Medical Oncology Software Market Size, Share & Industry Impact Analysis, By Deployment Type (Cloud, On-premise, and Hybrid), By Application (Treatment Planning, Patient Record Management, Clinical Decision Support, and Others), By End-user (Hospitals & Specialty Clinics, Diagnostic Centers, Research Institutes, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

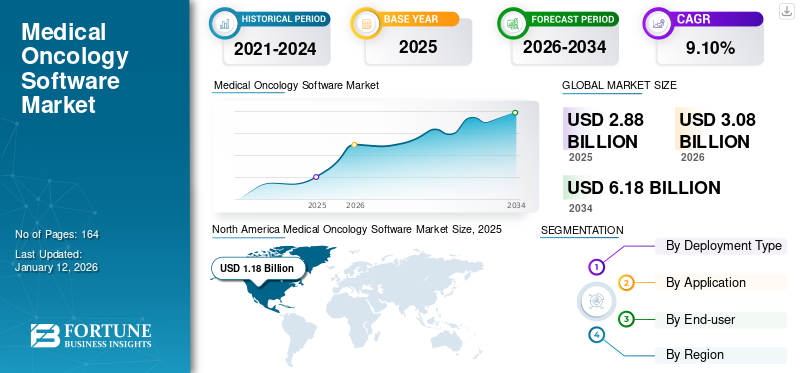

The global medical oncology software market size was USD 2.88 billion in 2025. The market is anticipated to grow from USD 3.08 billion in 2026 to USD 6.18 billion by 2034, exhibiting a CAGR of 9.10% during the forecast period. North America dominated the medical oncology software market with a market share of 41.00% in 2025.

Medical oncology software is an oncology informatics system that assists the healthcare provider in the precise delivery of systemic treatment of cancer, including chemotherapy, targeted therapy, immunotherapy, and hormone therapy. This software helps oncologists in managing patient data, treatment plans, medication schedules, clinical decision support, and monitoring of side effects.

The major factors driving the overall market growth include rising cancer prevalence, a growing number of research activities using oncology informatics, rising adoption of electronic health records (EHR) for integrated treatment plans, growing healthcare digitization, and rising investment to improve cancer care. Moreover, technological advancement and the rising number of cancer drug development are a few significant factors propelling the market’s growth during the forecast period.

Global Medical Oncology Software Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 2.88 billion

- 2026 Market Size: USD 3.08 billion

- 2034 Forecast Market Size: USD 6.18 billion

- CAGR: 9.10% from 2026–2034

Market Share:

- Region: North America dominated the market with a 41.00% share in 2025. This leadership is driven by the rising establishment of cancer care centers, the significant presence of market players, a high incidence of cancer, and advanced technological solutions in the region.

- By Application: Patient Record Management held a significant market share. The segment's growth is influenced by the software's ability to streamline patient information and data management, which enables smooth coordination among healthcare providers to deliver efficient patient care and improve engagement.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific region, Japan's market is driven by a rising incidence of cancer, a growing aging population, and increasing investment opportunities for companies developing oncology software.

- United States: Market growth is fueled by a very high burden of cancer, with nearly 2 million new cases projected for 2023. The market is also propelled by the rising adoption of EHRs and major partnerships, such as the one between Memorial Sloan Kettering (MSK) Cancer Center and Epic Systems Corporation, to create integrated cancer care platforms.

- China: The market is expanding as part of the high-growth Asia Pacific region, which features emerging key players, increasing investment opportunities, and a growing number of companies developing specialized medical oncology software.

- Europe: The market is advanced by rising collaboration between key market players and healthcare providers. Growth is also supported by an expanding technological infrastructure and increasing research activities, highlighted by institutions like the German Cancer Research Center (DKFZ) adopting advanced data management platforms.

COVID-19 IMPACT

Decline in New Sales due to Limited Healthcare Budgets during the Pandemic Slightly Impacted Market Growth

The COVID-19 pandemic had a negative impact on the market due to a significant decline in new sales. The factors behind sales decline included a limited or reduced budget of healthcare organizations, which led to reluctance in the adoption of medical oncology software, conversion of large multi-specialized hospital and cancer centers into one dedicated to COVID-19 patients, and delay in cancer diagnosis and treatment during COVID-19 pandemic further, and reduced usage and demand for the medical oncology software.

