Mint Oils Market Size, Share & Industry Analysis, By Application (Oral Products, Confectionary Products, Pharmaceutical Products, Tobacco Products, Fragrance Products, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

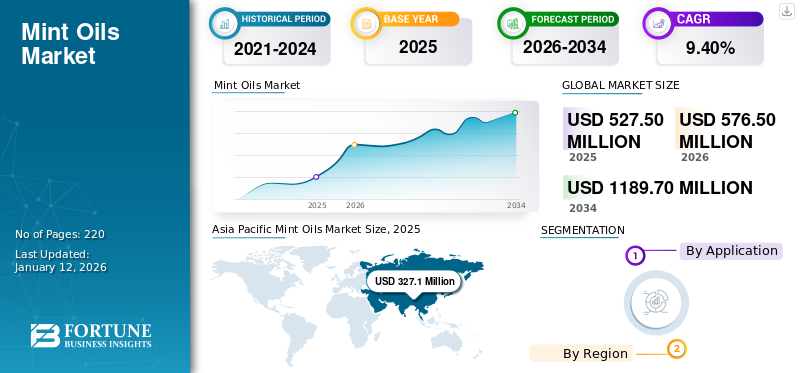

The global mint oils market size was valued at USD 527.5 million in 2025 and is projected to grow from USD 576.5 million in 2026 to USD 1,189.70 million by 2034, exhibiting a CAGR of 9.40% during the forecast period. Asia Pacific dominated the mint oils market with a market share of 62.00% in 2025.

Mint oils are essential oils extracted from various species of the mint plant, primarily Japanese mint, peppermint, spearmint, and bergamot mint. The extraction process typically involves steam distillation of raw materials such as plant leaves, yielding a highly concentrated oil rich in menthol and other volatile compounds. The antibacterial and cooling properties of mint oil make it a common ingredient in personal care products. It is commonly used in toothpaste, mouthwash, soaps, and skincare formulations for its refreshing sensation and healthcare benefits. In addition to this, its aromatic profile and therapeutic benefits contribute to its widespread use in products ranging from cosmetics to pharmaceutical formulations.

The COVID-19 pandemic brought both challenges and opportunities to the mint oil market. On the positive side, there was increased demand for mint oil in products such as hand sanitizers and disinfectants due to its natural antimicrobial properties. This surge in demand created new opportunities for mint oil producers and suppliers. However, the industry also faced significant challenges. Disruptions in global supply chains, logistic issues, and labor shortages impacted production and distribution, leading to uncertainties and delays.

GLOBAL MINT OILS MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 527.5 million

- 2026 Market Size: USD 576.5 million

- 2034 Forecast Market Size: USD 1,189.70 million

- CAGR: 9.40% from 2026–2034

Market Share:

- Asia Pacific led in 2025 with a 62.00% share, rising from USD 327.1 million in 2025 to USD 358.5 million in 2026, driven by strong demand from pharmaceuticals, oral care, and natural cleaning products.

- By application: Oral products dominated in 2024, supported by antibacterial, refreshing, and flavor-enhancing properties, followed by confectionery (17.7% share) and pharmaceuticals.

Key Country Highlights:

- China: Confectionery segment estimated at 11.1% share in 2024.

- United States: Steady demand in food, beverages, and oral care from preference for natural flavors.

- Germany, France, U.K.: Growth driven by rising adoption of natural oral care ingredients.

- Brazil, Mexico: Increasing use in personal care, food, and homecare products.

- Saudi Arabia, UAE: Strong demand in perfumes and cosmetics; Africa using mint oils in beverages, confectionery, and desserts.

Mint Oils Market Trends

Rising Preference for Natural Cleaning Products to Present a Market Growth Opportunity

Nowadays, consumers are becoming more conscious of the environmental and health impacts of traditional cleaning products. This has led to a growing shift toward eco-friendly and sustainable alternatives. Mint oils, with their natural antimicrobial properties, are increasingly recognized as effective ingredients in natural cleaning formulations. These oils contain compounds such as menthol and menthone, which have antimicrobial and antifungal properties. These properties make them effective in killing germs and bacteria, making them ideal for use in disinfectants, surface cleaners, and air fresheners. In addition to this, these oils provide a refreshing scent, replacing the harsh chemical odors often associated with conventional cleaning products. This aromatic quality enhances the appeal of natural cleaning solutions, making them more pleasant to use. Thus, the demand for natural cleaning products is driven by environmental concerns and a growing consumer preference for safer alternatives that pose fewer health risks to households. Mint oils offer a natural, non-toxic option for disinfection and cleaning, aligning with the preferences of environmentally conscious consumers and creating new market growth opportunities. Asia Pacific witnessed a mint oils market growth from USD 305.5 million in 2023 to USD 298.5 million in 2024.

