Linear Motion Products Market Size, Share & Industry Analysis, By Product (Bearings, Linear Guides & Tables, Actuator, Ball Screws, Linear Motors and Drives, and Others), By Application (Medical and Pharmaceuticals, Semiconductor & Electronics, Aerospace, Food & Beverages, Machining Tools, Automotive, and Others (Paper & Pulp)), and Regional Forecast, 2026-2034

Linear Motion Products Market Size

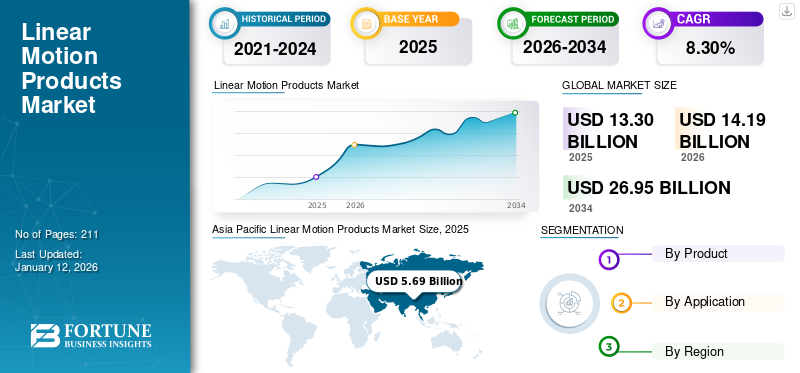

The global linear motion products market size was valued at USD 13.3 billion in 2025 and is projected to grow from USD 14.19 billion in 2026 to USD 26.95 billion by 2034, exhibiting a CAGR of 8.30% during the forecast period. The linear motion products market in the U.S. is projected to grow significantly, reaching an estimated value of USD 2.23 Bn by 2032, driven by the growing automation in the manufacturing sector. Asia Pacific dominated the global market with a share of 42.80% in 2025.

Linear motion is an important aspect of modern motion control. It is a broad term that comprises several technologies, such as linear actuators, linear motors, bearings, and linear roller guides. Linear motion enables automation in a variety of applications, including robotics, packaging machines, and semiconductor manufacturing. These technologies are essential for optimizing production processes and increasing efficiency in industries across the globe. Linear motion has had a significant impact on technological advances in automation, making it easier and faster to achieve precise and accurate movements.

Global Linear Motion Products Market Overview

Market Size:

- 2025 Value: USD 13.3 billion

- 2026 Forecast Value: USD 14.19 billion

- 2034 Forecast Value: USD 26.95 billion

- CAGR: 8.30% (2026–2034)

Market Share:

- Regional Leader: Asia Pacific dominated the market with a 42.80% share in 2025, driven by rapid industrial growth, automation, and the region's role as a global manufacturing hub.

- Leading Product: The bearings segment leads the market, propelled by high demand from diverse manufacturing industries requiring precision work, such as robotics and medical devices.

- Leading Application: The machining tools segment is dominant, fueled by the increasing production of CNC machines and the need for precise motion control in automated manufacturing processes.

Industry Trends:

- Industry 4.0 Integration: Linear motion systems are increasingly incorporating smart sensors, IoT connectivity, and data analytics for enhanced monitoring, control, and predictive maintenance.

- Electrification and Automation: Electromechanical linear actuators are gaining popularity over traditional systems due to their precision, flexibility, and ease of integration with digital controls.

- Miniaturization: A growing demand exists for smaller, lighter, and more compact linear motion solutions, especially in space-constrained industries like electronics, medical devices, and aerospace.

Driving Factors:

- Growth in Automation: The global trend toward industrial automation and Industry 4.0 principles is a primary driver, as linear motion products are essential components in automated machinery.

- Rise of E-commerce and Logistics: The e-commerce boom has increased demand for automated material handling equipment in warehouses, where linear actuators and guides are vital for efficiency.

- Global Manufacturing Expansion: As manufacturing activities grow worldwide, so does the need for advanced motion control systems to optimize production accuracy, speed, and reliability.

