IoT Cloud Platform Market Size, Share & Industry Analysis, By Service Type (Application Management, Device Management, and Data Management), By Cloud Type (Private, Public, and Hybrid), By End-User (Healthcare, IT & Telecom, Retail & E-Commerce, Manufacturing, Transportation and Logistics, Automotive, Energy and Power, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

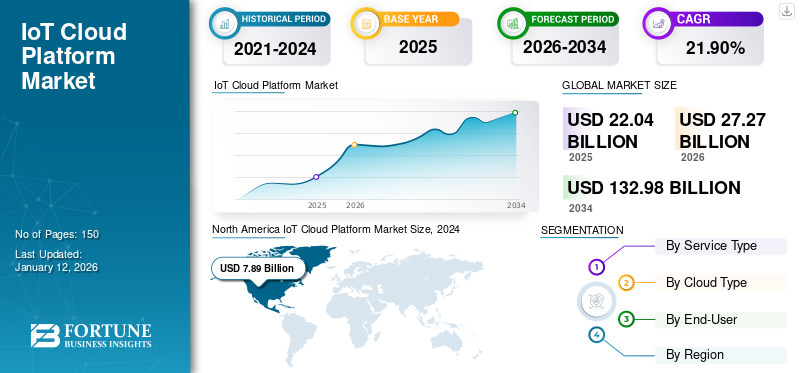

The global IoT cloud platform market size was valued at USD 22.04 billion in 2025 and is projected to be worth USD 27.27 billion in 2026 and reach USD 132.98 billion by 2034, exhibiting a CAGR of 21.90% during the forecast period. North America dominated the global market with a share of 35.81% in 2025.

IoT cloud platform, also recognized as cloud service IoT platform, incorporates IoT devices and cloud computing services, comprising both the ability to provide services through an end-to-end platform. This platform is critical to all IoT and cloud operations activities, including collecting data from IoT-enabled devices and analyzing and storing that data to develop a true vision. Demand for these platforms is increasing due to factors such as growing shift toward data management solutions, cloud-based data, increasing number of IoT connected devices, and the growing demand for technologies such as 5G, AI, edge computing and big data.

The outbreak of the COVID-19 pandemic played a major role in driving the market growth. The explosion of smart devices, the constant rollout of 5G networks, the prevalent implementation of IoT technology, the adoption of Industry 4.0, and the potential of large volumes of data generation by EduTech, HealthTech, FinTech, GamingTech, and media & entertainment, ACES mobility among other industries, are some of the significant factors driving the demand for IoT cloud platforms.

IoT Cloud Platform Market Trends

Rapid Adoption of Smart Connected Devices Across Industries Drives Market Growth

The growth of smart connected devices has led to a rapid increase in the use of Industrial IoT solutions in healthcare, logistics, manufacturing, and other sectors. IIoT applications use machines, connected sensors, and devices to optimize operations, improve productivity, and assist in predictive maintenance. IoT platforms form the backbone of the IIoT ecosystem by collecting real-time data from various sources, analyzing it to gain insights, and generating automated actions based on predefined rules. For instance,

- According to a leading industry analysis, around 47% of energy executives are adopting Internet of Things (IoT) across the sector. Energy data sources include the use of robots (46%) and machines (49%). 45% of energy companies are using IoT to monitor asset performance. 43% of energy companies are using IoT to improve customer experience, and 40% of energy companies report an increase in overall productivity.

- A recent survey by Cognizant found that manufacturing-intensive industries are leading the way in IoT implementation. More than half (53%) of IoT pioneers are from five production-intensive industries: consumer products, manufacturing, life sciences, oil and gas, and utilities.

As more devices connect to the internet, the demand for IoT cloud platforms is expected to increase.

Download Free sample to learn more about this report.

IoT Cloud Platform Market Growth Factors

Proliferation of IoT Devices Backed By Increased Adoption of Advanced Technologies to Boost Market Growth

The exponential increase in the number of connected devices is a primary driver. With the growing number of devices used in various sectors, the requirement for scalable and efficient data processing and storage solutions is on the rise, and that is where IoT cloud platforms play an important role. Additionally, the IoT cloud platforms are often coupled with a plethora of advanced analytics and machine learning capabilities that ensure the better processing and analyzing of the vast data generated by IoT devices for enriching the data network and thereby supporting the enhanced decision-making processes.

By integrating with AI, machine learning, and edge computing, cloud IoT platforms enable faster data processing, thereby reducing latency. Due to this, advanced cloud IoT-based applications are emerging. Additionally, the rollout of 5G networks provides the high-speed, low-latency connectivity required for advanced IoT applications. This technological advancement supports more robust and real-time IoT solutions. By leveraging these factors, the cloud IoT market is set to continue its growth trajectory, enabling more sophisticated, scalable, and cost-effective IoT solutions across various industries.

