IoT in Retail Market Size, Share & Industry Analysis, By Component (Hardware, Platform, and Services), By Application (Operations Management, Customer Experience Optimization, Asset Management, and Advertising & Marketing), By Deployment Mode (On-premises and Cloud), By Retail Format (Brick-and-Mortar Stores and E-commerce), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

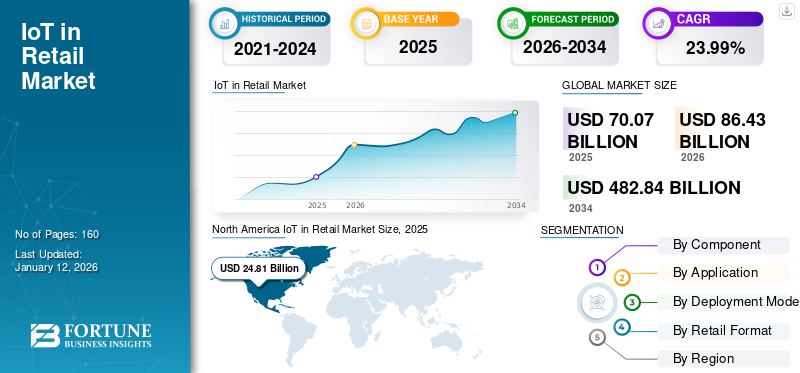

The global IoT in retail market size was valued at USD 70.07 billion in 2025. and is projected to grow from USD 86.43 billion in 2026 to USD 482.84 billion by 2034, exhibiting a CAGR of 23.99% during the forecast period. North America dominated the global market with a share of 35.4% in 2025.

The Internet of Things (IoT) is a network of interrelated devices that are embedded with sensors, software, and network connectivity. IoT helps retailers in accessing large volumes of data without requiring human-to-computer or human-to-human interactions. Retail organizations are increasingly using Internet of Things (IoT) for customer experience optimization, asset management, operations management, and advertising & marketing.

The retail sector is one of the largest sectors that have direct engagement with potential customers. Hence, a robust retail customer engagement strategy is important for continued success. Presently, retail stores are increasingly deploying advanced technologies such as cloud, RFID, beacons, smart shelves, and other connected technologies to improve shopping experiences for customers. For instance,

- In 2023, Lindex, a Scandinavian fashion retailer with around 440 stores in 18 markets, selected Nedap N.V., a multinational technology firm for large-scale RFID deployment. Lindex aimed to enhance inventory management and the customer experience by deploying RFID technology across its stores.

- In 2022, Lowe's, an American retail company specializing in home improvement deployed low-cost RFID chips and IoT sensors to fight retail theft. Named Project Unlock, the new technology features two interconnected solutions: point-of-sale product activation and transparent purchase record for authenticating and validating product ownership.

During the COVID-19 pandemic, lucrative opportunities arose with the benefits of IoT. Amidst the outbreak, businesses such as brick-and-mortar stores were forced to shut down or reduce their normal operating hours to limit the spread of the virus. However, as the pandemic continued to disrupt the business, supermarkets adopted IoT technologies to help prevent the spread of the virus, keep shelves stocked with products, and enhance the overall customer experience. For instance,

- In 2020, AT&T, an American Telecommunications company and Brain Corporation, an autonomous technology company developed autonomous cleaning robots to help retailers clean, sanitize surfaces, and monitor in-store activities.

IMPACT OF GENERATIVE AI

Convergence of IoT and AI to Fuel Market Growth

The use of Artificial Intelligence (AI) in retail involves automation and advanced technologies such as machine learning (ML) to offer highly personalized shopping experiences to customers. AI can be used in both physical and digital stores. According to the NVIDIA Corporation's “State of AI in Retail and CPG: 2024 Trends”, 69% of respondents noted a significant increase in annual revenue due to AI adoption and around 72% of retailers utilizing AI registered a remarkable drop in operating costs.

The convergence of AI and IoT in retail can help optimize store layout by training an algorithm with in-store customers and other business insights. This allows retailers to predict outcomes such as the likelihood of customers purchasing items placed together, enhancing the shopping experience. The rapid advancement in GenAI is anticipated to offer ample opportunities to the Internet of Things in retail market players.

