Marketing Automation Software Market Size, Share & Industry Analysis, By Application (Campaign Management, Email Marketing, Lead Management, Social Media Marketing, Inbound Marketing, Analytics and Reporting, and Others), By Deployment Model (On-Premises and Cloud), By Enterprise Type (Large Enterprises and Small & Medium Enterprises (SMEs)), By End-user (BFSI, Retail and Consumer Goods, Healthcare, Media and Entertainment, Manufacturing, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

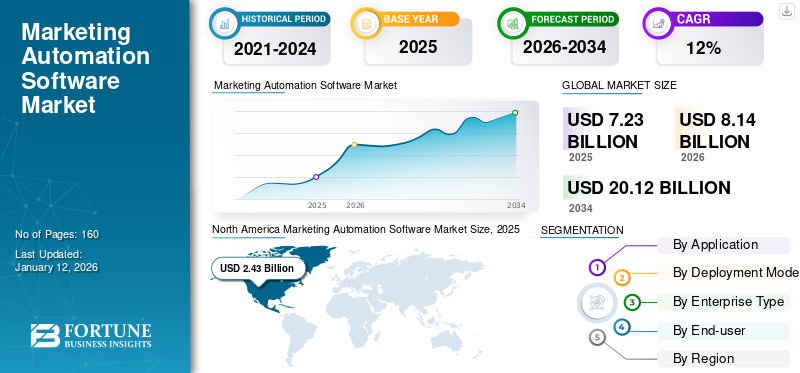

The global marketing automation software market size was valued at USD 7.23 billion in 2025 and is projected to grow from USD 8.14 billion in 2026 to USD 20.12 billion by 2034, exhibiting a CAGR of 12.00% during the forecast period. North America dominated the marketing automation software market with a market share of 33.60% in 2025.

Marketing automation is a technology that automatically manages the marketing process and multi-functional campaigns across multiple channels. Marketing departments can also use automated actions such as email campaigns, social media posts, and ad campaigns to offer their customers a better personalized experience.

The market’s growth can be attributed to several factors, such as growing demand for custom advertising and users' loyalty toward business growth, as well as a need for an informed advertising strategy. Furthermore, the growing product demand is due to the rapid growth of digital industries, a rise in internet connectivity, and the high usage of portable devices. Such factors are driving the global market share. According to Demand Spring, in 2021, 96% of marketers used a marketing automation platform for their businesses.

GLOBAL MARKETING AUTOMATION SOFTWARE MARKET OVERVIEW

Market Size:

- 2025 Value: USD 7.23 Billion

- 2034 Forecast Value: USD 20.12 Billion

- Forecast CAGR: 12.00% (2026–2034)

Market Share:

- Regional Leader: North America held the largest share in 2025

- Fastest‑Growing Region: Asia Pacific is expected to see the highest growth rate during the forecast period

- End‑User Leader: BFSI segment dominated the market in 2025

Industry Trends:

- Emergence of omnichannel marketing platforms offering seamless experiences across web, email, social, and mobile

- Analytics & reporting becoming a key driver for campaign personalization and ROI optimization

- Cloud-based marketing automation adoption rising rapidly due to scalability and flexibility

Driving Factors:

- Enterprises increasingly focusing on optimizing marketing budgets and improving campaign efficiency

- Surge in digital marketing investments across industries driving automation software uptake

- Growth in AI-driven personalization, lead scoring, and automated content generation

- SMEs and large enterprises alike adopting tools for cost-effective customer engagement

- Expansion of digital infrastructure and marketing platforms globally encouraging further adoption

COVID-19 IMPACT

Limited Marketing Budgets and Adoption of Latest Marketing Technologies Fueled Market Growth amid Pandemic

During the peak of COVID-19, marketing automation software adoption received a slight positive response. Several marketing companies took a ‘play safe’ approach during this pandemic, reducing their marketing budgets until they had an opportunity to assess the impact on their businesses and wait for economic conditions to improve.

Businesses began adopting a new approach to emerging marketing technologies, such as conversational media, email, video, and others. Changes in advertising, marketing, promotional, and media spending emerged during the pandemic. Consequently, to maintain a consistent revenue stream, firms and brands were forced to rethink their current and future marketing initiatives. Furthermore, the period recorded strategic acquisitions and partnerships. For instance,

- In December 2020, the Israeli company Kenshoo Limited, which provides digital advertising services, announced its acquisition of Signal Analytics to enable automated marketing automation campaigns.

Marketing Automation Software Market Trends

Emergence of Omnichannel Marketing to Propel Market Growth

The main trend in marketing automation is omnichannel marketing, which enables an audience to receive a seamless advertising experience. Enterprises can increase sales from many channels with data unification and automated processes while giving customers the same user experience in e-commerce and in-store. A study from Google has shown that 90% of all device owners switch devices daily, using an average of 3 devices in the course of their activities.

