LED Lighting Market Size, Share & Industry Analysis By LED Type (Traditional LEDs, SMD LEDs, High-Power LEDs, RGB LEDs, UV/IR LEDs, OLEDs, Miniature LEDs, and Chip-On-Board LEDs), By Application (Display & Signage Applications, Illumination/Lighting Applications, Specialty, Scientific and Communication Applications, and Security Applications), By Industry (Consumer Electronics, Automotive, Agriculture & Horticulture, Industrial Equipment, Highway & Roads and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

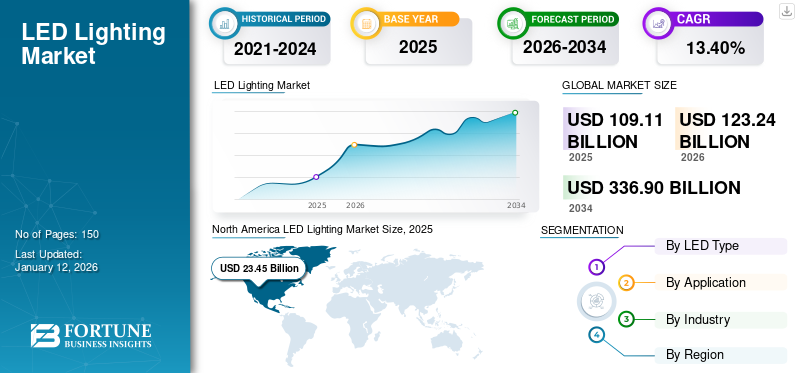

The global LED lighting market size was valued at USD 109.11 billion in 2025 and is projected to grow from USD 123.24 billion in 2026 to USD 336.90 billion by 2034, exhibiting a CAGR of 13.40% during the forecast period. North America dominated the LED lighting market with a share of 21.50% in 2024. The market growth is driven by rising demand for energy-efficient lighting, government incentives, AI integration, and adoption in sectors like automotive and consumer electronics. Urban infrastructure upgrades, sustainability goals, and ongoing R&D investments further fuel the expansion of advanced LED solutions globally.

LEDs are semiconductor devices that emit light when an electric current passes through them. LED lights are being increasingly adopted across the globe in various sectors as they are more energy-efficient compared to traditional incandescent and fluorescent lights. They have significantly longer lifespans, often lasting up to 25,000 hours or more, compared to traditional lights. Also, they are more environmentally friendly as they do not contain mercury elements. For instance,

- In March 2023: Syska Group introduced all-new LED track lights. These lights aim at creating ambient and luminous illumination by making them ideal for generating a radiant ambiance in any part. These lighting systems offer a cost effective and energy-efficient alternative to out-of-date lighting solutions.

Global LED Lighting Market Overview

Market Size:

- 2025 Value: USD 109.11 billion

- 2026 Value: USD 123.24 billion

- 2034 Forecast Value: USD 336.90 billion, with a CAGR of 13.40% from 2026–2034

Market Share:

- Regional Leader: North America held approximately 21.50% of the market in 2025

- Fastest‑Growing Region: Asia Pacific is expected to grow the fastest through the forecast period

- End‑User Leader: Within industries, consumer electronics captured the largest share in 2024

- Fastest‑Growing Segment by Application: The display & signage segment is expected to record the highest CAGR

- Leading LED Type:SMD LEDs held the largest market share in 2024; OLEDs projected to grow the fastest

Industry Trends:

- Generative AI Integration: Smart lighting solutions optimized with AI sensors and predictive maintenance

- Energy-Efficient Lighting Surge: LED adoption accelerated by eco‑friendly and energy-saving initiatives

- Urban and Infrastructure Upgrades: Strong deployment of LED streetlights and smart city lighting

- R&D Focus on OLED and Advanced LEDs: Innovations in OLED and miniature LEDs driving future use

Driving Factors:

- Energy Efficiency & Sustainability: LED lighting offers lower consumption and longer lifespan

- Supportive Government Policies: Incentives, energy mandates, and rebates encourage LED adoption

- Wide Industry Use Cases: LEDs are increasingly used in automotive, horticulture, industrial equipment, highways, signage, and more

The impact of COVID-19 pandemic had several significant impacts on the LED market, ranging from disruptions in the supply chain to shifts in market demand and technological advancements. Lockdowns and restrictions, particularly in major manufacturing hubs such as China, led to factory shutdowns and production delays. This affected the availability of LED components and finished products.

