Medical Hyperspectral Imaging Market Size, Share & Industry Analysis, By Component (Hyperspectral Camera and Accessories), By Modality (Push Broom, Snapshot, and Others), By Application (Quality Assurance & Drug Testing, Medical Diagnostics, and Others), By End User (Pharmaceutical & Biopharmaceutical Companies, Research Institutes & Organizations, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

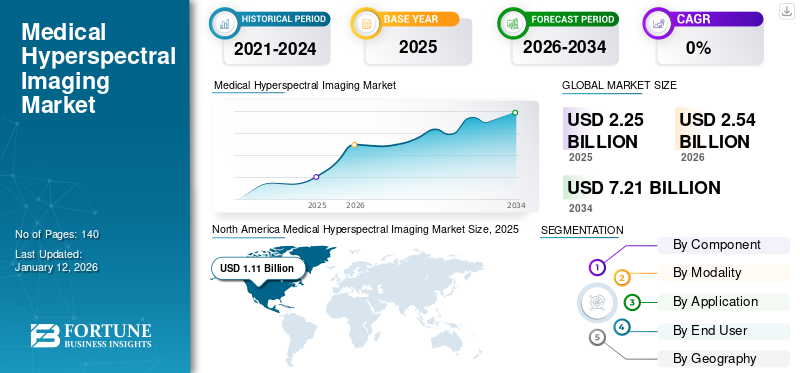

The global medical hyperspectral imaging market size was valued at USD 2.25 billion in 2025. The market is anticipated to grow from USD 2.54 billion in 2026 to USD 7.21 billion by 2034, exhibiting a CAGR of 13.94% during the forecast period. North america dominated the medical hyperspectral imaging market with a market share of 49.47% in 2025.

Hyperspectral imaging is an analytical technique based on spectroscopy and digital imaging that analyzes a wide band of the light spectrum to each pixel. Hyperspectral imaging is performed mainly by the hyperspectral camera that captures multiple images at different wavelengths for the same spatial area. The hyperspectral camera covers the wavelength range from ultraviolet to infrared majorly for 200–2500 nm. The growing research and development environment, increasing applications of hyperspectral imaging in the healthcare industry, and an increasing number of pharmaceutical and biopharmaceutical companies using hyperspectral imaging systems are some factors anticipated to significantly surge the demand for these imaging systems during the forecast period.

The major factor responsible for the market growth is the rising prevalence of cancer and improved imaging outcomes with the medical hyperspectral imaging technique. Moreover, technological advancement leading to enhanced diagnosis outcomes and increasing adoption of these imaging systems are other significant factors driving the medical hyperspectral imaging market growth. Furthermore, the introduction of technologically advanced products by key players to eliminate possible challenges associated with other imaging techniques is expected to boost the market growth during 2025-2032.

The COVID-19 pandemic slightly impacted the market due to a decline in demand for these systems. The widespread disruption caused by COVID-19 has significantly affected the supply of these systems leading to pending purchase orders and a decline in sales. Also, these systems have several applications in multiple industries, such as healthcare, food, and agriculture, which faced a negative impact of the COVID-19 pandemic overall.

- For instance, the financial reports of Konica Minolta Inc., the parent company of Specim, Spectral Imaging Ltd., revealed a decline in sales by 13.3% in 2020.

However, these systems were used for diagnosing oxygen saturation and rashes over the skin in COVID-19 patients, thereby creating awareness about using these systems in medical diagnostics. Such initiatives by the major players in this market during the COVID-19 pandemic created awareness about the use of these systems in COVID-19 and supported the sales of these systems in later phases of the pandemic. Thus, the decline in the purchase by key customers was somewhere compensated by research activities leading to a slight negative impact on the overall market. The market demonstrated robust recovery trends post the pandemic and is estimated to record a steady growth rate during the forecast period of 2025-2032.

Medical Hyperspectral Imaging Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 2.25 billion

- 2026 Market Size: USD 2.54 billion

- 2034 Forecast Market Size: USD 7.21 billion

- CAGR: 13.94% from 2026–2034

Market Share:

- North America dominated the medical hyperspectral imaging market with a 49.47% share in 2025, driven by technological advancements, a high prevalence of cancer, and strong presence of leading companies like Imec, Resonon, and Headwall Photonics in the region.