Moreover, omnichannel automation platforms enable brands to make the entire customer experience available through a variety of channels. This ensures an enhanced experience for customers.

Download Free sample to learn more about this report.

Marketing Automation Software Market Growth Factors

Increasing Focus of Enterprises on Optimizing Marketing Spending to Aid Market Growth

Businesses invest heavily in digital marketing to influence their target audience. Investment in strategies such as new customer acquisitions can be measured and managed through a properly allocated marketing budget. Organizations are also empowered to optimize their business strategies and improve ROI in the field of marketing activities.

Enterprises leverage marketing automation software to monitor the impact of their promotion activities and make better use of advertising budgets. The software makes it easy for businesses to make decisions based on data and convert more leads. This has led several companies to benefit from its usage, which is leading to the market growth.

RESTRAINING FACTORS

Lack of Experienced Professionals to Hinder Market Expansion

Due to the advent of new automation technologies, the market is lacking experienced professionals who can provide advice to consumers on the advantages of analytics solutions and exploit them for useful information and insights. Addressing this challenge is crucial to achieving substantial uptake of this market in high-volume sectors.

Marketing Automation Software Market Segmentation Analysis

By Application Analysis

Analytics and Reporting Segment to Witness Rapid Growth Due to Customized Content and AI-Driven Insights

Based on application, the market is segmented into campaign management, email marketing, lead management, social media marketing, inbound marketing, analytics and reporting, and others.

The analytics and reporting segment is expected to grow at the highest CAGR during the forecast period. The solution helps to monitor success and provides performance insights for improving advertising return on investment, maximizing the spread of channels, and delivering long-term trends. In addition, analytics and reporting enable companies to provide customers with customized content, personalized recommendations, and humanlike assistance with Chatbot’s virtual assistants, enabling them to remain up to date with minimal input.

In terms of market share, the campaign management segment dominated the market in 2026 with a share of 19.86%. With the use of a marketing automation tool, marketers can make several efficient advertising campaigns that help increase business revenues. This software also helps to gain customer insight, such as understanding the buying patterns and characteristics of customers. For instance, in January 2023, Yodelpop launched RaiserSync and YourMemberSync, two easy-install integrations for HubSpot Marketing Hub. The newly launched integration allows associations and NGOs to connect their systems with HubSpot's Marketing Automation software, which allows them to create effective and engaging marketing campaigns and communications.

By Deployment Model Analysis

On-premises Segment Leads as its Initial Investment Cost Leads to Long-term Benefits

Based on the deployment model, the market is segmented into on-premises and cloud. In terms of market share, the on-premises segment dominated the market in 2026 with a share of 51.90%. This model refers to the implementation of marketing automation solutions at the client's premises through their IT infrastructure. It initially requires large investments and maintenance by the organizations. However, no incremental costs are incurred throughout their ownership.

The cloud segment is expected to grow at the highest CAGR during the forecast period. The major factors that help make cloud technology more useful for growing marketing automation solutions are its scale and flexibility, security aspects, and data center management. In addition, cloud marketing automation is expected to increase in the coming years as a result of integrating marketing tools such as emails, social media management, and analytics.

By Enterprise Type Analysis

SMEs Anticipated for Rapid Growth as Due to Increasing Integration of Digitalization by SMEs

Based on enterprise type, the market is segmented into small & medium enterprises (SMEs) and large enterprises.

The small & medium enterprises (SMEs) segment is anticipated to expand at the highest CAGR during the forecast period. At the earlier stage of technological proliferation, there were a few applications of marketing automation in larger enterprises. However, a significant number of SMEs have begun integrating automation solutions into existing systems due to digitalization in industries and the increasing penetration of internet and mobile devices which need to be deployed for efficient marketing. In addition, the players are implementing acquisition strategies. For instance,

- In March 2023, Keap announced the acquisition of The Factory, a former partner of Keap, a provider of sales and marketing automation software to small businesses. The Factory facilitates the creation of powerful marketing strategies and implementing sales and marketing automation for small business owners.

In 2026, the large enterprises segment dominated the market with a share of 54.75%. The use of marketing automation software makes it possible for large enterprises to perform complex and time-consuming processes. This increases performance and minimizes errors. Furthermore, major companies frequently use marketing automation which is of paramount importance within highly regulatory sectors like banking, financial services, and healthcare.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Healthcare Industry Set for Expansion Owing to Personalized Patient Engagement

Based on end-user, the market is classified into retail and consumer goods, BFSI, healthcare, media and entertainment, manufacturing, and others.

The healthcare segment is expected to significantly grow at the highest CAGR during the forecast period. Healthcare marketing automation allows healthcare professionals to tailor their interactions with prior, current, and future patients based on predefined behaviors by using technology-driven marketing campaigns. Organizations are adopting strategies for using marketing automation to improve patient engagement and build lasting relationships. Strategies such as automation of patient referrals, online listing management, patient needs analysis, and others are being adopted by the organizations.

