Logistics Software Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premises), By Type (Transportation Management System, Warehouse Management System, Supply Chain Planning, Fleet Management System, Freight Management System, and Others), By End-User (Oil and Gas, Automotive, Healthcare, IT and Telecom, Retail and E-commerce, Manufacturing, Government, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

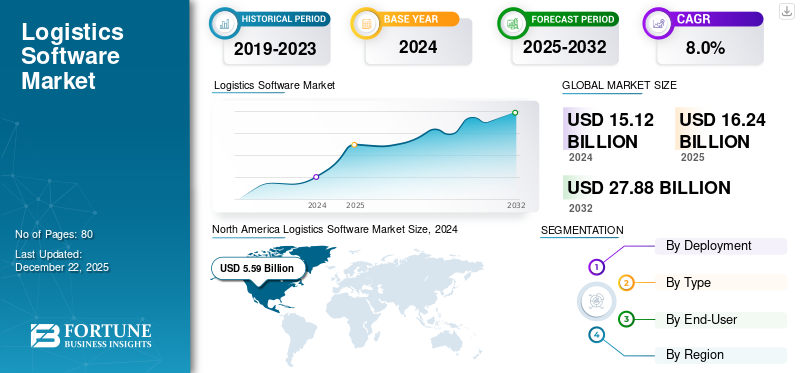

The global logistics software market size was valued at USD 16.24 billion in 2025 and is projected to grow from USD 17.47 billion in 2026 to USD 31.74 billion by 2034, exhibiting a CAGR of 7.75% during the forecast period. North America dominated the global market with a share of 36.78% in 2025.

Logistic Software is a technological solution that aids in managing and optimizing different stages of production procedures. These procedures could include transportation of resources, inventory management, warehouse operations, and shipping of different finished products. It enables a seamless interaction between warehouse and logistics management systems.

The market is expanding rapidly due to the growing need for automation, real time supply chain monitoring and efficient warehouse management. The rise of e-commerce and globalization of businesses is also driving the overall market growth. Moreover, integration of advanced technologies including AI, IoT, and cloud based platforms are also emerging as significant growth factors.

Few prominent key players operating in the market include SAP SE, Manhattan Associates, Körber AG & Infor, IBM Corporation, and others. These companies are adopting numerous strategic initiatives to sustain the competition and enhance their market presence.

MARKET DYNAMICS

Market Drivers

Rapid Expansion of Online Retail Boosts the Market Growth

The growing expansion of online retail or e-commerce has been a significant catalyst driving the logistics software market growth. E-commerce platforms are shifting consumer expectations toward fast, seamless and transparent delivery services. This, in turn necessitates advanced digital logistics solutions. Thus, logistics software has become crucial in synchronizing omnichannel resources, enhancing customer experience and reducing the operational costs.

- For instance, according to International Trade Administration.gov, the global B2B ecommerce market will be valued at USD 36 trillion by 2026. Additionally, since 2020, over 90% of B2B companies have shifted to a virtual sales model, due to improved process efficiencies.

Additionally, leading software providers are leveraging IoT, AI, and cloud computing technologies to offer integrated platforms customized to current complex retail supply chains. This has enabled data-driven decision making and efficient delivery. These factors collectively are expected to boost the market expansion over the forecast period.

Market Restraints

Transitioning to New Logistics Software Can Cause Operational Disruptions, Hampering Market Growth

Shift towards a new logistics software could bring significant challenges for the market growth which can disrupt the existing operational workflow, leading to a temporary loss of productivity and delay in services. This is majorly due to the need to integrate new solutions while sustaining stability in a complex supply chain environment.

Additionally, compatibility with legacy systems also creates a technical barrier, necessitating an extensive customization and higher IT resources. Data migration associated with shipping, inventory and customer information could be highly complex and time consuming, thus increasing the chances of errors, impacting the operational efficiency, and decision making. These factors are likely to impact the market development.

Market Opportunities

Increasing Consumer Expectations for Faster Deliveries is a Lucrative Growth Opportunity

Increasing demand for fast delivery offers a significant growth opportunity for the logistics software market. This includes retail businesses and e-commerce platforms to adopt innovative logistics software solutions that enable real time tracking and effective last-mile delivery options. Additionally, this also drives investments in AI-based route optimization, predictive analytics, automated warehouse management and other advanced technologies.

- For instance, according to India Brand Equity Foundation (IBEF), the gross merchandise value (GMV) of quick commerce in India reached USD 2.3 billion in 2023, rising by more than 70% over the previous year.

Growing consumer preference for same-day delivery also incentivizes logistics providers to innovate constantly with higher speed and reliability. Meeting these demands is crucial for customer retention and competitive advantage, thus making logistics software crucial to thrive in a growing e-commerce landscape.

