Home / Aerospace & Defense / Naval Marine & Ports Technologies / Marine Seats Market

Marine Seats Market Size, Share & Industry Analysis, By Ship Type (Cruise Ship, Yacht, Container Ship, Passenger Ship, and Others), By Seat Type (Passenger Seat, Captain Seat, Crew Seat, and Others), By Component (Seat Structure and Seat material), By Point of Sale (OEM and Aftermarket), and Regional Forecast, 2024-2032

Report Format: PDF | Latest Update: Oct, 2024 | Published Date: May, 2024 | Report ID: FBI106551 | Status : PublishedThe global marine seats market size was valued at USD 419 million in 2023 and is projected to grow from USD 448.8 million in 2024 to USD 620.8 million by 2032, exhibiting a CAGR of 4.1%. North America dominated the marine seats market with a market share of 47.14% in 2023.

Marine seats are specialized seating options designed for use in boats, yachts, and other types of ships. These seats are specifically engineered to withstand the unique challenges posed by the marine environment, such as exposure to water, UV rays, saltwater, and rough sea conditions. They are typically made from durable and weather-resistant materials that can withstand harsh conditions while providing comfort and support to passengers.

There are various types of seats, and the most common are helm seats, bucket seats, bench seats, flip-up seats, fishing seats, and others. Furthermore, while choosing seats, it is important to consider factors such as comfort, durability, functionality, and compatibility with specific boat types. Additionally, owing to the increase in fleet size across the globe, the seat market is anticipated to show significant market growth during the forecast period.

Marine Seats Market Trends

Development of Shock Mitigating Marine Seats to Enhance the Comfort of Passenger Will Propel Market Growth

The pounding waves of water can sway the ship, which can hurt a passenger’s spine when sitting on a chair. Due to the collision of waves on a high-speed vessel, boaters, passengers, and crew members are exposed to dangerous impacts, such as chronic pain and injuries. Several companies, therefore, focus on developing shock mitigation seats to minimize the risk to human health. In May 2023, Norwegian Cruise Lines acquired passenger tender new builds. The main deck on each tender has seating for 164 passengers and two wheelchair-accessible spaces. In addition, there are 188 indoor passenger seats and a covered outdoor area, also fitted with seats, on each upper deck of each vessel.

COVID-19 Impact Analysis

Since the COVID-19 outbreak in December 2019, the disease has spread to almost 100 countries around the globe, with the World Health Organization (WHO) declaring it a pandemic. The impacts of COVID-19 will significantly impact the market in the years 2020 and 2021. The pandemic led to disruption in global supply chains, including the manufacturing and distribution of seats. Restrictions, lockdowns, and reduced workforce in factoring in shipping ports affected the production and delivery of various products, including seats.

Marine Seats Market Growth Factors

Growing Marine Tourism Industry to Contribute Towards Growth of Market

Marine and coastal tourism is an important industry in several countries. The demand for tourism is expected to increase due to the improved global economy and increased personal wealth. In view of the fact that inland and maritime areas remain the most popular destinations for tourism, an increase in leisure boat traffic and tourist activities is expected during the forecast period.

Due to the availability of labor and raw materials, China has a very promising position in the Asian Pacific market for seats. To make it possible for many people to enjoy yachting, the Chinese government is promoting yachting as a leisure activity instead of a luxury service. In 2016, a circular was issued by the Chinese State Council, in which it stated its intention to draw up a development plan for yachting tourism.

According to the UNWTO, the number of international tourist arrivals is expected to reach 1.8 billion per year by 2030. By 2030, Europe is expected to account for up to 780 million tourists, and the increase in tourist arrivals is expected to be faster in emerging countries.

Thus, the growing marine tourism industry is expected to propel the growth of the market.

Growing Demand for Custom-Built Seats for Yachts, Boats, Cruises, and Naval Vessels Fuels Market Growth

To satisfy users' desire for ergonomics, comfort, and technology, there has been an increase in the number of seats manufactured from scratch. Manufacturers continue to exploit the increasing demand for custom seat solutions. Fleet owners and operators continue to seek solutions that will allow them to replace the existing seats with quality custom chairs at an affordable price.

Moreover, it is possible to customize the seat arrangements for boat and yacht owners so that they can meet their particular needs, preferences, or style requirements. Comfort & ergonomics, functionality, flexibility, durability, and longevity are some of the reasons for the growing customization. The trend of custom-made marine seats is likely to increase, providing the yacht and boat owners with more opportunities for creating comfortable, stylish, or functional seating arrangements in view of the growing demand for unique and personalized maritime experiences.

For instance, in May 2023, for the French Polynesia ship-owner Degage Group, Austal Vietnam launched a new high-speed catamaran built at its Vung Tau shipyard. On two decks, the catamaran is capable of accommodating 574 passengers. Up to 80 passengers can be seated on the sun deck.

