Middle East Soft Facility Management Market Size, Share & COVID-19 Impact Analysis, By Service Type (Janitorial and Sanitization, Housekeeping, Security, Pest Control, Ground Maintenance, Washing, and Others), By Channel (In-house and Outsourced), By Industry Vertical (Healthcare, Government, Education, Military & Defense, Real Estate, and Others) and Country Forecast, 2025–2032

KEY MARKET INSIGHTS

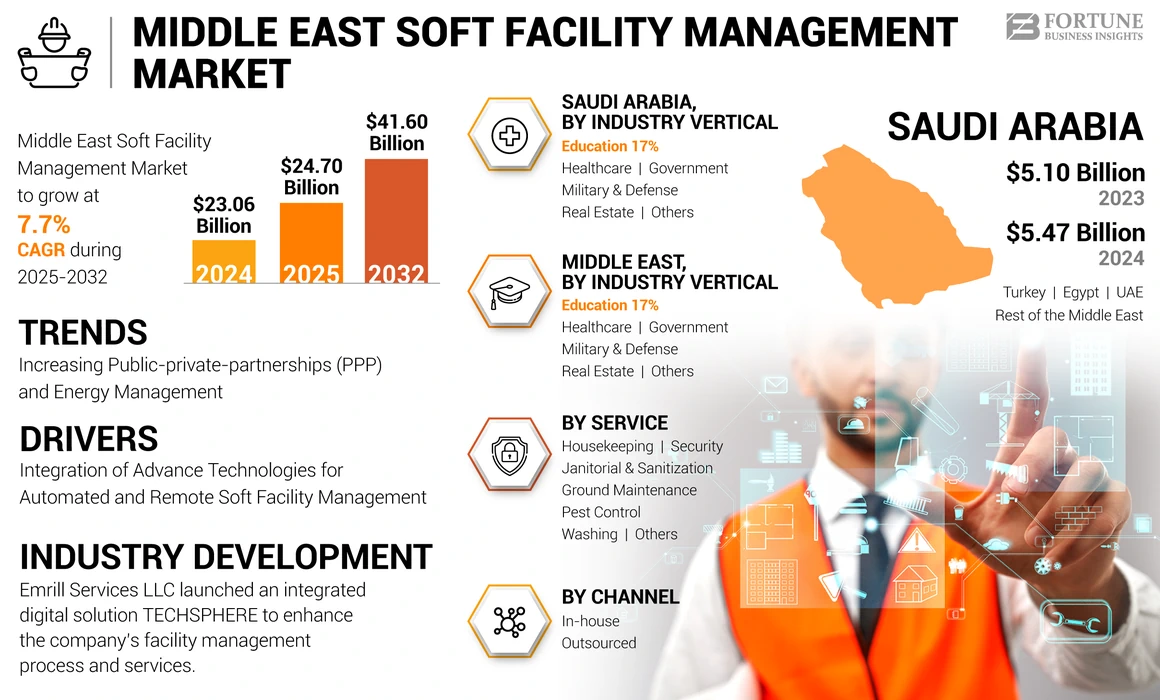

The Middle East soft facility management market size was valued at USD 23.06 billion in 2024. The market is projected to grow from USD 24.70 billion in 2025 to USD 41.60 billion by 2032, exhibiting a CAGR of 7.7% during the forecast period.

The Middle East Soft facility management market has undergone significant transformation recently. Manufacturers are actively working to integrate novel technologies with their services and expand their service portfolio. Saudi Arabia stands out as the most optimistic country in the regional market due to the rapid growth of the construction industry.

The market is characterized by intense competition, with numerous established players and emerging newcomers in the U.A.E. Substantial growth in awareness regarding the quality and demand for customized FM services by facility operators will encourage service providers to diversify their service offerings and position themselves as high-quality FM providers within the region.

COVID-19 IMPACT

Vital Improvements in the Sanitization Standards Post Pandemic Going to Aid Market Growth over the Long-Term Prospects

Facility managers were committed to maintaining safe workplaces for employees to resume normal business operations. However, the situation was challenging as organizations in this region were grappling with a significant unemployment problem. This high unemployment rate had a profound impact on the offering of facility services. The scarcity of workers was prevalent across the countries. Even well-established organizations faced challenges due to the COVID-19 pandemic, disrupting the usual state of affairs. Since the onset of the pandemic, facility managers have been struggling to explore new opportunities for remote work and create socially distant workplaces.

