IoT Chips Market Size, Share & Industry Analysis, By Product (Processors, Connectivity Integrated Circuits, Sensors, Memory Devices, and Logic Devices), By Connectivity (Wi-Fi, Bluetooth, RFID, Cellular Networks, and Others), By End-user (Healthcare, Consumer Electronics, Automotive, BFSI, Retail, Building Automation, and Others), and Regional Forecast, 2026 - 2034

IoT Chips Market Size

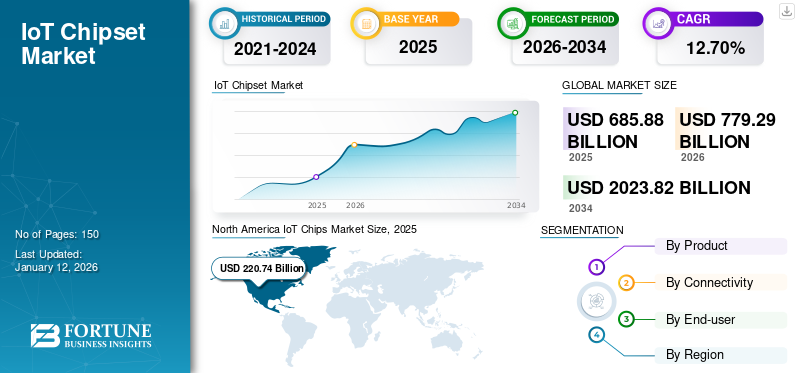

The global IoT chips market size was valued at USD 685.88 billion in 2025 and is projected to grow from USD 779.29 billion in 2026 to USD 2,023.82 billion by 2034, exhibiting a CAGR of 12.70% during the forecast period. North America dominated the global IoT chips market with a share of 32.20% in 2025.

An Internet of Things (IoT) chipset is a specified integrated circuit embedded in objects, machines, and things. With the aid of surrounding technologies, including sensors, processors, connectivity memory devices, ICs, and logic devices, IoT chips are used in IoT sensors' smart gateways to deliver data processing, connectivity, and communication. These chips are essential in transmitting, collecting, and processing data within IoT systems.

GLOBAL IoT CHIPSET MARKET OVERVIEW

Market Size:

- 2025 Value: USD 685.88 Billion

- 2026 Value: USD 779.29 Billion

- 2034 Forecast Value: USD 2,023.82 Billion, with a CAGR of 12.70% from 2026–2034

Market Share:

- Regional Leader: North America dominated the market in 2025, accounting for approximately 32.20% of global share.

- End‑User Leader: The consumer electronics segment was the largest end-user in 2024.

- High‑Growth Segment (by Product): Sensors and processors segments are expected to grow fastest due to demand in smart devices and industrial applications.

Industry Trends:

- Edge Computing & AI Integration: Increasing adoption of edge-capable chipsets with built-in generative AI for optimized processing.

- Connectivity Expansion: Growth in support for Wi‑Fi, cellular (5G), Bluetooth, RFID, and LPWAN within chipsets.

- Security & Energy Efficiency Focus: Prioritization of secure, low-power IoT chip designs suitable for battery‑powered and edge devices.

Driving Factors:

- Ubiquitous Device Connectivity: Rapid rise in connected devices across automotive, healthcare, industrial, and consumer sectors.

- Smart Infrastructure Investment: Expanding industrial automation and smart city infrastructure fueling chipset demand.

- Technological Innovation: Advances in AI, sensor fusion, and energy-optimized design powering next-gen IoT processors.

- Regulatory & Privacy Pressures: Focus on embedded security and compliance in sensitive applications.

Due to the COVID-19 pandemic, the market was considerably affected as severe supply chain scarcities occurred globally. Moreover, the limitations imposed by governments throughout the globe on the movement of individuals also obstructed production. As the world recuperates from the pandemic, the need for more advanced and automated processes has become a main aspect of achieving business objectives. The market for large IoT-enabled devices is predicted to increase in the coming years, generating a strong demand for IoT chips across the globe.

GENERATIVE AI IMPACT

Rising Adoption of Generative AI in IoT Chips to Drive Market Growth

Generative AI can significantly impact the Internet of Things (IoT) chipset market by automating and optimizing the design of IoT chipsets, leading to improved performance, energy efficiency, and reduced time-to-market. AI algorithms can explore vast design spaces, identifying optimal configurations faster than traditional methods. Generative AI enables the creation of customized chipsets tailored to specific applications or industries. This allows manufacturers to produce specialized IoT devices that meet unique requirements, enhancing functionality and efficiency.

Thus, this factor boosts the global Internet of Things (IoT) chips market growth.

IoT Chips Market Trends

Adoption of Edge Computing in IoT Chips to Drive Market Growth

The increasing adoption of edge computing is also a significant driver of the market. Edge computing processes data earlier to the source, reducing bandwidth usage and latency, and demands chips with improved processing capabilities for edge devices. Moreover, edge computing can ensure safety and data privacy by permitting local data processing and addressing issues related to cloud-based solutions. Therefore, this factor is expected to stimulate the growth of the chipsets market.

