Machine Safety Market Size, Share & COVID-19 Impact Analysis, By Product Type (Safety Sensors & Switches, Safety Controllers/ Modules/Relays, Programmable Safety Systems, Emergency Stop Controls, Two-Hand Safety Controls, and Others (Light Curtains & Scanners)), By Application (Security and Detention, Automotive, Electronics and Electrical, Food and Packaging, Logistics & Automation, Life Sciences, Oil & Gas, Semiconductor, and Others (Processing)), and Regional Forecast, 2026-2034

Machine Safety Market Size

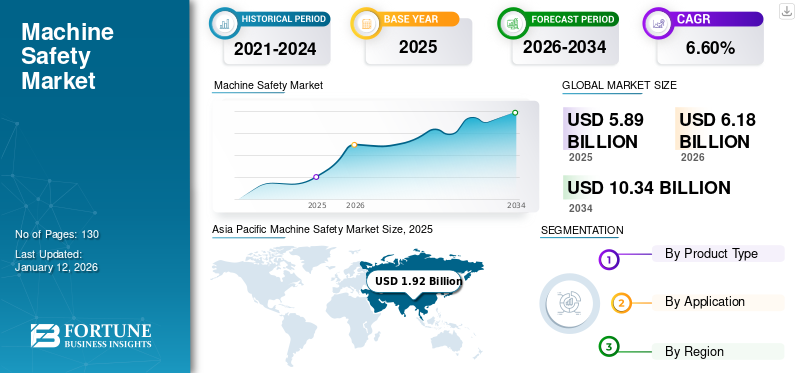

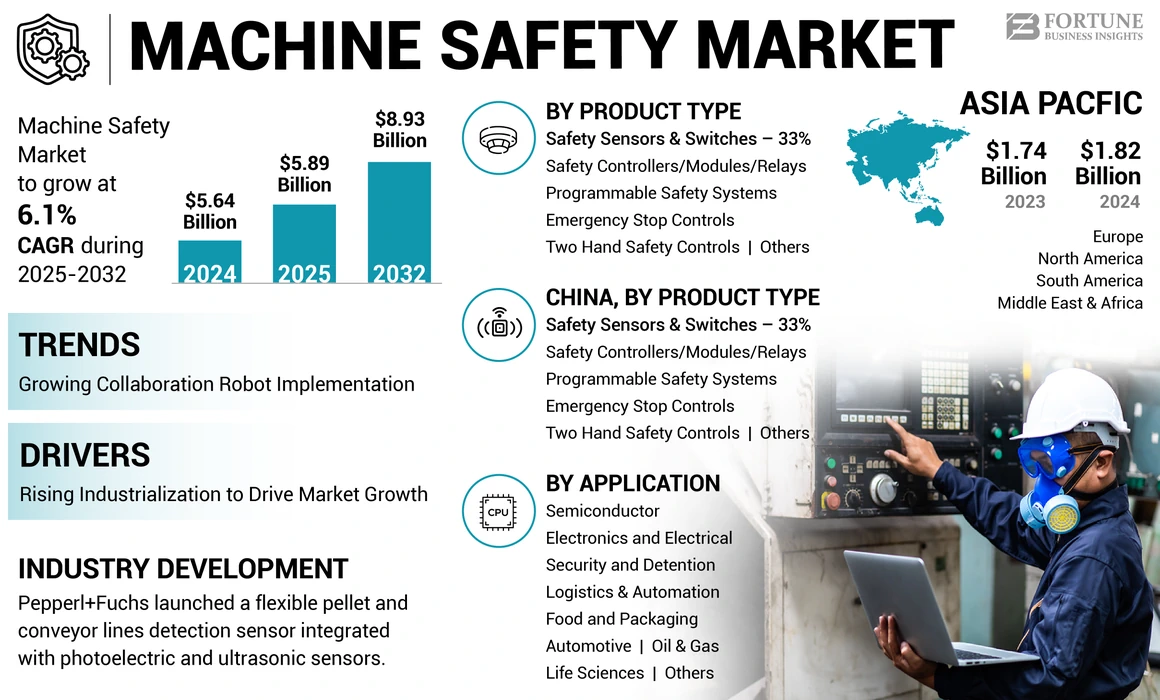

The global machine safety market size was valued at USD 5.89 billion in 2025 and is projected to grow from USD 6.18 billion in 2026 to USD 10.34 billion by 2034, exhibiting a CAGR of 6.60% during the forecast period. Asia Pacific dominated the machine safety market with a market share of 32.60% in 2025.

Machine safety refers to system controls and software that are integrated with the system to alert individuals of hazard zones during a machine operation. Also, these advanced instruments provide instantaneous responses by stopping the ongoing operation of machines through sensors and controls.

