Mobile Energy Storage System Market Size, Share & Industry Analysis, By Type (Self-mobile (Electric Vehicles), Containerized Solutions, and Trailers Mounted Solutions), By Application (Construction, Data Centers, Healthcare, Transportation, and Others), and Regional Forecast, 2026-2034

Mobile Energy Storage System Market Size

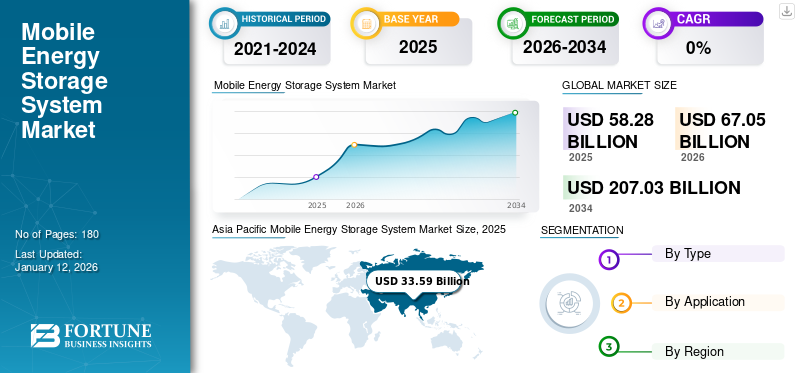

The global mobile energy storage system market size was valued at USD 58.28 billion in 2025. The market is projected to grow from USD 67.05 billion in 2026 to USD 207.03 billion by 2034, growing at a CAGR of 15.13% during the forecast period. Asia Pacific dominated the mobile energy storage system industry with a market share of 57.63% in 2025. The Mobile energy storage system market in the U.S. is projected to grow significantly, reaching an estimated value of USD 30.07 billion by 2032.

Mobile energy storage systems are stand-alone modular devices that utilize renewable energy resources to provide power backup in places during peak demand by connecting to the power grid. They provide electricity to a grid and for off-grid applications as well. These portable and scalable battery systems make them ideal for various applications. Unlike conventional and other fossil fuel generators, these units do not emit greenhouse gases during operation, aligning with global efforts to reduce carbon footprint. The increasing power and electricity consumption globally has created a demand for mobile energy storage systems.

The COVID-19 pandemic has impacted several business sectors, such as power generation, manufacturing, oil & gas, mining, automotive, construction sites, etc. As businesses and transportation globally came to a standstill, demand and production of electric vehicles also decreased, which are some of the major contributors in the mobile energy storage system market. Quarantines and stay-at-home orders prevented workers from working in battery and auto factories, closed mines and refineries, and froze shipments of manufactured goods. Economic uncertainty and mass layoffs have reduced spending and dampened demand for high-end cell phones and tablets. Thus, these factors negatively impacted the market's demand for mobile energy storage systems.

Mobile Energy Storage System Market Trends

Growing Usage of Mobile Energy Storage Systems in the Military and Defense Sector is Creating an Opportunity for Market Growth

Mobile energy storage systems (MESS) have recently been considered a resilience improvement strategy to provide power during outages in local emergency. Using these storage units during normal operations can create value beyond the value they provide during emergencies. Vehicle-to-grid (V2G) technology can revolutionize E.V. charging stations' operation, making them an integral part of the energy grid. When implemented correctly, V2G technology has minimal impact on the overall lifespan of electric vehicles.

A controlled charging and discharging process, together with advanced battery management systems, ensures optimal battery condition and long service life. V2G technology is known to enhance the grid stability by providing an additional energy source when most needed. This function contributes to a more stable and reliable grid infrastructure, thus mitigating the risk of blackouts or power disruptions during increased power consumption. Globally, countries are involved in V2G pilot programs to test the feasibility and other benefits of bidirectional energy flow. From the North America to Europe and Asia, various initiatives are under progress to assess and study the impact of V2G technology on grid stability with energy efficiency, and sustainability of the power grid.

For instance, Nissan has been exploring the V2G technology, through various R&D projects and initiatives such as “Leaf to Home” in Japan. In the project Nissan demonstrates how EVs have the potential to act as a mobile energy storage unit, to supply power to homes and the grid system during peak demand and emergencies.

Download Free sample to learn more about this report.

Mobile Energy Storage System Market Growth Factors

Growing Inclination towards Clean Fuels and Carbon Neutrality to Upsurge the Demand for Mobile Energy Storage Technologies

Carbon neutrality requires renewable energy sources, and the efficient use of renewable energy involves energy storage devices that allow excess energy to be stored and reused after spatial redistribution. The de-carbonization of the energy industry has driven utility initiatives to replace diesel generators with renewable alternatives for outage maintenance services and system reliability enhancement. As a result, many utilities have initiated programs to explore transportable and mobile energy storage solutions, which provide greater flexibility for relocation and redeployment at different sites.