LOGISTICS SOFTWARE MARKET TRENDS

Integration of IoT Devices for Real-Time Tracking and Monitoring is an Emerging Market Trend

A prominent trend propelling the market expansion is growing integration of IoT devices for real time tracking and monitoring, thus improving supply chain visibility. IoT devices enable logistics operations with interconnected sensors and various communication devices, thus offering real-time visibility into location and shipments, vehicles, as well as warehouse resources. This transparency would allow companies to optimize the routing and monitor different environmental situations including humidity and temperature proactively.

Additionally, IoT devices also include advanced analytics platforms that aid in generating actionable insights. This aids in minimizing idle time, improving asset utilization, and delivery accuracy. It also supports sustainability goals by decreasing fuel consumption and emissions via optimized fleet management.

IMPACT OF GENERATIVE AI

Integration of Gen AI Revolutionizes Logistics Software by Automating Complex Decision-Making

AI influences the logistics software by improving predictive analytics, optimizing the supply chain procedure and allowing for automation in complex decisions. It predicts the potential results and generates innovative solutions for demand forecasting, network design, and inventory management without any human indulgence. This benefits logistics providers with adjusting operational plans in real time and lessening the costs.

Additionally, Gen AI also synthesizes huge data from IoT devices, historical performance, and other components to generate in-depth insights for risk management and effective asset allocations.

SEGMENTATION ANALYSIS

By Deployment

Ease of Access, Scalability and Cost-Effectiveness of Cloud Based Logistics Software Contributes to Segment Growth

The market is bifurcated into cloud and on premise, based on deployment.

The Deployment segment is projected to dominate the market with a share of 62.28%in 2026. In 2024, cloud segment held the largest market share and is expected to grow with the highest CAGR over the forecast period. This is attributed to the scalability, cost effectiveness and ease of access of cloud based software. It offers a flexibility, thus enabling companies to scale their operations and response to the changing demand with less cost. It also offers real time data access from different locations, thus enabling remote and decentralized logistics management.

- For instance, according to industry experts, global cloud spending is expected to increase by 21.5% in 2025 compared to 2024.

Moreover, the on premise segment is growing significantly due to its benefits in customization, data security and control over different crucial operations. Additionally, different large enterprises prefer on premise to comply with stringent data privacy and regulatory needs.

By Type

Growing Need for Optimizing/Managing Freight and Carrier Operations Drives Transportation Management Systems Segment Growth

The market is divided into transportation management system, warehouse management system, supply chain planning, fleet management system, freight management system, and others, based on type. The Transportation Management System segment is expected to lead the market, contributing 36.43% globally in 2026.

The transportation management systems segment held the largest market share due to its significant role in optimizing and managing fleet operations effectively. It facilitates route planning, carrier selection, freight auditing, and shipment tracking, thus allowing for operational efficiency and cost savings. It also decreases manual errors and ensures timely delivery services, essential in the current complex supply chain environment. This comprehensive functionality tends to drive the segment’s leadership.

Moreover, the supply chain planning segment is likely to grow at the fastest pace, due to growing need for advanced forecasting and inventory optimization solutions. Companies are demanding effective software that enables analyzing huge datasets and predicting demand patterns accurately. This has also contributed toward the segment growth.

By End-User

To know how our report can help streamline your business, Speak to Analyst

Increasing Demand for Robust Logistics Software to Handle Complex Supply Chains Led to Manufacturing Segment Dominance

Based on the end-user the market is segmented into oil and gas, automotive, healthcare, IT & telecom, retail and e-commerce, manufacturing, government, and others.

The manufacturing segment held the largest logistics software market share in 2024. This is majorly due to the complexity of the supply chain in the manufacturing sector, thus demanding robust logistics software. These solutions aid in coordinating production, sourcing, inventory and distribution processes, thus ensuring a timely delivery of raw materials as well as finished goods across multiple locations. Additionally, advanced features including predictive analytics, real time tracking and automation enables operational visibility and agility for manufacturers.

- For instance, according to OECD, around 1.9% of Canadian manufacturers are including advanced technologies including AI in their operations.

On the other hand, the retail and e-commerce segment is expected to grow at the fastest CAGR over the forecast period. This is attributed to growth in online sales and consumer demand for reliable delivery services. Growing need for same-day-delivery is enabling retailers to invest in innovative solutions including logistics software.

LOGISTICS SOFTWARE MARKET REGIONAL OUTLOOK

Geographically the market is segmented into North America, Europe, Asia Pacific, South America and Middle East & Africa.

North America

North America Logistics Software Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market, generating a revenue of USD 5.97 billion in 2026. This is due to its early and advanced technology adoption. The region has a presence of a mature digital infrastructure and increasing investments in innovations including IoT, cloud computing, automation, AI, and others. Additionally, the region also includes numerous logistics software providers and large scale companies, increasing the software demand. The U.S. dominates the North America regional market with expected revenue of USD 4.45 billion in 2025. This is due to rapid urbanization, growing e-commerce sector, and demand for effective logistics services by key companies.