- Adoption in Robotics: The rapid growth of robotics in sectors like automotive, electronics, and logistics is a significant driver, as these systems rely heavily on precise linear movements.

Restraining Factors:

- Lack of Standardization: A lack of standard specifications across different product categories can lead to compatibility issues and increased complexity during system integration.

- Complex Installation & Maintenance: Some advanced linear motion systems require specialized knowledge for installation and maintenance, increasing the total cost of ownership.

- High Initial Costs: The relatively high upfront cost of acquiring and implementing advanced linear motion technologies can be a barrier, especially for small and medium-sized enterprises (SMEs).

This technology includes one-dimensional motion along a straight line. Linear motion products considered in the scope are all types of linear bearings, linear actuators, linear guides & tables, ball screws, and linear motors and drives, among others. Furthermore, applications of these linear products covered in the scope are medical and pharmaceuticals, semiconductor & electronics, aerospace, food & beverages, machining tools, and automotive.

Post the outbreak of the COVID-19 pandemic across the major economies across the globe, most of the leading market players registered a considerable decline in their revenue generation and have subsequently witnessed a reduction in their profit margins. The abrupt closure of the manufacturing facility, affecting the rate of daily output from the production facilities, played a pivotal role in plummeting sales of these market players.

Additionally, the restrictions during the initial phase of the pandemic and stringent SOP (Standard Operating Procedure) guidelines post-lockdowns affected the standard supply chain of the market. The complete breakdown of the supply chain increased the inability of market players to continue the streamlined supply of their products within the linear motion products market.

Linear Motion Products Market Trends

Amalgamation of Industry 4.0 and Electromechanical Products to Create Lucrative Opportunities

The adoption of Industry 4.0 principles, including the Internet of Things (IoT), data analytics, and connectivity, is influencing the market. Manufacturers are incorporating smart sensors and communication capabilities into linear motion systems for enhanced monitoring, control, and predictive maintenance. Electromechanical linear actuators, driven by electric motors, are gaining popularity due to their precision, flexibility, and ease of integration with digital control systems. This trend is notable in various industries, including manufacturing, robotics, and healthcare.

Furthermore, the demand for smaller, lighter, and more compact linear motion solutions is growing, driven by the need for space-efficient designs in industries such as electronics, medical devices, and aerospace. Miniaturized linear motion products cater to applications with limited space requirements. The mentioned trends highlight the manufacturers’ commitment to efficiency, quality, and sustainability through the incorporation of cutting-edge technology into the commercial construction sector, which contributes to the linear motion products market growth.

Download Free sample to learn more about this report.

Linear Motion Products Market Growth Factors

Growth in Automation, E-Commerce, and Material Handling to Bolster Market Growth

The increasing trend toward automation and the adoption of Industry 4.0 principles in manufacturing and other industries drive the demand for linear motion products. These products are essential components in automated systems and machinery, enhancing efficiency, precision, and speed in manufacturing processes. As manufacturing activities continue to grow globally, there is an increased need for advanced motion control systems to optimize production processes. These products play a crucial role in improving the accuracy and reliability of machinery in manufacturing settings. Furthermore, the growth of e-commerce has led to increased demand for material handling equipment in warehouses and distribution centers. These products, such as linear actuators and linear guides, are vital components in the design of automated material handling systems, contributing to the efficiency of order fulfillment processes.

RESTRAINING FACTORS

Limited Standardization and Complex Installation and Maintenance May Hamper Market Growth

A lack of standardized specifications across different linear motion product categories can lead to compatibility issues and increased complexity in system integration. This lack of standardization may also hinder interoperability between components from different manufacturers. Some linear motion systems can be complex to install and maintain. The need for specialized knowledge and expertise can increase the overall cost of ownership and may deter organizations from adopting certain linear motion solutions. Also, the initial costs associated with acquiring and implementing linear motion products can be relatively high. This may act as a barrier for Small and Medium-Sized Enterprises (SMEs) or businesses with budget constraints, limiting their adoption of advanced linear motion technologies.

