Lithography Equipment Market Size, Share & Industry Analysis, By Type (EUV and DUV), By Technology (ArF Scanners, KrF Steppers, i-line Steppers, ArF Immersion, Mask Aligners, and Others), By Applications (Advanced Packaging, LED, MEMs, and Power Devices), By Packaging Platforms (3D IC, 2.5D Interposer, Wafer Level Chip Scale Packaging, FO WLP Wafer, 3D WLP, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

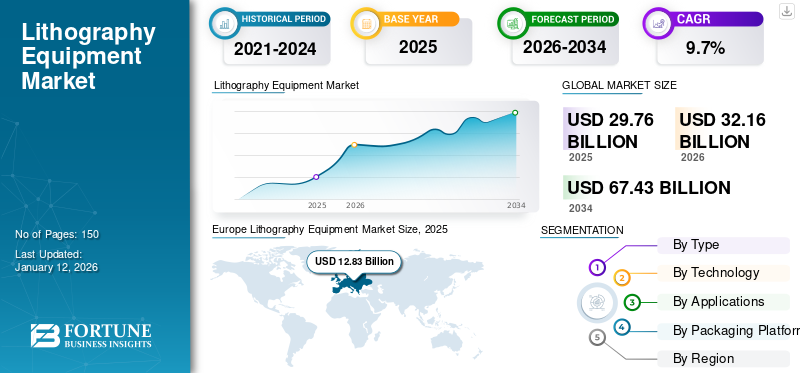

The global lithography equipment market size was valued at USD 29.76 billion in 2025. The market is projected to grow from USD 32.16 billion in 2026 to USD 67.43 billion by 2034, exhibiting a CAGR of 9.70% during the forecast period. The Europe dominated global market with a share of 43.1% in 2025.

Lithographic equipment refers to the machinery and tools used in the process of lithography, a printing method that comprises forming images on a flat surface, typically a stone or metal plate, then transferring the image onto paper or another material. It is a critical process in the production of integrated circuits (ICs) and microelectronic devices. It involves transferring patterns from a photomask onto a semiconductor wafer, which serves as the foundation for creating the intricate circuits that make up electronic devices. Moreover, semiconductor lithography techniques are scalable, allowing manufacturers to produce billions of transistors on a single chip, which is crucial for advancing computing power and reducing the cost per transistor.

Global Lithography Equipment Market Overview

Market Size:

- 2025 Value: USD 29.76 billion

- 2026 Value: USD 32.16 billion

- 2034 Forecast Value: USD 67.43 billion

- CAGR: 9.70% (2026–2034)

Market Share:

- Regional Leader: Europe dominated global market with 43.10% share in 2025

- Forecast Note: Europe is projected to hold the highest market share over the forecast period; Asia Pacific is expected to exhibit the highest CAGR during 2026–2034

- By Type (context): EUV and DUV segmentation (DUV led in 2024; EUV expected to grow faster)

- By Applications (context): Advanced Packaging dominates; LED expected to grow fastest among applications

- By Packaging Platforms (context): 3D IC, 2.5D Interposer, WLCSP, FO WLP Wafer, 3D WLP, Others

Industry Trends:

- Rising Demand for Advanced Lithography: Increasing need for EUV and multi-patterning to support smaller feature sizes and advanced nodes

- Generative AI Impact: AI-driven design optimization improves lens/mask design and exposure parameters

- COVID-19 Impacts & Recovery: Pandemic caused supply disruptions; recovery supports investment in advanced lithography

- Packaging & Integration Trends: Growth in advanced packaging (3D/2.5D/WLP) driving demand for lithography tools

Driving Factors:

- Semiconductor IC Demand: Growth across mobile, AI, data centers, and automotive drives lithography demand

- Advanced Packaging Adoption: 3D IC, interposers, and WLP technologies increase tooling needs

- EUV Adoption: Expansion of EUV capability enables smaller nodes and higher transistor density

- Regional Leadership & Ecosystems: Europe’s ASML-centric ecosystem and R&D incentives bolster market activity

The COVID-19 pandemic significantly impacted the semiconductor lithographic equipment industry, influencing both demand and supply chains. The pandemic caused delays in the production of lithographic equipment due to factory shutdowns, workforce reductions, and logistical challenges. This was particularly severe in regions such as Asia, where much of the semiconductor equipment manufacturing is concentrated.

