Mucopolysaccharidosis Treatment Market Size, Share & Industry Analysis, By Treatment (Enzyme Replacement Therapy (ERT), and Others), By Disease Type (Mucopolysaccharidosis Type I, Mucopolysaccharidosis Type II, Mucopolysaccharidosis Type IV A, Mucopolysaccharidosis Type VI, and Others), By Route of Administration (Intravenous, and Intracerebroventricular (ICV)), By End User (Hospitals, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

Mucopolysaccharidosis Treatment Market Size & Growth

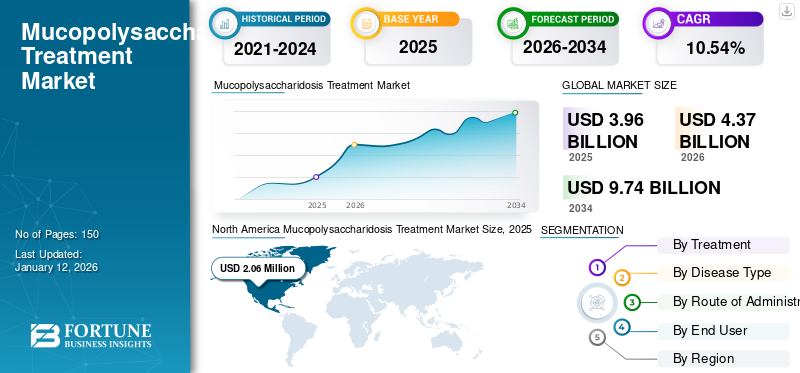

The global mucopolysaccharidosis treatment market size stood at USD 3.96 billion in 2025 and is projected to grow from USD 4.37 billion in 2026 to USD 9.74 billion by 2032, exhibiting a CAGR of 10.54% during the forecast period. North America dominated the global market with a share of 52.10% in 2025.

MPS, also known as mucopolysaccharidosis, refers to a group of key rare metabolic disorders which is caused by the absence, deficiency, or malfunctioning of lysosomal enzymes called glycosaminoglycans (GAGs). This inability to completely break down the sugar leads to the abnormal accumulation of certain compounds such as dermatan sulfate, heparan sulfate, and keratan sulfate, which interfere with normal cell function of the body. One of the characteristic symptoms of MPS is the presence of severe neurological symptoms that are present in several types of MPS, such as Hunter syndrome and Sanfilippo syndrome, and a number of clinical-stage companies are involved in the R&D of new therapeutics for the management of these symptoms.

Global Mucopolysaccharidosis (MPS) Treatment Market Overview

Market Size:

- 2025 Value: USD 3.96 billion

- 2026 Value: USD 4.37 billion

- 2034 Forecast Value: USD 9.74 billion, with a CAGR of 10.54% from 2026–2034

Market Share:

- North America dominated the global market with a share of 52.10% in 2025 due to high diagnosis and treatment rates, strong clinical trial activity, and advanced reimbursement policies.

- By end user, hospitals segment is expected to hold a 61.55% share in 2026.

Key Country Highlights:

- Japan: Mucopolysaccharidosis treatment market expected to reach USD 333.9 million by 2025.

- China: Projected to witness a strong CAGR of 11.90% during the forecast period.

- Europe: Anticipated to grow at a CAGR of 9.9% during the forecast period.

Mucopolysaccharidosis Treatment Market Trends

Increasing R&D for Rare Diseases to Drive the Market Growth

Market trends present in the mucopolysaccharidosis (MPS) treatment market is the increasing number of pipeline candidates from major companies in the therapeutic area of rare diseases or orphan diseases. Since, mucopolysaccharidosis is considered to be a potentially serious orphan disease group, some prominent clinical stage biopharmaceutical companies such as ArmaGen and REGENXBIO Inc. are involved in the clinical trials for new therapeutics. This increasing initiatives into the development of rare diseases’ therapies is due to the fact that development of major blockbuster drugs is more possible in these rare diseases as compared to the conventional pharmaceutical portfolios. Another driving factor for this trend is that the pharmaceutical companies are mandated to conduct larger outcome studies for conventional medications or therapies. This is applicable for therapies to treat diseases such as heart disease and diabetes in comparison to rare disorders such as the several disease types of mucopolysaccharidosis. This is projected to further positively drive the mucopolysaccharidosis treatment market growth during the forecast period.

Download Free sample to learn more about this report.

