Lighting Controls Market Size, Share & Industry Analysis, By Product Type (LED Drivers and Ballasts, Sensors, Switches, Dimmers, Transmitters and Receivers, and Others), By Connectivity Type (Wired and Wireless), By End-users (Residential, Commercial, Industrial, and Highways & Roadway Lighting), and Regional Forecast, 2026 – 2034

Lighting Controls Market Size

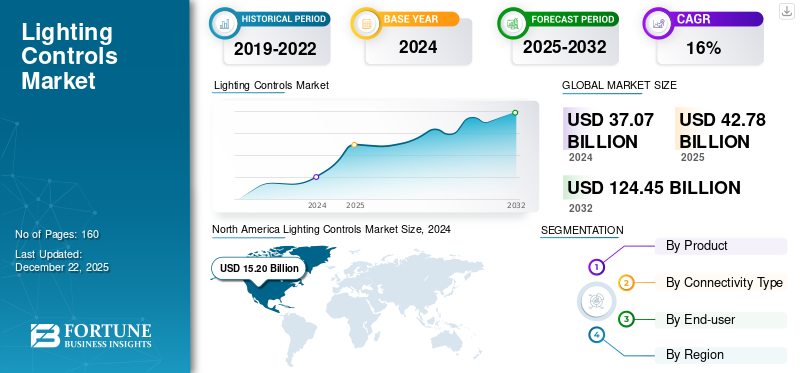

The global lighting controls market size was valued at USD 42.78 billion in 2025. The market is projected to grow from USD 49.56 billion in 2026 to USD 157.28 billion by 2034, exhibiting a CAGR of 15.53% during the forecast period. North America dominated the global market with a share of 40.71% in 2025.

Lighting controls refer to devices and systems used to regulate and manage the operation of lighting fixtures in indoor and outdoor environments. These controls include LED drivers, ballasts, sensors, switches, dimmers, transmitters, receivers, and others that enable users to adjust the intensity, timing, and lighting mode to suit specific needs and preferences. They contribute to energy efficiency, comfort, and convenience by optimizing lighting and reducing energy consumption.

The controls are commonly used in residential, commercial, industrial, and outdoor architectural lighting applications. This market includes solutions provided by companies including Signify Holding, Cisco Systems, Inc., General Electric Company, Schneider Electric, Toshiba Corporation, Lutron Electronics Co., Inc., Legrand S.A., Eaton Corporation, Honeywell International Inc., OSRAM GmbH, Acuity Brands, Inc., and Cooper Lighting LLC, among others.

The COVID-19 pandemic significantly impacted the market by delaying construction projects and reducing demand in commercial sectors. However, the crisis also accelerated the adoption of smart lighting systems in residential settings due to increased remote work and a heightened focus on energy efficiency and home automation. This shift in demand dynamics helped drive innovation and growth among residential users.

Impact of Generative AI

Incorporation of Generative AI in Lighting Controls to Drive Market Growth

Generative AI algorithms can optimize lighting controls system based on occupancy, time of day, and natural light availability. This leads to substantial energy savings and improved efficiency. AI can predict failures or maintenance needs for lighting systems, reducing downtime and maintenance costs. AI can create personalized lighting environments that adapt to individual preferences, activities, or moods. Generative AI can design complex lighting scenes and effects that respond to real-time inputs or events, enhancing the ambience in homes, offices, and public spaces. For instance,

- For instance, Smartmation’s cloud-driven software allows cities to efficiently access real-time IoT data and remotely manage their public lighting systems. Cities implementing Smartmation for remote lighting management may anticipate lighting issues and forestall citizen complaints. This solution provides managers with actionable insights into the status of their lighting systems, which helps them be more proactive.

- In November 2023, Schneider Electric drove generative AI production and sustainability solutions by integrating Microsoft Azure OpenAI. The collaboration with Microsoft improves solutions that control algorithms to generate code, text, and other types of content.