Download Free sample to learn more about this report.

Mint Oils Market Growth Factors

Complex Flavor Profile Offered by Mint Oils to Drive Demand in Food and Beverage Industry

In the food and beverages industry, mint oils play a crucial role in flavor enhancement and meeting consumer preferences. These oils are valued for their ability to add distinct and refreshing flavor to a wide range of products. This includes the cooling and crisp taste of spearmint or the intense menthol flavor of peppermint. These oils offer versatility in creating complex and appealing flavor profiles. Food and beverage manufacturers utilize these oils to infuse products such as confectionery, beverages, and baked goods with the taste and aroma of mint. Consumer preference is a key driving force behind the demand for mint-flavored products. Mint candies, gums, and beverages are popular choices among consumers of all ages, offering a refreshing sensation. In addition to this, mints association with digestive health contributes to its appeal as consumers increasingly prioritize natural and beneficial ingredients in their food choices. Thus, demand for mint oils is driven by its role in flavor enhancement in the food and beverage industry, catering to consumer preferences for refreshing and health-conscious choices.

RESTRAINING FACTORS

Competition from Synthetic Alternatives is Likely to Limit Market Growth

Synthetic mint flavoring is often cheaper to produce compared to natural mint oils. The production process for synthetic compounds can be more streamlined and efficient, resulting in lower manufacturing costs. This cost advantage makes synthetic alternatives appealing, especially in price-sensitive markets or for products with narrow profit margins. In addition, natural mint oil production is influenced by factors such as weather conditions and crop yield, resulting in price fluctuations. On the other hand, synthetic mint flavoring can be produced year-round, unaffected by seasonal fluctuations and supply chain risks associated with natural mint oil production. This reliable and steady supply, along with consistent quality, ensures uninterrupted availability for manufacturers, reducing the risk of production disruption. This competition poses a notable barrier to the demand for natural oils and is likely to hamper mint oils market growth.

Mint Oils Market Segmentation Analysis

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Oral Products Segment Accounted for the Largest Market Share Owing to Rising Adoption of Natural Ingredients

On the basis of application, the market is segmented into oral products, confectionary products, pharmaceutical products, tobacco products, fragrance products, and others.

The oral products segment accounted for the largest mint oils market with a share of 33.10% in 2026. Mint oils provide a refreshing taste and aroma, enhancing the overall sensory experience of oral products such as toothpaste and mouthwash. They have natural antibacterial properties, which can combat oral bacteria and promote dental health. These oils have the ability to reduce bad breath and leave a long-lasting freshness, making them desirable ingredients in oral care products, driving consumer preference and demand.

The pharmaceutical products segment accounts for a prominent market share. These oils naturally possess properties such as antimicrobial, analgesic, and anti-inflammatory. These properties make them a valuable ingredient in various pharmaceutical formulations, ranging from topical creams to oral medications. As consumers increasingly seek products with natural ingredients, the demand for these oils in the pharmaceutical sector is expected to rise, driving market growth. The confectionary products segment is expected to hold a 17.7% share in 2024.

REGIONAL INSIGHTS

Asia Pacific

Asia Pacific Mint Oils Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the largest share of the global market in 2025. Asia Pacific dominated the global market in 2025, with a market size of USD 327.1 million. The pharmaceutical industry in the Asia Pacific region is experiencing steady growth, driven by factors such as increasing healthcare expenditure and expanding access to healthcare services. Mint oils are utilized in pharmaceutical products such as throat lozenges, digestive aids, and topical treatments for conditions such as muscle pain and headaches. In addition, there is a growing emphasis on natural remedies and herbal medicines, driven by factors such as concerns about the side effects of synthetic drugs and the incorporation of a holistic healthcare approach. Pharmaceutical companies are responding to consumer demand by developing products that incorporate mint oils to benefit from their natural healing properties, driving the market growth in tandem. The Japan market is projected to reach USD 8.1 billion by 2026, the China market is projected to reach USD 101.4 billion by 2026, and the India market is projected to reach USD 222.5 billion by 2026.