IMPACT OF GENERATIVE AI

Growing Adoption of Generative AI in Lighting Solutions to Drive Market Demand

The implementation of AI in LED lighting is increasing, driven by advancements in technology and the demand for smarter, more efficient lighting solutions. AI algorithms can optimize lighting usage based on real-time data, thereby reducing energy consumption. Smart sensors and AI can adjust lighting levels based on occupancy, daylight availability, thereby ensuring that lights are only used when needed. AI can analyze data from these systems to predict when maintenance is needed, which reduces downtime and extends the lifespan of lighting fixtures. This proactive approach helps avoid sudden failures and reduces maintenance costs. Thus, the implementation of predictive maintenance aids in reducing time errors. For instance,

- In April 2024, Lepro, a provider of AI lighting innovations, introduced its AI-generated LightGPM technology. The new technology offers smart lights that adapt to emotions and commands, thereby tailoring the slighting effects to an individual‘s moods with unparalleled precision. The introduction of this technology further increases versatility, enabling mood and scene adjustments for advanced lighting solutions.

LED Lighting Market Trends

Increasing use of Energy-efficient Lighting Solutions to Boost Product Demand

The LED works as an energy-efficient lighting solution that is poised to get a favorable boost from the growing prevalence of environment friendly lighting options. The global focus on energy conservation and efficiency has catalyzed the widespread integration of such systems, contributing significantly to the global mission of energy conservation. For these purposes, a rapid and extensive implementation of LED systems was carried out in various locations under the guidance of property managers. This transformative technology has the potential to revolutionize the future of lighting, as ENERGY STAR-certified home LED light bulbs use 75% less energy and offer 25% longer life compared to traditional light bulbs. For instance,

- In March 2024, Cushman & Wakefield, a commercial real estate services firm, received an Energy Star Partner of the Year 2024 from the U.S. Environmental Protection Agency (EPA). The organization is committed to empowering its customers to achieve their ambitious goals and leveraging expertise to operate buildings that contribute entirely to the environment.

Download Free sample to learn more about this report.

LED Lighting Market Growth Factors

Increasing Government Regulations and Incentives for Energy-efficient LED Lighting Solutions to Drive Market Growth

Many governments worldwide have introduced stringent energy efficiency standards and regulations, which requires the gradual phasing out of inefficient lighting technologies and adoption of energy-efficient alternatives, such as LEDs. In addition to regulations, governments are also offering various incentives, including rebates and tax credits, to encourage consumers and businesses to switch to LED lights. These incentives help reduce the upfront cost of LED fixtures and act as a strong motivator for adoption, driving market growth and accelerating the transition toward more sustainable lighting solutions. Moreover, as demand increases, manufacturers are investing in R&D to produce more efficient and cost-effective LED solutions, further driving market growth. For instance,

- In January 2022: The Unnat Jyoti by Affordable LEDs (UJALA) Program circulated 360 million LED bulbs, equivalent to over 47 billion kWh. Installation of these LEDs resulted in a decrease of 37 million tons of CO2 emissions annually. To initiate the scheme, the UJALA vision is expected to reduce the national energy consumption by improving the market recognition of energy-saving LED bulbs.

RESTRAINING FACTORS

Higher Initial Deployment Costs of LED Lighting Systems May Hinder Market Growth

In recent years, LED systems have experienced a significant surge in their level of recognition. However, the primary cost related to purchasing a single unit of these systems surpasses that of the traditional CFL lighting systems presently available. The components that comprise these systems, including transmitters, diodes, and capacitors, involve considerable costs, thereby hiking the original retail price of the complete system. In addition, the replacement of current lighting systems with LED alternatives and installation of the latest LED lights pose affordability challenges for suburban consumers. This will ultimately hamper the progress of the global market. Therefore, the higher investment involved in these systems will slow the LED lighting market growth.

