Landing String Equipment Market Size, Share & Industry Analysis, By Application (Shallow and Deepwater and Ultra-Deepwater), By End-user (Oil & Gas Companies, Oilfield Service Companies, and Research & Development Institutions), and Regional Forecast, 2026-2034

Landing String Equipment Market Size

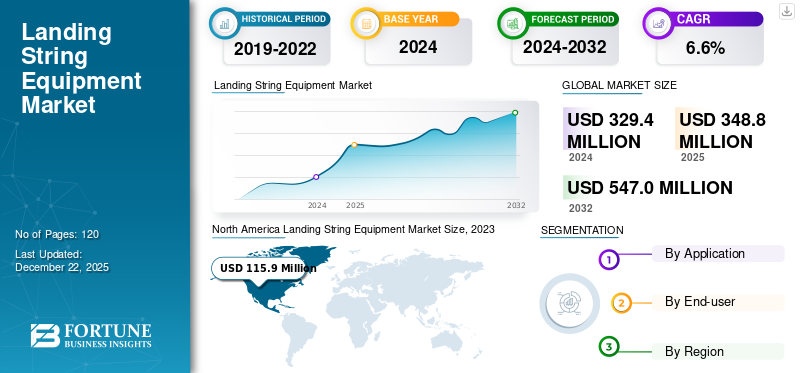

The global landing string equipment market size was valued at USD 348.80 million in 2025 and is projected to grow from USD 369.90 Million in 2026 to USD 634.50 million by 2034, exhibiting a CAGR of 7% during the forecast period. North America dominated the landing string equipment market with a share of 36.50% in 2025.

A landing string is an important component in offshore oil & gas operations, used to run a Subsea Test Tree for well test completion operations. It typically contains equipment, such as a subsea test tree, a retainer valve, and a lubricator valve. The components of the landing string system are universal and compact, enabling them to be scaled up or down as per the configuration and integrated with other third-party equipment. Landing string systems help oil & gas companies improve cost, efficiency, and safety for all well control applications.

The growing demand for landing string equipment is mainly attributed to the rapid offshore exploration and production, technological advancement in landing string technologies, rising demand for energy, and increasing investment in offshore oil & gas projects. In 2023, Schlumberger N.V., a company that provides oil services and equipment, said that between 2022-2025, offshore explorations investment decisions to USD 500 million, a significant increase of 90% compared to the 2016-2019 period. The increasing investment in offshore oil & gas explorations to increase well construction, production systems, and reservoir performance activities. In recent years, several oil & gas operators announced their investment decisions in offshore oil & gas projects.

For instance,

- In April 2024, DNO ASA, a Norway-based oil & gas operator announced its final investment decision for the Brasse field, a subsea oil development field.

Such growing investments worldwide in offshore oil & gas projects are anticipated to offer lucrative growth opportunities to the landing string market during the forecast period.

The COVID-19 outbreak had a negative impact on the market due to supply chain disruptions, project delays, and cancellations. Many oil & gas explorations and production projects were delayed or halted during the outbreak due to economic fluctuations. This, in turn, reduced the demand for landing string equipment.

Landing String Equipment Market Trends

Growth of Deepwater and Ultra-Deepwater Drilling to Augment Market Growth

In the past several years, the projects in deepwater and ultra-deepwater have increased significantly owing to the depletion of onshore and shallow water reserves, rapid technological advancements, increased investments, and high energy demands across the world. In 2023, the global energy demand increased significantly by 2.2%, faster than its average growth rate of 1.5% per year between 2010-2019. Especially in China and India, energy consumption surged by 6.6% and 5.1%, respectively. This growing energy demand augments the exploration and development of deepwater and ultra-deepwater reserves.

Landing string systems are important for deepwater and ultra-deepwater operations owing to their unique challenges. This equipment is equipped with safety features that are paramount in these environments. Its flexible and modular design also helps with rig time savings during handling operations.

Download Free sample to learn more about this report.

Landing String Equipment Market Growth Factors

Increasing Investment in Offshore Oil & Gas Projects to Drive Market Growth

Oil & gas companies and governments are increasingly focusing on deepwater and ultra-deepwater exploration as shallow water and onshore oil and gas resources become more depleted, driving demand for landing string systems. For instance,

- In April 2024, Exxon Mobil Corporation, an energy provider and chemical manufacturer announced a final investment decision for the offshore development of the Whiptail oil & gas project in Guyana.