Therefore, the integration of generative AI in the lighting control systems makes them more intelligent, responsive, and efficient, enhancing user experiences and contributing to sustainability goals.

Lighting Controls Market Trends

Innovation in Lighting Control Technologies and Internet of Things (IoT) Integration to Boost Market Demand

Smart lighting systems can be controlled wirelessly via smartphones, tablets, or voice commands, offering convenience and flexibility. These systems often use Wi-Fi, ZigBee, or Bluetooth for communication. These systems can adjust brightness and color temperature based on the time of day, user preferences, or specific activities. This adaptive lighting improves comfort and can enhance productivity and well-being. Additionally, users can create and save various lighting scenes or modes for different occasions, such as reading, dining, or watching movies. This customization enhances user experience and convenience.

Furthermore, IoT integration allows lighting systems to connect and interact with other smart home or building devices, such as thermostats, security systems, and home assistants. This interconnectivity enables comprehensive automation and energy management. Internet of Things enabled lighting systems can collect and analyze usage patterns, energy consumption, and occupancy data. This data helps optimize lighting performance and energy efficiency while providing insights for maintenance and improvements. Implementing AI and ML can predict when lighting components will likely fail and schedule maintenance proactively, reducing downtime and maintenance costs. AI algorithms analyze sensor data and user behavior to optimize lighting schedules and settings for maximum energy efficiency without compromising user comfort. For instance,

- In October 2023, Siemens launched new analytics to streamline construction operations and added two new partners to the Illuminated AI Partner Ecosystem. With the introduction of artificial intelligence machine learning models, the accuracy of finding assets and personnel tags has improved to more than 98%, allowing companies in various industries to optimize their operations and enable better inventory management.

I Download Free sample to learn more about this report.

Lighting Controls Market Growth Factors

Ongoing and Upcoming Smart City Projects in Developing Economies to Surge Market Growth

Most growing households are shifting their focus to digital awareness and digitization. As part of this digitization program, most countries are actively executing smart city projects on a great scale. A smart lighting system is one of the most important parts of smart urban projects as it uses a connected light system which can be easily managed by smart devices.

Connected lighting systems have played a crucial role in the smart and digital transformation of the latest buildings and metropolises over the past decade. This trend is expected to continue during the forecast period as the use of IoT and connected devices in smart city programs is increasing globally. Intelligent lighting and control systems in smart city projects are expected to reduce maintenance and energy costs of lighting systems by 40% in one year. It also helps in the reduction of environmental impact. For instance,

- In February 2024, Signify installed 42 networked Philips Lumi Street lights on one street in the city's vibrant and densely populated downtown. Green Switch, developed by Signify, is designed to help cities navigate sustainable development and climate change, invest in and install state-of-the-art public lighting, and create an innovative city plan that supports multiple drives.

Thus, the aforementioned factors are expected to fuel the lighting controls market share.

RESTRAINING FACTORS

High Initial and Deployment Costs of Lighting Systems May Restrain Market Growth

Smart lighting control systems have spread rapidly in recent years. However, the initial cost of a single smart lighting and control system unit is much higher than that of existing retrofit switches. The components used in this system, such as transmitters, sensors, and receivers, are expensive, directly affecting the entire system's retail price. Additionally, retrofitting existing systems and installing new smart lighting and control systems is not always profitable for residential customers, which may hinder the global market. For instance,

- Homewyse says that the average cost of installing a lighting control system is between USD 3,600 and USD 4,500 per system. This price can get even higher depending on the size and scope of the lighting installation. While a high installation price tag makes a lighting control system less cost-effective overall, a lighting system can be an essential addition to any existing building management system.

In addition, advanced lighting systems, such as LED smart lighting, often require substantial initial capital outlay compared to traditional lighting solutions. This includes the cost of fixtures, bulbs, controls, and sensors. Many businesses and homeowners operate under tight budget constraints and might not have the financial flexibility to invest in high-cost lighting solutions upfront. Thus, these factors may hinder the market growth.

