Liquid Filling Machines Market Size, Share & Industry Analysis, By Function Type (Automatic and Semi-Automatic), By Product Type (Glass, Plastics, Tetra Pack & Cardboards, and Others), By Filling Type (Vacuum filling, Volumetric Filling, Weigh Filling, and Others), By Filling Capacity (Upto 50 ml, 51-250 ml, 250-1000 ml, and above 1000 ml), By End Use (Food, Beverages, Pharmaceuticals, and Cosmetics), and Regional Forecast, 2026–2034

Liquid Filling Machines Market Size

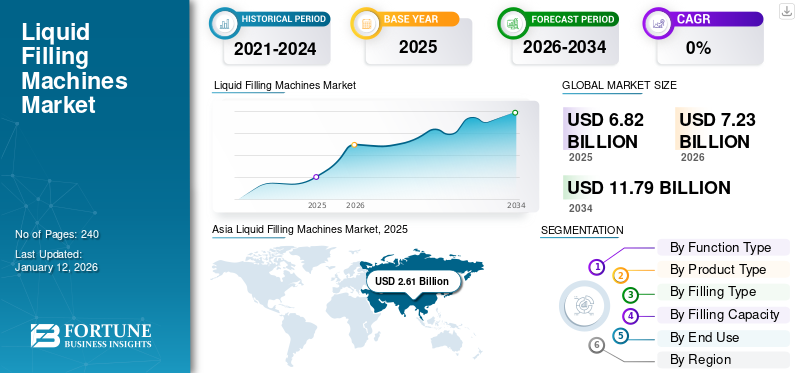

The global liquid filling machines market size was valued at USD 6.82 billion in 2025. The market is projected to grow from USD 7.23 billion in 2026 to USD 11.79 billion by 2034, exhibiting a CAGR of 6.30% during the forecast period. The Asia Pacific dominated global market with a share of 38.20% in 2025.

Liquid filling machines are equipment used across the packaging industry to fill various liquid products, such as water, oil, shampoo, medicine, and beverages into specific packaging and quantities. The machineries are optimally designed to maximize filling speed and accuracy, thereby increasing productivity and minimizing human errors. Liquid filling machines work automatically, either fully automated through IoT and Industry 4.0 or semi-automatically, where an operator controls the filling process manually. They are offered with different filling technologies such as vacuum filling, volumetric filling, weigh filling, overflow filling and others.

Global Liquid Filling Machines Market Overview

Market Size:

- 2025 Value: USD 6.82 billion

- 2026 Value: USD 7.23 billion

- 2034 Forecast Value: USD 11.79 billion

- CAGR (2026–2034): 6.30%

Market Share:

- Regional Leader: Asia Pacific held the largest share of 38.20% in 2025

- Fastest-Growing Region: Asia Pacific is projected to grow fastest over the forecast period

- End‑User Leader: The beverage segment is expected to represent the highest CAGR among all applications

Industry Trends:

- Volumetric Filling Machines Dominating: Volumetric filling equipment leads in market share and growth due to widespread use in beverage production lines

- Focus on Hygienic and Calibrated Filling: Increasing demand for precision, safety, and calibrated filling solutions is reshaping market preferences

- Automation and Smart Integration: Growing uptake of automated systems with clean-in-place (CIP) features, real-time monitoring, and quick format changeover

Driving Factors:

- Demand for Sanitized and Precise Filling Solutions: Key sectors such as beverages and pharmaceuticals require contamination-free, accurate filling systems

- Increased Beverage Consumption: Expanding packaged drink demand is boosting machine deployment in beverage manufacturing

- Manufacturing Growth in Asia Pacific: Industrial expansion and infrastructure investments are enhancing regional adoption of advanced filling machinery

Globally, the demand for liquid filling machines is increasing with growing varieties in the beverages and drink segment. Consumers are spending heavily on cold drinks and beverages that are more high in sugar content and instantly boost dopamine. Furthermore, changing consumer behavior and growing ready-to-eat food culture have bolstered the demand for dairy, sauces, and other liquid food. These machines enhance productivity, accuracy, and precision, ensure hygiene and food safety, decrease human errors, and offer flexibility to fill various products from a single product line.