- By component, the hyperspectral cameras segment held the largest market share in 2024 and is expected to continue leading due to its central role in imaging systems and higher cost compared to accessories. Continuous innovation, such as OmniVision and Diaspective Vision’s collaborative developments, supports the segment’s dominance.

Key Country Highlights:

- Japan: Market growth is supported by technological collaborations, such as Specim (a Konica Minolta subsidiary), and increased focus on diagnostic precision in clinical settings. Demand is rising due to efforts to improve surgical and diagnostic imaging outcomes with compact, advanced cameras.

- United States: Growth is propelled by a high cancer burden (2.28 million new cases in 2020), increasing use of hyperspectral imaging for early cancer detection, and R&D investments by companies like BaySpec and HyperMed Imaging. The FDA registration of products like TIVITA Mobile further enhances adoption in clinical practice.

- China: Increasing healthcare investment and R&D funding, along with domestic production of hyperspectral systems by companies such as Optosky, are contributing to market expansion. Government-backed innovation initiatives are accelerating the availability of cost-effective imaging solutions.

- Europe: The region benefits from robust research funding and innovation. For example, Hypervision Surgical secured USD 8.1 million to develop real-time surgical imaging tools, and the HyPPOCRATES project received USD 27 million in EU funding to enhance data interpretation platforms. Germany and the U.K. are key contributors to regional growth due to advanced medical technology infrastructure.

Medical Hyperspectral Imaging Market Trends

Remote Sensing-based Diagnosis with Hyperspectral Imaging is a Key Market Trend

Hyperspectral imaging plays a significant role in the remote diagnosis of conditions. The technological advancements in smartphones led to the integration of several sensors, such as magnetometers, accelerometers, ambient light sensors, high-resolution hyperspectral cameras, and gyroscopes. These integrations can detect and magnify valuable information for the screening, diagnosis, and monitoring of diseases. Moreover, following the trend of remote diagnosis, many companies are introducing remote imaging devices to make healthcare more accessible.

- For instance, in March 2022, Swift Medical Inc. announced the launch of Swift Ray 1. Swift Ray 1 is a hardware device that wirelessly attaches to a smartphone camera and captures comprehensive clinical data to support better assessment, treatment, and monitoring of skin and wound conditions. The device also integrates directly into many of the EHRs to help clinicians both improve clinical efficiency and ensure that all relevant medical information is recorded in the patient’s chart.

Thus, the use of remote sensing technology in healthcare is trending and leading to the introduction of innovative devices that are anticipated to influence the market to a growth pattern.

Download Free sample to learn more about this report.

Medical Hyperspectral Imaging Market Growth Factors

Increasing Prevalence of Cancer to Boost Market Growth

Solid tumor detection is one of the major applications of medical hyperspectral imaging. One of the main advantages associated with hyperspectral imaging is the non-invasive nature of cancer diagnosis, avoiding tissue biopsies, and providing diagnostic signatures without needing a real-time contrast agent. The increasing prevalence of cancer is leading to increasing demand for medical hyperspectral imaging and contributing to market growth.

- For instance, according to WHO, in 2020, cancer accounted for nearly 10 million deaths, where breast, lung, and colon cancers are the top three in the category.

- According to the International Agency for Research on Cancer (IARC), in 2020, more than 1.9 million new cases of colorectal were reported leading to 930,000 deaths. The mentioned statistics are predicted to increase by 63% (3.2 million new cases) and 73% (1.6 million), respectively, by 2040 on an annual basis.

The increasing prevalence of cancer has boosted the demand for medical hyperspectral imaging systems and is driving the market's growth.

Moreover, the outcome of multiple research indicates the accuracy of hyperspectral imaging in cancer diagnosis. For instance, a research study published in Springer Nature in 2022 revealed that hyperspectral imaging could identify breast cancer from the excised breast tissue during surgery with an accuracy of over 84%. Also, medical hyperspectral imaging could analyze the tissue within a few minutes, which enables checking whether there are residual tumor cells on the margin of resection areas. The advantages and accuracy of this technique in cancer diagnosis is one of the major factors driving the market growth during the forecast period.

Increasing Research to Explore Medical Applications will Contribute to Market Growth

The use of hyperspectral systems in the medical field is still in the exploratory phase; therefore, multiple research is going on, resulting in disease diagnosis.