Lighting Controls Market Segmentation Analysis

By Product Type Analysis

Escalating Need for Optimizing Energy Efficiency in Smart Cities and Buildings to Boost the Sensors Segment Growth

Based on product type, the market for lighting controls is divided into LED drivers and ballasts, sensors, switches, dimmers, transmitters and receivers, and others.

The sensors segment dominated the market share by 30.17% in 2026 as they are pivotal in optimizing energy efficiency and user comfort. They enable adaptive lighting that responds to occupancy and daylight changes and minimizing energy use and costs. Advances in sensor technology have enhanced their integration into smart lighting systems, which are crucial for smart cities and buildings. Moreover, the regulatory support for energy-efficient standards further boosts their adoption, leading to their significant share and the highest CAGR in the market.

The switches segment is set to exhibit the second highest CAGR over the forecast period due to the increasing demand for user-friendly and customizable lighting solutions. Modern switches, including smart and touch-sensitive variants, offer enhanced functionality and integration with home automation systems. They provide easy control over lighting settings, contributing to energy savings and improved convenience. Additionally, technological advancements and declining costs of smart switches encourage their adoption in both residential and commercial sectors, driving substantial market growth.

By Connectivity Type Analysis

Advancements in Wireless Technologies to Fuel the Segment Growth

On the basis of connectivity type, the market is bifurcated into wired and wireless.

The wired segment is likely to hold the highest share of 61.52% in the market in 2026 due to its reliability, stability, and security. Wired systems are less susceptible to interference and signal loss, ensuring consistent performance, particularly in large and complex installations. They also support higher data transfer rates and offer better integration with existing infrastructure. Additionally, many commercial and industrial applications prefer wired connections for their robustness and longevity, further driving their dominance in the market.

The wireless segment is expected to grow at the highest CAGR of 18.73% over the analysis period due to its flexibility, ease of installation, and compatibility with smart home technologies. Wireless solutions can be deployed without extensive rewiring, reducing labor and material costs. The rise of IoT and smart home devices, which rely on wireless communication, further propels the segment growth. Additionally, advancements in wireless protocols, such as Zigbee and Bluetooth, enhance reliability and performance, driving broader adoption.

By End-users Analysis

To know how our report can help streamline your business, Speak to Analyst

Rising Awareness of Energy Efficacy and Advancement in IoT-based Devices to Boast Segment Growth

By end-users, the market is subdivided into residential, commercial, industrial, and highways & roadway lighting.

The commercial segment is anticipated to hold 36.54% of the market share in 2026 due to their significant need for energy efficiency, cost savings, and regulatory compliance. Large-scale commercial buildings highly benefit from advanced lighting control systems, reducing energy consumption and operational costs. Additionally, these systems offer enhanced functionality, such as automated scheduling, occupancy sensing, and daylight harvesting, which improve user comfort and productivity. The drive toward sustainable building practices and smart building technologies further propels the adoption of lighting solutions in the commercial sector.

The residential segment is expected to grow at the highest CAGR of 17.66% over the analysis period due to the rising demand for smart home technologies, increasing awareness of energy efficiency, and advancements in IoT-enabled devices. Homeowners are increasingly adopting smart lighting solutions for convenience, remote control, and automation features. Additionally, integrating lighting solutions with voice assistants and home automation systems further enhances the appeal. Growing urbanization and the trend toward sustainable living also contribute to the rapid adoption in the residential sector.

REGIONAL INSIGHTS

The global market scope is classified across five regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America Lighting Controls Market Size, 2024 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

The North America market dominated the market with a value of USD 20.01 billion in 2026 due to advanced technological infrastructure, high adoption rates of smart technologies, stringent energy efficiency regulations, and substantial investments in smart city projects. The region’s strong emphasis on energy efficiency is a significant market driver. Governments and organizations are increasingly aware of reducing energy consumption's environmental and economic benefits. For instance,

- The U.S. Department of Energy (DOE) has implemented various initiatives to promote energy efficiency, such as the Better Buildings Challenge, encouraging organizations to improve their energy performance. It estimates that using energy-efficient lighting controls, such as occupancy sensors and daylight harvesting systems, can save up to 60% in commercial buildings.