MARKET DRIVERS

Need for Advanced Therapeutics Due to Unmet Clinical Needs and Better Treatment Outcomes to Propel Market Growth

The lack of presence of a wide range of therapeutics for the patients, which has led to the creation of the monopoly of one type of therapy, enzyme replacement therapy is the most critical driver for the market growth. For instance, for the treatment of mucopolysaccharidosis type II (Hunter syndrome), Elaprase is the most commonly used therapeutic, an enzyme replacement therapy (ERT). This ERT is a prohibitively expensive therapy option and often patients from developing countries cannot easily access this therapeutic due to cost constraints. Other therapeutics for MPS treatment include Vimizim (elosulfase alfa) which is administered for the treatment of MPS IV A (Morquio syndrome) and which at the time of launch in the market is estimated to cost US$ 380,000 for the disorder’s annual treatment. Hence, due to the six-figure costs of most of the enzyme replacement therapy (ERT), the patients in the emerging countries such as India, often cannot afford these therapeutics despite increasing initiatives for improved access from various governments. Anticipated launches of cheaper alternatives and advanced therapeutics is anticipated to drive the growth of the global MPS treatment market during the forecast period.

Another critical driving factor is the increasing need for advanced therapeutics due to unmet clinical needs and better treatment outcomes. During the current period therapeutics, such as Elaprase, and ALDURAZYME are not capable of crossing the blood-brain barrier, a key requirement for effective management of the disorder. So, these therapeutics are not able to appropriately address the neurological symptoms and complications of the patients of mucopolysaccharidosis (MPS), who are most severely affected. For instance, in the patients of Hunter syndrome with the most severe symptoms, which affects approximately two-thirds of the total patient population, the neurological symptoms are severely disabling. The therapeutics used currently are not able to treat the neurological symptoms, thus a significant proportion of the population remains in the need for appropriate treatment. This is anticipated to propel the demand for effective therapeutics which aid in the management of all types of the symptoms of the mucopolysaccharidosis and drive the growth of the MPS treatment market size during the forecast period.

Increasing Number of Clinical Stage Candidates in R&D Pipelines of Major Players to Drive Market

There is a significant number of pipeline candidates for the development of advanced therapeutics for an increasing number of rare disorders and the several types of mucopolysaccharidosis is one of the key disease groups for these companies due to the severity of the disease. According to the National Organization for Rare Disorders (NORD) (NORD), the prevalence of all disease types of mucopolysaccharidosis is estimated to be 1 in 25,000 births. In April 2019, it was reported that in Japan, an estimated 150 individuals suffered from mucopolysaccharidosis type II (Hunter syndrome). Such driving factors are further leading to the presence of prominent and important pipeline candidates. ArmaGen, Denali Therapeutics, and REGENXBIO Inc., all have pipeline candidates for the various types of MPS in various stages of clinical trials. The above factors combined with the need for advanced therapeutics is further anticipated to drive the demand for these therapeutics and stimulate the MPS market growth.

MARKET RESTRAINT

High Cost Therapeutics Coupled with Poorer Diagnosis Rates and Low Treatment Rates in Emerging Countries to Restrain the Market

In recent times, globally due to sophistication in diagnostics, there is a higher prevalence of MPS in several countries which includes emerging regions such as Asia, there are certain factors that are restraining the widespread usage of these therapies. Due to the high costs associated with enzyme replacement therapies (ERT), which is the mainstay treatment for MPS, one of the major factors limiting the growth of the market is low levels treatment rates in emerging countries. This severely limits the number of patients undergoing treatment, and a significant proportion of the patients of MPS are left without treatment due to their inability to afford treatment. Often, these therapies are not available to the patients in the developing countries due to lack of awareness and also options for the payment of these therapies. The governments in these countries often do not have appropriate awareness regarding these diseases and do not adequately reimburse them. Another key limiting factor is the delays associated with the diagnosis of mucopolysaccharidosis. A study published in 2024, in the Orphanet Journal of Rare Diseases, indicated that there is a failure to shorten the diagnostic delay in the two ultra-orphan diseases of mucopolysaccharidosis types I and mucopolysaccharidosis type III. Factors as such are further expected to restrain the market growth.

SEGMENTATION

By Treatment Analysis

Enzyme Replacement Therapy (ERT) is Expected to Dominate the Global Market

Based on treatment, the global market is segmented into enzyme replacement therapy (ERT) segment is expected to account for 93.89% of the market in 2026., and others. The primary treatment for lysosomal storage disorders, a group of disorders to which MPS belongs, is enzyme replacement therapy (ERT). These enzyme replacement therapies, aim to replace or generate the missing or deficient enzyme in the body, due to which mucopolysaccharidosis occurs. Hence, the enzyme replacement therapy (ERT) segment dominated the mucopolysaccharidosis treatment market share in 2024. The only major therapeutics approved by the regulatory agencies globally treatment of MPS, is enzyme replacement therapy (ERT). For example, in case of mucopolysaccharidosis type II (Hunter syndrome), the only two approved products are Elaprase and Hunterase which are both ERTs, and have been instrumental in the dominance of this segment in the global market.