- According to a research study published in January 2023 in NCBI, hyperspectral imaging can be used to predict the healing of diabetic foot ulceration. The study outcome revealed that hyperspectral imaging is a simple exam that can easily be added to daily clinical practice and has the potential to provide useful information regarding the healing potential of DFU over a short period of time.

- A research study published in Springer Nature in January 2023 revealed that medical hyperspectral imaging is a feasible approach for quantifying systemic sclerosis-associated Raynaud phenomenon in the clinical setting. Being a non-invasive technique, it measures oxygenated and deoxygenated hemoglobin concentrations and oxygen saturation in the skin and depicts data as oxygenation heat maps.

Similar initiatives by researchers to develop a diagnostic method for diseases are driving the market growth.

RESTRAINING FACTORS

High Cost of Medical Hyperspectral Imaging Systems and Huge Data Storage Limit the Market Growth

The cost of a hyperspectral imaging system includes the cost of the hyperspectral camera, light sources, software, reflectance panel, microscope, and other accessories. The cost of hyperspectral cameras and microscopes puts pressure on the affordability of the healthcare system within the allocated healthcare expenditure. For instance, Optosky, a Chinese company, manufactures hyperspectral cameras with prices ranging from USD 45,000 to USD 49,800. In the U.S., this system usually ranges from USD 50,000 and more.

Moreover, the complexity of data requires huge storage spaces, which is not feasible for companies at affordable cost and limits market growth. For instance, according to an article published in Hindawi in April 2022, hyperspectral imaging systems integrated with machine and deep learning face high space complexity due to bulk data storage. Also, it takes much time due to training and testing of the huge amount of raw HSI data, which costs additionally and further limits market growth during the forecast period.

Medical Hyperspectral Imaging Market Segmentation Analysis

By Component Analysis

Hyperspectral Cameras Segment to Dominate Market as it is the Main Component of the System

Based on component, the market is bifurcated into hyperspectral camera and accessories. The hyperspectral camera segment held the major market share of 61.75% in 2026 and is projected to grow with a notable CAGR during the forecast period. The segment’s dominance is due to the ability to capture the broad spectral range, being the main component of a system, and the higher cost of hyperspectral camera than accessories.

- For instance, according to a report published by Sutarja Center for Entrepreneurship & Technology (Berkeley Engineering), standard monochrome visible cameras have a 75% likelihood of being replaced, as hyperspectral cameras have greater image collection capabilities that monochrome cameras cannot achieve.

In addition, key players in the market have entered strategic collaborations and utilized their expertise for the development of innovative hyperspectral cameras.

- For instance, in November 2021, OmniVision Technologies, Inc. and Diaspective Vision GmbH entered a partnership for the development of a new medical hyperspectral imaging camera.

The accessories segment is expected to grow substantially during the forecast period due to increasing technological advancements in the light source and integration of microscopes in these imaging systems to magnify and capture the image at a microscopic level.

- For instance, according to ProPhotonix, a manufacturer of custom LED lights and laser modules, LED lights are advantageous over Halogen due to the capability to boost the spectrum as required within the range of interest. Using LED lights as a light source is beneficial for applications where illumination is needed to compensate for any deficiencies caused by a camera’s response sensitivity.

Thus, technological advancement and hyperspectral imaging capabilities encouraged the deployment of these systems for research and adoption of these systems.

To know how our report can help streamline your business, Speak to Analyst

By Modality Analysis

Push Broom Segment to Dominate the Market due to Maximized Image Capacity

Based on modality, the market is categorized into push broom, snapshot, and others. Being a traditional modality, the push broom segment held the largest share of 68.05% in 2026 and is projected to grow with a notable CAGR during the forecast timeframe. The dominant share of this segment is due to broad adoption, high spatial & spectral resolution offered by this modality, and increased use of this technology in the pharmaceutical industry. Several key players in the market are introducing push broom hyperspectral imaging systems due to their numerous advantages, such as lower illuminance exposure, minimum heat load, and maximum imaging speed.

- For instance, according to Middleton Spectral Vision, a developer of hyperspectral-based solutions, a push broom is highly used in pharmaceutical tablet monitoring. It is possible to image 200 tablets per second with a spatial resolution of 125 pixels per tablet. Thus, as a screening tool, it helps detect uneven ingredient distribution.

