Intraoral Scanners Market Size, Share & Industry Analysis, By Product Type (Wired and Wireless), By Application (Implantology, Orthodontics, Prosthodontics, and Others), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

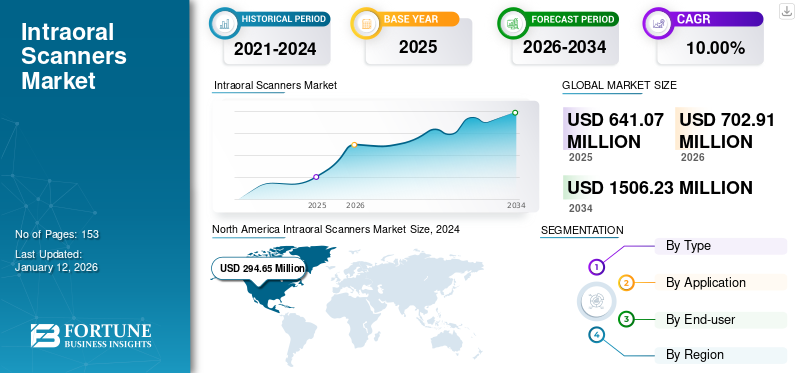

The global intraoral scanners market size was valued at USD 641.07 million in 2025 and is projected to grow from USD 702.91 million in 2026 to USD 1,506.23 million by 2034, exhibiting a CAGR of 10.00% during the forecast period. North America dominated the intraoral scanners market with a market share of 45.96% in 2025.

Intraoral scanners are dental devices used in dentistry to create precise 3D models of a patient's oral cavity. These handheld instruments employ advanced optical technology to capture detailed images of the teeth and soft tissues in real-time, eliminating the need for messy traditional molds. By providing digital impressions quickly and accurately, these scanners improve the efficiency of various dental procedures, from crowns and bridges to orthodontic treatments, including aligners. They enhance patient comfort by minimizing discomfort associated with conventional impression techniques, making them an indispensable tool in modern dental practices.

The market’s growth is attributed to an increasing shift toward digital dentistry due to several technological advancements that have enhanced patient outcomes and workflow efficiency in dental care settings. In addition, the increasing burden of dental disorders is propelling the utilization of these devices due to high awareness of early detection of such conditions to prevent complications.

The key players operating in the market include Dentsply Sirona, 3Shape A/S, and Align Technology, Inc. These companies are focusing on new product launches, collaborations, and expanding geographic reach to gain a significant portion of the market.

MARKET DYNAMICS

Market Drivers

Integration of CAD/CAM Systems in Dentistry to Drive Market Growth

CAD/CAM technology has revolutionized the dental industry by enabling digital design and fabrication of dental restorations such as crowns, bridges, and dental implants. In this context, these scanners play a pivotal role as the initial step in digital workflow, capturing precise digital impressions of a patient's teeth and oral tissues. Furthermore, the integration of these scanners with CAD/CAM systems is enabling real-time communication and collaboration between dentists and dental laboratories.

- For instance, according to the blog published by the Institute of Digital Dentistry, the adoption of intraoral scanners (IOS) was accelerated in 2021 and continued in 2022. Also, the penetration has already reached 30.0 - 35.0% in the U.S. and mature markets.

Digital impressions can be instantly transmitted electronically, allowing technicians to start designing restorations immediately without the need for physical shipping. This has streamlined the production process, reducing turnaround times and enhancing communication, leading to faster treatment delivery and improved patient satisfaction.

As the demand for esthetic and minimally invasive restorative treatments continues to rise, the integration of CAD/CAM systems with such scanners has positioned dental practices to meet these evolving patient needs effectively.

Overall, the seamless integration of such scanners with CAD/CAM systems is expected to drive efficiency, accuracy, and innovation in dental care, thereby fueling the global intraoral scanners market growth.

Aging Population and Demand for Dental Restoration to Boost the Market Growth

The aging population globally is critical for rising prevalence of dental issues, such as tooth decay, gum disease, and tooth loss. Additionally, older adults often require more extensive dental treatments, including crowns, bridges, implants, and dentures, to restore oral function and aesthetics. Hence, the demand for intraoral scanners is also expected to increase in order to meet the need for dental restorative solutions.

- For instance, according to a study published by BMC Oral Health in January 2024, the proportion of Iranians aged 60 years and over is approximately 10.0%, which is anticipated to increase to 21.7% by 2050. In the same study, it was analyzed that there was a high prevalence of edentulism and denture use among participants aged 50 years and above.

