Multi-Vendor Support Services Market Size, Share & Industry Analysis, By Service Type (Hardware and Software), By Enterprise Type (SMEs and Large Enterprises), By Service Delivery Model (Onsite, Remote, and Hybrid), By Application (IT Operations, Sales & Marketing, Finance & Accounting, Human Resources, Supply Chain & Logistics, and Others), By Industry (Healthcare, BFSI, Retail, Manufacturing, IT & Telecom, Media & Entertainment, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

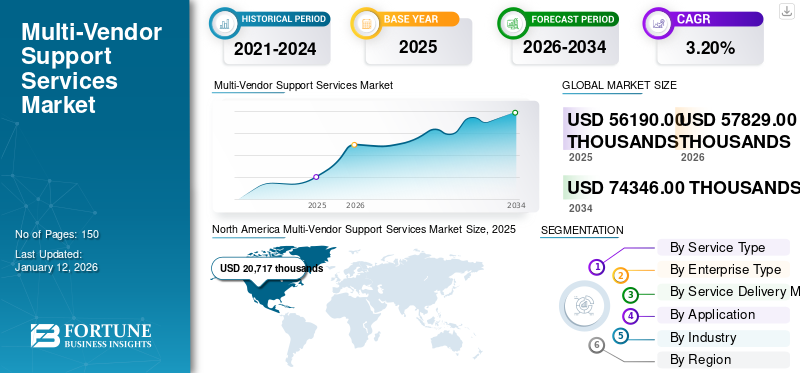

The global multi-vendor support services market size was valued at USD 56,190.00 thousands in 2025. The market is projected to grow from USD 57,829.00

thousands in 2026 to USD 74,346.00 thousands by 2034, exhibiting a CAGR of 3.20% during the forecast period. North America dominated the global market with a share of 36.90% in 2025.

Multi-vendor support services are services offered by companies to provide technical assistance, maintenance, and troubleshooting for products or services sourced from multiple vendors or suppliers. These services are essential for businesses that utilize diverse technologies and solutions from various vendors to operate their infrastructure or deliver services to their customers.

The market is primarily driven by the increasing complexity of technology ecosystems within organizations. As businesses adopt diverse solutions from various vendors to meet their operational needs, the demand for comprehensive support services rises.

The COVID-19 pandemic has both positively and negatively impacted the market. On the one hand, the rapid shift to remote work and digitalization has increased the demand for IT support services to ensure smooth business operations and address technical issues arising from dispersed work environments. On the other hand, budget constraints, supply chain disruptions, workforce challenges, and economic uncertainty have led some organizations to re-evaluate their support service expenditures, potentially slowing multi-vendor support services market growth.

Moreover, as cloud adoption increases, the demand for such support services specifically designed for cloud environments is also growing. This presents a significant opportunity for providers who can offer expertise in managing cloud infrastructure. For instance, IBM Support Insights, a cloud-based offering, integrates support services across IBM and multi-vendor infrastructures, enhancing IT team efficiency. Similarly, HPE offers HPE Pointnext Services, including multi-vendor support solutions hosted on cloud platforms.

IMPACT of GENERATIVE AI

Significant Push for Leveraging Generative AI in Support Services to Boost Market Growth

Generative AI is growing up in an era where AI-driven support solutions are becoming the norm. These solutions include virtual assistants and chatbots, can provide initial troubleshooting and assistance for a wide range of issues across multiple vendor products. Support services will likely leverage AI to deliver personalized support experiences, such as recommending specific troubleshooting steps based on past interactions or user profiles.

For instance, Wipro leverages Gen AI in its FullStride Cloud AIOps solution. This platform uses AI to automate IT operations, identify potential issues proactively, and personalize support across multi-cloud environments. Similarly, BMC Software integrates IBM's Watson AI into its Helix platform for multi-cloud management. This integration allows for AI-powered anomaly detection, automated incident resolution, and improved service desk automation within MVSS offerings.

In November 2023, DXC Technology partnered with ServiceNow to enhance its multi-vendor support offerings, extending its capabilities in predictive maintenance and proactive issue resolution. The integration of ServiceNow's advanced analytics and enhanced AI functionalities from its ITSM Pro and process mining solutions into the DXC Platform X will catalyze a new era of innovation for shared clientele.