LED Lighting Market Segmentation Analysis

By LED Type Analysis

Increasing Adoption of SMD LEDs in Urban Areas for Street Lights Propel Market Growth

On the basis of LED type, the market is categorized into traditional LEDs, SMD LEDs, High-Power LEDs, RGB LEDs, UV/IR LEDs, OLEDs, Miniature LEDs, and Chip-on-Board LEDs.

The SMD LEDs segment held the largest market share with a share of 21.49% in 2026 as they are small and compact, which allows for versatile design and easy integration into different LED lighting products and fixtures. They provide uniform and consistent light distribution, enhancing visibility and safety. This is particularly important for street lighting and public spaces in urban areas. Hence, this factor promotes the segment’s growth.

The OLEDs segment is expected to record the highest CAGR during the forecast period. OLED displays provide exceptional contrast ratios, deeper blacks, and vibrant colors, leading to superior image quality. The fast response time of OLEDs reduces motion blur, enhancing the viewing experience for fast-paced content, such as sports and action movies. This is a key selling point in markets with high consumption of multimedia content. Thus, this factor will boost the growth of the segment.

By Application Analysis

Rising Adoption of Illumination LEDs in Various Sectors to Boost Segment’s Growth

On the basis of application, the market is categorized into display & signage applications, illumination/lighting applications, specialty, scientific & communication, and security applications.

The illumination/lighting applications segment held the largest LED lighting market with a share of 42.68% in 2026. These LEDs provide superior light quality with higher Color Rendering Indexes (CRI), making colors appear more vibrant and natural. This is particularly beneficial in retail environments, art galleries, warehouses, hospitals, and other workspaces. Hence, this factor will promote the segment’s growth.

The display & signage application segment is expected to record the highest CAGR during the forecast period. These LED displays can be designed in various shapes and sizes, including flexible and curved formats. This versatility supports innovative and creative signage solutions that can adapt to different environments and applications worldwide. Thus, these factors will play a vital role in driving the growth of the segment.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Growing Adoption of Consumer Electronics in LED Lighting Drives Segment’s Growth

On the basis of industry, the market is categorized into consumer electronics, automotive, agriculture & horticulture, industrial equipment, highway & roads, and others.

The consumer electronics segment held a larger market with a share of 35.64% in 2026 and is anticipated to maintain its dominance over the forecast period. These LEDs are used in backlighting LCD TVs, thereby improving brightness, contrast, and color accuracy. The emergence of OLED (Organic LED) technology has further enhanced display quality by providing deeper blacks and more vibrant colors. Also, LEDs are used in the displays of VR headsets, providing the high resolution and fast response times necessary for immersive experiences.

The automotive segment is projected to record the highest CAGR during the forecast period as LEDs provide brighter, more focused lights for vehicles for better visibility and safety. They have a longer life span and use less power compared to halogen and HID (High-Intensity Discharge) lamps. Furthermore, the use of DRLs improves vehicle visibility during the day, enhancing safety. They consume less power and last longer than traditional bulbs. Thus, the growing adoption of LEDs in automotive lighting is expected to fuel market growth in the coming years.

REGIONAL INSIGHTS

In terms of region, the global LED Lighting market is divided into five key regions: North America, South America, Europe, the Middle East & Africa, and Asia Pacific. They are further segmented into countries.

North America LED Lighting Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 23.45 billion in 2025 and USD 26.01 billion in 2026. North America holds the largest share of the market due to the strong presence of R&D institutions and a robust manufacturing infrastructure, which has contributed to the advancement and adoption of LED lighting technologies. Many cities across the U.S. have upgraded their street lighting to LEDs to save on energy costs and improve public safety. Cities, such as Los Angeles and New York have implemented large-scale LED street lighting projects. Los Angeles, in particular, has undertaken one of the most significant LED street lighting retrofit projects, replacing over 140,000 streetlights with LED fixtures. This has resulted in significant energy savings and reduced maintenance costs. The U.S. market is valued at USD 18.37 billion by 2026.

Asia Pacific is predicted to witness the highest growth in terms of CAGR during the forecast period. China is the largest manufacturer and consumer of LED products worldwide and has witnessed rapid adoption of LED lights. Government policies promoting energy conservation and subsidies for LED manufacturing have fueled this growth. Additionally, government initiatives and regulations are key drivers of market growth in this region. The Japan market is valued at USD 14.64 billion by 2026, the China market is valued at USD 16.37 billion by 2026, and the India market is valued at USD 8.23 billion by 2026.