Generative AI Impact

Growing Innovations Across Various Design Aspects Through Generative AI to Drive Market Growth

Generative AI is having an increasing influence on the semiconductor lithographic equipment industry, driving innovations and changes across various aspects of design, manufacturing, and process optimization. These algorithms optimize the design of complex components within lithographic equipment, such as lenses and mirrors used in photolithography. By simulating millions of variations, AI can help engineers identify the most efficient designs, improving the precision and performance of the equipment. Moreover, for cutting-edge processes such as extreme ultraviolet (EUV) lithography, generative AI can optimize mask designs and exposure parameters, reducing the need for multiple trial-and-error iterations. This enhances the efficiency of using EUV lithography for advanced semiconductor nodes. Hence, this factor boosts the growth of the market.

Lithography Equipment Market Trends

Rising Demand for Advanced Lithography Technologies in Several Circuits to Impel Market Growth

Recently, the demand for advanced circuit densities and minor feature sizes has risen significantly. This, in turn, increases the demand for advanced lithography technologies such as extreme ultraviolet (EUV) lithography and multiple patterning. Therefore, lithography equipment providers are focused on offering products that can handle the difficulties related to miniaturized ICs. The applications of these ICs include mobile phones and robots. For instance,

- In December 2023, Nikon Corporation launched the new NSR-S636E ArF immersion scanner. The launch of scanners provides superior overlay accurateness and ultra-high throughput. This advanced system provides next-level overlay accuracy using higher-precision measurement and widespread wafer warpage and misrepresentation modification abilities while sustaining supreme scanner throughput.

Moreover, an increase in demand for floating complex and condensed ICs to run intricate equipment is anticipated to drive the global lithography equipment market growth.

Download Free sample to learn more about this report.

Lithography Equipment Market Growth Factors

Increase in Demand for Semiconductor ICs in Several Applications to Proliferate Market Growth

The increasing demand for semiconductor integrated circuits (ICs) is a substantial driver of the lithography equipment industry. As the semiconductor industry is transitioning toward smaller feature sizes and complex degrees of integration, lithography equipment is gradually becoming important in the manufacturing of complex integrated circuits. Lithography is a technique of transporting circuit designs to semiconductor wafers through light or radiation. With the increasing need for integrated circuits in applications that include automobile electronics, cell phones, and artificial intelligence, there is a larger need for sophisticated lithography equipment capable of producing greater feature sizes and better throughput. Therefore, this factor is projected to stimulate the growth of the lithography equipment market.

RESTRAINING FACTORS

Technological Constraints and Complexity of Lithography Equipment May Restrain Market Growth

The market has tremendous technological obstacles and difficulties. The trend for miniaturization in semiconductor production requires more complex lithography technologies capable of generating ever-smaller components with outstanding accuracy. This involves the development of substances, improved optics, and control systems, which increases research and expansion expenditures. In addition, transitioning to innovative transistor nodes, including extreme ultraviolet (EUV) lithography, presents technical hurdles in mask flaws, source power, process stability, and complex equipment design and manufacture. Thus, these high-tech constraints, the difficulty of lithography equipment, and delayed development cycles prevent market development and innovation.

Lithography Equipment Market Segmentation Analysis

By Type Analysis

Adoption of DUV Lithography By Several Semiconductor Manufacturers to Propel Segment Growth

On the basis of type, the market is categorized into EUV and DUV.

The deep ultraviolet (DUV) segment held the largest market with a share of 56.69% in 2026. As the industry has pursued the creation of increasingly smaller and more powerful chips, DUV lithography has played a significant role, particularly at the 193 nm wavelength. In addition, DUV lithography is more mature and cost-effective than EUV lithography. Many foundries and semiconductor manufacturers continue to use DUV for a significant portion of their processes due to its lower cost and higher throughput. Therefore, this factor accelerates the growth of the market.

The extreme ultraviolet (EUV) segment is expected to grow at the highest CAGR during the forecast period. This lithography is a cutting-edge technology used in semiconductor manufacturing, particularly for producing advanced microchips with extremely small feature sizes. It plays a crucial role in extending Moore’s Law, which predicts the doubling of transistors on a chip roughly every two years. Without EUV, it would be much more challenging to continue this trend. Thus, these factors boost the growth of the semiconductor market.

By Technology Analysis

Increasing Demand for ArF Immersion in Advanced Microchips to Drive Segmental Growth

On the basis of technology, the market is categorized into ArF scanners, KrF steppers, i-line steppers, ArF immersion, mask aligners, and others.