Multi-Vendor Support Services Market Trends

Growing Adoption of Hybrid and Multi-Cloud Environments to Accelerate Demand for Support Services

As organizations adopt hybrid and multi-cloud environments, support services are adapting to provide seamless management and support across diverse cloud platforms. This includes cloud migration assistance, optimization services, and ongoing support for hybrid infrastructure configurations. Cloud adoption is driving the need for support services specifically designed for cloud environments. These solutions offer scalability and flexibility, security and compliance, and integration with cloud platforms such as AWS and Azure. Moreover, Original Equipment Manufacturer (OEM) support contracts can be expensive and may not cover all the services needed in a multi-cloud environment. Such support services help organizations with broader support at a potentially lower cost, catering to diverse needs.

In March 2023, Hewlett Packard Enterprise (HPE) completed the acquisition of OpsRamp, an IT operations management (ITOM) firm. By integrating OpsRamp's hybrid digital operations management solution with HPE GreenLake edge-to-cloud platform and services, the companies can streamline multi-vendor and multi-cloud IT environments across public cloud, colocations, and on-premises setups, reducing operational complexities.

Download Free sample to learn more about this report.

Multi-Vendor Support Services Market Growth Factors

Centralized Management and Seamless Integration by Support Service Vendors in Complex IT Environments to Drive Market Growth

Businesses often use a variety of technologies from different vendors to meet their specific needs. However, integrating these diverse technologies into a cohesive ecosystem can be challenging. These support services specialize in managing and troubleshooting issues across disparate systems, ensuring seamless integration and interoperability.

As businesses expand and evolve, their IT environments become increasingly complex. Support services help manage this complexity by providing centralized management and support for diverse technology ecosystems. They streamline processes, minimize downtime, and ensure optimal performance across the entire IT infrastructure. In addition, modern IT environments are becoming increasingly complex, comprising a mix of on-premises infrastructure, cloud services, and hybrid deployments. Support services offer expertise in managing this complexity, ensuring seamless integration and operation of diverse IT systems. Moreover, outsourcing support services to third-party providers can be more cost-effective than maintaining an in-house support team. These services also offer flexible pricing models, allowing businesses to scale their support expenses according to their needs and budgets.

RESTRAINING FACTORS

Integration Complexity and Vendor Dependence May Hamper the Market Growth

Managing support across multiple vendors introduces integration challenges, including compatibility issues, interoperability concerns, and coordination difficulties between different systems. This complexity can increase the time and resources required for implementation and support, deterring some businesses from adopting multi-vendor solutions. Businesses relying on multiple vendors for support may become dependent on external service providers, leading to vendor lock-in and limited flexibility. This dependence can restrict organizations' ability to negotiate terms, switch providers, or adapt to changing business needs, posing a significant restraint to multi-vendor support services market growth.

Multi-Vendor Support Services Market Segmentation Analysis

By Service Type Analysis

Increasing Complexity of Software Ecosystems Drives Demand for Specialized Support of Such Services

Based on service type, the market is bifurcated into hardware and software.

The software segment holds the highest multi-vendor support services market with a share of 73.14% in 2026, attributed to the increasing complexity of software ecosystems, driving demand for specialized support. Software support services typically require ongoing maintenance, updates, and troubleshooting, resulting in consistent demand for support services.

On the other hand, the hardware segment is expected to grow at a higher CAGR during the forecast period due to factors such as technological advancements, aging hardware infrastructure, and the need for hardware upgrades and replacements. As hardware becomes more sophisticated and integral to operations, the demand for comprehensive support services grows, which is poised to lead to a higher CAGR of the segment.

By Enterprise Type Analysis

Need for Comprehensive Support across Multiple Vendors in IT Infrastructures to Fuel Large Enterprises Segment Growth

By enterprise type, the market is categorized into SMEs and large enterprises.

The large enterprises segment holds the highest share of the global market due to extensive IT infrastructures and diverse technology ecosystems that require comprehensive multi-vendor support, accounting for a 66.72% market share in 2026. By utilizing such support service, they reduce downtime, streamline maintenance processes, and achieve cost savings through integrated service contracts. Additionally, the scalability and customized solutions offered by these service vendors cater to extensive needs of large enterprises.