RESTRAINING FACTORS

Lack of Standardization of IoT Protocol Hamper Market Growth

The lack of standardization of IoT protocols is one of the biggest obstacles to the global IoT cloud platform market growth. This creates interoperability that can lead to compatibility issues and limited functionality. Different devices use different protocols, making it challenging to integrate them into a single system. This makes the system complex and difficult to manage. Moreover, it also increases the cost of setting up, maintaining, and updating the system.

IoT Cloud Platform Market Segmentation Analysis

By Service Type Analysis

Increased Number of Connected Devices to Dominate Market Owing to Generate IoT Devices

Based on service type, the market is segmented into application management, device management, and data management.

Among these, device management held the largest market share 42,01% in 2026 due to the increasing number of connected devices across various sectors, such as healthcare, manufacturing, transportation, and smart homes. Additionally, the platform integrates advanced analytics and machine learning capabilities, allowing companies to derive actionable insights from the massive amounts of data generated by IoT devices.

Application management is expected to grow at the highest CAGR during the forecast period. IoT application enablement platforms allow developers to build, deploy, and monitor IoT applications effectively. These platforms allow rapid application development by providing frameworks and tools to collect, process, and evaluate data from connected devices. With capabilities, such as data storage, device connectivity, real-time analytics, and visualization, developers can design unique IoT solutions for specific use cases. Platforms, such as Google Cloud IoT, AWS IoT Core, Microsoft Azure IoT Suite, and IBM Watson IoT Platform, offer comprehensive suites of services that make it easy to build complete IoT applications. In the growing IoT space, application enablement platforms are a significant tool for unlocking the full potential of connected devices and data.

By Cloud Type Analysis

Increased Investment in Public Cloud Infrastructure Contributing to Segmental Growth

Based on the cloud, the market is segmented into public, private, and hybrid.

The public cloud held a major market share 62.62% in 2026 and is expected to grow at the highest rate during the forecast period. The growth of the public cloud is primarily driven by factors, such as ease of flexibility, deployment, and cost-effective pricing structures. Increasing investments in public cloud infrastructure by developed countries, such as Australia, China, the U.S., the U.K., and Canada, are expected to boost the demand for public cloud options in the market. As a result of digital transformation, firms are changing their business models and operations. Public cloud services include a wide range of capabilities, from primary storage, processing, and networking performance to artificial intelligence, natural language processing, and regular office programs.

Private cloud is also growing considerably as communication with industries, external partners, and customers is on the rise, and the private cloud provides an ideal foundation for developing private inter-business networks.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

Rapid Usage of Wireless Devices in Healthcare Industry Contributing to Segmental Growth

Based on end-user, the market is studied into healthcare, IT & telecom, retail & e-commerce, manufacturing, transportation and logistics, automotive, energy and power, and others.

Healthcare held the highest IoT cloud platform market share 24.85% in 2026. The growth of this sector is due to the availability of high-speed cellular networks, the increasing use of embedded sensors, and the use of wireless devices in the healthcare industry. Sensor and device communication enables healthcare companies to manage workflows, improve patient care in real-time, and optimize clinical operations even from remote locations. Hence, healthcare institutions are making great efforts to adopt reliable apps and connected technologies.

BFSI is expected to grow at the highest CAGR during the forecast period. The adoption of IoT in financial services is primarily driven by the rise in financial fraud, which has increased the demand for efficient security systems. The adoption of IoT in the banking and financial services sector is also expected to improve the operational efficiency of the sector, thereby driving segment expansion. Furthermore, the introduction of new IoT solutions integrated into BFSI is expected to create opportunities for market expansion. There has been an upsetting increase in banking and financial fraud in recent years. For instance,

- According to a SEON report, around 36% of financial institutions were affected by card fraud in 2022, representing a 26% increase over the previous year.

REGIONAL INSIGHTS

Geographically, the market is studied across North America, Europe, Asia Pacific, the Middle East & Africa, and South America. They are further categorized into countries.

North America IoT Cloud Platform Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America holds a major IoT cloud platform dominated the market with a valuation of USD 7.89 billion in 2025 and USD 9.78 billion in 2026. as it is likely to benefit from technological advancements and its status as a developed region. The widespread use of IoT-enabled devices, large research and development investments in IoT, and the presence of major market players, such as Google, Amazon Web Services (AWS), IBM, Microsoft, and Cisco Systems, are some of the key factors driving the adoption in the North American market. IoT is a rapidly growing industry in the U.S. Modern U.S. manufacturing facilities rely on new technologies and innovations to produce higher-quality products at lower costs. For instance,The U.S. market is projected to reach USD 5.31 billion by 2026.

- According to the Consumer Technology Association, 791 million connected devices were shipped to the U.S. in 2022.

Europe has the second largest market share. The increasing trend toward cloud-based IoT software, the need for improved supply chain operations and customer relationship management, and advancements in industrial-grade digital products are the major factors contributing to the growth of the IoT market across the region.The UK market is projected to reach USD 1.49 billion by 2026, while the Germany market is projected to reach USD 1.39 billion by 2026.

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. As industries across the market continue to transition from traditional to digital ecosystems, a massive need for connected ecosystems is emerging, driving demand for IoT cloud platforms. For instance,The Japan market is projected to reach USD 2.48 billion by 2026, the China market is projected to reach USD 2.03 billion by 2026, and the India market is projected to reach USD 1.37 billion by 2026.

- In January 2023, Schlag, a leading home security and access solutions provider, launched the Schlage Encode Smart Wi-Fi Lever. This Wi-Fi-enabled smart lock seamlessly integrates with other smart home technologies such as Amazon Alexa and Google Home.

South America and the Middle East & Africa have become increasingly popular in recent years. Increasing urbanization, the use of advanced technologies in industries, and improving economies are the major factors driving the market's growth. Moreover, the growing demand for remote monitoring and real-time streaming solutions for continuous control of equipment and site safety and operational efficiency, especially in sectors, such as agriculture, logistics, transportation, and manufacturing, is also supporting the growth of the IoT market in South America and the Middle East & Africa.

KEY INDUSTRY PLAYERS

Key Players to Emphasize on IoT Cloud Platform to Strengthen their Positions

The prominent players in the market, such as Google LLC, AWS, Inc., IBM Corp., and Oracle Corp., are expected to dominate the market. These players are focused on offering IoT Cloud Platform options to cater to the changing user requirements. Similarly, these players are adopting various strategies, such as product launches and partnerships, to continue their dominance in the upcoming years.

List of Top IoT Cloud Platform Companies:

- Google LLC (U.S.)

- Amazon Web Services (U.S.)

- IBM Corporation (U.S.)

- Cisco Systems, Inc. (U.S.)

- Oracle Corporation (U.S.)

- PTC (U.S.)

- ThingBoard (U.S.)

- TagoIO, Inc. (U.S.)

- Salesforce, Inc. (U.S.)

- Particle Industries, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: VVDN Technologies has partnered with Google to launch its innovative Internet of Things (IoT) cloud platform called Intelligent Cloud Engine (ICE). This platform provides data aggregation, analytics, visualization, and management.

- April 2024: Since 2018, Palo Alto Networks has extended its partnership with Google Cloud. As a part of this longstanding partnership, Palo Alto Networks' Network Security platform and an AI-driven security operations platform enable the company to address complex security challenges using tools powered by Google Cloud’s generative AI.

- January 2024: Arduino, an open-source hardware and software company, has introduced the Arduino IoT Cloud Remote app as part of its Arduino Cloud overhaul. This app will enable the users to receive real-time alerts on their mobile devices directly from their connected Arduino Cloud devices and services.

- August 2023: A secure parking solution provider has partnered with Microsoft to develop a solution called "Voyager." This solution has Microsoft Dynamics 365 and Microsoft Azure as its core backend technology and is integrated with over 3,000 devices, including IoT edge controllers, boom gates, entry/exit terminals, and roller doors.

- March 2023: Goliath, an IoT Cloud services provider, has partnered with Nordic Semiconductor. The partnership aims to integrate Golioth’s Cloud solution with Nordic’s wireless IoT products. This enabled Golioth’s users to streamline the entire process, from concept to managing IoT end devices in the field.

REPORT COVERAGE

The study on the market includes prominent areas globally to help the user get a better knowledge of the industry. Furthermore, the research provides insights into the most recent market trends and an analysis of technologies that are being adopted globally. It also emphasizes some of the growth-stimulating factors and restrictions, allowing the reader to obtain a thorough understanding of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 21.90% from 2026 to 2034 |

|

Segmentation |

By Service Type

By Cloud Type

By End-User

By Region

|

Frequently Asked Questions

The market is projected to reach USD 132.98 billion by 2034.

In 2025, the market stood at USD 22.04 billion.

The market is projected to record a CAGR of 21.90% during the forecast period of 2026-2036.

By industry, the healthcare is likely to lead the market.

Proliferation of IoT devices backed by increased adoption of advanced technologies to boost market growth

Google LLC, Cisco Systems, Inc., and IBM Corporation are the top players in the market.

North America is expected to hold the highest market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us