The ArF immersion segment held the largest global lithography equipment market with a share of 22.05% in 2026. It allows for the production of features as small as 38-45nm and can extend to smaller sizes with additional techniques. This is essential for keeping up with Moore’s law and producing more powerful and efficient chips. This immersion lithography has been optimized for high-volume manufacturing, providing a good balance between resolution, cost, and throughput. This makes it suitable for producing large quantities of advanced microchips. Therefore, this factor accelerates the growth of the market.

Moreover, the mask aligners segment is expected to grow at the highest CAGR during the forecast period. It is an essential tool in the fabrication of microelectromechanical systems, optoelectronic devices, and other specialized microfabrication applications. These aligners are less expensive than any other lithographic equipment, such as step-and-scan systems used in advanced semiconductor manufacturing. This makes them an attractive option for small to medium-scale production, research, and development applications where cost constraints are significant. Thus, these factors boost the growth of the semiconductor market.

By Applications Analysis

Implementation of Advanced Packaging Techniques in Multiple Chips to Boost Segmental Growth

On the basis of applications, the market is segregated into advanced packaging, LED, MEMs, and power devices.

The advanced packaging segment dominates with the maximum market with a share of 41.73% in 2026. This packaging allows for shorter interconnects between chips, reducing signal latency and improving overall performance. Techniques such as 2.5D and 3D stacking enable faster communication between chips, leading to better computational speed and energy efficiency. Moreover, these packaging techniques enable the integration of multiple chips in a single package, allowing for greater functionality in a smaller footprint. Hence, this factor contributes to the growth of the market.

Moreover, the LED (light-emitting diodes) segment is expected to grow at the highest CAGR during the forecast period. These LEDs consume less power than traditional light sources such as mercury lamps or lasers, leading to reduced operational costs and lower environmental impact. LEDs have a much longer operational life, often exceeding tens of thousands of hours, reducing the need for frequent replacements and maintenance, which is crucial in a high-throughput environment. Thus, these factors boost the growth of the market.

To know how our report can help streamline your business, Speak to Analyst

By Packaging Platforms Analysis

Increase in Demand for 3D ICs in Lithographic Equipment to Spur Segment Expansion

On the basis of packaging platforms, the market is categorized into 3D IC, 2.5D interposer, wafer level chip scale packaging, FO WLP wafer, 3D WLP, and others.

The 3D IC segment held the largest market with a share of 26.15% in 2026. These 3D ICs allow for stacking multiple layers of circuits vertically, leading to higher transistor density and performance. This enables lithographic equipment to handle more complex computations and control functions in a smaller footprint, improving overall efficiency. In addition, 3D IC technology offers greater scalability and flexibility in design, allowing lithographic equipment manufacturers to tailor their systems to specific needs. This is particularly useful as semiconductor manufacturing processes evolve and demand more advanced and customizable solutions. Therefore, this factor contributes to the growth of the market.

The FO WLP wafer segment is anticipated to expand at the highest CAGR during the forecast period. FO WLP allows for higher I/O compared to traditional packaging methods. This can lead to more compact and efficient designs in lithographic equipment, improving performance and integration capabilities. It provides better heat dissipation due to its packaging design, which enhances the thermal management of lithographic equipment. Moreover, efficient heat dissipation is crucial for maintaining stability and accuracy in high-precision systems. Hence, these factors drive the growth of the market.

REGIONAL INSIGHTS

Regionally, the global market is classified into five major regions: South America, North America, Europe, Asia Pacific, and the Middle East & Africa. They are further segmented into countries.

Europe

Europe Lithography Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe is projected to witness the highest market share over the forecast period. The region is home to ASML, the world’s leading supplier of photolithography equipment, particularly in the realm of extreme ultraviolet (EUV) lithography. ASML’s dominance has made Europe a critical hub for the development and adoption of cutting-edge lithographic technology. It has a well-established research and development ecosystem, with many universities, research institutes, and private firms dedicated to advancing semiconductor technology. This R&D strength supports the development and rapid adoption of advanced lithographic equipment. Thus, this factor boosts the global lithographic equipment market growth. The UK market is expected to reach USD 2.65 billion by 2026, while the Germany market is anticipated to reach USD 3.24 billion by 2026.

North America

North America is expected to exhibit a steady growth rate over the forecasted period. The region hosts numerous semiconductor fabrication facilities that utilize advanced lithographic equipment to produce integrated circuits. These facilities are often equipped with the latest technologies to meet the demands of cutting-edge semiconductor manufacturing. The region also plays a crucial role in the global semiconductor supply chain. The adoption of advanced lithographic equipment supports the region’s integration into this supply chain, enhancing its ability to produce high-performance semiconductor devices. Therefore, these factors boost the market growth. The U.S. market is estimated to reach USD 3.45 billion by 2026.