In contrast, the SMEs segment is slated to hold the highest CAGR during the forecast period because these enterprises are increasingly recognizing the benefits of outsourcing support services to specialized providers. With limited in-house resources and expertise, SMEs rely on such support services to efficiently manage their IT environments, scale operations, and stay competitive, driving the demand for such services at a faster rate compared to larger enterprises.

By Service Delivery Model Analysis

Provision of Hands-On Support for Critical Issues to Surge Enterprise Adoption of Remote Services

By service delivery model, the market for multi-vendor support services is categorized into onsite, remote, and hybrid.

The onsite segment accounts for the largest share of the market due to its long-standing tradition and perceived reliability in providing hands-on support for critical issues, accounting for a 51.89% market share in 2026. Additionally, the physical presence of skilled technicians facilitates better communication, customized solutions, and comprehensive maintenance, enhancing trust in the service provider.

On the contrary, the remote segment is anticipated to experience the highest CAGR during the forecast period due to advancements in technology, such as remote monitoring, diagnostics, and resolution capabilities. In addition, factors such as cost-effectiveness, scalability, and the increasing adoption of cloud-based solutions are driving the demand for remote support services, leading to its rapid growth in the market.

By Application Analysis

Seamless Operation of CRM Systems and Marketing Automation Platforms to Drive Sales & Marketing Segment Growth

By application, the market for multi-vendor support services is studied among IT operations, sales & marketing, finance & accounting, human resources, supply chain & logistics, and others.

The sales & marketing segment holds the highest share in the market due to the critical role they play in driving revenue and customer engagement. Businesses prioritize support services to ensure seamless operation of sales and marketing tools, such as customer relationship management systems and marketing automation platforms, to maintain competitive advantage.

The IT operations segment is poised to grow at the highest CAGR during the forecast period as organizations increasingly rely on multi-vendor support to manage the complexity of their IT infrastructure, including network, server, and cloud environments, to ensure optimal performance and reliability.

To know how our report can help streamline your business, Speak to Analyst

By Industry Analysis

Reliance of IT & Telecom Operators on Comprehensive Support Solutions to Impel Segment Growth

By industry, the market for multi-vendor support services is categorized into healthcare, BFSI, retail, manufacturing, IT & telecom, media & entertainment, and others.

The IT & telecom segment holds the largest share in the global market due to its extensive use of diverse technologies from multiple vendors, necessitating comprehensive support solutions. This sector requires robust support services to ensure seamless integration, maintenance, and optimization of these multiple systems. Additionally, the rapid technological advancements and high demand for uninterrupted services drive the need for vendor services to troubleshoot issues across different platforms.

The manufacturing segment is anticipated to exhibit the highest CAGR during the forecast period due to the increasing adoption of automation, IoT, and Industry 4.0 technologies, leading to a greater reliance on such support services to ensure seamless integration, maintenance, and optimization of complex manufacturing systems and processes.

REGIONAL INSIGHTS

The global market is classified across five regions: North America, Europe, the Asia Pacific, the Middle East & Africa, and South America.

North America

North America Multi-Vendor Support Services Market Size, 2025 (USD thousands)

To get more information on the regional analysis of this market, Download Free sample

North America holds the highest share in the global market due to several key factors, with the regional market size reaching USD 20,717 thousand in 2025. Firstly, the region is home to a large number of technology-intensive industries such as IT, telecommunications, healthcare, and manufacturing, which have extensive and diverse technology ecosystems requiring such support services. Secondly, the region boasts a mature IT infrastructure and a high level of technology adoption among businesses, driving demand for comprehensive support solutions across multiple vendors. The U.S. market is projected to reach USD 16,277 thousands by 2026.

Asia Pacific

On the other hand, the Asia Pacific region is expected to exhibit the highest compound annual growth rate (CAGR) in the global multi-vendor support services market during the forecast period. This can be attributed to rapid industrialization, economic growth, and increasing technology adoption across various sectors in emerging economies such as China, India, and Southeast Asian countries. In addition, rising investments in IT infrastructure, coupled with the proliferation of cloud computing and Internet of Things (IoT) technologies, further drives the demand for multi-vendor support services in the region, fueling its impressive growth rate in the global market. The Japan market is projected to reach USD 3,074 thousands by 2026, the China market is projected to reach USD 4,490 thousands by 2026, and the India market is projected to reach USD 3,832 thousands by 2026.