RESTRAINING FACTORS

Regulatory Compliances and Strict Rules Related to Environment to Hamper Market Growth

The marine industry is subject to various regulations and standards concerning safety, comfort and environmental impact. Seats must meet certain requirements and certifications to ensure compliance. Furthermore, manufacturers need to stay updated with the regulations in the region for specific requirements, which can include conducting tests, obtaining certifications, and maintaining proper documentation to demonstrate adherence to the relevant standards and regulations. This is a time-consuming task and can increase overhead costs for the owners or shipbuilders.

A few of the certifications are the American Boat and Yacht Council (ABYC) standard, ISO 9001, ISO 846, ISO12216, EN ISO 15085, fire resistant standards, and others. Manufacturers need to invest in research, development, and testing to meet these standards, which can be a constraint in terms of time, resources, and costs.

Marine Seats Market Segmentation Analysis

By Ship Type Analysis

Passenger Ship Segment Dominates Market Owing to Increase in Marine Tourism

The market by ship type is segmented into cruise ship, yacht, container ship, passenger ship, and others. The passenger segment dominated the market in the base year and is anticipated to record the highest CAGR due to the growing tourism industry. With more people traveling for leisure trips, the global tourism industry is experiencing a robust growth. In particular, in coastal areas, tourist destinations and other routes, passenger ships play an essential role in the provision of transport and accommodation for tourists. The segment is expected to remain dominant during the forecast period as a result of these factors.

The cruise ship segment is expected to capture the second-largest market share during the forecast period. The cruise industry has continued to expand with more ships, larger vessels, and a broad range of destinations. A cruise holiday offers passengers a unique and convenient way to explore several destinations. Consequently, the number of cruise ships increased, thus boosting the segment’s growth.

By Seat Type Analysis

Passenger Seat Segment to Lead Market Owing to Higher Demand for Passenger Ship Transportation

By seat type, the market is segmented into passenger seat, captain seat, crew seat, and others. The passenger seat segment dominated the market in 2023 and will record the highest CAGR during forecast period. The increase in the segment is due to the growth in passenger traffic in the marine industry. Moreover, the increase in passenger accommodation, which will lead to the segment’s growth during the analysis period, is due to increased demand for other services, such as ferries that offer both passengers and transport by car.

The crew seats segment is projected to show significant growth during the forecast period. The Maritime Labor Convention of the United Nations, which lays down guidelines for crew accommodation and welfare, has contributed to growth in this segment. These regulations lay down minimum standards for crew accommodation, which include provisions concerning the adequate availability of seats to crew members on rest days.

By Component Analysis

Owing to Technological Advancements and Changing Consumer Preference, the Seat Material Segment is the Dominating one

The component segment is categorized into seat structure and seat material. The seat material segment is projected to dominate the market along with highest CAGR during the forecast period owing to the enhanced comfort expectations across different sectors. Seat materials with enhanced cushioning and support are in demand to provide optimal comfort to users.

The seat structure segment is projected to grow significantly during the forecast period. The growth of the segment is owing to the advanced manufacturing processes, changing safety regulations, and increase in demand for custom-built seats. For instance, in April 2022, Yacht architects and shipbuilders at Alpha Marine Ltd. announced the construction of a new 47-meter diesel-electric superyacht called The First. The yacht will be marketed as the new company ProMarine Yachts S.A. traded and incorporated in Greece.

By Point of Sale Analysis

Aftermarket Segment to Dominate the Market Owing to the Rise in Replacement of Old Seats

The market by point of sale is divided into OEM and aftermarket. The aftermarket segment is anticipated to grow at a higher CAGR throughout the forecast period due the rise in replacement of marine seats in various ship types. Additionally, aftermarket products are often priced more competitively compared to OEM productions. This improves the segmental growth during the study period.

The OEM segment is anticipated to grow significantly owing to the rise in fleet size and increased number of contract for installation of advanced and comfortable marine seats with improved design and material.

REGIONAL INSIGHTS

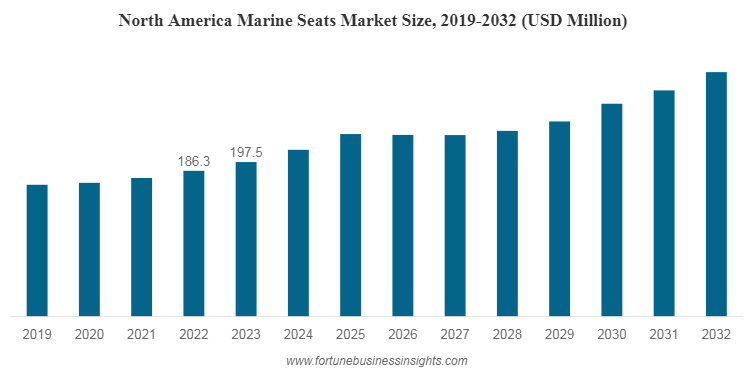

In terms of geography, the market is divided into North America, Europe, Asia Pacific and the Rest of the World. North America was valued USD 197.5 million in 2023. The growth in this region is owing to the rise in recreational boating, increase in marine tourism, leisure activities, and charter services, more number of boats, yacht manufacturing facilities, and others.