Intraoral scanners offer several advantages over traditional impression methods, making them increasingly popular among dentists and prosthodontists. These scanners enable quick and accurate digital impressions of patients' teeth and oral tissues, eliminating the need for old impression materials and uncomfortable procedures. Moreover, these scanners provide high-resolution 3D images that can be easily manipulated and shared with dental laboratories for fabrication of custom restorations.

The efficiency and precision offered by intraoral scanners are particularly valuable in the context of an aging population with complex dental needs. As a result, dentists are using these devices to streamline the restoration process, reduce chairside time, and improve overall treatment outcomes for elderly patients. Such advantages offered by these devices in restorative treatment for the elderly population are expected to increase its demand in the near future.

Market Restraints

High Cost of Intraoral Scanners to Hamper the Market Growth

Despite numerous benefits and innovative capabilities, the intraoral scanners require a high initial investment and ongoing maintenance. These high costs are expected to hamper their adoption among the resource-limited settings, especially in low-income countries, due to inadequate investment capability.

- For instance, according to the Institute of Digital Dentistry, iTero Lumina (Align Technology, Inc.) is priced around USD 45,000 - 50,000 in the U.S. market for the end user.

Also, there are limited reimbursements for the dental procedures, and some dental procedures require additional diagnosis and treatments, which increase overall costs for the patients. This, in turn, is limiting the utilization of advanced products, such as intraoral scanners, which is anticipated to hamper the market growth over the forecast period.

Market Opportunities

Untapped and Emerging Countries to Offer Lucrative Opportunities

In recent years, there has been a rapid shift toward the adoption of digital dentistry products such as intraoral scanners in emerging countries such as China, Brazil, and India due to increasing awareness about innovative diagnostic options. This shift toward digitization is transforming dental workflows by replacing traditional impressions. Such high demand for advanced products in these countries is influencing key players to enter these markets with new launches.

- In February 2023, Launca Medical launched the Launca intraoral scanner equipped with the latest technology, with an aim to strengthen its product portfolio at the Dental South China 2023 International Exhibition in China.

Moreover, the developing countries such as Brazil and South Korea are also driving the adoption of intraoral scanners due to growing per capita healthcare expenditure across the countries. Additionally, the rising medical tourism in these countries is also demanding the availability of chairside digital imaging and AI-powered intraoral scanners for various applications, such as fabrication of customized dental products and detecting anomalies including caries and misalignments. This is expected to represent lucrative opportunities for the prominent players to sign strategic agreements with dental care facilities and expand their market presence.

Market Challenges

Limited Skilled Professionals to Hinder Optimal Utilization of Intraoral Scanners

In several countries, especially rural areas, there has been a shortage of skilled professionals, such as trained clinicians, dental assistants, and lab technicians who can operate, interpret, and fully utilize the advanced technology in the dental sector.

- For instance, according to the data published by the American Dental Association in 2021, the Health Resources and Services Administration (HRSA) estimated a shortage of 10,877 dentists in the U.S. in the respective year.

Operating an intraoral scanner requires an understanding of digital workflows, software integration, and communication with labs. As a result, in several clinics, the inadequately trained dental staff is leading to underutilization or incorrect usage of intraoral scanners, resulting in poor scan quality and unsatisfactory results. Moreover, this shortage of skilled professionals is also expected to result in delays of dental procedures, ultimately leading to decreased product adoption. Such a scenario is expected to pose a major challenge for market expansion.

Intraoral Scanners Market Trends

Technological Advancements in Intraoral Scanners to Improve Diagnosis and Treatment in Dentistry, Driving Market Expansion

Technological advancements in intraoral scanners, especially the emergence of wireless capabilities, have become a prominent trend in the market, revolutionizing dental practice. Wireless scanners have eliminated the need for cables, providing greater mobility and flexibility for dental practitioners during procedures. This innovation is enhancing patient comfort and allowing for easier maneuverability, leading to more efficient and accurate scanning processes. Furthermore, companies are continuously developing novel, technologically advanced products and showcasing them in various events to spread awareness regarding such advancements in the market.

- For instance, in November 2023, Owandy Radiology Inc. showcased its brand-new AI-enhanced digital intraoral scanner, Owandy-IOS, at the 2023 Greater New York Dental Meeting (GNYDM).