The others segment is anticipated to grow at a comparatively stronger CAGR. The mucopolysaccharidosis (MPS) treatment market growth during the forecast period is anticipated to be driven by the growing number of clinical trials involving the usage of the hematopoietic stem cell transplant (HSCT). Other than stem cell transplantation, a number of prominent clinical stage biopharmaceutical companies are conducting trials on gene therapy including Sangamo Therapeutics, which has a pipeline candidate for Hunter syndrome.

By Disease Type Analysis

To know how our report can help streamline your business, Speak to Analyst

MPS II (Hunter Syndrome) to Dominate the Disease Type due to Presence of Key Products

In terms of disease type, the market is segmented into mucopolysaccharidosis type I also known as Hurler syndrome/Hurler-Scheie syndrome/Scheie syndrome, mucopolysaccharidosis type II also known as Hunter syndrome, mucopolysaccharidosis type IV A also known as Morquio A syndrome, mucopolysaccharidosis Type VI also known as Maroteaux–Lamy syndrome, and others. The mucopolysaccharidosis type II (Hunter Syndrome) is expected to dominate the market share of 24.25% in 2026. due to the presence of key products such as Hunterase and Elaprase. Both of these products account for a significant portion of the market revenue share. The other segments in the global mucopolysaccharidosis treatment market, which include mucopolysaccharidosis type I, mucopolysaccharidosis type IV A, and mucopolysaccharidosis Type VI, all of which have key product offerings attributable to them. Such factors are anticipated to drive the market during the forecast period. By disease type, the mucopolysaccharidosis type II segment is projected to generate USD 236.9 million in revenue by 2025.

The other segment includes mucopolysaccharidosis type VII (Sly syndrome), whose product offering of MEPSEVII (vestronidase alfa-vjbk) is anticipated to register a strong growth rate during the forecast period. The growing prevalence of the mucopolysaccharidosis types, along with the introduction of major enzyme replacement therapy (ERT) products in the market, is expected to drive the growth of the segment during the forecast period.

By Route of Administration Analysis

Presence of Major Therapeutics in Intravenous Form to Aid Dominance of the Segment

In terms of route of administration, the market is segmented into intravenous and intracerebroventricular (ICV). The intravenous type is anticipated to account for the majority of the revenue share of 98.16% in 2026. the route of administration segment, because most of the therapeutics for MPS treatment are to be administered through intravenous injections only. For example, the most prominent therapeutic for Hunter syndrome, Elaprase, is administered intravenously. Intravenous therapeutics hold a monopoly over the mucopolysaccharidosis treatment market and are anticipated to hold control over their market share in the forecast period.

The only other approved therapeutic that is not in an intravenous form and whose route of administration is intracerebroventricular (ICV) is Hunterase. Growing approvals in other countries of these therapeutics, along with anticipated introduction in other countries across the globe, are expected to drive the growth of the segment during the forecast period.

By End User Analysis

Increased Need for Administration of Therapeutics at Hospitals to Enable Dominance of the Segment

On the basis of end user, the market is segmented into hospitals segment is expected to account for 61.55% of the market in 2026., specialty clinics, and others. The key factor aiding in the dominance of hospitals segment is that the therapeutics used in MPS treatment can often be administered by trained medical professionals who can administer these therapeutics in settings such as hospitals with care and proper guidelines. This allows for the proper adherence to the MPS treatment guidelines and administration of critical therapeutics which have to be administered intravenously, in a safe environment to manage the increased risk of infusion site infections. By end user, the hospitals segment is expected to hold a 61.4% share in 2025.

The growing number of specialty clinics, due to the increasing need for specialist care of a higher degree for the treatment and management of several types of mucopolysaccharidosis (MPS) patients, is one of the major factors responsible for this segment’s dominance forecast period. Also, a number of these specialty clinics are based in developed countries, resulting in a strong market revenue share. Also, the increasing government initiatives, such as the Brazilian Government’s initiative for the setting up of treatment guidelines, are also anticipated to contribute to the segment’s growth.

REGIONAL ANALYSIS

North America Mucopolysaccharidosis Treatment Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America

The mucopolysaccharidosis (MPS) treatment market size in North America stood at USD 0.06 million in 2025. Some of the characteristics of this market is higher diagnosis and treatment rates for a number of rare disorders, coupled with adequate reimbursement policies for these therapeutics. These factors, coupled with higher awareness among patient population towards advanced treatment options, increasing diagnostic sophistication, presence of significant clinical trials, and the presence of major clinical-stage biopharmaceutical companies are their pipeline candidates, are responsible for highest share of the region in the global market. The U.S. market is projected to reach USD 2.13 billion by 2026.