The snapshot segment is expected to grow significantly during the forecast period. The segment's growth is attributed to the high data throughput and increased product launches.

- For instance, in 2019, Cubert announced the launch of ULTRIS 20, a hyperspectral camera with a snapshot modality based on light field technology, where both the intensity and direction of incident light rays are used to produce spectral images.

Other segments include whisk broom and staring modalities. The others segment is anticipated to grow at a stagnant rate due to limited awareness and use of these technologies compared to push broom and snapshot.

Thus, advantages associated with a push broom and high data throughput with snapshot modality are expected to boost the segment’s growth during the forecast period.

By Application Analysis

Quality Assurance & Drug Testing to Hold Major Market Share Due to Growing R&D Expenditure

On the basis of application, the market is categorized into quality assurance & drug testing, medical diagnostics, and others. The quality assurance & drug testing segment accounted for a significant share of 44.39% in 2026, and the market is anticipated to register a notable CAGR. The growth of the segment is due to factors such as growing pharmaceutical industry and rising expenditure on drug testing by pharmaceutical companies.

- For instance, the data published by the Congressional Budget Office, in 2019, revealed that the pharmaceutical industry devoted USD 83 billion to R&D expenditures to discover and test new drugs, develop incremental innovations such as product extensions, and clinical testing for safety-monitoring or marketing purposes.

The medical diagnostic segment is anticipated to grow at a significant rate due to increasing research to establish hyperspectral imaging for medical diagnostics. For instance, a research published in Springer Nature in 2021 used hyperspectral imaging in the mouse’s retina to diagnose Alzheimer’s disease. As the clinical diagnosis of Alzheimer’s disease is either expensive or inaccessible, using the retina as a biomarker is gaining traction.

The others segment includes oxygen saturation in blood, hemoglobin identification, ex-vivo diagnosis, and drug discovery.

- For instance, as per the data published by Sage Journals in July 2021, hyperspectral imaging (HSI) is a new technique specially designed for diagnostic applications. This system provides diagnostic information for hypoxia, cancer detection, skin lesions, anemia, and urinary stone analysis. The additional applications cover a range of measurements from in-vivo to ex-vivo settings, including image-guided surgery, dermatology, endoscopy, macroscopic analysis of ex-vivo tissue samples, and histology.

The other segment captures relatively less market share due to ongoing development to perform these applications through hyperspectral imaging.

The above mentioned factors are expected to support the market growth in coming years.

By End User Analysis

Pharmaceutical & Biopharmaceutical Companies Segment to Hold Major Market Share due to Rapid Growth in respective Industries

Based on end user, the market is segmented into pharmaceutical & biopharmaceutical companies, research institutes & organizations, and others.

The pharmaceutical & biopharmaceutical companies segment dominated the market with a share of 49.44% in 2026 and is expected to register a notable CAGR during the forecast period of 2025-2032. The segment’s growth is attributed to the increasing number of pharmaceutical companies adopting hyperspectral imaging for in-house quality assurance.

The research institutes & organizations segment is expected to record a substantial CAGR during 2025-2032. The high growth rate is due to the factors such as the increasing research to explore the medical applications of hyperspectral images and method development for tissue diagnosis.

The others segment is expected to witness comparatively lower growth during the forecast period. The factors attributed to limited growth are limited awareness about the deployment of hyperspectral imaging and the high cost of the system.

Thus, such increasing incidence of respiratory conditions among all age groups, mainly in adults, is predicted to aid the market growth during 2025-2032.

REGIONAL INSIGHTS

North America Medical Hyperspectral Imaging Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 1.11 billion in 2025 and USD 1.25 billion in 2026. Rising technological development, high incidence of cancer in the U.S., and strong presence of key market players are major factors behind the growth of the North America market. The U.S. market is projected to reach USD 0.69 billion by 2026.

- For instance, in 2020, the Global Cancer Observatory published that in the U.S., the number of new cancer cases was 2,281,658. Also, within the five-year range, the number of prevalent cases was reported as 8,432,938. Thus, the increasing prevalence and incidence of cancer in the country is anticipated to increase the demand for hyperspectral imaging systems for early diagnosis to reduce healthcare burden.