Global Machine Safety Market Overview

Market Size:

- 2025 Value: USD 5.89 billion

- 2025 Value: USD 6.18 billion

- 2034 Forecast Value: USD 10.34 billion, with a CAGR of 6.60% from 2026–2034

Market Share:

- Regional Leader: Asia‑Pacific accounted for 26.20% share in 2025

Industry Trends:

- Collaboration Robot Integration: Rising adoption of collaborative robotics (cobots) is driving machine safety implementation, integrating safety sensors to protect human-robot shared workspaces

- Industry 4.0 Automation: Increased automation levels across manufacturing lines are boosting demand for programmable safety systems and light curtain/scanner integration

Driving Factors:

- Rising Industrialization: Expanding industrial activity and the need for modern engineering products are fueling demand for machine safety solutions

- Advanced Machining Processes: Increased use of robotics, light curtains, programmable controllers and advanced safety systems in production lines drives the market

- Post‑Pandemic Recovery: After COVID‑19 disruptions, resumed supply and high safety standards helped restore growth in the sector

The global market is estimated to grow progressively with the rising adoption of technology across production lines in automotive, electronics and electrical, and oil & gas. These are some critical zones where individual safety during the operations leads to accidents. Machine safety primarily uses safety switches, safety controls, modules, & relays, along with programmable systems that ensure safety with minimal or no accidents happening during the machine operation.

COVID-19 IMPACT

The COVID-19 resulted in a major deficit in the market, causing workforce availability at minimum wages. This caused a decline in investments and funding across Industry 4.0 owing to high initial investments. Safety Machines are an essential part of Industry 4.0 that responded correspondingly and noticed a significant drop in sales of essential safety components across the industry. However, post-pandemic recovery has developed essential revenue growth for industry participants owing to high safety standards and resumed supplying safety machine components, which is augmented to grow revenue significantly in the long term.

Machine Safety Market Trends

Growing Collaboration Robot Implementation to Drift Machine Safety Adoption

Machine safety adoption is set to drift due to Industrial Revolution 4.0, which has lifted the automation levels to its high. The continuous production lines and operation efficiency achievement through collaboration robots is a leveraging trend. Also, the integration of safety sensors into these machines and co-bots to ensure individual safety is a necessary process. Thus, to achieve operational efficiency and human safety at the workplace, safety products are important and will expand the machine safety market share over the forecast period.

- For instance, in April 2023, SICK sensor intelligence launched 3D Cameras with integrated time of flight technology. The technology comes with machine vision and a safety camera with programmability that protects the co-bots from collision.

Download Free sample to learn more about this report.

Machine Safety Market Growth Factors

Rising Industrialization to Drive Demand For Machine Safety

Machine safety demand revived positively with the growing industrialization and the need for modern engineering products driving the holistic demand. Further, the rising use of advanced machining processes across product engineering is augmented to drive the forecasted demand. The modern engineering process integrated with modern robotic process automation needs safety from human intervention through new-age safety solutions, such as light curtains and safety controllers, to expand machine safety market growth during the forecast period.

- For instance, in December 2022, Rockwell Automation, a leading automation technology leader, launched an advanced serially connected input solution for safety designated to reduce installation costs and machine downtime.

RESTRAINING FACTORS

High Preventive Maintenance and low Quality Components to Disseminate Market

Machine safety devices need quick monitoring analysis and control systems. However, many niche and small players offer small components and products at much lower costs than average which frequently disturbs the machine safety intrusion capabilities. Also, frequent needs to change the low quality components and high expenses on preventive maintenance is augmented to disseminate the market.

Machine Safety Market Segmentation Analysis

By Product Type Analysis

Safety Assurance across Production Lines to Boost Safety Sensor Demand

Based on product type, the market is classified into safety sensors & switches, safety controllers/ modules/relays, programmable safety systems, emergency stop controls, two-hand safety controls, and others (light curtains & scanners).

The safety sensors & switches segment is projected to dominate the machine safety market with a 33.01% share in 2026. Growing industrialization and demand for safety sensors & switches has dominated the market capital globally, which drives capital across industries. Sensing safety sensors and switches are the essential products that are being adopted progressively across major production facilities and production lines for minimal safety intrusion during Robotic Process Automation (RPA) operation to dominate the market.

Safety controllers, modules, and relays are also prominent in machining operations. Also, programmable safety systems integrated with small safety controllers such as emergency stop controls and two hand safety controls have a prominent application with a stable safety light curtains demand across industries.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Rising Application of Automotive to Dominate the Application

Based on application, the market is classified into security and detention, automotive, electronics and electrical, food and packaging, logistics & automation, life sciences, oil & gas, semiconductor, and others (processing).