Europe

The European market is anticipated to account for the second largest revenue share during the forecast period. The presence of key products in the region, such as Elaprase and ALDURAZYME, is anticipated to drive the demand for MPS treatment in Europe during 2025-2032. Europe is anticipated to grow at a CAGR of 9.9% during the forecast period. The UK market is projected to reach USD 0.18 billion by 2026, while the Germany market is projected to reach USD 0.27 billion by 2026.

Asia-Pacific

Asia-Pacific is projected to register the highest CAGR during the forecast period. Anticipated launch of some therapeutics such as Hunterase in Japan in Asia Pacific, the upcoming product launches in the region due to increased regulatory applications for approvals, and the presence of a strong potential patient population base in the region, together are projected to fuel the mucopolysaccharidosis (MPS) treatment market growth in Asia Pacific during forecast period. The mucopolysaccharidosis treatment market in Japan is expected to reach USD 333.9 million by 2025. China is projected to witness a strong CAGR of 11.90% during the forecast period. The Japan market is projected to reach USD 0.37 billion by 2026, the China market is projected to reach USD 0.27 billion by 2026, and the India market is projected to reach USD 0.13 billion by 2026.

Latin America and Middle East & Africa

The rest of the world market comprises of Latin America and the Middle East & Africa and is currently in nascent stage. However, developing healthcare infrastructure in these regions, increased government initiatives and growing awareness of rare disorders is projected to fuel the mucopolysaccharidosis treatment market demand during forecast period.

KEY INDUSTRY PLAYERS

Key Product Offerings and Core Focus on Mucopolysaccharidosis of Shire (Takeda Pharmaceutical Company Limited) and BioMarin, to Propel the Company to a Leading Position

Competition landscape of mucopolysaccharidosis (MPS) treatment market depicts a competitive landscape dominated by a few key players. Shire (now owned by Takeda Pharmaceutical Company Limited), whose prominent product of Elaprase commands a strong revenue share, and BioMarin are some of the key market players. For example, the product offering of Shire (Takeda Pharmaceutical Company Limited) of Elaprase (idursulfase), its efficiency in terms of treatment outcomes and also its indispensability in treatment of MPS II, are prominent factors responsible for the dominance of the company in the mucopolysaccharidosis treatment. BioMarin has the key product offerings of ALDURAZYME, VIMIZIM, and NAGLAZYME in its product portfolio, covering three types of mucopolysaccharidosis.

However, ArmaGen, and REGENXBIO Inc., are some of the prominent clinical stage biopharmaceutical companies such who have entered the clinical trials with their potential drug candidates. This is projected to positively impact the global market as these companies are poised to gain market share during the forecast period through key regulatory approvals.

LIST OF KEY COMPANIES PROFILED :

- Shire (Takeda Pharmaceutical Company Limited)

- Denali Therapeutics

- ArmaGen

- REGENXBIO Inc.

- Sangamo Therapeutics

- BioMarin

- Lysogene

- Abeona Therapeutics Inc.

- Ultragenyx Pharmaceutical

- Genzyme Corporation

- Others

KEY INDUSTRY DEVELOPMENTS:

- February 2020 – Lysogene, a key clinical stage biopharmaceutical company, received the FDA fast track designation for the pipeline candidate of LYS-SAF302 gene therapy in MPS IIIA, also known as the Sanfilippo syndrome.

- April 2019 – Abeona Therapeutics, a key integrated leader in cell and gene therapy development, received the FDA Fast Track Designation for their pipeline candidate of ABO-101 for the treatment of Sanfilippo syndrome type B or MPS IIIB.

- August 2018 – Ultragenyx announced the approval of Mepsevii (vestronidase alpha) in Europe for the treatment of mucopolysaccharidosis VII, also known as Sly syndrome.

REPORT COVERAGE

The mucopolysaccharidosis treatment market report provides a detailed analysis of the market and focuses on key aspects such as prevalence of key mucopolysaccharidosis types - by key regions (2018), pipeline analysis, key industry developments, regulatory scenario- by key regions, overview of emerging treatments for mucopolysaccharidosis, and reimbursement scenario - by key regions. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over the recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Treatment

|

|

By Disease Type

|

|

|

By Route of Administration

|

|

|

By End User

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 4.37 billion in 2026 and is projected to reach USD 9.74 billion by 2034.

In 2025, the global market value stood at USD 3.96 billion.

Growing at a CAGR of 10.54%, the market will exhibit steady growth in the forecast period (2026-2034).

Enzyme replacement therapy (ERT) segment is expected to be the leading segment in this market during the forecast period.

Anticipated introduction of more advanced therapeutics in the market, coupled with significant unmet clinical need, is fueling the demand for this market.

BioMarin and Shire (Takeda Pharmaceutical Company Limited) are the leading players of the global market.

North America dominated this market share in 2025.

Growing R&D and clinical trials by market players is leading to the development of advanced and efficient therapeutics coupled with increased prevalence and awareness for mucopolysaccharidosis treatment in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us