Linear Motion Products Market Segmentation Analysis

By Product Analysis

Bearings Segment to Dominate the Market Due to Increasing Demands Across Industries

Based on product, the market is classified into linear motors and drives, linear guides & tables, bearings, ball screws, actuator, and others.

The bearings segment is expected to dominate the market with share of 38.41% in 2026 with the highest CAGR during the forecast period, owing to the increasing demand from the manufacturing industry. For example, machines used in defense, robotics, robotic surgery, positioning, and CT scanners require precision work. Linear bearings play an important role in a variety of applications depending on the type of business. This has led to an increase in the production of bearings to meet the diverse requirements of various industries.

Moreover, the actuator segment is anticipated to have major growth in the coming years attributed to the increasing demand for products for a variety of applications, such as industrial machinery, valves, computer peripherals and many other areas where linear motion is important. Linear actuators are also the most challenging products in the manufacturing industry as they are a key component in robotics and are expected to significantly advance automation technology in the future.

Furthermore, the ball screws segment is anticipated to witness noteworthy growth in the coming years. These are widely used in various industrial fields, such as automotive and mechanical engineering fields, as well as processing for attaching the internal parts of cars to ensure smooth operation, accordingly stimulating the linear motion products market share.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Machining Tools Segment to Lead the Market Due to Rising Demand in Automation Processes

Based on application, the market is divided into semiconductor & electronics, medical and pharmaceuticals, automotive, food & beverages, aerospace, machining tools, and others (paper & pulp).

The machining tools segment is expected to grow exponentially with market share of 29.67% in 2026, owing to the increase in CNC machine production and controlling the motion of machine parts, leading to precise and productive machining.

In addition, the semiconductor and electronics segment is expected to grow significantly in the coming years. This is due to increased investment in the Asian semiconductor industry. This has increased the demand for wafer fabrication, wafer assembly, wafer transfer, semiconductor test equipment and other complex manufacturing processes.

In addition, the automotive segment is also expected to gain a significant share due to the increase in the production of electric passenger vehicles and automobiles. This creates the need for linear bearings, actuators and linear guides to produce better and affordable products in a short period. The aerospace, medical, and pharmaceutical segments are expected to grow significantly over the forecast period due to the increasing number of industrial processes where self-monitoring and location localization tactics are implemented.

REGIONAL INSIGHTS

Based on geography, the linear motion products market has been studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Linear Motion Products Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 5.69 billion in 2025 and USD 6.13 billion in 2026. Asia Pacific is projected to dominate the market with a major market share as key countries continue to experience industrial growth and automation owing to the substantial demand for linear motion products. These components are crucial in automated manufacturing processes for precision movement and control. Also, the growth in the small & mid-sized players is also influencing the growth of the market as CNC machine production and sales growth is expected to surge over the forecast period. The emerging trend of multi-faceted tools is compelling companies to manufacture machine centers with high precision, custom finishing, and multifunctional capabilities.

China is leading the market in the region with the foremost share owing to the rise of robotics in industries such as automotive manufacturing, electronics, and logistics, which has driven the demand for linear motion products. These components are used in the design and construction of robotic systems that require precise linear movements. Moreover, China, being the manufacturing hub with low manufacturing, labor, and raw material costs, suppliers believe in mass-producing linear products and obtaining substantial profits from other parts of the region. The Japan market is projected to reach USD 1.68 billion by 2026, the China market is projected to reach USD 2.63 billion by 2026, and the India market is projected to reach USD 0.57 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America has had the fastest growth in terms of CAGR in recent years. The growth is influenced by several factors contributing to the region's industrial landscape. North America, particularly the U.S., has a strong and diverse manufacturing sector. The continuous expansion and modernization of manufacturing facilities in industries such as automotive, aerospace, electronics, and machinery contribute to the demand for linear motion products. Additionally, the trend toward automation and the adoption of Industry 4.0 principles have been significant drivers of the demand for these products. Manufacturers are increasingly incorporating advanced motion control systems to enhance efficiency, productivity, and precision in their processes. The U.S. market is projected to reach USD 1.43 billion by 2026.

Europe

Europe is inclined to various factors driving industrialization, automation, and technological advancements in the region. As the automotive and manufacturing sector is the heart of the European region for revenue generation, companies are majorly focusing on expanding their business across the countries. The adoption of automation in manufacturing processes continues to drive the demand for these products in Europe. Industries such as automotive, aerospace, and machinery incorporate linear motion solutions to enhance precision and efficiency. The UK market is projected to reach USD 0.92 billion by 2026, while the Germany market is projected to reach USD 1.32 billion by 2026.

Middle East & Africa

The Middle East & Africa is expected to witness steady growth during the forecast period. The GCC holds the largest market share in the Middle East & Africa due to the rapid adoption of automation and modernized methods in the production and warehouse management systems of the developed Gulf countries.

South America could grow at a moderate pace due to niche opportunities for manufacturing development. However, the limited presence of network traffic product players and the underdevelopment of market distribution channels has resulted in the slow growth of the South American industry.

Key Industry Players

Manufacturers Focus on Product Upgradation to Drive Market Growth

The market is identified as highly competitive, with the presence of multiple players operating at a global level, as well as certain regions where the domestic players have substantial market shares. Companies such as THK Co. Ltd, Hiwin, NSK Ltd., Nippon Thomson, and Bosch are prominent players in the global market, covering a major market share. The promising share of the established market leaders can be attributed to the diverse product portfolio offerings of these players.

- THK specializes in the production of linear motion guides, ball screws, and linear motion actuators. It is recognized for its precision engineering solutions.

- NSK is involved in manufacturing bearings and linear motion products. It produces linear guides, ball screws, and other components for various applications

List of Top Linear Motion Products Companies:

- UMBRAGROUP (Italy)

- NSK Ltd. (Japan)

- Moog Inc. (U.S.)

- Korta (Spain)

- August Steinmeyer GmbH & Co. KG (Germany)

- SHUTON (Spain)

- Curtiss-Wright (U.S.)

- TSUBAKI NAKASHIMA CO., LTD (Japan)

- KURODA Precision Industries (Japan)

- THK CO., LTD. (Japan)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: NSK, Ltd. and Toppan Edge Inc. initiated a joint development of a maintenance system for industrial machinery. The maintenance management equipment is developed using RFID tags that can sense temperature. The system consists of temperature-sensing RFID, an RFID reader compatible with tags, and a system that can analyze and manage the acquired data.

- November 2023: Timken, a global leader in industrial motion and engineering-bearing manufacturing, completed the acquisition of Engineered Solutions Group (iMech). iMech is a manufacturer of thrust bearings, radial bearings, specialty coatings, and other components for the energy industry.

- October 2023: UMBRAGROUP acquired a 51% stake in COMEAR and BSP, both of which have been prominent suppliers to UMBRAGROUP’s Foligno factory for around 30 years. Now, the acquisition will further strengthen the business by exploiting important opportunities for the growth and development of complex and sustainable architecture.

- March 2023: Ewellix, a prominent linear motion product manufacturer, launched its new electric actuators that are compatible with the mobile application. The new actuators offer exceptional power with a high level of energy efficiency, position and motion control capability and repeatability.

- June 2023: NTN develops IMT Bearings, Ball screw support rolling bearings for the injection molding machine that offers long operating life and high performance during rotational operation using separate retainers.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 26.95 billion by 2034.

In 2025, the market was valued at USD 13.3 billion.

The market is projected to grow at a CAGR of 8.30% during the forecast period.

Growth in automation, e-commerce, and material handling drives market growth.

UMBRAGROUP, NSK Ltd., Moog Inc., Korta, August Steinmeyer GmbH & Co. KG, SHUTON, Curtiss-Wright, TSUBAKI NAKASHIMA CO., LTD, KURODA Precision Industries, and THK CO., LTD. are some of the leading companies in the market.

Asia Pacific holds the highest market share.

The bearings segment is anticipated to lead the market with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us