The European market has the second-largest marine seat market share and is anticipated to witness significant growth through the projection period due to the growing tourism industry in the region. The swiftly increasing tourism industry in countries such as Italy, France, Greece, Norway, and others is anticipated to surge the demand for passenger ships in the region, thus increasing the demand for seats.

The share in the Asia Pacific marine seats market dominated in the base year. This growth is owing to the increasing cruising activities in China. Moreover, the presence of shipbuilding companies in South Korea and Japan aids the market's growth in the region.

Rest of the World is expected to grow during the forecast period owing to the rising trade activities and improving economy in countries such as Brazil. Moreover, growing demand for tourist activities such as water sports and voyages is projected to increase the market in this region.

List of Key Companies in Marine Seats Market

Key Players Are Focusing on the Development of Marine Seats Technologies to Improve Ergonomic Properties of the Seat

The market is fragmented with many players. Some of the major market players include NorSap AS, Stidd Systems Inc. Jiangsu Trasea Marine Seating Ltd., and others. The companies are expanding their business through strategic agreements, partnerships, acquisitions, and others. The companies are introducing new technologies and focusing on the innovation of products to sustain their position in the market.

LIST OF KEY COMPANIES PROFILED:

- NorSap AS (Norway)

- Stidd Systems Inc. (U.S.)

- Shockwave Seats (Canada)

- Jiangsu Trasea Marine Seating Ltd. (China)

- ScotSeat Group (U.K.)

- Springfield Marine Company (U.S.)

- Ullman Dynamics (Sweden)

- Alu Design & Services AS (Norway)

- Todd Marine (U.S.)

- Cleemann Chair-Systems GmbH (Germany)

- TEK Seating (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- January 2023– Mayor Daniel J. Lyman of New Jersey has announced that Bridgeport, Connecticut's Hornblower Marine has awarded a USD 9.8 million contract from New Jersey Transit to build the county's second 149-passenger ferry. The Lyman administration received more than USD 46 million in grants from federal and state governments for the Carteret Ferry Terminal

- May 2023 - A new river cruise ship ordered by a compatriot operator, Mashpromlizing, has been launched by Russia's Southern Centre for Shipbuilding and Ship Repair, a division of United Shipbuilding Corporation. Aurum is a part of the Project PKS 180 series of river cruise vessels. It will have a length of 81.6 meters, an angle of 13.93 meters and accommodation for 180 passenger seats on three decks once it is completed.

- February 2022– Allsalt Maritime has introduced the Shoxs Caster suspension seat series designed to provide a smooth ride for offshore boaters. The new Helmcaster and Saltcaster models represent the only full-suspension, all-in-one seating system for recreational boating enthusiasts, eliminating the challenges of fitting seat pans to spring-based shock-absorbing sockets and modules.

- October 2022– All American Marine (AAM) has won a contract to build a high-speed, long-haul, 150-passenger eco-tour vessel for Phillips Cruises and Tours. The ship will be deployed to Whittier, Alaska upon completion.

- October 2022– Singaporean shipbuilder Strategic Marine has announced that it has won an order for four crew boats from Malaysian operator Surya Nautica. The ship has a large galley and dry storage, suitable for large, long-stay crew. The passenger saloon features 80 reclining seats arranged as singles or doubles in each row for additional space and privacy.

REPORT COVERAGE

The market report provides a detailed analysis of the market. It comprises all major aspects, such as R&D capabilities and optimization of the manufacturing process. Moreover, the market research report offers insights into the Marine Seats market trends and primarily highlights key industry developments, Porter’s five forces analysis, and others. In addition to the above-mentioned factors, it mainly focuses on several factors that have contributed to the global market growth over recent years.

Report Scope & Segmentation

ATTRIBUTE |

DETAILS |

Study Period |

2019-2032 |

Base Year |

2023 |

Estimated Year |

2024 |

Forecast Period |

2024-2032 |

Historical Period |

2019-2022 |

Growth Rate |

CAGR of 4.1% from 2024 to 2032 |

Unit |

Value (USD Million) |

Segmentation

|

By Ship Type

|

By Seat Type

|

|

By Component

|

|

By Point of Sale

|

|

By Geography

|

Frequently Asked Questions

How much was the marine seats market worth in 2023?

As per the Fortune Business Insights study, the market size was valued at USD 419 million in 2023.

At what CAGR is the marine seats market projected to grow during the forecast period of 2024-2032?

The market is likely to record a CAGR of 4.1% over the forecast period of 2024-2032.

Which is the leading conversion segment in the market?

Passenger segment is expected to lead the market due to the development of electronics industry globally.

What is the value of the Greece market?

The market size in Greece stood at USD 35.5 million in 2023.

What are the key factors driving the market?

Growing Marine Tourism Industry to Contribute Towards Growth of Market

Who are the top players in the market?

Some of the top players in the market are NorSap AS (Norway), Stidd Systems Inc. (U.S.), Shockwave Seats (Canada), Jiangsu Trasea Marine Seating Ltd. (China)

Which factor is expected to restrain the deployment of the product?

Regulatory Compliances and Strict Rules Related to Environment to Hamper Market

- Global

- 2023

- 2019-2022

- 180