A mobile energy storage system provides temporary electricity for mobile users where and when needed. By storing inexpensive grid electricity at peak times and dispatching it locally when required, portable storage gives operators emission- and noise-free electricity, often for days or weeks without recharging. The government is implementing policies and regulations at both state and national levels to promote renewable energy supply, construction of operational reserves, and improving system flexibility by building ESS capacity.

In July 2022, the Ministry of Power released the Energy Storage Obligation (ESO), which makes it mandatory to procure 1% of electricity from wind and solar projects with storage capacity in 2023-24. Moreover, in March 2022, the Ministry of Power also issued guidelines for the procurement and utilization of Battery Energy Storage Systems (BESSs) as components of generation, distribution, and assets transmission.

Development of Utility-Scale Mobile Energy Storage System to Drive the Market Growth

A portable energy storage system provides the same services as a fixed energy storage system, such as renewable energy integration, various support services, grid congestion to delay investment, etc. Energy storage is key in many utility applications, including high-end shaving, backup power, and charging mobile electric vehicles (EV). Utility-scale battery storage systems are adaptable to variable renewable energy into the grid by storing any excess generated energy. According to the U.S. Department of Energy (DOE), reliable grid energy storage capacity is essential to a more robust grid, particularly as intermittent renewable energy sources increase. For renewable power generation systems such as wind and solar, energy storage is vital for balancing power supply and demand over time. Surplus energy is stored during peak production periods for later use to help supply loads when wind or solar energy production is low.

Energy storage prove to be a critical energy source in numerous utility-scale applications where large energy consumers can use energy storage better to manage their energy costs through time-based pricing arbitrage. Derived from close collaboration with major U.S. utilities and industry partners, TerraCharge’s unique modular approach segregates the BESS into separate trailer-mobile battery storage and power conversion units. This modular approach offers a high level of flexibility and scalability to customers. Multiple battery storage units can be paired with a single PCS unit to scale as needed to meet the application's power requirements. Additional PCS units can be added to projects that require even more energy capacity.

RESTRAINING FACTORS

High Initial Cost and Availability of Established Alternative Products to Hamper Market Growth

Mobile energy storage systems have emerged as an alternative to diesel generators for temporary off-grid power. Diesel generators have long served as temporary power sources for industries that rely on temporary off-grid power, such as construction, live events, film, utilities, and disaster relief. Unfortunately, generators come with unwanted drawbacks such as noise, fuel and maintenance costs, and, millions of tonnes of greenhouse gas emissions each year. The energy storage segment is expected to significantly influence various nations’ journeys to net zero in the coming decades. When planning the implementation of a battery energy storage system's implementation, policymakers face various design challenges.

There are limitations to the deployment of mobile energy storage systems. For example, they must not be installed indoors, in covered parking spaces, roofs, lower levels, or under prominent parts of the building. This is primarily due to the unique nature of each battery energy storage system, which doesn't neatly fit into any established power supply service category. These challenges encompass technical aspects, like determining storage capacity sizing and regulatory considerations, including ownership, safety regulations, sustainability, and commercial industrial viability. While the outlook for the energy storage sector looks positive, there are still several challenges facing the sector. To begin with, exploration, research, and development of advanced energy storage technologies require a high initial investment cost, which deters several potential investors from establishing a robust energy storage market.

The lack of long duration batteries, standardization, and timely degradation, as well as the limited energy density of existing batteries, are other impediments to the global mobile energy storage system market growth. A well-defined market structure for energy storage technologies has not been established, and the sector remains highly dependent on government-provided policy support.

Mobile Energy Storage System Market Segmentation Analysis

By Type Analysis

Self-Driving (Electric Vehicles) Dominates the Market due to Technological Advancements and its Wide Applications

Based on type, the market is segmented into self-driving (electric vehicles), containerized solutions, and trailer mounted solutions.

Self-driving (electric vehicle) dominates the global mobile energy storage system in 2026 with a market share of 94.42%. Technological advances in electric vehicles and huge investments are all over the media. There have been significant positive changes in the federal and state policies. For instance, in the U.S. over 45 states and the District of Columbia provide an incentive for certain E-vehicles and PHEVs, where the incentives range from tax credits and exemptions from certain emissions testing and utility time of use rate reductions. Moreover, vehicle adoption and electrification of public and private fleets are also boosting the sale of electric vehicles. In addition, the most of the countries have committed to the global goal of net zero emissions by 2050. Governments are jumping to support the electric car revolution, investing in charging infrastructure and pushing it as part of a climate change agenda.

Containerized solutions are an energy storage system encapsulated in a modular and scalable container. It allows easy transport, installation, and scalability, making it a preferred choice for applications ranging from large-scale utility projects to remote microgrid systems. The market for containerized energy solutions is further segmented into Upto 100 KW, 101 to 500 KW, and above 500 KW. 101 to 500 KW sub-segment of containerized solutions lead the market, followed by the above 500 KW sub-segment.

Trailers mounted solutions segment is further segmented into Upto 100 KW, 101 to 500 KW, and Above 500 KW.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Transportation Segment Dominates the Market Owing to Increased Government Support and Investments in this Sector

Based on application, mobile energy storage systems are segmented into construction, data centers, healthcare, transportation, etc.