The COVID-19 pandemic caused a slight decline in the growth of the liquid-filling industry owing to a disturbed supply chain and decrease in the production of beverages and drinks. Additionally, lockdown situations and precautionary measures hampered the product demand. However, the removal of lockdown restrictions post-pandemic has up scaled the demand in the food and beverages sector, significantly supporting the demand for liquid filling machines in the long term.

Liquid Filling Machines Market Trends

Demand for Automated Production Lines and Expansion in Alcoholic Beverage Sales to Bolster Product Demand

Globally the automated production lines installation for beverages and drinks consumption has increased exponentially due to heavy promotions and branding. Growing demand for the varieties in the refreshment industry, such as energy drinks, zero sugar drinks, health drinks, and many more, stimulated the demand for liquid filling machines in the nonalcoholic beverage industry. Additionally, growing demand for alcoholic beverages and beers owing to increasing sales of mid-size beer bottles and canned products in the winery industry has bolstered liquid filling machines market share during the forecast period.

- For instance, in December 2023, Coca-Cola System commissioned a new bottling plant in Senegal. The state-of-the-art facility represents a USD 50 million investment as a part of the process to reshape the Coca-Cola presence in the country.

Download Free sample to learn more about this report.

Liquid Filling Machines Market Growth Factors

Growing Demand for Advanced Precision and Hygiene Solutions to Stimulate Market Growth

Integration of more advanced solutions for liquid filling, ensuring more precise and hygiene, has driven demand across production lines by achieving safer products with minimal productivity loss. Additionally, the filling machines need to have more correct settings to ensure more accurate dosing and filling processes. In volumetric filling, automatic level sensors and level controlling system accurately control liquid levels, avoiding overfilling and under filling in the production lines. These technological advancements in the filling technology are stimulating the demand for liquid filling machines market growth in the long term.

- For instance, in August 2023, Mitsubishi Heavy Industries Machinery Systems, Ltd. commissioned a new aseptic filling system for beverages, featuring dual-level sterilization of the PET bottles to ensure an aseptic environment.

RESTRAINING FACTORS

Challenges in Temperature Control and Impact of Sustainability Packaging Trends May Restrain Market Growth

Liquid filling machines operate at different temperatures for various products ranging from bottled water, window cleaners, jams, pastes, sauces, and other materials. Different materials present unique challenges such as temperature variations in different operating conditions for liquid machine manufacturers. At the same time packaged products are getting deposited in landfills. Thus, emphasis on adopting sustainable packaging has restrained the demand for liquid packaging in the short term. Some of the challenges in liquid filling are the choice of materials for machinery construction or managing the viscosity of the product being filled. Viscosity can vary with temperature changes, complicating accurate filling processes. Keeping the temperature constant can solve the viscosity issues but increases the cost of the machinery. These factors are negatively impacting sales and directly restraining the market.

Liquid Filling Machines Market Segmentation Analysis

By Function Type Analysis

Automatic Segment to Lead Owing to Precise Filling Capabilities

Based on function type, the market is categorized into automatic and semi-automatic.

The automatic liquid filling machines segment is poised to dominate the market with a share of 26.14% in 2026, owing to their high operational accuracy and precise liquid filling in the production lines. Automatic machines are the preferred choice in production as it offers lesser complexity in commissioning and operations compared to semi-automatic filling systems. Automatic machines over time are getting more efficient with lesser consumption of electricity and faster liquid filling this enable faster production and enhanced production capacity for manufacturers.

Semi-automatic machines are growing steadily due to the less cost of installation and productive output in the Micro Small Medium Enterprises (MSME) units.

By Product Type Analysis

Plastic Segment Dominated due to Recycling Initiative

Based on product type, the market is divided into glass, plastic, tetra pack & cardboard, and others (cans).

Globally, plastic products have been replaced majorly in every packaging segment with a share of 19.09% in 2026. In liquid processing and packaging, Polyethylene Terephthalate (PET) and other plastic substitutes are dominating the bottle type segment.

The plastic segment attained the highest market revenue share in 2024, owing to the high demand for beverages that include water, soft drinks, and energy drinks. Ban on single use plastic has expanded its potential that provided a progressive growth to plastic product type segment owing to recycling initiatives and Recycled Polyethylene Terephthalate (rPET) demand.