Moreover, wireless scanners often incorporate advanced imaging sensors and optics, resulting in higher resolution and sharper images. This improvement in image quality is enabling dental professionals to capture precise digital impressions with higher detailing and clarity, facilitating more accurate treatment planning and fabrication of dental restorations.

Furthermore, technological advancements have expanded the scope of applications for these scanners beyond traditional restorative dentistry. They are increasingly being utilized in orthodontics, implantology, and digital smile design, driving demand for more versatile and sophisticated scanning solutions.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Wired Scanners to Hold the Largest Share owing to its Diverse Benefits

Based on type, the market is segmented into wired and wireless.

In 2024, the wired segment held the largest intraoral scanners market share due to its reliability and stability. Additionally, its preference is increasing due to their affordability compared to wireless ones. Such benefits are influencing key players to increase the introduction of new devices into the market, thereby growing the product availability and accessibility.

- For instance, in June 2023, DEXIS IOS Solutions expanded its digital dentistry offerings with new end-to-end workflows. Also, it launched IS 3800 wired scanners, which offer high-speed performance.

The wireless segment is projected to dominate the market with a share of 57.77% in 2026, owing to its advantages in mobility and convenience. These scanners are offering dental professionals freedom of movement during scanning procedures, allowing for enhanced patient comfort and flexibility in clinical settings. Such advanced features of these devices have increased their adoption in group practices and hospitals, where it is easy to move the device among various dental chairs for treatment.

By Application

Orthodontics to Hold a Major Share Owing to High Cases of Malocclusion

By application, the market is segmented into implantology, orthodontics, prosthodontics, and others.

The orthodontics segment is expected to account for 44.49% of the total market share in 2026. The segmental growth is attributed to the growing adoption of digital orthodontic workflows. These scanners play a crucial role in orthodontic treatment planning by capturing precise 3D images of a patient's dentition, facilitating the design and customization of orthodontic appliances such as braces, aligners, and retainers.

- For instance, in 2021, Align Technology, Inc. nearly doubled its revenue for imaging systems and CAD/CAM services, generating a share of USD 705.5 million. The majority of Invisalign cases started in the fourth quarter were submitted via an intra-oral scan.

Additionally, the digitization of orthodontic workflows reduces reliance on traditional physical impressions, offering patients a more comfortable and efficient treatment experience. Furthermore, a surge in the number of clear aligner treatments is expected to increase the usage of these devices in such treatment during the forecast period.

The prosthodontics segment accounted for a significant market share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The segmental growth is attributed to growing prosthodontics treatments, such as crowns, bridges, and dentures, which require scanners for impressions to manufacture these solutions. Prosthodontists rely heavily on these scanners to streamline their workflow, optimize treatment outcomes, and deliver customized, high-quality restorations to their patients.

To know how our report can help streamline your business, Speak to Analyst

By End-user

Solo Practices Dominate with Increasing Patient Visits in These Settings

As per end-user, the market is segmented into solo practices, DSO/group practices, and others.

The solo practices segment is anticipated to hold a significant market share of 55.50% in 2026. The growth is attributed to a large number of orthodontists and prosthodontists working in these practices. Moreover, the growing number of key oral diseases coupled with surge in patient visits to these practices to opt for solutions is expected to propel segmental growth during the forecast period.

The DSO/group practices segment is projected to grow at the highest CAGR during the forecast period. This growth is attributed to the surge in high-cost wireless scanners in these settings, coupled with increased patient visits due to benefits offered by a group compared to solo practices. Hence, the revenues generated from the DSO/group practices segment are anticipated to increase during the forecast period.

The others segment include dental hospitals, health centers, and academic research institutes. The segment is expected to grow at a moderate CAGR during the forecast period. The segmental growth is attributed to a large number of people obtaining oral care in these types of settings. For instance, according to the study published by “The Journal of the American Dental Association” in July 2022, in the U.S. from 2001 to 2020, the number of people obtaining oral health care at Federally Qualified Health Centers (FQHCs) increased from 1.4 million to 5.2 million.

INTRAORAL SCANNERS MARKET REGIONAL OUTLOOK

Geographically, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Intraoral Scanners Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a revenue of USD 271.2 million in 2024 and is expected to continue its dominance during the forecast period. The region’s growth is due to the large penetration of these devices in the dental clinics and favorable reimbursement policies. Moreover, increasing awareness about oral health and aesthetics among the population, coupled with rising disposable incomes, is contributing to the demand for advanced dental technologies. The U.S. market is projected to reach USD 298.96 billion by 2026.