- For instance, in 2020, Elekta witnessed a 5.7% decrease in its total revenues generated from devices and software. The reduced sales were attributed to little or no demand for the software during the forecast period.

Thus, the above-mentioned factors indicated the negative impact of COVID-19 during the pandemic. However, in 2021 and 2022, this market showed unprecedented growth owing to an uplift of lockdown restrictions, leading to a rapid influx of cancer patients for diagnosis and treatment.

Medical Oncology Software Market Trends

Development of Personalized Treatment Plans using Genomic Data

The rising inclination of healthcare providers toward precision medicine in oncology is enabling them to develop personalized treatment plans for patients by using their genomic data. The genomic profile of the patient is assessed to understand the cancer-related mutations or variations in genes. Medical oncology software plays a crucial role in analyzing genomic data, including specific genetic mutation and biomarker association, by using advanced algorithms. The software then compares the patient’s overall profile, including genetic profile, against the most effective treatment, including targeted therapy, immunotherapy, and hormonal therapy. Based on overall analysis, the software generates personalized treatment recommendations, including specific drugs, dosage, and treatment regimens tailored to the patient’s genetics.

Moreover, the genomic software tools represent important advantages such as speediness in discovery work and diagnosis of cancer by allowing rapid, automated, and accurate analysis of next-generation sequencing data.

- In August 2023, Tempus collaborated with CureMD to integrate its genomic test into CureMD’s oncology EHR. Due to this partnership, CureMD users can order genomic tests directly from the oncology EHR of Tempus. This partnership is expected to support the return of results as discrete data to inform clinical decisions and risk assessment. It provides clinicians, staff, and patients with the knowledge and person-specific information to support a patient's health.

Download Free sample to learn more about this report.

Medical Oncology Software Market Growth Factors

Increasing Incidence of Cancer to Boost the Demand for Medical Oncology Software

Patient record management and treatment planning are a few major applications of these software. The growing number of new cancer cases each year is imposing a huge burden on the healthcare system worldwide. The rising patient pool needs efficient management in all aspects, including diagnosis and treatment, leading to increased demand for software for medical oncology.

- For instance, according to an article published in January 2023 by the American Cancer Society, the number of new cancer cases is projected to rise to 1,958,310 in 2023, with an estimated 609,820 cancer deaths in the U.S.

Moreover, cancer is more prevalent in geriatric patients owing to weakened immunity; thus, the rising geriatric population is further contributing to growing cancer cases and thereby is anticipated to drive market growth during the forecast period.

Rising Need for Data Integration to Provide Efficient Workflow to Contribute Market Growth

Integration of medical oncology software with other software, including electronic medical records (EMR) and radio oncology software, is leading to more enhanced integrated treatment plans. Among all, data integration with EHR plays a significant role, as it enables the analysis of patient history, laboratory reports, and imaging studies. This further helps the oncologist to understand the patient comprehensively and allows for a more accurate assessment. Thus, the rising adoption of EHR is fueling the demand for software for medical oncology and is anticipated to contribute to the market growth.

- For instance, in February 2023, Syneos Health partnered with Equicare to use proXimity. This advanced cloud-based software platform hastens the transfer of clinical trial subject data from multiple EHRs to the sponsor’s electronic data capture systems. This platform served as a key tool for clinical trial data management to accelerate cancer research.

Moreover, data integration facilitates seamless communication between all healthcare providers involved in patient care, including oncologists, radiologists, pathologists, and nurses. Also, the integration reduces manual data entry and the risk of error.

RESTRAINING FACTORS

High Risk of Cyber Attack and Data Breaching Activities Limit Market Growth

The growing use of digital tools and integration with one another is leading to rising incidents of data breaching activities and cyber-attacks. The increasing frequency of cyberattacks and sophistication are resulting in the exposure of patient-sensitive information. This is further leading to an impact on patient’s trust and thereby discouraging the adoption of software for medical oncology.

- For instance, in April 2021, Elekta faced a healthcare ransomware attack on its cloud-based oncology software. The company restored all of its services and took the software offline to prevent, identify, and address the chances of vulnerabilities. In addition, the company’s decision to take the software offline led to long delays in cancer patient’s treatment and many of them were transferred to other healthcare facilities for immediate treatment. The incident affected around 170 health systems using Elekta’s software.

Moreover, rising incidents of cyberattacks are causing huge financial losses to companies and impacting the overall functioning of healthcare facilities.

Medical Oncology Software Market Segmentation Analysis

By Deployment Type Analysis

Cloud-Segment Leads the Market Owing to Rising Adoption of Cloud-based Systems

By deployment type, the market is segmented into cloud, on-premise, and hybrid.

In 2026, the cloud segment captured a significant share 54.55% of the market and is projected to grow at a rapid CAGR over the forecast period. The high share of the cloud segment is attributed to factors such as growing healthcare IT infrastructure, rising cancer pool, increasing need for patient data integration, and rising product launches.

- For instance, in March 2023, Illumina Inc., an American biotechnology company, announced the launch of Connected Insights. Connected Insights is a cloud-based software that enables tertiary analysis of clinical NGS data for advanced tumors. Connected Insights is currently under beta testing in the U.S. and is anticipated to enable the analysis of complex cancer genomic profiles.

The on-premise segment is expected to grow substantially during the forecast period. The segment's growth is attributed to the existing healthcare infrastructure supporting on-premises deployment in developing nations, more control over patient data and security, availability of limited data in less populated countries that can be easily managed with on-premises installation, and increasing launch of on-premises software.

- For instance, in July 2023, RaySearch Laboratories announced the launch of RayCare 2023B, the latest version of the RayCare oncology information system that supports medical oncology functions. RayCare 2023B possesses improved usability and high efficiency of treatment management and is typically deployed on-premises.

The hybrid segment is anticipated to show gradual growth during the forecast period. The major factors contributing to the growth of segments include advantages associated with hybrid deployments, such as higher flexibility, scalability, and cost efficiency.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Rising Cancer Patient Pool to Influence the Usage of Medical Oncology Software for Patient Record Management

By application, the market is segmented into treatment planning, patient record management, clinical decision support, and others.

The patient record management segment is anticipated to account for a significant market share 54.87% with a notable CAGR during the forecast period. The factors influencing the segment’s growth include the ability to streamline patient information and data management and enable smooth coordination among healthcare providers to provide efficient patient care and patient engagement.

These software solutions provide patient portals, allowing patients to access their records, schedule appointments, and communicate with the healthcare team, enhancing patient engagement and satisfaction.

- For instance, according to a news article published in September 2022, Kaiku Health, a part patient portal and a part of Elekta’s MOSAIQ, enabled patients to input information about their symptoms and quality of life during treatment. This innovative approach helped healthcare providers in resolving acute fever in melanoma patients. Elekta developed a specific model for patients with advanced and metastatic BRAF V600E/K–mutant melanoma treated with dabrafenib plus trametinib.

The treatment planning segment is anticipated to grow with a notable CAGR due to the growing need for efficient treatment planning for cancer patients and increasing partnerships with oncology software providers to develop treatment planning solutions.

- For instance, in May 2022, GE Healthcare entered into a collaborative agreement with RaySearch Laboratories, an oncology software provider. This collaboration aimed to develop simulated treatment planning workflow solutions intended to plan cancer treatment.

Clinical decision support is an emerging software application for medical oncology. The segment’s growth is attributed to the rising utilization of these software solutions, aiding oncologists and pathologists in locating cancer-suspected areas within the body and efficiently diagnosing the cancer type. The rising development of clinical decision-support solutions in the field of medical oncology further fuels this growth.

- For instance, in August 2021, Varian, a Siemens Healthineers company, announced that cancer patients in Australia were the first in the world who benefited from streamlined, coordinated cancer care facilitated by the release of the ARIA oncology information system (OIS). This comprehensive oncology information system manages comprehensive cancer treatment's clinical, administrative, and financial processes. The software provided by the company offers clinical staff members up-to-the-minute information for making important clinical decisions rapidly at every point in a patient’s course of treatment.

By End-user Analysis

Hospitals & Specialty Clinics Segment Dominated the Market Due to Rapid Adoption of Medical Oncology Software

Based on end-user, the market is segmented into hospitals & specialty clinics, diagnostic centers, research institutes, and others.

The hospitals & specialty clinics segment is estimated to account for a significant market share 74.03% with notable CAGR during the forecast period. The factors influencing the segment’s growth include the increasing number of cancer care centers to facilitate more patients, rising adoption of these software in hospitals and cancer care centers, established healthcare IT infrastructure, and others.

- In November 2022, Memorial Sloan Kettering (MSK) Cancer Center announced that it had selected Epic Systems Corporation to provide a new platform for integrated cancer care to ensure patients and physicians have easy access to electronic health records. The utilization of Epic Systems Corporation’s cancer research platform transformed cancer care for its patients and enhanced cancer research.

The diagnostic centers segment is anticipated to grow with a notable CAGR during the forecast period. This is due to the rising demand for software for medical oncology to assist diagnostic decisions, rising cancer screening and monitoring, and rising collaboration with research centers and hospitals.

- For instance, in April 2023, Koninklijke Philips N.V. announced a partnership with 2 France hospitals, Saint-Joseph & Marie-Lannelongue. The collaboration focused on integrating digital pathology into the hospitals’ enterprise workflow, allowing care teams to access comprehensive diagnostic information at the cellular, anatomical, and molecular levels. Through this partnership, hospitals’ multidisciplinary cancer panels can guide cancer patients to improve personalized cancer care.

The research institutes segment is anticipated to grow with a notable CAGR due to growing cancer research activities in emerging nations, increasing clinical trials, rising funding opportunities for cancer research, and growing adoption of these software in research institutes.

- For instance, in June 2023, Conquer Cancer, the ASCO foundation, in collaboration with Pfizer Global Medical Grants, announced grants of more than USD 1.0 million to support innovative approaches. These grants are anticipated to address inequities to increase healthcare access. In addition, this funding helped hospitals and clinics adopt software for medical oncology to improve the quality of metastatic breast cancer (mBC) patient care in Latin America.

REGIONAL INSIGHTS

Based on geography, the market is studied across Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America Medical Oncology Software Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America accounted for the highest market share and generated a revenue of USD 1.18 billion in 2025. The rising establishment of cancer care centers, the growing trend of centralized care in the U.S., the significant presence of market players, the increasing incidence of cancer, and technological advancements in oncology software solutions are the major factors driving the growth of the market in North America.The U.S. market is projected to reach USD 1.19 billion by 2026.

- For instance, according to the data published by GLOBOCAN in 2020, cancer is a primary cause of death in the U.S., with around 8,432,938 reported prevalent cases in the 5-year range. In 2022, an estimated 8.5 million people lived with cancer in the U.S.

The market in Europe accounted for a significant market share in the global market in 2024 and is anticipated to grow with a notable CAGR during the forecast period. The factors propelling the market growth in Europe include rising collaboration among key market players and healthcare providers, growing technological infrastructure, and rising research activities and clinical trials.The UK market is projected to reach USD 0.15 billion by 2026, while the Germany market is projected to reach USD 0.2 billion by 2026.

- For instance, in July 2023, the German Cancer Research Center (DKFZ) conducted cutting-edge research on cancer and related diseases. This center employed its StorageMAP platform to strengthen its data management and security capabilities.

Asia Pacific is anticipated to grow with rapid CAGR during the forecast period owing to the rising incidence of cancer, growing aging population in the region, emerging key players, growing investment opportunities, and increasing entry of companies developing this software.The Japan market is projected to reach USD 0.14 billion by 2026, the China market is projected to reach USD 0.25 billion by 2026, and the India market is projected to reach USD 0.07 billion by 2026.

- For instance, in August 2022, The National Cancer Grid (NCG) established the Koita Centre for Digital Oncology (KCDO) to endorse digital technologies and tools to improve cancer care across India. KCDO supported NCG hospitals by enabling them to adopt digital health tools, use practices in digital health, and drive technology initiatives, including healthcare data interoperability and EMR adoption.

Latin America and the Middle East & Africa markets are anticipated to exhibit gradual growth during the forecast period. Limited healthcare infrastructure supporting digital tools and the high cost of medical oncology software are the major factors for gradual growth in these regions.