Moreover, soft facility management played a critical role in managing COVID-19 and ensuring a safe working environment, with a strong emphasis on sanitation. Soft FM service providers need to assess daily cleaning techniques, janitorial schedules, workplace-specific spot sterilization, and all necessary requirements. Building sanitization necessitates experimentation with innovative products and techniques to address the unique challenges posed by COVID-19 for many facility managers. Additionally, COVID-19 influenced facility policies for facility managers. They faced the challenging task of re-educating workers and visitors on how to interact with the workplace, encompassing everyone and everything.

LATEST TRENDS

Increasing Public-private-partnerships (PPP) and Energy Management to Propel Market Growth

Saudi Arabia is actively implementing its Vision 2030 program, which primarily aims to shift the country's current oil-dependent economy. According to this program, the government is focusing on establishing public-private partnerships. These collaborations are significantly boosting healthcare facilities, real estate, and education-related infrastructure.

- For instance, the KSA’s Ministry of Health has strategically proposed its inaugural public-private partnership project. Under this crucial initiative, the government intends to allow overseas suppliers for numerous projects over 10 years.

Moreover, the increasing emphasis on privatization in the market will bolster investments in the infrastructure sector, leading to strong consolidation in the country's economic growth. Consequently, the facilities management market in the Kingdom of Saudi Arabia (KSA) is expected to witness robust development throughout the market forecast.

Download Free sample to learn more about this report.

DRIVING FACTORS

Integration of Advance Technologies for Automated and Remote Soft Facility Management to Bolster Market Growth

The growing adoption of Building Information Modeling (BIM), wearable gadgets, robotic systems, and the Internet of Things (IoT) in the facility management industry is enhancing service quality and increasing the feasibility of accessing and evaluating services before commencing actual operations.

Building Information Modeling (BIM) is a process that utilizes various tools and technologies to create scale models of building projects. It is commonly used in facilities management by contractors and architects to develop virtual models of assets and floor plans. BIM is expected to experience significant growth in the Kingdom of Saudi Arabia (KSA) due to the expanding scale of the infrastructure sector and the transition from 3D to 5D construction modeling information.

Similarly, Wearable Technology is a pivotal advancement in the facilities management industry, enhancing services by enabling remote management of facility services via mobile applications from anywhere around the globe.

The Internet of Things (IoT) involves a network of internet-accessible devices used in facilities for a wide range of applications. Asset optimization necessitates efficient facilities management, safety measures, and smarter buildings that can reduce energy consumption and overhead costs using sensors, actuators, thermostats, and other equipment. For example, IBM's new Watson IoT platform, launched in Saudi Arabia, transforms businesses by connecting facilities with IoT-enabled infrastructure to enhance customer experience.

RESTRAINING FACTORS

Dearth of Stable Soft facility management Contracts and Resources Impeding Market Growth

Many large facilities management enterprises with substantial investment amounts typically do not encounter such challenges, as these companies secure long-term contracts. Moreover, large enterprises often leverage innovative technologies to provide both hard and soft services, enabling them to deliver improved and enhanced services.

On the other hand, small and medium-sized companies frequently face these challenges due to a lack of financial resources and funding in the country. Additionally, the rapid growth in the infrastructure sector necessitates a larger workforce, impacting domestic facilities management across the country.

The scarcity of skilled and properly trained facility service providers and professionals is constraining contracts and operations, adversely affecting training and development in the facility industry. Lower daily wages and inconsistent compensations discourage the development of skilled welders across Saudi Arabia and other GCC economies thereby limiting the Middle East soft facility management market growth.

SEGMENTATION

By Service Type Analysis

Janitorial and Sanitization Services Propel Growth Due to Surge in Demand Post-COVID-19

By service type, the market is classified as janitorial and sanitization, housekeeping, security, pest control, ground maintenance, washing, and others (parking, catering, and others).