- In China, the confectionary products segment is estimated to hold a 11.1% market share in 2024.

North America

To know how our report can help streamline your business, Speak to Analyst

Rising demand for mint-flavored food products is expected to drive market growth in North America. Mint-flavored products have long been popular in the region, from classic peppermint candies to mint-flavored beverages. This established consumer preference is expected to continue to contribute to the steady demand for the product in the region. In addition to this, there has been a growing demand in the food and beverage industry due to increasing consumer preference for natural flavors and ingredients. These oils are sought after for their natural and authentic flavor profile, making them a popular choice for food and beverage manufacturers aiming to create innovative and appealing products. Thus, in turn, benefitting and driving market growth. The U.S. market is projected to reach USD 95.90 billion by 2026.

Europe

In Europe, rising preference for natural flavors in oral care products is anticipated to drive market growth. Mint is a popular flavoring agent in oral care products such as toothpaste and mouthwash. Mint is associated with various health benefits, including its ability to freshen breath, soothe gums, and provide antiseptic properties. Over the past few years, consumers in the region have become increasingly conscious of the ingredients in their oral care products and prefer natural and herbal alternatives. These oils, derived from the leaves of the Mentha plant, are perceived as natural and effective ingredients, prompting their inclusion in oral care formulations. This trend is expected to continue to grow, driving market growth during the forecast period. The UK market is projected to reach USD 26.4 billion by 2026, while the Germany market is projected to reach USD 19 billion by 2026.

Latin America

Latin America is expected to witness market growth due to an emerging trend for preference towards natural products. Consumers in the region are becoming more health-conscious and environmentally aware, leading to a rise in demand for natural and organic products. Mint oils are perceived as natural and safe alternatives to synthetic ingredients, aligning with consumer preferences for clean-label products. Manufacturers are capitalizing on this trend by incorporating these oils into a wide range of natural and organic products, including skincare, personal care, and homecare products. This, in turn, is likely to benefit and drive market growth.

Middle East

The Middle East is renowned for its rich heritage of fragrances and perfumes. These oils, with their refreshing and aromatic qualities, are used as a key ingredient in perfumes, cosmetics, and personal care products, driving market growth. In addition, in Africa, these oils are utilized in the food and beverage industry as a flavoring agent in a wide range of products, including tea, candies, desserts, and alcoholic beverages. As the food processing industry in the region expands, the demand for these oils is expected to grow in tandem, driving market growth.

List of Key Companies in Mint Oils Market

Market Players Opt Distribution Network Strategies to Gain Competitive Edge

The competitive rivalry in the market is moderate, with several established players competing for market share. Factors such as product quality, brand reputation, distribution network, and pricing strategies influence market dynamics. Additionally, the market often experiences price competition during periods of oversupply or fluctuations in demand, leading to intensified rivalry among producers. A few of these top key players include companies such as H. Reynaud & Fils, A.G Industries, Robertet S.A., Lebermuth, Inc., and BERJÉ INC.

LIST OF KEY COMPANIES PROFILED:

- H. Reynaud & Fils (France)

- A.G Industries (India)

- Robertet S.A. (France)

- Lebermuth, Inc. (U.S.)

- BERJÉ INC (U.S.)

- India Essential Oils (India)

- AVI NATURALS (India)

- Silverline Chemicals (India)

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, applications, and products. The report also offers market insights into key trends and highlights vital industry developments. In addition, the report encompasses various factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

CAGR |

CAGR of 9.40% during 2026-2034 |

|

Unit |

Value (USD Million) and Volume (Ton) |

|

Segmentation

|

By Application

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 576.5 million in 2026 and is projected to reach USD 1,189.70 million by 2034.

In 2025, the Asia Pacific market value stood at USD 327.1 million.

Registering a significant CAGR of 9.40%, the market will exhibit considerable growth in the forecast period (2026-2034).

By application, the oral products segment led the market in 2025.

Complex flavor profile offered by mint oils to fuel demand in the food and beverage industry, driving market growth.

Asia Pacific held the largest share of the market in 2025.

H. Reynaud & Fils, A.G Industries, Robertet S.A., Lebermuth, Inc., and BERJE INC are the leading players in the market.

Rising preference for natural cleaning products presents a market growth opportunity and wider adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us