Key Industry Players

Investments in Innovation and Global Presence Propel Key Players to Command Significant Market Share

The major players in the global market include Varian Medical Systems, Inc. (Siemens Healthineers AG), Elekta, and Oracle (Cerner Corporation). These companies accounted for a significant market share, leading to a consolidated market landscape globally. Rising investment by these companies to develop innovative products and rising strategic alliances coupled with a wide presence across the globe are the major factors supporting large medical oncology software market share.

- For instance, in April 2021, Siemens Healthineers AG announced the acquisition of Varian Medical Systems, Inc. to address the growing need for personalized, data-driven diagnosis and precision cancer care. In addition, both companies built "EnVision", a strategic partnership to establish a comprehensive diagnostic, digital, and therapeutic ecosystem for cancer.

Moreover, other emerging companies include Altai, Inc., RaySearch Laboratories, MCKESSON CORPORATION, EndoSoft LLC, Epic Systems Corporation, and Koninklijke Philips N.V. also have a dynamic impact on the global market owing to their active participation in exhibitions, focused product portfolios and collaboration with healthcare providers.

- In July 2023, RaySearch showcased the latest software innovations at the American Association of Physicists in Medicine (AAPM) in Texas. During the conference, the company presented the latest advances in the RayStation treatment planning system, RayCare oncology information system, and the cloud-based oncology analytics system RayIntelligence.

List of Top Medical Oncology Software Companies:

- Epic Systems Corporation (U.S.)

- Altai, Inc. (U.S.)

- Varian Medical Systems, Inc. (Siemens Healthineers AG) (U.S.)

- Cerner Corporation (Oracle) (U.S.)

- American Medical Software (U.S.)

- Elekta (Sweden)

- EndoSoft LLC (U.S.)

- RaySearch Laboratories (Sweden)

- MCKESSON CORPORATION (U.S.)

- Koninklijke Philips N.V. (Netherlands)

KEY INDUSTRY DEVELOPMENTS:

- April 2023: Epic Systems Corporation expanded its partnership with Microsoft to integrate generative artificial intelligence (AI) technology into the electronic health record. The partnership intended to increase providers’ productivity, reduce administrative burden, and improve care by giving clinicians additional time to spend with their patients.

- February 2023: Varian Medical Systems, Inc., a Siemens Healthineers company, announced its collaboration with Nova Scotia Health to accelerate the digital revolution of the health system's complete oncology service line. Through this partnership, Varian Medical Systems, Inc. aimed to provide a variety of multidisciplinary oncology solutions to connect cancer patients and optimize patient care throughout their cancer care journey.

- April 2022: Epic Systems Corporation announced a partnership with precision oncology company Guardant Health to support an Epic EHR integration to enhance patient access to cancer screening. This oncology platform drives commercial adoption, improves patient clinical outcomes, and lowers healthcare costs through all stages of the cancer care continuum.

- April 2021: EndoSoft LLC announced the launch of the EndoVault app, designed for specialty-specific modules, including oncology within EndoSoft’s oncology suite of technology. This app helps healthcare providers and patients to improve their quality of life.

- December 2020: MCKESSON CORPORATION announced the launch of Ontada, an oncology technology and insights intended to support innovation and evidence generation for better outcomes for patients with cancer. Ontada’s launch aimed to deliver innovative solutions and construct differentiated assets in oncology that help to improve patient outcomes.

REPORT COVERAGE

The global medical oncology software market research report provides an in-depth industry analysis. It focuses on segments such as deployment type, application, and end-user. Besides this, it offers insights related to technological advancements, the prevalence of cancer, the impact of COVID-19, and market trends in regions. In addition, the report consists of several factors contributing to industry growth and key industry developments, including mergers, acquisitions, partnerships, and new product launches by market players. The report also provides the competitive landscape of the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.10% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment Type

|

|

By Application

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

The global medical oncology software market size is anticipated to grow from $2.88 billion in 2025 to $6.18 billion by 2034, at a CAGR of 9.10%

The market is projected to grow at a CAGR of 9.10% during the forecast period (2026-2034).

By deployment type, the cloud segment captured a significant share of the market.

The increasing prevalence of cancer, technological advancement, and increasing clinical trials are some factors driving the market.

Varian Medical Systems, Inc. (Siemens Healthineers AG), Elekta, and Oracle (Cerner Corporation) are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us