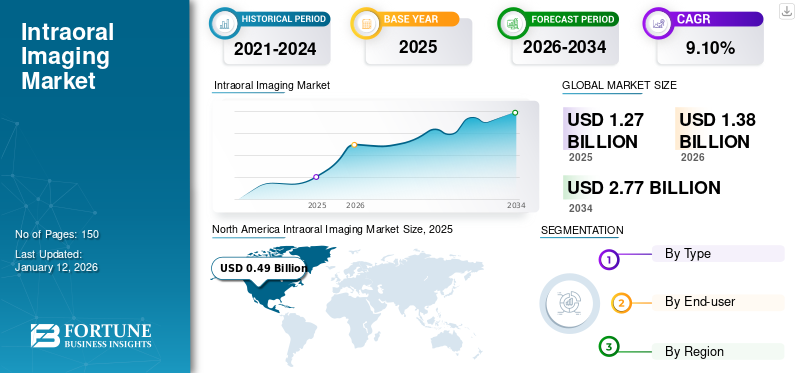

The global intraoral imaging market size was valued at USD 1.27 billion in 2025. The market is projected to grow from USD 1.38 billion in 2026 to USD 2.77 billion by 2034, exhibiting a CAGR of 9.10% during the forecast period. North America dominated the intraoral imaging market with a market share of 38.59% in 2025.

Intraoral imaging in the dental imaging industry refers to the utilization of various techniques to capture images of the inside of the mouth, primarily for dental diagnostics and treatment planning. This includes methods such as periapical, bite-wing, and occlusal radiographs, which help detect dental issues, including cavities, periodontal disease, and other oral pathologies. Digital intraoral imaging technologies, such as intraoral cameras, enhance the ability to visualize oral conditions, allowing for better patient communication. These technologies enhance dental diagnostics and treatment, improving the overall efficiency of dental care.

The global market growth can be attributed to the increasing demand for dental services such as intraoral imaging globally. The growing incidence of dental disorders such as periodontal diseases and cavities primarily fuels this demand. Moreover, the technological advancements in dental technologies, such as 3D capabilities and high-definition imaging, which improves diagnostic accuracy and treatment planning, are also propelling the demand for the product, which is anticipated to fuel the industry's growth during the forecast period.

- For instance, in March 2023, the World Health Organization (WHO) reported that an estimated 19.0% or 1.0 billion adults across the globe are affected by periodontal diseases. This is expected to fuel the demand for intraoral imaging equipment for diagnosis, propelling the market growth in the coming years.

The global market witnessed a decline in growth during the COVID-19 pandemic. This decreased growth was attributed to the postponed non-essential purchases and procedures by several dental practices, affecting the sales of products such as intraoral cameras, sensors, and others. Furthermore, in 2021, the market regained its growth rate due to the resumption of postponed dental services and the increased focus of manufacturers on novel innovations. The market also witnessed some turbulences to the growth during 2022 and 2023 however, the market is poised to witness steady growth prospects henceforth during the forecast period.

Global Intraoral Imaging Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 1.27 billion

- 2026 Market Size: USD 1.38 billion

- 2034 Forecast Market Size: USD 2.77 billion

- CAGR: 9.10% from 2026–2034

Market Share:

- Region: North America dominated the market with a 38.59% share in 2025. This is due to a well-established healthcare infrastructure, high adoption rates of advanced dental imaging technologies, and growing awareness of oral health and aesthetics among the population.

- By Type: The intraoral scanners segment held the largest market share in 2026. The segment's growth is driven by advancements such as wireless scanners that produce higher resolution images, allowing for precise digital impressions and more accurate treatment planning.

Key Country Highlights:

- Japan: As a key part of the fast-growing Asia Pacific market, demand is fueled by an increasing number of dental clinics, rising dental tourism, and the rapid adoption of advanced digital imaging technologies.

- United States: The market is driven by the high adoption rate of advanced dental technologies, a significant number of patients undergoing orthodontic treatments, and a strong preferential shift toward digital dentistry to improve diagnostic accuracy and efficiency.

- China: Growth is propelled by rising dental tourism, an increasing number of dental clinics, and the expansion of both international and local manufacturers introducing new technologies into the market to meet growing demand.

- Europe: The market is advanced by the presence of prominent global companies introducing novel products. A high volume of crown and implantation procedures also fuels the demand for precise intraoral imaging equipment.

Intraoral Imaging Market Trends

Increasing Focus on Advancements and Introduction of Innovative Intraoral Imaging Devices

Advancements in intraoral equipment are driving significant innovations in the market. The advanced devices are revolutionizing the way dental professionals diagnose and treat oral health problems. In consideration of this, manufacturers are introducing intraoral cameras with improved features such as ergonomic designs for ease of use, enhanced resolution, and compatibility with digital dental systems, thereby optimizing the diagnostic capabilities of dental professionals and improving patient care experiences. Hence, this is identified as a prominent global market trend.

- For instance, in July 2024, Dr. Petra Wilder-Smith partnered with Rongguang Liang at the Wyant College of Optical Sciences, University of Arizona, to develop a commercial intraoral camera capable of screening for cancer.

Moreover, the advancements in intraoral scanners, particularly the advent of wireless capabilities, are revolutionizing the dental practice by eliminating the need for cables and providing greater flexibility and mobility for dental specialists during procedures. Such innovation is enhancing patient comfort, leading to more efficient and accurate imaging and scanning processes. Such benefits encourage key players to develop and showcase their products to expand their penetration in the market.

- For example, in November 2023, Owandy Radiology Inc. unveiled its latest AI-powered digital intraoral scanner, the Owandy-IOS, at the 2023 Greater New York Dental Meeting (GNYDM).

Download Free sample to learn more about this report.

Intraoral Imaging Market Growth Factors

Preferential Shift Toward Digital Dentistry to Boost Market Growth

In recent years, there has been a preferential shift toward digital dentistry across the globe. This shift is significantly driving the demand for intraoral cameras by transforming the process and delivery of care in dental practices. Digital dentistry includes various technologies, such as intraoral cameras, digital scanners, CAD/CAM systems, and digital impressions, which are designed to enhance efficiency, accuracy, and patient outcomes. The advanced features of intraoral cameras improve diagnostic accuracy, enabling dentists to identify problems early and formulate treatment plans with greater precision.

- For instance, as of July 2024, Oasis Scientific Inc. offers the ViSee T11 Wi-Fi/USB wireless digital dental camera, an innovative product featuring high-definition 720P video quality. It provides flexible connectivity options, allowing users to connect via Wi-Fi for smartphones/iPads or through USB for PCs/MacBooks. The camera also includes a complimentary patient management system (PMS) for Windows and supports multiple functionalities, including snapshot, video recording, and zoom.

Furthermore, the digital intraoral sensors enable instant image capture and display on computer screens, removing the necessity for traditional film processing and reducing patient waiting times. This enhances efficiency, allowing dentists to evaluate and diagnose dental issues quickly, resulting in accelerated treatment planning and better patient outcomes. Such a shift toward digital dentistry due to the benefits of intraoral imaging equipment is expected to spur the intraoral imaging market growth in the forthcoming years.

Increasing Dental Restoration Demand and Aging Population to Propel Market Expansion

The significant rise in the aging population across the globe is leading to a higher incidence of dental ailments such as gum disease, tooth loss, and tooth decay (dental caries). Aged individuals often require more comprehensive dental treatments, including bridges, crowns, dentures, and implants, to restore both oral function and aesthetics, which is expected to surge the need for intraoral imaging devices such as intraoral scanners.

- For instance, a BMC Oral Health study in January 2024 reported that around 10.0% of the Iranian population is currently aged 60 and over, and this number is expected to rise to 21.7% by 2050. Furthermore, the study also highlighted a significant prevalence of edentulism and denture usage among individuals aged 50 and above.

Intraoral scanners provide numerous benefits over traditional impression techniques, making them favorable among prosthodontists and dentists. These devices allow for accurate and quick digital impressions of the patient's teeth and oral tissues, which eliminates the need for outdated impression Types and uncomfortable procedures. In addition, they generate high-resolution 3D images that can be easily shared with dental laboratories and manipulated for the creation of custom restorations.

Such precision and efficiency provided by intraoral scanners are particularly beneficial in addressing the complex dental needs of the aging population, which is expected to increase the demand for these devices in the elderly’s restorative treatment, driving the market growth during the projection period.

RESTRAINING FACTORS

High Costs and Concerns Regarding Radiation Exposure of Intraoral Imaging Devices May Restrict Market Growth

Despite the fact that this type of imaging equipment offers several benefits and capabilities in dental practices, the high cost of dental imaging equipment and ongoing maintenance costs are anticipated to limit their adoption across the globe. The purchase of intraoral scanning equipment requires a high initial investment, which can deter several dental practices, particularly smaller clinics in developing countries, from adopting it.

- For instance, as per the article published by the National Center for Biotechnology Information (NCBI) in July 2023, the average retail price of wireless TRIOS 4 of 3Shape A/S was USD 30,000.0, and CS3800 of Carestream was around USD 38,000.0. Such high prices of these advanced devices are projected to limit their adoption among dental practices, hindering market growth.

Furthermore, despite the technological advancements that have lowered radiation doses in comparison to traditional film-based X-rays, concerns about the potential health risks associated with ionizing radiation continue to remain among patients and healthcare providers. Intraoral sensors expose patients to a minimal amount of ionizing radiation, which could pose certain risks. In consideration of this, regulatory bodies have established strict guidelines to minimize radiation exposure in dental settings, necessitating compliance with safety protocols and regular monitoring. These regulations contribute to increased compliance costs and administrative burdens for dental practices, affecting their adoption decisions, which is expected to hinder the market growth during the forecast period.

Intraoral Imaging Market Segmentation Analysis

By Type Analysis

Intraoral Scanners Segment Dominated Driven by Advancements in Terms of Wireless Scanners

By type, the market is classified into X-ray systems, intraoral sensors, intraoral photostimulable phosphor systems, intraoral cameras, and intraoral scanners.

The intraoral scanners segment dominated the global intraoral imaging market with a share of 28.03% in 2026 and is projected to expand at the fastest-growing CAGR during the forecast period. The segment’s growth can be attributed to the emergence of wireless scanners. These wireless scanners utilize advanced imaging sensors and optics, producing higher resolution and sharper images. This enhancement in image quality allows dental professionals to obtain precise digital impressions with increased clarity, aiding in more accurate treatment planning and the creation of dental restorations. Such efficiency of the intraoral scanners is expected to propel the segment growth during the forecast period.

The intraoral cameras segment accounted for the second-largest share of the global market in 2024. This growth can be attributed to the rise of digital dentistry, which is promoting the integration of intraoral cameras with CAD/CAM systems and electronic health records (EHR). This integration is helping to streamline workflows and boost efficiency. Furthermore, these advancements enable dental professionals to capture, store, and share high-quality images promptly, enhancing treatment planning and patient education.

- For instance, an article published by Discovery Dental in July 2024 stated that imaging technologies, such as intraoral cameras, can identify oral health issues, including tooth decay, gum disease, and even oral cancer, earlier than traditional methods. Such benefits due to advancements in intraoral cameras are anticipated to boost their demand, driving the segment growth during the forecast period.

The intraoral sensors segment accounted for a moderate share in 2024 and is expected to expand at a significant CAGR during the study period. The incorporation of artificial intelligence (AI) and machine learning (ML) techniques in intraoral sensors has enabled automated image analysis and interpretation, which is enhancing both diagnostic precision and efficiency. Such a scenario is anticipated to propel the segment growth in the coming years.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Increasing Popularity of Intraoral Imaging Equipment Among Solo Practitioners to Boost the Segment Growth

By end-user, the market is divided into DSO/group practices, solo practices, and others.

The solo practices segment occupied the largest share contributing 52.89% globally in 2026. The segmental growth is credited to the increase in popularity of intraoral imaging equipment due to the affordability of intraoral sensors compared to conventional X-ray techniques, their ease of use, and superior diagnostic features. Solo practitioners are experiencing improved patient care and operational efficiency with such equipment, which is projected to boost the segment growth further.

The DSO/group practices segment is projected to grow at a substantial CAGR during the forecast period. Several dental practices are concentrating on introducing new and advanced dental groups to provide advanced treatment, propelling the utilization of intraoral cameras. Moreover, the DSO/group practices also gain benefits from economies of scale in purchasing and implementing the intraoral cameras, which is projected to boost segment growth.

- For instance, In January 2024, Dental Associates of Connecticut introduced a multispecialty dental partnership organization, Archway Dental Partners, through which the adoption of intraoral cameras is anticipated to increase significantly.

The others segment includes dental hospitals and academic research institutes. The segment is anticipated to exhibit a moderate CAGR during the study period. The segment’s growth is attributable to the significant proportion of patients preferring these settings for oral care treatment.

REGIONAL INSIGHTS

Based on geography, the market has been analyzed across Asia Pacific, North America, the Middle East & Africa, Europe, and Latin America.

North America

North America Intraoral Imaging Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America market value stood at USD 0.49 billion and led in 2025. The growth is attributable to the well-established healthcare infrastructure and high adoption rates of advanced dental imaging technologies in the region. In addition, the growing awareness regarding oral aesthetics and health among the regional population, along with growing disposable incomes, is expected to fuel the demand for advanced dental technologies, such as intraoral imaging equipment, driving the market growth. The U.S. market is projected to reach USD 0.49 billion by 2026.