Asia Pacific

Asia Pacific is anticipated to witnessed the highest CAGR in 2024. In this region, particularly countries such as Taiwan, South Korea, China, and Japan, is among the world’s largest semiconductor foundries, with the presence of manufacturing companies such as TSMC, Samsung, and SMIC. These companies are at the forefront of adopting advanced lithographic equipment to produce leading-edge semiconductor devices. In addition, the region has seen significant investments in advanced lithography technologies, such as EUV lithography, to keep up with the demands of producing smaller, more efficient, and more powerful semiconductor devices. As a result, these factors contribute to the growth of the region. The Japan market is forecast to reach USD 2.61 billion by 2026, the China market is set to reach USD 2.58 billion by 2026, and the India market is likely to reach USD 1.11 billion by 2026.

Rest of The World

Similarly, South America witnesses significant growth in this market. Countries such as Brazil and Argentina have shown interest in advancing their technological capabilities, which could eventually lead to greater adoption of semiconductor lithography equipment.

The Middle East & Africa (MEA) market is predicted to grow in the coming years owing to improved investment and government funding for digitization.

KEY INDUSTRY PLAYERS

Market Players to Adopt Merger & Acquisition Strategies to Expand Their Operations

Prominent firms in the industry are actively expanding their presence across the globe by introducing specialized solutions tailored to particular sectors. They are strategically forming partnerships and acquiring local businesses to establish a robust foothold in various regions. These companies are concentrating on creating effective marketing strategies and developing new solutions to maintain and grow their market share. Thus, the rising demand for lithography equipment is expected to create lucrative opportunities for the market players.

List of Top Lithography Equipment Companies:

- ASML Holding NV (Netherlands)

- Nikon Corporation (Japan)

- Canon, Inc. (Japan)

- EV Group (Austria)

- Veeco Instruments Inc. (U.S.)

- SUSS MicroTec SE (Germany)

- Shanghai Micro Electronics Equipment (Group) Co. Ltd. (China)

- Neutronix Quintel Inc. (U.S.)

- JEOL Ltd. (Japan)

- Onto Innovation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- June 2024: ASML Holding N.V. and Imec opened a common higher NA EUV lithography lab proposing a primary development platform for the leading-edge semiconductor ecosystem. The incorporation offers memory chip makers, leading-edge logic, and advanced materials and equipment supplier’s entree to the prototype High NA EUV scanner and adjacent handling and metrology tools.

- June 2024: Canon announced the development of firming its core commercial segments of printing, imaging, and surveillance, along with a rising presence in the flat panel display business, semiconductor, and the medical industry. It aims to offer lithography solutions and emphasize eco-friendly practices by contributing to client services in India.

- May 2024: Canon Inc. declared the introduction of MPAsp-E1003H lithography equipment for smartphones and dashboard displays. The launch of the product aided in recovering the efficacy of display manufacturing by merging wider exposure and enhanced overlay accuracy with innovative technology.

- December 2023: EV Group, a supplier of wafer bonding and lithography equipment for the MEMS, launched the EVG NanoCleave layer system to feature EVG’s revolutionary NanoCleave technology. The system permits ultra-thin-layer transfer from silicon substrates through nanometer precision, transforming 3D integration for innovative packaging and transistor scaling.

- February 2023: Veeco Instruments Inc. acquired Epiluvac AB to provide innovative silicon carbide (SiC) applications in the electric vehicle market. The collaboration quickens permeation into the developing, higher-growth SiC equipment market through decreasing time to market.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Technology

By Applications

By Packaging Platforms

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach USD 67.43 billion by 2034.

In 2025, the market was valued at USD 29.76 billion.

The market is projected to grow at a CAGR of 9.70% during the forecast period.

By applications, the advanced packaging segment leads the market.

The increase in demand for semiconductor ICs in several applications across the globe is the key factor driving the market growth.

ASML Holding NV, Nikon Corporation, Canon, Inc., EV Group, Veeco Instruments Inc., SUSS MicroTec SE, Shanghai Micro Electronics Equipment (Group) Co. Ltd., Neutronix Quintel Inc., JEOL Ltd., and Onto Innovation are the top players in the market.

Europe is set to hold the highest market with a share of 43.10% in 2025.

By packaging platforms, the FO WLP wafer segment is expected to grow at the highest CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us