- In March 2023, Shell Plc, an energy and petrochemical company, made a final investment decision for the Dover deepwater project within Mississippi Canyon. This project is to be developed as a subsea tie-back to Shell’s Appomattox production facility and is expected to commence in late 2024 or early 2025.

In addition, major oil & gas companies are spending significantly on offshore projects to maintain competitive edge and secure future reserves. All these factors are expected to drive the landing string equipment market growth.

RESTRAINING FACTORS

Economic Slowdowns Coupled with Regulatory Concerns to Hinder Market Growth

The oil and gas industry is highly sensitive to the economic downturns. During periods of economic slowdowns, expenditure on offshore oil & gas exploration activities often slows down, resulting in reduced demand for landing string systems. In addition, the oil & gas sector is monitored by strict regulatory frameworks to address environmental concerns. The public opposition due to the environmental impact of offshore drilling may result in a delay in project completion, affecting landing string system demand.

Landing String Equipment Market Segmentation Analysis

By Application Analysis

Increasing Ultra-Deepawater Exploration to Fuel Growth for Segment

Based on the application, the market is segmented into shallow and deepwater and ultra-deepwater.

The ultra-deepwater segment is predicted to grow with the highest CAGR during the forecast period due to the rapid advancements in drilling technology afloating production and drilling units. In recent years, the production of ultra-deepwater operations has grown significantly. The major ultra-deepwater exploration occurs in the U.S., Brazil, Norway, and Angola. These nations have realized a rising share of crude oil production from ultra-deepwater operations. The landing string system plays a crucial role in ultra-deepwater exploration by maintaining well integrity, improving the accuracy of drilling, and compliance with regulatory standards.

The shallow and deepwater segment holds the highest landing string equipment market share of 64.64% in 2026 during the forecast period. Shallow water projects are still preferred by many oil-producing nations due to the high cost of ultra-deepwater exploration projects. This segment captured 65% of the market share in 2024.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Rising Importance of Operational Efficiency and Safety Assurance to Augment Market Growth for Oil & Gas Companies

Based on the end-user, the market is divided into oil & gas companies, oilfield service companies, and research & development institutions.

The oil & gas companies segment is predicted to hold the highest market share of 61.26% in 2026. The landing string system improves the accuracy of drilling operations, minimizing the risk associated with the re-drilling. This equipment is also crucial for maintaining well pressure and avoiding blowouts. This segment is expected to dominate the market with a share of 62% in 2025.

The oilfield service companies segment to grow with the highest CAGR of 8% during the forecast period (2025-2032). These companies increasingly use advanced equipment, such as landing string to maintain a competitive edge and offer superior services to their clients.

REGIONAL INSIGHTS

Geographically, the market is studied across five major regions, including North America, South America, Europe, the Middle East & Africa, and Asia Pacific. They are further categorized into countries.

North America Landing String Equipment Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America

North America accounted for the largest market share valued at USD 329.4 million in 2023 and USD 121.5 million owing to rapid technological advancements, strict regulatory compliance, increased offshore exploration and production activities, and investments by major oil & gas companies in offshore projects. The region has the highest number of offshore rigs worldwide. In the U.S., there are a total of 590 rigs. Of these, 569 are land rigs, and 21 are offshore rigs. In addition, there is a rapid rise in deepwater drilling projects in the U.S., driving the demand for landing string systems capable of handling advanced exploration projects. The U.S. market is projected to hold USD 64.28 million in 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is the third largest market likely to be worth USD 59.87 million in 2025. Asia Pacific is predicted to show the highest growth rate during the forecast period, augmented by the increasing energy demand, aging offshore infrastructure, and increased investments in the oil & gas sector. According to the International Energy Agency (IEA), the average energy demand in Southeast Asia has grown by 3% every year in the last two decades and is expected to continue by 2030. The Chinese market is expected to grow with a valuation of USD 28.84 million in 2026. In addition, the Asia Pacific region accounts for a third of the global oil demand and a quarter of the gas demand. The growing energy demand augments offshore drilling projects, propelling the landing string equipment market. India is set to reach USD 15.57 million in 2026, while ASEAN is expected to be worth USD 12.3 million in the same year.