Download Free sample to learn more about this report.

IoT Chips Market Growth Factors

Increasing Demand for Connected Devices Among Several IoT Solutions to Boost Market Growth

The upsurge in demand for connected devices aids as an important driving factor for the growth of the IoT chip market. Through the proliferation of IoT applications across several industries, such as automotive, healthcare, agriculture, and smart homes, there is an increasing need for devices that can collect, communicate, and process information seamlessly. Connected devices, ranging from smartphones and wearables to sensors and actuators, enable users and businesses to enter real-time data, automate processes, and increase productivity. This surge in demand for connected devices is driven by the growing adoption of IoT solutions aimed at optimizing resource utilization, improving operational efficiency, and augmenting customer experiences.

RESTRAINING FACTORS

Concerns Regarding the Security and Privacy of User Data to Restrain Market Growth

IoT has tremendous potential due to the significant adoption rate in every end-user application, including retail, healthcare, and wearables, among others. However, data security and privacy are major restraints to the market growth. As the number of connected devices is rising with the increasing adoption of IoT in end-use applications, a vast amount of information is being produced. Cybercriminals can intrude into systems and use such data for cyber threats.

Additionally, the IoT gateway, which aids as a connectivity layer between cloud services and edge devices, must handle a great number of IoT devices and the information moved between them. Protocol translation makes it tough for the IoT gateway to uphold data privacy. Though encryption security keys can be used to protect data, handling those keys would still be a substantial concern. Therefore, these factors may hamper the global IoT chips market growth.

IoT Chips Market Segmentation Analysis

By Product Analysis

Proliferation of IoT Devices across Several Industry Verticals to Propel Processors Segment

On the basis of product, the market is categorized into processors, connectivity Integrated Circuits (ICs), sensors, memory devices, and logic devices.

The processors segment held the largest global IoT chips market share in 2023. The proliferation of IoT devices across various industries, such as healthcare, automotive, smart homes, and industrial automation, is driving the demand for more advanced and efficient processors. Furthermore, enhanced security features in modern processors are crucial for IoT applications, which often deal with sensitive data and require robust protection against cyber threats. Therefore, this factor accelerates the growth of the market.

Moreover, the Sensors segment is poised to account for 30.86% of the market share in 2026. The sensors segment is expected to grow at the highest CAGR during the forecast period. There is an enhanced integration of sensors with communication modules and processors within IoT chipsets, which simplifies the design and reduces the power consumption of IoT devices. Further, sensors provide critical data that enable real-time monitoring, predictive maintenance, and data-driven decision-making across various sectors, increasing operational efficiency and reducing costs.

By Connectivity Analysis

Widespread Adoption of Wi-Fi Networks Among Several IoT Applications to Drive Segment Growth

On the basis of connectivity, the market is categorized into Wi-Fi, Bluetooth, RFID, cellular networks, and others.

The Wi-Fi segment dominates the market with the maximum share. These networks are widespread in homes, businesses, and public spaces, providing a readily available connectivity solution for IoT devices without requiring additional infrastructure. Moreover, Wi-Fi offers high data transfer rates, which makes it suitable for IoT applications that require the transmission of large amounts of data, such as video surveillance, smart appliances, and industrial automation.

The Cellular Networks segment is projected to dominate the market with a share of 26.28% in 2026. The cellular networks segment is expected to grow at the highest CAGR during the forecast period. These networks provide extensive coverage, making them ideal for IoT applications that require connectivity over large geographical areas, such as asset tracking, fleet management, and smart agriculture. Additionally, the technology offers seamless connectivity for moving devices, which is essential for applications such as vehicle telematics, connected cars, and wearable devices.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Growing Adoption of Consumer Electronics in the IoT Chipsets to Boost Segmental Growth

On the basis of end-user, the market is categorized into healthcare, consumer electronics, automotive, BFSI, retail, building automation, and others.

In 2026, the Automotive segment is projected to lead the market with a 22.09% share. The consumer electronics segment held the largest market share in 2023. The segment includes products such as smart speakers, thermostats, lighting systems, security cameras, and home appliances, which are increasingly incorporating IoT chipsets to enable remote control, automation, and integration with digital assistants such as Amazon, Alexa, and Google Assistant. In addition, IoT chipsets are embedded in a variety of home automation systems, allowing users to control and monitor home environments, including climate control, lighting, and security systems, from their smartphones or through automated routines.

Moreover, the healthcare segment is anticipated to grow at the highest CAGR during the forecast period. IoT-enabled devices such as wearable fitness trackers, glucose monitors, and heart rate monitors allow for continuous monitoring of a patient’s vital signs, enabling healthcare providers to track health metrics in real time and respond proactively to any issues. Thus, this factor promotes market growth.