- For instance, in September 2023, as per the publication of the AAO Economics of Orthodontics and Patient Census Survey, the estimated number of patients undergoing active orthodontic treatment among members in the U.S. and Canada was around 5.51 million.

Europe

Europe market held the second-highest share in 2025. This growth can be attributed to the presence of prominent companies focused on the introduction of new and advanced products in the region. Moreover, the large number of crowns and implantation procedures are propelling the demand for intraoral imaging equipment, which is projected to drive the regional market growth. The UK market is projected to reach USD 0.06 billion by 2026, while the Germany market is projected to reach USD 0.12 billion by 2026.

Asia Pacific

The Asia Pacific market is anticipated to rise at the highest CAGR during the study period. The highest CAGR of the region is attributed to the increasing number of dental clinics and rising dental tourism in the region. This is boosting the adoption of advanced dental technologies, such as the product, which is anticipated to increase regional market growth. The Japan market is projected to reach USD 0.07 billion by 2026, the China market is projected to reach USD 0.09 billion by 2026, and the India market is projected to reach USD 0.03 billion by 2026.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa markets are poised to depict a significant CAGR during the forecast period. The growth can be attributed to the high prevalence of dental diseases and government initiatives promoting dental care in these regions. Such factors are expected to fuel the adoption of the product, propelling regional growth.

KEY INDUSTRY PLAYERS

Carestream Dental LLC and Other Players Held Significant Share Owing to Large Customer Base and Diversified Portfolio

Market players such as Align Technology, Inc., Carestream Dental LLC, and Aceton accounted for a significant share in 2024. The significant market share accounted by these companies is mainly due to factors such as a large customer base globally, an advanced imaging technology portfolio, and a strong geographical presence. Furthermore, the introduction of novel imaging products by these key players to enhance dental care is expected to strengthen their positions in the global market.

Other players, such as Medit, Dentsply Sirona, and OMNIVISION, are involved in numerous strategic activities such as partnerships and geographic expansions to gain significant market share during the projected period. Moreover, the commercialization of their products in various geographies and the integration of novel features into existing products are projected to enhance the market share of these companies.

List of Top Intraoral Imaging Companies:

- Acteon (U.K.)

- Dentsply Sirona (U.S.)

- OMNIVISION (U.S.)

- Align Technology, Inc. (U.S.)

- Medit (South Korea)

- PLANMECA OY (Finland)

- Carestream Dental LLC. (U.S.)

- Dental Imaging Technologies Corporation (U.S.)

- XpectVision Technology Co., Ltd (China)

- Midmark Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2024: DEXIS launched the DEXIS Titanium Sensor, which includes the new Ti2 intraoral sensor. This product came with enhanced features, such as a more durable housing design and the ability to utilize 2D artificial intelligence (AI) for dental findings.

- March 2023: COLOGNE announced the launch of its smallest and latest PANDA intra-oral scanner, the PANDA Smart, at IDS 2023.

- December 2022: XpectVision Technology Co., Ltd announced the Indian launch of Xpect vision intraoral sensor through Unicorn Denmart Ltd, a local distributor in the country.

- November 2022: Ori Dental launched the Ori intraoral scanner, a modern alternative to traditional dental PVS impressions. This product provides an easier, faster, more precise solution, improving patient experience.

- November 2022: Aceton announced the addition of the next-generation C50, its most advanced intra-oral camera, at the ADF congress.

REPORT COVERAGE

The research report provides a detailed competitive landscape, including the global market industry forecast. It focuses on key aspects such as market dynamics and new product launches. In addition, it includes key industry developments such as mergers, partnerships, acquisitions, and technological advancements in the market. Moreover, it provides an analysis of different segments in various regions, company profiles of key players, and the impact of COVID-19 on the market. The report also covers qualitative and quantitative insights that contribute to the market growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.10% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 0.49 billion in 2025 and is projected to reach USD 2.77 billion by 2034.

In 2025, the North America market stood at USD 0.49 billion.

The market is expected to exhibit a CAGR of 9.10% during the forecast period.

By type, the intraoral scanners segment is the leading segment, as it captured a dominant market share in 2026.

The rising demand for dental restoration and the shift toward digital dentistry are the key factors driving the market growth.

Align Technology, Inc., Carestream Dental LLC, and Aceton are the top players in the market.

North America dominated the intraoral imaging market with a market share of 38.59% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us