Glass market share is set to grow steadily owing to high re-usability and low operational cost.

In contrast, tetra packs, cardboard, and other packaging products are showcasing a subtle growth.

By Filling Type Analysis

Growing Demand for Beverages to Dominate Volumetric Filling Segment

Based on filling type, the market is categorized into vacuum filling, volumetric filling, weigh filling, and others (overflow filling).

The volumetric filling segment is attaining the highest market share of 16.74% in 2026 and growth across the liquid filling industry owing to their dominant sales in the beverage filling lines and high efficiency in production lines. They have easy commissioning and attachments made available for different bottle and packaging type. These machines are easy to operate with less workforce and offers more precise filling that bolster the demand for volumetric filling in long term.

Vacuum filling is growing at a steady pace with increasing use in sterilized syrups and cosmetic products packaging.

Weigh filling and other filling systems are forecasted to showcase a subtle growth due to their application-specific operations.

To know how our report can help streamline your business, Speak to Analyst

By Filling Capacity Analysis

51-250 ml Segment to Lead due to High Demand for Cost Effective Refreshment

Based on filling capacity, the market is divided into 50 ml, 51-250 ml, 251-1000 ml, and above 1000 ml.

The 51-250 ml segment is expected to hold the highest share in 2026 with 19.23%, owing to high production costs and shrinkage in the beverage industry. Consumers demand on-the-go drinks that can give a refreshment at an effective cost and minimal consumption of the beverage.

Growing demand for mid-size packaged liquid items of 251-1000ml in the food and beverage segment, due to decreasing consumption, is driving the liquid bottle-filling revenue.

By End Use Analysis

Dominant Beverage Demand Across Consumer to Bolster Liquid Filler End Use

By end-user, the market is classified into food, beverages, cosmetics, and pharmaceuticals.

Beverages segment is set to lead the market. The nonalcoholic segment is set to dominate the market with the highest CAGR and share due to increasing consumer demand for beverages that are loaded with 0% sugar and give instant energy. Post-pandemic introduction of many health drinks and entrant of small and medium enterprises in the beverage industry has boosted the economy and demand for beverage. Thus, to address the growing beverage demand across consumer prominent players are providing manufacturer specific solutions to bolster demand in long term.

The growing trend of sauces and fillings in the food industry has raised the demand for viscous food and sauces, supporting the steady growth of the food segment and bolstering the growth of liquid fillers across the industry.

REGIONAL INSIGHTS

The global liquid filling market is studied across North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Liquid Filling Machines Market, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The global liquid filling machines market landscape is changing progressively owing to several factors that include growing industrialization, environmental regulations, changing consumer choices, and, notably, economic conditions.

The Asia Pacific dominated the market with a valuation of USD 2.61 billion in 2025 and USD 2.79 billion in 2026. Region is set to dominate the global liquid bottle-filling market during the forecast period and held the largest market share in 2024, owing to urbanization and an increase in demand for beverages that are low in sugar and boost energy levels instantly. Furthermore, the Asia Pacific liquid filling machines market was impacted positively by the COVID-19 pandemic owing to the strong demand for liquid health supplements, food and beverages, and other health-related liquid products. The Japan market is projected to reach USD 0.5 billion by 2026, the China market is projected to reach USD 1.11 billion by 2026, and the India market is projected to reach USD 0.41 billion by 2026.

China is augmented to dominate the Asia Pacific market owing to growing population emphasized initiatives for rapid urbanization and the consumer shift towards healthy lifestyles, especially in the post-pandemic period. Such factors are the prime market drivers across Asia Pacific countries. India, Japan, and South Korea are vital contributors to market growth in this region.

North America's liquid filling is a mature market and growing steadily, driven by high adoption of technological advancements and automation. Additionally, the U.S. and Canada have well-established beverages, packaged foods, and consumables, which drive the demand for liquid filling machines during the forecast period. The U.S. market is projected to reach USD 0.95 billion by 2026.