Moreover, the region has several leading technology companies at the forefront of developing innovative lighting control solutions. For instance, Lutron Electronics and General Electric have introduced advanced lighting control systems integrating smart home platforms and Internet of Things (IoT) devices. These systems allow users to control lighting remotely via smartphones or voice assistants, enhancing convenience and energy efficiency. The adoption of wireless controls and smart lighting systems is rapidly increasing, driven by the desire for more flexible and user-friendly solutions. The U.S. market size is anticipated to reach USD 11.64 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is expected to grow at the highest CAGR in the market due to rapid urbanization, increasing government initiatives for energy efficiency, rising investments in smart infrastructure, and growing awareness of sustainable practices. The region is likely to hit USD 9.65 billion in 2026 as the third-largest market. Rapid urbanization in the region significantly drives the demand for lighting controls. Countries such as China, India, and Indonesia are experiencing rapid urban expansion to accommodate their growing populations. This urbanization leads to the construction of numerous residential, commercial, and industrial buildings. The market value in China is expected to be USD 2.82 billion in 2026.

On the other hand, India is projecting to hit USD 1.30 billion and Japan is likely to hold USD 2.31 billion in 2026. For instance,

- China’s urbanization plan aims to move over 250 million people to its cities by 2025, resulting in a massive demand for smart lighting solutions. Advanced lighting controls such as occupancy sensors, daylight sensors, and automated dimmers are essential for these new developments to ensure energy efficiency and enhance the comfort and productivity of building occupants.

Moreover, regional governments are implementing stringent regulations and policies to reduce energy consumption and carbon emissions. For instance,

- India’s National Mission for Enhanced Energy Efficiency (NMEEE) promotes energy-saving measures across various sectors, including lighting. Similarly, China’s 13th Five-Year Plan emphasizes the importance of energy conservation and environmental protection, encouraging the adoption of energy-efficient technologies.

These government initiatives create a favorable environment for the widespread use of smart lighting, driving the lighting controls market growth.

Europe is anticipated to account for the second-highest market size of USD 10.91 billion in 2025, exhibiting the second-fastest growing CAGR of 17.48% during the forecast period. Europe holds the second-highest share in the market owing to factors such as stringent energy efficiency regulations, increasing adoption of smart home technologies, rising awareness of sustainable practices, and substantial investments in smart city projects. Strict energy efficiency regulations across the region significantly drive the market. The European Union has implemented various directives and standards to reduce energy consumption and promote sustainable practices. The market value in U.K. is expected to be USD 2.67 billion in 2025.

On the other hand, Germany is projecting to hit USD 2.30 billion and France is likely to hold USD 2.05 billion in 2025. For instance,

- The EU’s Ecodesign Directive sets minimum energy performance standards for lighting products. At the same time, the Energy Performance of Buildings Directive (EPBD) mandates the use of energy-efficient technologies in buildings. These regulations encourage the adoption of advanced lighting controls, such as dimmers, occupancy sensors, and daylight harvesting systems, to comply with energy efficiency requirements and reduce overall energy consumption.

The European market is also characterized by a high adoption rate of wireless technologies, such as Zigbee and Bluetooth, which offer flexibility and ease of installation.

- According to a study by the European Commission, wireless lighting controls are expected to account for over 40% of Europe's total lighting control market by 2025.

This shift toward wireless solutions is driven by the increasing demand for retrofitting existing buildings with energy-efficient lighting systems and the growing popularity of smart home automation.