IoT in Retail Market Trends

Rapid Technological Advancements in RFID Tags and Edge Computing to Augment Market Growth

Ongoing developments in Radio-frequency identification (RFID) technology are enabling retailers to detect and prevent retail theft, improve the checkout process, analyze in-store traffic patterns, and boost in-store inventory accuracy. In 2021, a study by Accenture showed that the adoption of RFID technology in the North American retail industry was rapidly growing, with 93% of store chains stating that they are employing RFID. More advanced and affordable RFID tags are enabling various capabilities in retail and warehouse settings. Leading companies are increasingly focusing on the development of advanced RFID tags with enhanced usability and strong identification capabilities. For instance,

- In 2022, Zebra Technologies Corporation, a provider of advanced digital solutions, hardware, and software unveiled easy-to-deploy and highly precise RFID portals. These deployments cater to asset management, traceability, and compliance applications in various settings including retail backrooms.

In addition, the tremendous progress in edge computing in the past few years is significantly benefitting IoT applications by moving computing processes closer to the IoT device. This approach decreases network traffic and latency, enabling real-time consumer insights. All these ongoing trends are expected to augment IoT in retail market growth during the forecast period.

Download Free sample to learn more about this report.

IoT in Retail Market Growth Factors

Increasing Importance of Offering Personalized & Interactive Shopping Experiences to Augment Market Growth

Retail personalization involves offering every consumer a unique personalized experience across every single touchpoint and channel, based on proprietary data and real-time insights generated from IoT devices. The retail environment worldwide is highly competitive due to pricing pressure from discounters and market disruption from emerging players. Today’s customers expect a personalized experience when they are shopping. According to the "The State of Personalization 2022" report by Twilio Inc., around 49% of customers noted that they will probably become repeat buyers if they get a personalized shopping experience from a retail brand. Additionally, about 80% of business leaders stated consumers spend more when their experience is highly personalized. Hence, to maintain a competitive edge, businesses are increasingly investing in IoT technologies in retail to differentiate themselves and enhance the shopping experience.

RESTRAINING FACTORS

Data Security Concerns and Lack of Interoperability to Limit the Market Growth

IoT devices are connected to the internet, which can be vulnerable to cyber threats and privacy breaches. Security concerns related to data protection and unauthorized access create concerns among retailers, limiting adoption. Another challenge lies in the compatibility and interoperability among devices from different manufacturers. This challenge makes it difficult for IoT devices to communicate efficiently. Without standardized protocols and frameworks, compatibility issues emerge, restricting the ability to produce cohesive IoT solutions. Moreover, the deployment of advanced technologies can be expensive for small-scale retailers. All these factors are expected to hinder the IoT in retail market growth.

IoT in Retail Market Segmentation Analysis

By Component Analysis

Increasing Need for Building a Robust IoT Implementation Strategy to Propel the Service Segment Growth

Based on the component, the market for IoT in retail is divided into hardware, platform, and services.

The services segment is anticipated to grow with the highest CAGR during the forecast period. IoT services help retailers better understand IoT technologies, examine potential use cases, and develop an implementation strategy. IoT services offer the design, development, and integration of IoT frameworks for a smart connected devices ecosystem for business. In addition, IoT consultants guide businesses through the development journey and assist in implementing customized IoT solutions. The Hardware segment is expected to lead the market, contributing 42.92% globally in 2026.

The services segment is further divided into professional services and managed services. Managed services are likely to show the highest growth rate during the forecast period, enabling businesses to focus on core objectives and eliminate the cost of hiring and training new IT staff. Owing to these benefits, retailers are increasingly opting for outsourced solutions that offer end-to-end management of IoT infrastructure, devices, and applications.

The hardware held the highest IoT in retail market share in 2024 due to the significant decrease in the cost of IoT hardware components, making it more accessible to businesses. IoT hardware encompasses a wide range of various devices that are fully connected to each other and is further divides into RFID, sensors, beacon, and others. The sensors segment is expected to show the highest growth rate during the forecast period. The IoT sensors play a crucial role in IoT ecosystem by enabling the collection and transmission of real time data. Some common types of IoT sensors are temperature sensors, motion sensors, humidity sensors, pressure sensors, smoke sensors, and more. Different type of applications require different type of IoT sensors. For instance, temperature sensors are crucial in applications where careful temperature management is required. This includes retail settings where frozen food and dairy must be kept below certain temperature to avoid degradation and spoilage.

By Application Analysis

Operations Management Holds the Largest Market Share owing to Growing Importance of Real-time Visibility into Inventory Levels

Based on application, the market for IoT in retail is segmented into operations management, customer experience optimization, asset management, and advertising & marketing.