Europe is anticipated to exhibit steady growth over the forecast period as LED lights are energy efficient, which contributes to reduced carbon emissions. This aligns with the global efforts to combat climate change and reduce the environmental footprint of infrastructure projects in the region. Moreover, the shift toward Electric Vehicles (EVs) and smart cars is accelerating the adoption of LED lighting in the region as these technologies align well with the energy-efficient and advanced features of modern vehicles. The UK market is valued at USD 3.9 billion by 2026, while the Germany market is valued at USD 3.6 billion by 2026.

Similarly, South America is showing substantial growth in this market due to its growing interest in sustainable and low-cost technologies. Many South American countries have established energy efficiency programs aimed at reducing energy consumption and promoting sustainable technologies, including LED lights. Governments are implementing regulations that phase out inefficient lighting technologies and mandate the use of energy-efficient alternatives, such as LEDs.

Moreover, the Middle East & Africa (MEA) is anticipated to witness prominent growth in the coming years due to improved investment and government funding for digitization.

KEY INDUSTRY PLAYERS

Market Players to Implement Major Business Growth Strategies to Increase Their Global Footprint

Some of the key players operating in this market are taking various steps to increase their global presence by launching customized products and solutions that are specifically made for certain industries. They are signing collaboration and partnership agreements and buying out local firms to create a strong footprint in different regions. They are also developing effective promotion strategies and novel solutions to increase their market share. Thus, the growing need for LED lighting systems is predicted to catalyze the market players’ growth.

List of Top LED Lighting Companies

- EVERLIGHT ELECTRONICS Co., Ltd. (Taiwan)

- CITIZEN ELECTRONICS Co., Ltd. (Japan)

- Harvatek Corporation (Taiwan)

- OSRAM (Austria)

- Lite-ON Technology, Inc. (Taiwan)

- Signify Holding (Netherlands)

- Syska LED (India)

- Dialight (U.K.)

- Wipro (India)

- LSI Industries, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- January 2024: Dialight launched a new battery backup model for its iconic LED High Bay. The introduction of LED High Bay claims to offer greater safety in severe industrial environments.

- April 2024: LSI Industries, Inc. acquired EMI Industries for an all-cash purchase price of USD 50 million by increasing the food service and store fixtures equipment business. The partnership serves a growing portfolio of national retail chains that value an integrated, solutions-based approach that emphasizes reliability, quality, and technical expertise.

- May 2024: Acuity Brands, Inc. launched Verjure, a horticulture LED lighting solution that offers productive and reliable performance for indoor horticulture applications. The solution is intended to encounter and surpass the production of out-of-date 1,000W HPS grow lights by distributing up to 40% energy investments, paying for a lower energy bill, and operative cost savings. This will improve the overall sustainability.

- November 2023: Elephantech partnered with LITEON Technology for an innovative and sustainable future. The collaboration aims to fasten startups’ acceptance of advanced solutions, sustainability, and clean energy.

- November 2023: Signify introduced its Philips Direct-to-Consumer (D2C) website to transform the client's involved with lighting. The website offers an extensive selection of over 1,000 customer products across numerous categories of convenience, highlighting comfort and accessibility for its valued clients.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, types, industries, and top applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By LED Type

By Application

By Industry

By Region

|

Frequently Asked Questions

The market value is projected to reach USD 336.90 billion by 2034.

In 2025, the market was valued at USD 109.11 billion.

The market is projected to record a CAGR of 13.40% during the forecast period.

By industry, the consumer electronics sector captured the largest market share in 2024.

Increasing government regulations and incentives for energy-efficient LED lighting solutions across the globe are the key factor driving the market growth.

EVERLIGHT ELECTRONICS Co., Ltd., CITIZEN ELECTRONICS Co., Ltd., Harvatek Corporation, OSRAM, Lite-ON Technology, Inc., Signify Holding, Syska LED, Dialight, Wipro, and LSI Industries, Inc. are the top players in the market.

North America holds the highest market share.

By mode of application, the display & signage segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us