Middle East & Africa

The Middle East & Africa is the second largest market poised to hold USD 92.7 million in 2025, registering a considerable CAGR of 8% during the forecast period (2025-2032). The Middle East & Africa market is primarily driven by the presence of vast hydrocarbon reserves, offshore drilling expansion, and robust international investments. According to the Organization of the Petroleum Exporting Countries (OPEC), in 2023, around 79.5% of the world’s proven oil reserves were located in OPEC countries, including Saudi Arabia (21.5%), Iran (16.8%), Iraq (11.7%), and United Arab Emirates (9.1%). The presence of a large number of oil and gas reserves results in increased exploration activity that requires landing string equipment. The GCC market is poised to stand at USD 55.1 million in 2025.

In the South American region, investments in offshore projects and energy demand are anticipated to offer lucrative growth opportunities.

Europe

Europe is the fourth largest market estimated to be valued at USD 43.8 million in 2025. In Europe, the growing North Sea activities, coupled with technological advancements in landing string systems, expanded market growth. The U.K. market continues to grow, projected to reach a market value of USD 9.78 million in 2026. while the Germany market is projected to reach USD 1.68 million by 2026. Russia is set to be valued at USD 3.8 million in 2025, while Norway is expected to hold USD 8.5 million in the same year.

KEY INDUSTRY PLAYERS

Key Players Focused on Strengthening their Market Position with Continuous Developments

The global landing string equipment market key players include Expro Group Holdings N.V., Nov, Inc., TechnipFMC plc, SLB, Aker Solutions, ExPert E&P Companies, LLC., Interventek Subsea Engineering, Hilong Holding Limited, Yantai Enerserva Machinery Co., Ltd., and Optime Subsea, among others. These companies in the market are expanding their operations by adopting strategies such as mergers, acquisitions, product launches, collaborations, and partnerships.

List of Top Landing String Equipment Companies:

- Expro Group Holdings N.V. (U.S.)

- Nov, Inc. (U.S.)

- TechnipFMC plc (U.K.)

- SLB (U.S.)

- Aker Solutions (Norway)

- ExPert E&P Companies, LLC. (U.S.)

- Interventek Subsea Engineering (Scotland)

- Hilong Holding Limited (China)

- Yantai Enerserva Machinery Co., Ltd. (China)

- Optime Subsea (Norway)

KEY INDUSTRY DEVELOPMENTS:

- February 2023: Optime Subsea, a provider of subsea solutions, signed an agreement with Wintershall Holding GmbH to rent three landing string systems and two wireless electric subsea control and intervention systems (eSCILS).

- October 2021: Interventek Subsea Engineering, a subsea engineering company, announced the launch of Revolution-7 Subsea Landing String. This landing string equipment is a 7-inch nominal and 10,000psi rated system equipped with Interventek’s Revolution safety valve. It also includes PowerPlus technology, which arranges locally integrated gas-accumulated power source that offers valve actuation under a second.

- October 2021: SLB, also known as Schlumberger and Nov, Inc. (formerly known as National Oilwell Varco), an oilfield service company announced a strategic partnership to accelerate automated drilling solutions by oil & gas companies and contractors.

- April 2021: Halliburton Company, an oil services company, and Optime Subsea announced the strategic partnership to apply Optime’s remotely operated controls system to Halliburton’s completion landing string services.

REPORT COVERAGE

The report offers qualitative and quantitative insights into the market and a detailed analysis of the size & growth rate for all possible segments. It also provides an elaborative analysis of market dynamics, emerging trends, and the competitive landscape. The report offers key insights, such as the implementation of automation in specific market segments, recent industry developments, such as partnerships, mergers, funding, acquisitions, consolidated SWOT analysis of key players, business strategies of leading market players, macro & micro-economic indicators, and major industry trends. This detailed analysis provides a comprehensive view of the market and its potential for growth and development.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021 – 2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026 – 2034 |

|

Historical Period |

2021 – 2024 |

|

Growth Rate |

CAGR of 7% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Application, End-user, and Region |

|

Segmentation |

By Application

By End-user

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market is predicted to record a valuation of USD 634.50 million by 2034.

In 2025, the market value stood at USD 348.80 million.

The market is projected to record a CAGR of 7% during the forecast period.

Shallow and deepwater is the leading application segment in the market.

Rapid technological advancements, increasing automation in the oil & gas sector, and growing offshore oil & gas exploration are expected to drive the market growth.

Some of the top players in the market are Expro Group Holdings N.V., Nov, Inc., TechnipFMC plc, SLB, and others.

Asia Pacific is expected to show the highest CAGR due to the rapid infrastructure growth across this region.

By end-user, the oilfield service companies segment is expected to show the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us