The operations management dominates the market with the largest share in 2024. IoT devices revolutionize operation management by offering real-time visibility into inventory levels. RFID and various sensors enable retailers to automate replenishment processes and lower out-of-stock situations. With accurate inventory data, businesses can optimize their supply chain operations, reduce costs, minimize waste, increase profits, enhance quality, and ensure that highest highest-selling products are always available, boosting customer shopping satisfaction. The Operations Management segment will account for 38.48% market share in 2026.

To know how our report can help streamline your business, Speak to Analyst

The customer experience optimization is expected to show the highest growth rate during the forecast period. Customer satisfaction improvement is pivotal for retailers to boost conversion and foster loyalty. By using IoT technology, businesses can gather crucial, real-time data that helps them to define strategic actions.

By Deployment Mode Analysis

Less Upfront Costs and Versatile Pricing Model to Augment Cloud IoT Deployment

Based on deployment mode, the market for IoT in retail is segmented into on-premises and cloud.

The cloud deployment is likely to show the highest growth rate during the forecast period. Cloud IoT deployment offers numerous benefits to organizations including scalability, cost reduction, and continuous accessibility. With cloud-based deployment, IoT applications can be hosted virtually, which requires no capital expenses and routine data backups. In addition, cloud IoT deployment allows retailers to effortlessly connect with consumers, making it an ideal solution for organizations planning to expand.

The on-premises dominates the market with the largest share. On-premises IoT deployment offers several benefits including security, reliable connectivity, customization, and better control over IoT infrastructure to address specific business needs. The On-premises segment is expected to account for 23.32% of the market in 2026.

By Retail Format Analysis

Thriving E-commerce Sector due to Digitization and Expanding Internet Access to Propel E-commerce Segment Growth

Based on retail format, the market is segmented into brick-and-mortar stores and e-commerce.

E-commerce is poised to show the highest growth rate during the forecast period. The e-commerce sector is growing at an astounding rate across the globe owing to digitization and growing internet penetration. According to various estimates, there are around 12 billion to 24 billion total online stores globally. Owing to the fierce competition, e-commerce businesses are investing more in advanced technologies to improve their services and strengthen their position. IoT helps e-commerce businesses in warehouse automation, inventory management, and last-mile delivery tracking to improve efficiency, reduce costs, and enhance customer satisfaction.

The brick-and-mortar stores dominated the IoT in retail industry with the largest share. IoT enables the modernization of the brick-and-mortar shopping experience. Businesses increasingly use IoT sensors, RFID, and cameras to gain valuable insights from consumer behavior. This data helps retailers make informed decisions and stay ahead of the competitive curve. The Brick-and-Mortar Stores segment is anticipated to hold a dominant market share of 57.08% in 2026.

REGIONAL INSIGHTS

Geographically, the market for IoT in retail is fragmented into five major regions, including North America, South America, Europe, the Middle East & Africa, and the Asia Pacific. They are further categorized into countries.

North America

North America IoT in Retail Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is expected to hold the largest market share owing to the presence of major players, increasing adoption of advanced technologies in the retail sector, and tech-savvy consumer base. The U.S. has maintained its leadership in the region owing to a mature e-commerce ecosystem. The e-commerce growth in the U.S. is on a strong upward trajectory, driven by e-commerce’s convenience and major retail brands focusing to become omnichannel retailers. For instance, Walmart, Inc., one of the major American retail corporations continues to diversify its revenue stream by focusing on an omnichannel strategy. The company invested around USD 7.2 billion in supply chain and omnichannel strategy in 2022. Walmart monetizes consumer data using a demand-side platform that links brands to customers using the retailer’s historical purchasing data, predictive audience segments, and consumer shopping behavior across various channels. The U.S. market is estimated to reach USD 19.46 billion by 2026.

Asia Pacific

In the Asia Pacific region, the market is expected to show the highest growth rate during the forecast period due to the rising cloud adoption, rapid 5G rollout, and rapid urbanization. Rising disposable income, a fast-growing middle class, and changing customer behavior contribute to retail industry growth. This, in turn, increases the investment by retailers in technological innovations and a customer-centric approach. The Japan market is forecast to reach USD 3.1 billion by 2026. The China market is poised to reach USD 9.51 billion by 2026. The India market is set to reach USD 4.95 billion by 2026.