Europe is emerging as another mature market with a strong emphasis on quality, sustainability, and efficiency. Many countries in this region, such as Germany, the U.K., and Italy, are some major industrial clusters for liquid filling machines. The growing demand for packaged beverages, liquid alcohol and drinks, and packaged liquid food products is driving market growth. The UK market is projected to reach USD 0.15 billion by 2026, while the Germany market is projected to reach USD 0.62 billion by 2026.

The Middle East & Africa's liquid bottle-filling industry is experiencing significant growth backed by rising urbanization and increasing tourism. Countries including Saudi Arabia, UAE, and South Africa are the major markets of this region, driving capital for liquid bottle-filling machines.

Additionally, the South America region is at a subtle growth due to increasing emphasis on innovation, advancements, and modernization in manufacturing processes, driving the acceptance of liquid filling machines across SMEs (Small and Medium Enterprises).

KEY INDUSTRY PLAYERS

Key Firms Emphasize Innovation to Expand their Market Reach

Major players are introducing new state-of-the-art liquid bottle-filling machines for the food and beverages industry. Industry players emphasize innovation by developing new machines that can be user-friendly, environment-friendly, and improve speed and productivity of the operation. These innovative packaging product strategies are increasing the player's revenue and filling machines market size in the long term.

- For instance, in May 2023, Krones AG opened a new R&D excellence center to provide aftermarket support and introduce new technological advancements to its machine product portfolio.

List of Top Liquid Filling Machines Companies:

- Adelphi Group of Companies (U.K.)

- ATS Corporation (Canada)

- GEA Group Aktiengesellschaft (Germany)

- JBT Corporation (U.S.)

- KHS GmbH (Germany)

- Krones AG (Germany)

- ProMach Inc (U.S.)

- Tetra Laval S.A. (Switzerland)

- Syntegon (Bosch) (Germany)

- Mitsubishi Heavy Industries Ltd. (Japan)

KEY INDUSTRY DEVELOPMENTS:

- March 2024: KHS GmbH introduced new Plasmax, a coating technology, which manufactures tech-advanced filler machines. The benefits associated with this technology include higher output, better production efficiency, low energy consumption, flexibility, low maintenance cost, and extended durability. It has a filling capacity of around 48,000 PET bottles per hour.

- February 2024: Ampack, a subsidiary of Syntegon Technology GmbH, introduced a new FBL filling machine for PP, HDPE, and PET bottles. It is used to fill products such as dairy products, soups, and milk and plant-based drinks. This machine can fill bottles between 50 ml and 1,500 ml efficiently, with a production capacity of 36,000 bottles per hour.

- October 2023: GEA Group Aktiengesellschaft launched the new GEA Visitron filler for the beverage industry. It has a production speed of 10,000 containers per hour and can fill various containers such as glass, PET, and aluminum cans. It features durability, easy of use, and low energy consumption.

- October 2023: GEA Group Aktiengesellschaft opened a new manufacturing facility in Parma, Italy. The main aim of opening the manufacturing facility was to increase the production capacity of filling equipment, processing equipment, and packaging equipment by 50 percent. This facility spans 4,000 square meters, enhancing efficiency and technology in filling systems.

- December 2022: TechniBlend, a subsidiary of ProMach Inc., launched the new ProFill V volumetric can filler with a filling capacity ranging from 100 to 600 cans per minute. This versatile machine is designed for use in the food and beverages sector, offering accuracy and high speed operations.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends market insights and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Function Type, Product Type, Filling Type, Filling Capacity, End Use, and Region |

|

Segmentation |

By Function Type

By Product Type

By Filling Type

By Filling Capacity

By End Use

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach USD 11.79 billion by 2034.

In 2025, the market was valued at USD 6.82 billion.

The market is projected to grow at a CAGR of 6.30% during the forecast period.

By filling type, volumetric filling segment is leading in terms of market share.

Growing demand for calibrated and hygienic filling is a key factor driving market growth.

Adelphi Group of Companies, ATS Corporation, Coesia S.p.A., Avantis Systems Ltd., GEA Group Aktiengesellschaft, JBT Corporation, KHS GmbHKrones AG, Tetra Laval S.A., Syntegon (Bosch), Cozolli Machine, Marchesini Group, Fuji Machinery, Mitsubishi Heavy Industries Ltd. are top players in the market.

Asia Pacific held the maximum market share in 2025.

The beverage end-use segment is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us