Among the various segments, the transportation segment dominates the global market with a share of 95.38% in 2026. Battery-based energy storage transport in public transport systems often refers to trains, ships, containers, and trucks which are energy-high consumers in this market.

Construction segment is the second leading segment. At construction site, mobile energy storage systems is used for operating various tools that consume power, and thy also complement the power supplies by the generator in different construction sites

REGIONAL INSIGHTS

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, and the Rest of the World.

Asia Pacific Mobile Energy Storage System Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific accounted for the major global market share due to rising power and electricity demand, due to increased industrialization and urbanization in developing nations such as India and China. The Japanese market is projected to reach USD 2.05 billion by 2026, the Chinese market is projected to reach USD 33.7 billion by 2026, and the market in the region is also increasing due to the growing expansion of renewable energy power generation.

Europe is also expected to grow, owing to the rising environmental concerns in the region. The UK market is projected to reach USD 2.32 billion by 2026, while the Germany market is projected to reach USD 4.88 billion by 2026. Mobile battery storage systems are increasingly important in Europe's growing energy storage system market. Specifically, these mobility systems provide a zero-emission alternative or complement to off-grid CO₂-emitting diesel generators and help create a more sustainable supply/demand storage buffer for sustainably produced electricity, where energy is stored on-site when needed.

The U.S. market is projected to reach USD 10.42 billion by 2026.

Key Industry Players

Key Players Focus on Increasing Their Production Capacity by Improving Efficiency of Products

Since the last few years, the mobile energy storage system industry has been continuously consolidating, giving rise to the current market dominance of a small number of large players. The mobile energy storage system market is in a growing stage. The primary factors for expansion are the growing demand for reliable & efficient power supply and the rising energy security concerns due to macroeconomic conditions. At the same time, the market is restricted by fierce price competition among manufacturers and the absence of distinct product features. Chinese and Korean manufacturers dominate the lithium-ion battery supply for mobile applications. However, the emergence of new battery suppliers, including Enovix, Verkor, Northvolt, and ACC, is expected to make the battery supply chain more competitive. CATL is among the leading brands in the world for mobile energy storage, offering one of the largest portfolios of mobile energy storage batteries.

List of Top Mobile Energy Storage System Companies:

- Greener (Netherlands)

- RES (U.K.)

- LG Energy Solution (South Korea)

- Panasonic (Japan)

- Green NRG Co (Australia)

- Amperex Technology Limited (Japan)

- CALB (China)

- GE Renewable Energy (France)

- Aquion Energy (U.S.)

- Saft (France)

KEY INDUSTRY DEVELOPMENTS:

- August 2023- RES, one of the leading independent renewable energy company announced the acquisition of Ingeteam’s Renewable Service division. Both parties signed a Sale and Purchase Agreement (SPA), after which RES will have USD 38.28 of assets under management, thus making it the largest renewable energy support services provider in the world, as claimed by the company

- February 2023- Hanwha and LG Energy Solution signed a MoU for collaborations in battery business. The collaboration is aimed at comprehensive battery business cooperation for Energy Storage Systems (ESS) and other cleantech energy solutions. Hanwha Solutions’ Qcells Division, Hanwha Aerospace and Hanwha Corporation/Momentum are the subsidiaries of Hanwa, which are part of the partnership.

- September 2022- General Electric announced to convert its old, gas-fired power station in Britain into a battery-storage unit. GE supplied 50 MW project’s battery storage system. On completion of the project, the unit will store energy from 43 onshore wind farms located in Lincolnshire.

- November 2021- Panasonic launched the second edition of its EverVolt home battery system named EverVolt 2.0, with a power output of 7.6 kW off-grid and 9.6 kW with on-grid and a usable capacity of 17.1 kWh or 25.65 kWh. The new system can be AC- and DC-coupled, based on customer requirements.

- August 2021- A product recall has been announced for around 10,000 units of residential battery energy storage systems (BESS) by manufacturer LG Energy Solution Michigan in the US because the United States Consumer Product Safety Commission (US CPSC) issued the notice for LG Chem Model RESU 10H lithium-ion battery storage units that were installed with solar after there were five reports of the batteries smoking and catching fire.

- March 2021- Northern Reliability Inc. (NRI) and KORE Power joined a joint venture, Nomad Transportable Power Systems (NOMAD), to provide mobile energy storage systems based on renewable energy to various industries in the U.S.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as key players, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the global mobile energy storage system market growth in the recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.13% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, By Application, and By Region |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 58.28 billion in 2025.

The market is likely to grow at a CAGR of 15.13% over the forecast period (2026-2034).

The transportation segment leads the market due to the development of mobile energy storage systems globally.

The market size of the Asia Pacific stood at USD 33.59 billion in 2025.

The market growth key factors are the growing inclination towards clean fuels and carbon neutrality.

Some of the top players in the market are CALB, LG Energy Solution, and GE Renewable Energy.

The global market size is expected to reach USD 207.03 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us