Over the recent past, especially after the COVID-19 pandemic, the market has witnessed a significant interest from facility operators, as well as commercial and residential facility owners, in janitorial and sanitization services. This trend has substantially contributed to the market share of janitorial and sanitization services. In terms of market growth, ground maintenance services are projected to register a high CAGR, outpacing their counterparts. The integration of automated technology in ground maintenance services is expected to drive the Middle East market.

By Channel Analysis

Outsourcing Embraced by Facility Owners due to Cost Efficiency and Liability Reduction

By channel, the market is bifurcated into in-house and outsourcing.

The increasing trend among facility owners and operators to outsource their requirements has been a key finding. Moreover, numerous companies are keen to transform their soft facility management operations structure by fully outsourcing their operations to dedicated FM service providers. The viability of the outsourcing channel mainly relies on two advantages: firstly, its cost-effective nature, and secondly, the fact that facility owners do not have to maintain a dedicated workforce for in-house services, reducing liabilities on the company's balance sheet.

By Industry Vertical Analysis

Real Estate Sector Dominates Owing to Robust Infrastructure and Sustainable Developments

By industry vertical, the market is classified into healthcare, governments, education, military & defense, real estate, and others (IT & telecommunication, BFSI).

The real estate sector is anticipated to hold a considerable share in the global market, given that countries in the Middle East region are known to have well-structured, established, and ever-evolving infrastructures. Saudi Arabia and the U.A.E. have hefty investments in the construction sector, and real estate developers in these sectors continuously strive to elevate the standards of green buildings and commercial constructions across the nation. The heavy investments in real estate development projects are likely to attract a dominant market share. The commitment of Egypt's government to enhance the country's infrastructure is also a promising aspect for market growth.

However, in terms of growth rate, the healthcare segment is estimated to develop at a swift pace. The region's world-class healthcare facilities propel significant growth in this industry and are expected to hold a promising market share. The education sector is also expected to hold about 17% of the share in the regional market, growing at a decent pace. Government, military, and defense are the industry verticals expected to develop steadily during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

Saudi Arabia is analyzed to emerge as a leading country in terms of rapid revenue generation growth during the forecast period. The constant efforts and inputs by the government of KSA toward its Vision 2030 program, supported by several megaprojects undertaken in the country such as NEOM, the Red Sea Project, AMAALA, and others, are factors propelling development prospects. This, in turn, is helping create new jobs in construction and development, employment opportunities within the hospitality sector, and investments in infrastructure and renewable energy. These planned projects across the Kingdom highlight the effort toward economic, social, and cultural diversification, aligned with the 2024 budget announcement focusing on investments in the education, healthcare, and social development sectors.

As a result, hefty investment activities and a project cost exceeding USD 800 billion are creating substantial opportunities for market growth in Saudi Arabia. Moreover, Saudi Arabia holds a dominant Middle East soft facility management market share in the Gulf Cooperation Council (GCC) region.

Middle East Soft Facility Management Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The government of the Kingdom of Saudi Arabia has placed considerable emphasis on developing new buildings and advancing existing infrastructure. Throughout our research, we have identified certain trends likely to be pivotal for transforming and swiftly growing the infrastructure sector across Saudi Arabia. Saudi Arabia has announced an allocation of nearly USD 1 trillion in investments for its infrastructure projects, aiming to diversify its economy and reduce over-dependence on oil production.

The Economic Cities Authority, established by the KSA government, is constantly striving to increase investors' participation in the development of housing projects to address the increasing issue of affordable housing across the country, an issue expected to grow with rapid population growth.

The robust growth in the sales of cement and related materials for infrastructure development supports the data showcasing a transformation in the construction industry throughout Saudi Arabia. The substantial demand for construction services is evident from the high demand for cement and other building materials, as well as the number of ongoing and new projects in Saudi Arabia. Additionally, to maintain a streamlined supply of building materials and support the growth of the construction industry, the Ministry of Commerce and Industry has recently announced an investment of USD 800 million, which will be directed toward constructing approximately three to four cement plants in the next three years.