The automotive segment is expected to lead end-use adoption, contributing 19.90% of the market share in 2026. The automotive industry’s share will dominate the application with increasing the integration of automated solutions to ensure safety in moving production lines. Also, the high demand for automatic intrusion systems in production lines is increasing in automotive applications. rising safety concerns and the requirement for automation across manufacturing significantly raise the sales of safety systems and controls in the electronics & electrical, food & packaging, and logistics industries. Furthermore, applying safety alert systems in oil and gas, life sciences, and other processing solutions drives the market growth significantly.

REGIONAL INSIGHTS

The global market is studied across the regions, such as North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America

The globally dominant application of safety sensors and switches across automotive production lines to generate significant revenue from sales. Also, growth across other safety systems and controls ensures a safe workplace and minimal downtime and accidents during operation to drive significant sales over the forecast period. The U.S. market reaching USD 1.28 billion by 2026.

Asia Pacific Machine Safety Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific (APAC) accounted for USD 1.92 billion in 2025. Asia Pacific’s industry is set to grow progressively with expanding industrial development across China and India. The growing robotic application and expanding foreign direct investments for setting up new industrial cultures expand the safety market potential exponentially. The Japan market reaching USD 0.45 billion by 2026, the China market reaching USD 0.80 billion by 2026, and the India market reaching USD 0.23 billion by 2026.

- For instance, According to the Ministry of Commerce and Industry, India bagged a foreign direct investment equity inflow of USD 21.34 billion, an increase of 76% from the past year of USD 12.09 billion.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is forecasted to grow steadily owing to an instantaneous push from the local manufacturing players that have headquarters in the Europe region. Furthermore, the growing adoption of programmable safety systems integrated with safety sensors and switches expands the safety machine market growth.

South America

South America is augmented to rise moderately with emerging potential for the food processing cluster and investment across industries, such as mining, machining, and food processing. Also, Brazil has a leadership position and hold over essential raw materials, which helps the region grow steadily.

Middle East & Africa

Middle East & Africa are forecasted to grow significantly owing to stable and continuous demand for safety alert systems in the oil rigging and mining industries.

KEY INDUSTRY PLAYERS

Technological Advancements and Investments in the Research to Lead The Industry

Key players are offering safety system solutions for the people working on the production floor that intelligently manage the equipment and the safety switches integrated at the shop floor. Also, rising investments in the research and development to manufacture efficient safety systems and controls create lucrative opportunities for players operating in the market.

- For instance, in August 2023, Rockwell Automation developed an ArcShield Technology that can be easily integrated with the CENTERLINE. This centralized motor control manages the motor and prevents arcing faults.

List of Key Companies Profiled:

- Rockwell Automation (U.S.)

- Emerson Electric Co. (U.S)

- Schneider Electric (France)

- Honeywell International Inc. (U.S.)

- Siemens AG (Germany)

- Omron Corporation (Japan)

- Keyence Corporation (Japan)

- Yokogawa Electric Corporation (Japan)

- General Electric (U.S.)

- Mitsubishi Electric Corporation (Japan)

- IDEC Corporation (Japan)

- ABB Ltd (Switzerland)

- Pepperl Fuchs (Germany)

- Hartell (Ingersoll Rand) (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2022: Pilz GmBH Co., Kg. launched the modular safety device for modern automated guided vehicles AGVs. The new safety laser scanner PSENScan for safeguarding AGVs that can detect objects and prevent a collision at the workplace.

- October 2022: Omron Automation, a leading safety system manufacturer, launched the Heater conditioning monitor K7TM. The monitor system provides support from preventive maintenance to prevent the failure of the heater.s

- July 2022: Pepperl+Fuchs, offering a more comprehensive sensor solution, launched a flexible pellet and conveyor lines detection sensor integrated with photoelectric and ultrasonic sensors.

- December 2019: Sick, a safety solution provider, expanded local production facilities in China that will create sensor products and construction systems in China.

REPORT COVERAGE

The global machine safety market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

By Application

By Region

|

Frequently Asked Questions

The market is projected to reach USD 10.34 billion by 2034.

In 2025, the market was valued at USD 5.89 billion.

The market is growing at a CAGR of 6.60% during the forecast period.

The safety sensors & switches segment is expected to lead the market.

Rising Industrialization is the key factor driving the market growth.

Emerson Electric Co., Schneider Electric, Honeywell International Inc., Rockwell Automation, Siemens AG, Omron Corporation, Keyence Corporation, Yokogawa Electric Corporation, General Electric, Mitsubishi Electric, IDEC Corporation, and ABB Ltd are the top players in the market.

Asia Pacific is expected to hold the highest market share.

By application, the automotive segment is expected to grow with a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us