Europe

In Europe, market growth is majorly driven by the increasing adoption of IoT solutions that prioritize security and consumer trust. Retailers in Europe majorly use IoT technology for supply chain optimization, enhanced customer engagement, and sustainability initiatives. The UK market is expected to reach USD 3.31 billion by 2026. The Germany market is anticipated to reach USD 4.02 billion by 2026.

Rest of The World

In South America, the telecom sector growth as well as rapid urbanization fuels the adoption of IoT in retail. Brazil is expected to lead the market in this region on account of the increasing internet penetration and growing consumer demand for personalized shopping experiences.

The Middle East & Africa (MEA) region shows significant adoption of IoT in retail due to increasing government initiatives to boost digital infrastructure, innovation in the retail sector, and the presence of developing economies.

Key Industry Players

Key Players are Focused on Strengthening their Market Positions with Continuous Developments

The global market is consolidated by leading players, such as Microsoft, Amazon Web Services, Inc., Broadcom, NXP Semiconductors, AT&T, Telit, AVERY DENNISON CORPORATION, Zebra Technologies Corp., OMRON Corporation, Qualcomm Technologies, Inc., and others.

These major market players are expanding their operations by adopting strategies, such as mergers & acquisitions, product launches, collaborations, and partnerships. For instance,

- In April 2023, Qualcomm Technologies, Inc., an American multinational company, announced the introduction of advanced IoT solutions QCS8550, QCM8550, QCS4490, and QCM4490 processors for various IoT use cases in retail, industrial automation, and others. These processors are built for performance-intensive IoT applications.

List of Top IoT in Retail Companies

- Microsoft (U.S)

- Amazon Web Services, Inc. (U.S.)

- Broadcom (U.S.)

- NXP Semiconductors (Netherlands)

- AT&T (U.S.)

- Telit (U.S.)

- AVERY DENNISON CORPORATION (U.S.)

- Zebra Technologies Corp. (U.S.)

- OMRON Corporation (Japan)

- Qualcomm Technologies, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- January 2024: Wiliot, an IoT startup company, announced the launch of an ambient IoT platform for packaging. This IoT enabled platform with RFID technologies connect the digital world with the physical world using the company’s cloud-based IoT pixels, self-powered computing devices, and smart tags.

- January 2024: Optimum Retailing, an in-store experience management solution provider, announced advanced RFID technology that enables retailers to efficiently monitor in-store product displays and comply with approved planograms.

- July 2023: Verizon, a telecommunication company, unveiled a global IoT connectivity platform to help businesses deploy and centrally manage devices across international borders. This platform is suitable for companies aiming to expand their IoT operations globally.

- November 2022: Impinj, Inc., a manufacturer of RFID, launched two new RFID tags, such as the Impinj M780 and M781 RAIN RFID tags to enhance system readability and accuracy.

- January 2022: Scandit, a smart data capture company launched “ShelfView”, an advanced data capture and analytics solution for retailers. ShelfView is based on advanced computer vision technology that captures and processes data, such as pricing and inventory locations to drive cost optimization.

REPORT COVERAGE

The IoT in retail market report offers qualitative and quantitative insights into the market and a detailed analysis of the size and growth rate for all possible segments in the market. It also provides an elaborative analysis of market dynamics, emerging trends, and the competitive landscape. The report also offers key insights, such as the implementation of automation in specific market segments, recent developments, business strategies of leading market players such as partnerships, mergers, funding, acquisitions, consolidated SWOT analysis of key players, macro and micro economic indicators, and major industry trends. This detailed analysis provides a comprehensive view of the market and its potential for growth and development.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021 - 2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026 – 2034 |

|

Historical Period |

2021 - 2024 |

|

Growth Rate |

CAGR of 23.99% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Component

By Application

By Deployment Mode

By Retail Format

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market is predicted to reach USD 482.84 billion by 2034.

In 2025, the market value stood at USD 70.07 billion.

The market is projected to grow at a CAGR of 23.99% during the forecast period (2026 – 2034).

Hardware segment held the highest market with a share of 42.92% in 2026.

Increasing importance of offering personalized & interactive shopping experiences is a key factor driving market growth.

Some of the top players in the market are Microsoft, Amazon Web Services, Inc., Broadcom, and others.

North America is likely to hold the highest marketwith a share of 35.40% in 2025, due to the presence of major players and increased adoption of advanced technologies in retail sector.

By application, customer experience optimization is expected to show the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us