To know how our report can help streamline your business, Speak to Analyst

The United Arab Emirates is estimated to emerge as a key stakeholder in the market. The established and interconnected infrastructure in the country is identified as one of the critical driving forces behind the noteworthy performance of the country. The increasing investments in the development of industrial and commercial infrastructure in the country and efforts to integrate the infrastructure with enhanced solutions will also aid the sales of Middle East soft facility management growth across the country. Egypt is estimated to hold a sizable chunk of the market revenue-generating country across the region of the Middle East. The efforts of the manufacturers to expand their operations in Egypt and the increasing demand for the country's soft services project itself as one of the prominent countries with optimistic growth prospects. Turkey and the rest of the Middle East are anticipated to progress sluggishly over the forecast period due to limited infrastructure development in the said countries.

KEY INDUSTRY PLAYERS

Key Players Expand Beyond U.A.E. as Saudi Arabia and Egypt Offer Growth Opportunities

The Middle East soft facility management market is extensively fragmented, with many local players holding a considerable share of the market. These local players have rapidly increased their market share in recent years; primarily due to their ability to provide customer-tailored solutions and their extensive direct customer reach across the Middle East. Key players such as Emrill Services LLC and Farnek Services LLC are actively working to enhance their presence across the regions.

The current market dynamics and shifts in market growth and share in Saudi Arabia and Egypt have encouraged service providers to expand their reach beyond their primary market of the U.A.E. However, the U.A.E. still retains a significant portion of the regional market. Due to the matured and saturated nature of the U.A.E. FM services market, the country is expected to maintain a relatively modest growth rate through the forecast period.

List of Key Companies Profiled:

- Sodexo (France)

- INITIAL SAUDI GROUP (Saudi Arabia)

- Imdaad LLC (U.A.E.)

- Emrill Services LLC (U.A.E.)

- Ejadah Asset Management Group (U.A.E.)

- Transguard Group (U.A.E.)

- Veolia (Enova) (U.A.E.)

- Saudi Binladin Group (Saudi Arabia)

- G4S plc (U.K.)

- Khidmah (U.S.)

- Dussmann Group (Germany)

- MEEM Facility Management (Saudi Arabia)

- TAMAM (Saudi Arabia)

- Munjz (Saudi Arabia)

KEY INDUSTRY DEVELOPMENTS:

- May 2023: Emrill Services LLC, which is engaged in providing integrated facility management solutions, announced the launch of its holistic Together for Sustainability Program. The program aims to provide greener and environmentally friendly solutions to its clients. Moreover, the program also focuses on increasing its services' efficiency and quality to increase its market presence.

- March 2023: Emrill Services LLC unveiled its newly developed TECHSPHERE, an integrated digital solution. The solution is targeted to enhance the company's FM process and services.

- September 2022: Sodexo expanded its partnership with the healthcare service provider Ardent. The collaboration will improve the patient-specific nutrition program and provide the required nutrition.

- August 2022: Transguard Group, a premium supplier of facility management services, finalized its aftersales dealer agreement with the prominent hospitality in-room equipment provider Dometic. The agreement is between the company's commercial kitchen maintenance and servicing group, which is a kitchen maintenance solution (TGKMS) and Dometic.

- April 2022: CBRE Group Inc. partnered with Microsoft to provide a differentiated suite of technology offerings to serve their large retail clients and other companies. The partnership will enhance the largest retail and FM services and transform the existing pilot retail facility management technology.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Moreover, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

An Infographic Representation of Middle East Soft Facility Management Market

To get information on various segments, share your queries with us

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 7.7% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service Type, Channel, Industry Vertical, and Country |

|

Segmentation |

By Service Type

By Channel

By Industry Vertical

By Country

|

Frequently Asked Questions

The market is projected to reach USD 41.60 billion by 2032.

In 2024, the market was valued at USD 23.06 billion.

The market is projected to grow at a CAGR of 7.7% during the forecast period.

The janitorial and sanitization segment is expected to lead the market.

Incorporation of novel technologies to develop automated and remote soft facility management services is a key factor driving market growth.

Enova, Transguard Group, Sodexo, Emrill Services, Cleanco, Ejdah Asset Management are the top players in the market.

Saudi Arabia is expected to hold the highest market share.

By industry vertical, the healthcare is expected to grow with a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic