Motorcycle Airbag Market Size, Share & Industry Analysis, By Component (Crash Sensor, Airbag Module, Airbag, Inflator, and Airbag ECU), By Motorcycle Type (Standard, Sports, Cruiser, Touring, and Scooters), and Regional Forecast, 2024 – 2032

KEY MARKET INSIGHTS

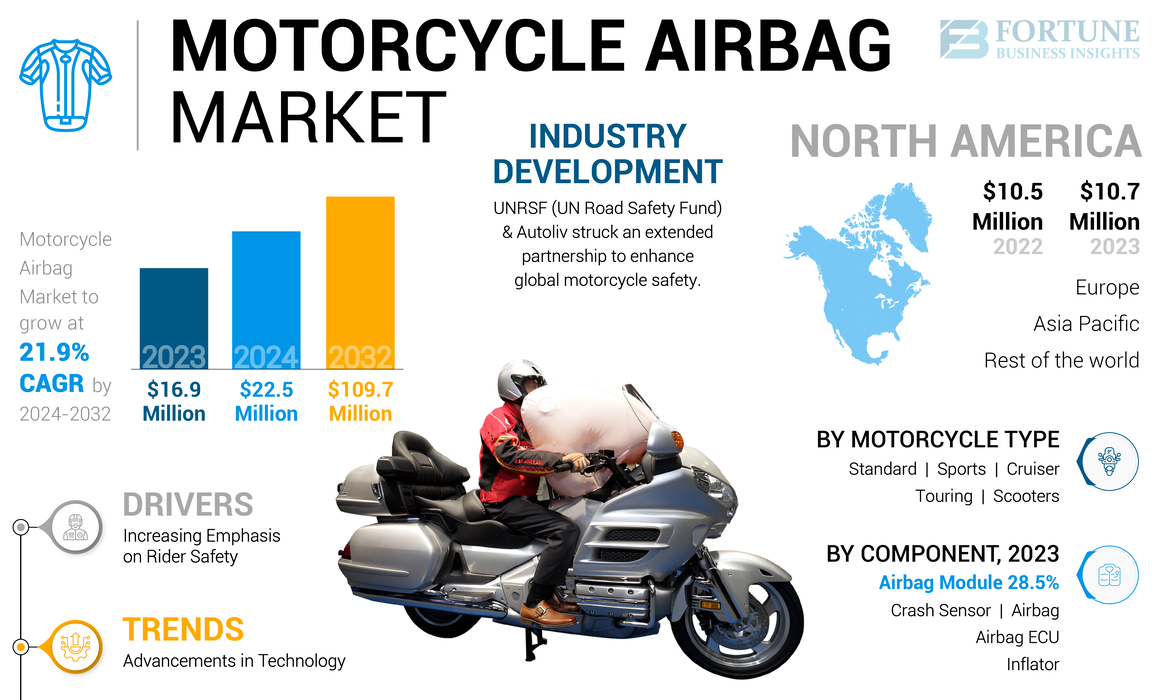

The global motorcycle airbag market size was valued at USD 16.9 million in 2023 and is projected to grow from USD 22.5 million in 2024 to USD 109.7 million by 2032, exhibiting a CAGR of 21.9% during the forecast period. North America dominated the global market with a share of 63.31% in 2023. The Motorcycle Airbag Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 58.7 MillionBy 2032

A motorcycle airbag is a safety device or system designed to protect motorcycle riders during collisions. Typically integrated into the motorcycle, it deploys rapidly upon detecting an impact, cushioning the rider to reduce injury. Airbags can be installed in the bike's chassis or front fork, providing added protection to critical areas such as the chest and back during accidents.

The market is growing as manufacturers increasingly integrate airbag systems into bike designs, enhancing safety features directly within the vehicle structure. High production costs and complex installation processes are barriers, limiting affordability and widespread adoption among lower-priced motorcycle models. However, rising awareness of rider safety and stringent safety regulations are driving the demand for motorcycle airbags, prompting manufacturers to prioritize built-in airbag systems for enhanced protection.

The COVID-19 pandemic disrupted the motorcycle airbag market by causing supply chain interruptions and production delays. Economic uncertainty reduced consumer spending on new motorcycles, impacting sales. However, the pandemic heightened safety awareness, potentially increasing the long-term demand for advanced safety features such as airbags as riders prioritize health and safety.

Motorcycle Airbag Market Trends

Advancements in Technology Augment Market Growth

The market for motorcycle airbags is witnessing significant advancements, driven by the integration of cutting-edge safety features in high-performance and touring motorcycles. Manufacturers such as Honda and others are developing more compact, lightweight, and efficient airbag systems that deploy rapidly upon collision, offering enhanced protection to riders. Improved sensor technology and sophisticated deployment algorithms are key focuses, ensuring timely and accurate airbag activation.

The market is also influenced by increasing regulatory pressures and consumer demand for advanced safety features. Additionally, collaborations between automotive safety companies and motorcycle manufacturers are accelerating innovation and adoption. These trends highlight a growing commitment to rider safety, with airbag systems becoming a standard feature in premium motorcycle models, aiming to reduce fatalities and severe injuries in accidents.

Download Free sample to learn more about this report.

Motorcycle Airbag Market Growth Factors

Rising Emphasis on Rider Safety Propels Market Demand

Elevating interest among consumers in rider safety is one of the key drivers that propel the market demand over the forecast period. Increasing awareness about the high risk of severe injuries and fatalities in motorcycle accidents has led to a demand for enhanced safety features. Regulatory bodies worldwide are pushing for stricter safety standards, compelling manufacturers to integrate advanced motorcycle airbag systems. Technological advancements in sensors and deployment mechanisms are making these airbags more efficient and reliable. For instance, in 2022, according to the National Safety Council of the U.S., despite the fact that motorcycles comprised only 3% of vehicles and 0.7% of all miles traveled in the U.S., motorcyclists accounted for 14.6% of traffic fatalities and 3.5% of injuries in 2022.

Motorcycle rider and passenger fatalities rose by 1% from 2021 to 2022, though the fatality rate per 100 million miles traveled dropped by 16%, attributed to a 21% increase in miles driven. Over the past decade, motorcycle deaths have surged by 32%, with death rates climbing 13%. Currently, the number of motorcycle fatalities is 6,218, with a rate of 26.16 per 100 million vehicle miles.

Additionally, consumer preference for motorcycles with superior safety features creates market opportunities for the airbag equipped motorcycles. Collaborations between airbag technology providers and motorcycle manufacturers are fostering innovation and widespread adoption. These factors collectively drive the market as safety becomes a paramount concern for both regulators and consumers.

RESTRAINING FACTORS

High Cost and Complexity of Integration Hampers Market Adoption

Developing and implementing technologically advanced motorcycle airbag systems requires significant investment in product and market research, development, and testing, which translates into higher costs for manufacturers. Consequently, these costs are often passed on to consumers, making airbag-equipped motorcycles more expensive and less accessible to a broader market. Additionally, the complexity of integrating airbags without compromising the motorcycle's design, weight, and performance poses significant engineering challenges.

Consumer reluctance due to concerns over potential maintenance issues and the limited availability of models with integrated airbags also hinder the growth of the global market. Moreover, there is a lack of widespread regulatory mandates specifically requiring motorcycle airbags, reducing the urgency for manufacturers to adopt this technology universally. These factors may collectively restrain the motorcycle airbag market growth during the forecast period.

Motorcycle Airbag Market Segmentation Analysis

By Component Analysis

Rising Integration of Advanced Sensors Fuels Crash Sensor Segment Growth

By component, the market is divided into crash sensor, airbag module, airbag, inflator, and airbag ECU.

The crash sensor segment is estimated to grow at the fastest CAGR during the forecast period (2024-2032). The segment growth is driven by advancements in sensor technology and elevated integration of sensors that enhance the accuracy and speed of airbag deployment. Growing regulatory mandates for improved motorcycle safety, coupled with rising consumer demand for enhanced safety features, further fuel the adoption of sophisticated crash sensors, driving segment growth.

The airbag module segment dominated the market in 2023. The growth of the segment is driven by the critical role of the component in ensuring rider safety, encompassing the essential components such as the airbag and inflator. Technological advancements, increasing regulatory safety standards, and consumer’s increased demand for enhanced safety features in motorcycles further propel the adoption and integration of airbag modules, solidifying its leading market share.

To know how our report can help streamline your business, Speak to Analyst

By Motorcycle Type Analysis

Sports Segment to Grow at Fastest CAGR Due to Risks Associated with High-speed Riding

Based on motorcycle type, the market is divided into standard, sports, cruiser, touring, and scooters.

The sports segment is estimated to surge at the fastest CAGR over the forecast period. Sports motorcycles are designed for high performance and speed, which inherently increases the risk of accidents. The incorporation of airbags provides an additional layer of safety, appealing to riders who are conscious of the risks associated with high-speed riding. Endorsements from professional racers and high-profile marketing campaigns that highlight the safety benefits of airbags can influence consumer perceptions and drive the sports segment growth. The visibility of such endorsements in racing events and media can boost the adoption of airbag-equipped sports motorcycles. All these factors are poised to drive the segment growth over the forecast period.

The touring segment held the largest market share in 2023. Touring motorcycles are designed for long-distance travel, where rider comfort and safety are paramount. The integration of airbags aligns with the overall focus on providing a safe and comfortable riding experience, making them a natural fit for this segment. Moreover, touring motorcycles are popular among older and more experienced riders who are often more safety-conscious and willing to invest in premium safety features. This demographic is more likely to appreciate and demand the added protection offered by airbags.

REGIONAL INSIGHTS

Demand for Touring and Cruising Motorcycle Fuels Market Growth in North America

By region, the market has been studied across North America, Europe, Asia Pacific, and the rest of the world.

North America Motorcycle Airbag Market Size, 2023 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest motorcycle airbag market share in 2023. The U.S. witnessed a high demand for touring and cruising motorcycles such as the Honda Goldwing series. These types of motorcycles are equipped with airbags, which fuels the product demand in the region.

Europe held the second-largest market share in 2023. Europe has stringent safety regulations and standards for motorcycles, driven by the European Union's focus on improving road safety. Regulations may include recommendations or requirements for advanced safety features such as airbags, pushing manufacturers to incorporate these systems into their motorcycles. In March 2021, the Directorate-General for Traffic proposed a draft reform of traffic regulations that included making airbags mandatory for motorcycles.

Asia Pacific’s market for motorcycle airbags is projected to exhibit the fastest CAGR during the forecast period (2024-2032). With increasing urbanization and economic growth in the region, the number of motorcycle users is growing rapidly. Thus, this higher usage drives the demand for enhanced safety features, including airbags.

The rest of the world, comprising Latin America and the Middle East & Africa, accounted for a decent share of the market in 2023. In many regions outside the major markets, the popularity of motorcycles is growing due to their affordability and practicality. This increased usage drives the demand for enhanced safety features such as airbags.

KEY INDUSTRY PLAYERS

Collaboration between OEM and Airbag Companies Fuels Market Competition

The motorcycle airbag market is evolving, featuring major players such as Honda, BMW, and others, who are integrating advanced airbag systems directly into motorcycle designs. These companies are focused on enhancing rider safety through innovative airbag technologies, which are often combined with electronic systems for real-time impact detection.

Competition is driven by technological advancements, with ongoing efforts to develop more compact, efficient, and reliable motorcycle airbag solutions. Additionally, collaborations between motorcycle manufacturers and specialized airbag technology firms are common, aiming to improve product performance and consumer appeal. The market is further influenced by regulatory pressures and growing consumer awareness of safety features, driving innovation and differentiation.

List of Top Motorcycle Airbag Companies:

KEY INDUSTRY DEVELOPMENTS:

- June 2024: Autoliv and the UN Road Safety Fund (UNRSF) announced the continuation of their partnership to improve motorcycle safety worldwide. This collaboration aligns with the UN Sustainable Development Goal 3.6, which aims to reduce road traffic deaths and injuries by 2030 and supports Autoliv's objective of saving 100,000 lives each year.

- June 2023: Autoliv, Inc. leads the way in enhancing safety for 200 million road users with its comprehensive approach to motorcycle and scooter safety. The first of its new motorcycle safety products planned to be launched will be the bag-on-bike airbag, with production set to start in Q1 2025.

- November 2022: Yamaha announced the development of an airbag system for its motorcycle.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product types, and top applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 21.9% from 2024 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Component

|

|

By Motorcycle Type

|

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size was valued at USD 16.9 million in 2023.

The market is expected to record a CAGR of 21.9% over the forecast period of 2024-2032.

By motorcycle type, the touring segment held the largest market share in 2023.

In 2023, North America’s market size was valued at USD 10.7 million.

Rising emphasis on rider safety propels the market growth.

Major players in the market include Honda and Autoliv, among others.

North America dominated the market in 2023.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us