The BFSI segment accounted for a dominating share of 25.58% in the market in 2026. The BFSI industry is adopting marketing automation software, enabling payment automation, transparent and auditable audits, error-free insurance claims processing, and unified KYC processes. Traditional contracts require substantial documentation and detailed record-keeping to ensure financial audits. By connecting to the marketing automation platform, this sector offered advanced banking solutions for this market.

REGIONAL INSIGHTS

Regionally, the market is segmented into North America, Europe, South America, the Middle East & Africa, and Asia Pacific.

North America Marketing Automation Software Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

As per the analysis, North America dominated the market with a valuation of USD 2.43 billion in 2025 and USD 2.65 billion in 2026. The adoption of marketing automation products in the region is increasing as more digital omnichannel campaigns are now being run than traditional ones. In a survey conducted by the American Marketing Association and Duke University in January 2021, B2B marketing professionals in the U.S. suggested that their spending on traditional advertising would decrease by 0.61% in the following year, while their spending on digital advertising would increase by 14.32%. The U.S. market is projected to reach USD 1.71 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is anticipated to grow at the highest growth rate during the study period. In the Asia Pacific, due to an increase in digital advertising on all social media platforms, the use of marketing automation solutions is growing. Chinese social media applications such as WeChat, Weibo, and Tieba have been among the most highly placed advertising platforms to help enterprises concentrate on people and enhance their marketing strategies. This market is, therefore, expected to grow over the forecast period as a result of growing internet penetration, the use of social networking applications, and an increasing digitization of businesses in the region. The Japan market is projected to reach USD 0.56 billion by 2026, the China market is expected to reach USD 0.54 billion by 2026, and the India market is anticipated to reach USD 0.38 billion by 2026.

The Middle East & Africa market is estimated to record the second-highest growth rate during the analysis period. Advancements in cloud technologies used for marketing automation software led to a proliferation of this market in the region. The UK market is expected to reach USD 0.41 billion by 2026, while the Germany market is projected to reach USD 0.28 billion by 2026.

KEY INDUSTRY PLAYERS

Market Players Announce Product Development, Merger & Acquisition, and Partnership Strategies to Expand Product Reach

Key players operating in the global market for marketing automation software focus on providing automated marketing services for better revenue generation and brand awareness of enterprises. These companies focus on acquiring local and small firms to expand their business presence. Moreover, strategic partnerships, mergers and acquisitions, and leading investments help enhance the product demand.

List of Top Marketing Automation Software Companies:

- Adobe (U.S.)

- IBM Corporation (U.S.)

- Oracle Corporation (U.S.)

- HubSpot, Inc. (U.S.)

- Salesforce, Inc. (U.S.)

- Creatio (U.S.)

- Microsoft Corporation (U.S.)

- Zoho Corporation Pvt. Ltd. (India)

- Act-on (U.S.)

- Sage Group plc (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- October 2023: Phonexa integrated with Tipalti, the payment automation platform, to launch an integration for its clients that enables Global Payment Methods to be automated, compliant, and more easily than ever before used by affiliate marketing agencies and publishers.

- April 2023: Deployteq, a provider of self-service marketing automation, shared plans to target growth in the U.K. market through its user-friendly 'no code' platform. This would allow advertisers to control Omni channel campaigns and drive significant returns on investment.

- February 2023: Utrecht Trengo, the customer engagement platform with a global marketing automation platform Klaviyo, announced its new partnership and integration. This integration would allow online retailers to leverage WhatsApp at a critical time in the buying process and connect with their customers so that they can improve conversion rates into repurchase funnels.

- January 2023: ImPartner, the complete Partner Relationship Management (PRM) provider, increased its partner marketing automation solutions to include more ‘Do it for me’ options, which would make co-selling and referral marketing even more automated.

- May 2022: GetResponse, a marketing automation software provider, launched an upgrade of its Ecommerce Marketing Automation solution. Its marketing automation would help online retailers to grow their businesses in an automated manner to increase revenue and sales.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies and end-users of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.0% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application

By Deployment Model

By Enterprise Type

By End-user

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 20.12 billion by 2034.

In 2025, the market value stood at USD 7.23 billion.

The market is projected to grow at a CAGR of 12.0% over the study period.

By end-user, the BFSI segment led the market in 2025.

The increasing focus of enterprises on optimizing market spending is expected to aid market growth.

Adobe, IBM Corporation, Oracle Corporation, HubSpot, Inc., Salesforce, Inc., Creatio, Microsoft Corporation, Zoho Corporation Pvt. Ltd., Act-on, and Sage Group plc are the top players in the global market.

North America held the largest market share in 2024.

Asia Pacific is expected to exhibit the highest growth rate during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us