REGIONAL INSIGHTS

In terms of region, the global market is divided into five key regions: North America, South America, Europe, the Middle East & Africa, and Asia Pacific. They are further segmented into countries.

North America IoT Chips Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 220.74 billion in 2025 and USD 249.58 billion in 2026.. The region has a well-established and advanced telecommunications infrastructure, including widespread high-speed internet and extensive cellular network coverage, which supports the deployment of IoT devices and systems. Moreover, significant investments from both the private sector and government initiatives are fueling the growth of IoT technology in North America. Programs aimed at smart cities, healthcare innovation, and industrial automation are receiving substantial funding. The U.S. market is valued at USD 164.94 billion by 2026.

Asia Pacific is estimated to witness significant CAGR during the forecast period. High mobile and internet penetration rates in many Asia Pacific countries facilitate the deployment and adoption of IoT devices, enabling seamless connectivity and integration. Manufacturing powerhouses such as China, Japan, and South Korea are adopting the Industrial Internet of Things (IIoT) for predictive maintenance, supply chain optimization, and factory automation, enhancing productivity and efficiency. The Japan market is valued at USD 17.86 billion by 2026, the China market is valued at USD 32.68 billion by 2026, and the India market is valued at USD 9.92 billion by 2026.

Europe is projected to exhibit steady growth over the forecast period. The region has a strong regulatory framework that emphasizes data privacy and security, as observed with the General Data Protection Regulation (GDPR). This focus on protecting personal data is crucial for the widespread adoption of IoT devices. The UK market is valued at USD 66.07 billion by 2026, while the Germany market is valued at USD 46.43 billion by 2026.

Similarly, South America is showing significant growth in this market owing to the expansion of mobile and broadband internet services, which are crucial for IoT adoption. Brazil, Argentina, and Chile are investing in improving connectivity, which supports the deployment of IoT devices.

Additionally, the Middle East & Africa market is predicted to grow in the impending years. This is owing to the improved investment and government funding for digitization.

KEY INDUSTRY PLAYERS

Market Players to Adopt Merger and Acquisition Strategies to Expand their Operations

Prominent firms in the industry are introducing specialized solutions tailored to various industries to expand their global presence. They are strategically entering collaborations and acquiring local businesses for establishing a strong industry foothold. These industry players are focused on developing effective marketing strategies and introducing new solutions for increasing their market share. Thus, the escalating demand for IoT chips is anticipated to generate lucrative opportunities for industry players.

List of Top IoT Chips Companies:

- Qualcomm Technologies (U.S.)

- Samsung Electronics Co., Ltd. (South Korea)

- Intel Corporation (U.S.)

- MediaTek Inc. (Taiwan)

- Texas Instruments (U.S.)

- STMicroelectronics (Switzerland)

- NXP Semiconductors (Netherlands)

- Broadcom (U.S.)

- Huawei (China)

- Microchip Technology Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Honeywell and NXP Semiconductors partnered to aid in enhancing building energy management. The collaboration aims to provide smart energy solutions driven by AI/machine learning and data analytics to improve building autonomy and drive energy efficiency through guiding service specialists.

- November 2023: MediaTek introduced the launch of new chipsets- Filogic 360 and Filogic 860 solutions for mainstream devices. The chipsets offer the finest solutions with exceptional consistency in busy network environments, ultra-fast speeds with abridged latency, and improved range.

- June 2023: Qualcomm Technologies launched two modem chipsets, the Qualcomm 212S Modem and the Qualcomm 9205S Modem with satellite ability. These chipsets would allow companies to track and monitor valuable assets for better virtually anytime and anywhere around the globe.

- April 2023: Texas Instruments launched the SimpleLink family of Wi-Fi 6 confidant Integrated Circuits (ICs). The solutions would aid designers in implementing highly secure, reliable, and efficient Wi-Fi connections at a reasonable price for applications that activate in high-temperature or high-density environments.

- March 2023: Samsung introduced the Exynos Connect U100, an ultra-wideband chipset with centimeter-level accuracy for smartphones and automotive devices. The solution is optimized for use in automotive, mobile, and Internet of Things (IoT) devices, proposing accurate distance and location data.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

By Connectivity

By End-user

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 2,023.82 billion by 2034.

In 2025, the market was valued at USD 685.88 billion.

The market is projected to grow at a CAGR of 12.70% during the forecast period.

By end-user, the consumer electronics segment is the leading segment as it captured the largest share in 2025.

The increasing demand for connected devices among several IoT solutions across the globe is the key factor driving market growth.

Qualcomm Technologies, Samsung Electronics Co., Ltd., Intel Corporation, Mediatek, Inc., Texas Instruments, STMicroelectronics, NXP Semiconductors, Broadcom, Huawei, and Microchip Technology Inc. are the top players in the market.

North America holds the highest market share.

By connectivity, the cellular networks segment is expected to grow at the highest CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us