- For instance, according to the data AAO Economics of Orthodontics and Patient Census Survey published in September 2023, the estimated number of total patients in active orthodontic treatment across members in the U.S. and Canada is approximately 5.51 million.

In the U.S., high dental expenditure per capita and the availability of highly-equipped dental care settings are leading to widespread adoption of advanced tools such as intraoral scanners, which are expected to fuel the regional market growth.

Europe

Europe held the second-highest market share in 2024 as these scanners are widely integrated into dental practices and institutions across the region, facilitating efficient and precise digital impressions for various dental procedures. Moreover, the large number of crowns and implant procedures as well as surge in the development of these devices are further stimulating market growth. For instance, in September 2023, Neoss Group, based in the U.K., announced the fast and easy-to-use wireless intraoral scanner NeoScan 2000. This follows the success of last year's launch of the NeoScan 1000. The UK market is projected to reach USD 24.85 billion by 2026, while the Germany market is projected to reach USD 53.55 billion by 2026.

Asia Pacific

Asia Pacific is expected to grow at a highest CAGR over the projected years. The growth is attributed to the increasing adoption of advanced dental technologies, rising dental tourism, and growing awareness regarding oral healthcare. Japan, China, South Korea, and India have witnessed significant growth in the demand for these scanners due to expansion of dental clinics, rising disposable income, and government initiatives promoting dental health. The Japan market is projected to reach USD 37.1 billion by 2026, the China market is projected to reach USD 43.24 billion by 2026, and the India market is projected to reach USD 19.49 billion by 2026.

Latin America and Middle East & Africa

The Latin America and Middle East & Africa markets are expected to grow at a significant CAGR during the forecast period. The growth is due to increasing prevalence of dental disorders and a rising awareness of dental aesthetics. Moreover, investments in healthcare infrastructure, technological advancements, and government initiatives promoting dental care have boosted market growth in the region.

COMPETITIVE LANDSCAPE

Key Market Players

Companies with Wired Scanners in their Product Portfolios to Hold Key Market Share

The market is consolidated with the presence of a few prominent companies with substantial market share. Align Technology, Inc. dominated the market with a significant global intraoral scanner market share in 2024. The company’s prominent position is led by its advanced product portfolio and large customer base. Furthermore, a focus on the introduction of new products is expected to strengthen its position.

Other companies operating in this market include Medit, Dentsply Sirona, 3Shape A/S, and other small & medium-sized players. These companies are involved in a range of strategic initiatives, including the continuous introduction of innovative solutions to meet the changing requirements of healthcare professionals and patients. This initiative is expected to increase their brand presence within the industry.

LIST OF KEY INTRAORAL SCANNERS COMPANIES PROFILED

- Align Technology, Inc. (U.S.)

- Medit (South Korea)

- Dentsply Sirona (U.S.)

- 3Shape A/S (Denmark)

- PLANMECA OY (Finland)

- Dental Imaging Technologies Corporation (U.S.)

- imes-icore GmbH (Germany)

- Carestream Dental LLC (U.S.)

- 3M (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2025 – Dentsply Sirona partnered with Biotech Dental to develop a new, highly accurate Scan4All 3D Intraoral Scanner.

- March 2025 – Dentsply Sirona collaborated with the FDI World Dental Federation to raise awareness of oral health on World Oral Health Day, thereby increasing demand for its intraoral scanners.

- March 2025 – PLANMECA OY showcased its portfolio of CAD/CAM products to IDS 2025, along with the PLANMECA Onyx intraoral scanner.

- January 2024 – Align Technology, Inc. announced the launch of iTero Lumina intraoral scanner with a 3X wider field of capture in a 50% smaller and 45% lighter wand. The device delivers faster scanning speed, higher accuracy, and superior visualization.

- April 2024 – Medit announced the next evolution of intraoral scanning technology with the launch of Medit i900. The Medit i900 has an innovative new control interface, improved ergonomics, smoother scanning, and enhanced material capture technology.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 10.00% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation

|

By Type

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 641.07 million in 2025 and is projected to reach USD 1,506.23 million by 2034.

In 2025, North Americas market stood at USD 294.65 million.

The market is expected to exhibit a CAGR of 10.00% during the forecast period.

The wired segment is set to lead the market.

Growing procedures of orthodontics and prosthodontics, coupled with the integration of CAD/CAM in dentistry, drive market growth.

Align Technology, Inc., 3Shape A/S, Medit, and Dentsply Sirona are the top players in the market.

North America dominated the market in 2025 with the largest share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us