The lighting controls market in the Middle East & Africa (MEA) and South America is expected to grow at an average rate, driven by several key factors. The Middle East & Africa is expected to hit USD 2.75 billion in 2025 as the fourth-largest market. These include rapid urbanization, increasing government initiatives for energy efficiency, rising investments in smart infrastructure, and growing awareness of sustainable practices. Rapid regional urbanization is a significant driver of the market. Cities are expanding quickly to accommodate the increasing population, leading to a surge in residential, commercial, and industrial building construction projects. The GCC market size is expecting to reach USD 0.94 billion in 2025. For instance,

- The UAE government has introduced the Dubai Integrated Energy Strategy 2030, which aims to reduce energy demand and improve energy efficiency across various sectors. Similarly, Saudi Arabia’s Vision 2030 includes energy efficiency and sustainability initiatives.

- Brazil's National Energy Efficiency Plan (PNEf) aims to reduce electricity consumption by 10% by 2030 through various measures, including promoting energy-efficient lighting.

KEY INDUSTRY PLAYERS

Key Players Launch New Products to Strengthen their Market Positions

Key market players in the global market launch new products to enhance their market positions by leveraging the latest technological advancements, addressing diverse consumer needs, and staying ahead of competitors. They prioritize portfolio enhancement and strategic collaborations, acquisitions, and partnerships to strengthen their product offerings. Such strategic product launches help companies maintain and expand their market share in a rapidly evolving industry.

List of Top Lighting Controls Companies:

· General Electric Company (U.S.)

· Signify Holding (Netherlands)

· Cisco Systems, Inc. (U.S.)

· Schneider Electric (France)

· Toshiba Corporation (Japan)

· Legrand (France)

· Lutron Electronics Co., Inc. (U.S.)

· Eaton Corporation (Ireland)

· Honeywell International Inc. (U.S.)

· OSRAM GmbH (Germany)

· Acuity Brands, Inc. (U.S.)

· Cooper Lighting LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS:

April 2024: CISCO and Toronto-based Morgan Solar announced a pilot project to enhance collaboration and meeting spaces with solar power. The startup promotes the development of intelligent solutions that aim to reduce greenhouse gas emissions from traditional energy production technologies and provide companies with new paths to sustainable development.

December 2023: General Electric Company invested around USD 1,907 million and USD 1,786 million in 2023 and 2022, respectively. The company's investment drives the development of cutting-edge technologies, such as advanced sensors, wireless controls, and AI-driven systems.

December 2023: Eaton invested around USD 754 million and USD 665 million in 2023 and 2022, respectively. The company’s investment would lead to significant cost savings for end-users by reducing electricity usage and maintenance costs.

May 2023: Cisco Systems, Inc. and NTT collaborated to develop and implement joint solutions that enable organizations to improve operational efficiency and advance sustainability goals.

April 2023: GE Gas Power bought Nexus controls from Baker Hughes. The partnership would provide a full-service management business area for the further development of GE's proprietary Mark Vle management system platform, customer-facing management service delivery, and functionality redesign and training.

March 2023: Signify, a provider of lighting solutions, acquired Intelligent Lighting Controls, Inc., a U.S. manufacturer provider of wired control systems, and expanded its connected portfolio. The collaboration provides enhanced opportunities to sell a broad range of energy-efficient LED lighting products in Canada, the U.S., and Mexico.

January 2023: Lutron Electronics unveiled the latest availability of the Diva intelligent dimmer in six colors and an innovative Claro auxiliary smart switch to the Caseta collection of products. The introduction provides a strengthened option for multi-location control through the Claro smart switch and smart dimmer.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.53% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

By Connectivity Type

By End-users

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 157.28 billion by 2034.

In 2025, the market was valued at USD 42.78 billion.

The market is projected to grow at a CAGR of 15.53% during the forecast period.

By product type, the sensors segment leads the market.

Ongoing and upcoming smart city projects in developing economies is a key factor propelling market growth.

Schneider Electric, Honeywell International, Inc., Eaton, Legrand, and Signify Holding are the top players in the market.

North America holds the highest market share.

By end-users, the residential segment is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us