The Europe market is estimated to grow at a substantial CAGR due to technological advancement in the region and increasing public & private investments in R&D. The UK market is projected to reach USD 0.15 billion by 2026, while the Germany market is projected to reach USD 0.17 billion by 2026.

- For instance, in June 2023, Hypervision Surgical secured USD 8.1 million (EUR 6.5 million) in funding to advance the development of its hyperspectral intelligence platform. The platform utilizes rapid snapshot hyperspectral imaging and advanced data analytics to enhance decision-making during surgical procedures.

- Similarly, the EU funded a research project HyPPOCRATES in August 2022, by investing approximately USD 27 million. The project aimed to create a powerful mHS imaging interpretation software platform for mHS data processing by applying machine-learning principles.

The market in Asia Pacific registered the highest growth due to increasing awareness about the use of medical hyperspectral imaging in the healthcare industry and rising funding and growth opportunities. The Japan market is projected to reach USD 0.09 billion by 2026, the China market is projected to reach USD 0.12 billion by 2026, and the India market is projected to reach USD 0.07 billion by 2026.

- For instance, in December 2019, Enlighten Imaging, an Australian start-up company, received the Australian Government’s Medical Research Future Fund support under the BioMedTech Horizons 2.0 program delivered by MTPConnect. The funding was used to develop a technology to scan the retina through hyperspectral imaging for signs of brain and eye diseases.

The market in the rest of the world is expected to expand at a lower CAGR than other regions during the forecast period. The limited share and growth are attributable to the lack of infrastructure for medical hyperspectral imaging.

Key Industry Players

Companies Focus on Improving their Product Portfolio to Strengthen their Market Share

Specim, Imec, Resonon Inc., and BaySpec, Inc. are the key companies that accounted for the major medical hyperspectral imaging market share in 2024.

In 2024, Imec held a considerable share of the market due to its diverse product portfolio. Moreover, the company is present across 96 countries, thereby possessing a wide penetration worldwide. Imec is rigorously involved in collaboration and partnership to broaden its distribution network leading to broadening its presence.

Specim, a Konica Minolta, Inc. subsidiary, held a significant market share due to high adoption of its hyperspectral cameras and accessories by healthcare professionals, especially in Europe and Asia Pacific that enabled the company to capture a significant position among competitors.

List of Top Medical Hyperspectral Imaging Companies:

- Imec (Belgium)

- Specim (Konica Minolta, Inc.) (Japan)

- BaySpec, Inc. (U.S.)

- Resonon Inc. (U.S.)

- Headwall Photonics (U.S.)

- HyperMed Imaging, Inc. (U.S.)

- XIMEA GmbH (Germany)

- Cubert (Germany)

- Diaspective Vision (Germany)

- ClydeHSI (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024 - Headwall Photonics acquired inno-spec GmbH. This acquisition is expected to enhance Headwall’s hyperspectral imaging portfolio.

- July 2022 - Headwall Photonics announced the acquisition of Holographix LLC to expand its manufacturing capabilities to address future growth.

- June 2022 – Resonon Inc. announced the launch of Pika IR-L and IR-L+ hyperspectral cameras (925 - 1700 nm).

- August 2021 - Resonon Inc. announced the launch of Pika NUV2, an ultraviolet plus visible hyperspectral camera with push broom modality.

- May 2021 - Diaspective Vision announced the registration of its three products, TIVITA 2.0, TIVITA Mini and TIVITA Mobile, as medical devices.

- November 2020 – Imec announced its collaboration with XIMEA, a Germany-based company. The collaboration resulted in the launch of the xiSpec2 hyperspectral camera.

REPORT COVERAGE

The global market research report provides an in-depth industry analysis. It focuses on segments such as component, modality, application, and end user. Besides this, it offers insights related to medical hyperspectral imaging market trends in major regions. Additionally, the report consists of several factors contributing to industry growth. The report also provides the competitive landscape of the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.94% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Component

|

|

By Modality

|

|

|

By Application

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market is anticipated to grow from USD 2.25 billion in 2025 to USD 7.21 billion by 2034.

The market is projected to record a CAGR of 13.94% during the forecast period of 2026-2034.

By component, the hyperspectral camera segment will lead the market.

The increasing prevalence of cancer, technological advancement, and increasing research to explore medical applications are some factors driving the market.

Imec, Specim, BaySpec, Inc. and Resonon Inc. are the major players in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us