Download Free sample to learn more about this report.

Europe

The European market is growing with a significant market share contributing to a revenue share of USD 4.56 billion in 2025. This is due to growing regulatory focus on sustainability and compliance. Policies including EU’s Green Deal, is driving the investment in software that enables in reducing emissions and optimizing energy usage. Additionally, growing e-commerce sector also fuels the demand for optimized logistics solutions. U.K., Germany, and France are major contributors to the market growth with a predicted revenue share of USD 0.9 billion, USD 1.24 billion and USD 0.67 billion in 2026.

Asia Pacific

The Asia Pacific regional market is predicted to grow with the fastest CAGR during the forecast period and generate a revenue share of USD 3.76 billion in 2025. This is attributed to the rapid industrialization and growing e-commerce markets across the region. Economically growing countries including India, Japan, and China have an increasing demand for efficient logistics solutions. India is like to reach USD 0.69 billion and China with USD 1.21 billion in 2025. Additionally, the rise of digital commerce also fuels the need for software capable of managing complex logistics and providing real time data. These factors tend to drive the regional market growth.

South America and Middle East & Africa

The South America and Middle East & Africa regions are growing substantially due to rising digital advancements and increasing manufacturing as well as e-commerce sections across countries including Argentina, Mexico and Brazil. South America is estimated to reach the revenue of USD 0.63 billion and Middle East & Africa of USD 1.31 billion in 2025. Additionally, surging investments in infrastructure development boosts the demand for optimized supply chain management and logistics solutions. GCC is probable to hold a prominent position in the market, generating a share of USD 0.44 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Companies Focus on R&D Activities to Boost Their Market Positions

The logistics software market is characterized by the presence of numerous technological leaders and small innovations striving to capture market share. This has made the market highly competitive, and hence the companies are adopting various strategies to gain higher market position. These strategies include investments in research and development, adoption of advanced technology, launching innovation products, and strategic partnerships and acquisitions.

- For instance, in June 2024, HERE Technologies launched its software package for fleet optimization, designed to enhance the scalability and efficiency of fleet management operations.

Some of the prominent players operating in the market include SAP SE, Manhattan Associates, Körber AG & Infor, IBM Corporation, The Descartes Systems Group, Inc., Oracle, FarEye, LogiNext Solutions, and others.

LIST OF KEY LOGISTICS SOFTWARE COMPANIES STUDIED

- SAP SE (Germany)

- Manhattan Associates (U.S.)

- Körber AG & Infor (Germany)

- IBM Corporation (U.S.)

- The Descartes Systems Group, Inc. (Canada)

- Oracle (U.S.)

- FarEye (U.S.)

- LogiNext Solutions (U.S.)

- WiseTech Global (Australia)

- Alvys Inc. (U.S.)

- Acumatica, Inc. (U.S.)

- Optym (U.S.)

- Kuebix, LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS

- In June 2025, China’s JD Logistics launched a regional operations center in Riyadh, enabling same-day and next-day deliveries across Saudi Arabia through its self-operated express service. This is supported by advanced automation and a robust supply chain infrastructure.

- In March 2025, Eltra Logis, one of the leading players in the niche logistics, transportation, and warehousing market, developed its own software solution, Rapido, with a strategic investment of USD 9,39,240.

- In March 2024, Walmart Commerce Technologies revealed a new AI-powered logistics product called Route Optimization. This product, which has been previously used internally by Walmart, is now available to other businesses as a Software as a Service (SaaS) solution. The goal is to help enterprises enhance their supply chain efficiency.

- In February 2024, Blue Yonder acquired Flexis AG, which has a large customer base in the automotive and industrial OEM sectors. It reinforces Blue Yonder's ability to help enterprises with highly flexible goods and large supplier networks organization and streamline their complex production facilities and network structures.

- In December 2023, Fujitsu announced the launch of a new cloud-based logistics data standardization and visualization service for shippers, logistics companies, and vendors across the supply chain.

REPORT COVERAGE

The global report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, deployment modes, types, and end users of the product. Besides this, it offers insights into the logistics software market trends and highlights key industry developments and market share analysis for key companies. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Growth Rate |

CAGR of 7.75% from 2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

|

|

By Type

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 16.24 billion in 2024 and is projected to reach USD 31.74 billion by 2034.

The market is expected to exhibit steady growth at a CAGR of 7.75% during the forecast period.

rapid expansion of online retail drives the market growth.

SAP SE, Manhattan Associates, and Körber AG & Infios are some of the top players in the market.

North America region held the largest market share.

North America was valued at USD 5.97 billion in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us