In August 2023, Hewlett Packard Enterprise collaborated with Schneider Electric to offer a comprehensive suite of sustainability IT solutions to customers across Asia Pacific. This partnership aims to assist enterprises in advancing their sustainability and net-zero objectives. HPE delivers a Sustainability dashboard for efficient management of multi-vendor infrastructure and application resources in hybrid and multi-cloud environments.

Europe

Europe accounts for a substantial portion of the global market in terms of revenue. The region is known for its strong technology ecosystem, with several countries being hubs for innovation and research in areas such as IT, telecommunications, and healthcare. For example, countries such as Germany, the U.K., and France have vibrant technology industries, driving demand for advanced services to maintain and optimize complex IT infrastructures. Moreover, Europe’s regulatory environment creates a demand for specialized multi-vendor support services that can ensure adherence to regulatory standards while providing comprehensive technical assistance. For instance, the implementation of the General Data Protection Regulation (GDPR) has prompted businesses to seek support services to ensure compliance with data protection laws. The UK market is projected to reach USD 2,054 thousands by 2026, while the Germany market is projected to reach USD 2,029 thousands by 2026.

Middle East & Africa (MEA) and South America

The Middle East & Africa (MEA) and South America play significant roles in the global market. The MEA region is witnessing increasing adoption of multi-vendor support services due to rapid digital transformation initiatives and growing investments in IT infrastructure. South America is experiencing similar trends of digital transformation and increasing reliance on technology across various industries.

List of Key Companies in Multi-Vendor Support Services Market

Strategic Partnerships and Collaborations to Boost Market Presence of Key Players

The key players are entering strategic partnerships and collaborating with other significant market leaders to expand their portfolio and provide enhanced low-code and no-code tools to fulfill their customer's application requirements. In addition, through collaboration, the companies are gaining expertise and expanding their businesses by reaching a mass customer base. The major companies provide innovative solutions for industries and users to handle the growing expectations for sustaining customers.

List of Key Companies Profiled:

- Hewlett Packard Enterprise Development LP (U.S.)

- Zoho Corporation Pvt. Ltd. (U.S.)

- Dell Inc. (U.S.)

- IBM Corporation (U.S.)

- DXC Technology (U.S.)

- NTT Ltd. (Japan)

- Cisco (U.S.)

- Atos (France)

- Fujitsu (Japan)

- OSI Global (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: CDS Corporation, specializing in multi-vendor services (MVS) for data centers, acquired Natrinsic to bolster global support, migration, optimization, and management of enterprise data warehouses. This strategic acquisition underscores CDS's dedication to augmenting its data center support offerings, delivering clients a comprehensive suite for cost-efficiently managing storage, networking, computing, and data warehouse environments.

- February 2024: DISH Wireless implemented VMware Telco Cloud Service Assurance within the Boost Wireless Network, marking a significant step in their pilot production deployment. This solution plays a pivotal role in enabling DISH Wireless to comprehensively oversee their multi-vendor environments, thereby enhancing network operations and improving efficiency.

- February 2024: Softchoice introduced SAM+, a suite of software asset management solutions and services customized to navigate the details of subscription-based licensing. Clients leverage Softchoice's broad multi-vendor support and strategic alliances with industry leaders such as Microsoft, VMware, Cisco, Adobe, and Red Hat, optimizing their software management processes efficiently.

- October 2023: IBM launched the IBM Storage Scale System 6000, a cloud-scale global data platform addressing modern data-intensive and AI workloads. It expanded the IBM Storage for Data and AI portfolio, facilitating data connectivity through an open ecosystem, integrating multi-vendor storage options such as AWS, Azure, IBM Cloud, and public clouds alongside IBM Storage Tape.

- December 2022: Endeavor initiated Endeavor Managed Services as a digital transformation managed services platform provider. The acquisition of SOVA Inc. enabled Endeavor to deliver end-to-end digital transformation and management services, encompassing design, installation, service provisioning, monitoring, help desk support, and comprehensive multi-vendor assistance for Fortune 500 enterprises globally.

REPORT COVERAGE

The report provides a detailed analysis of the market overview and focuses on key aspects such as prominent companies, product/service types, and leading applications of the product. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD thousands) |

|

Growth Rate |

CAGR of 3.20% from 2026 to 2034 |

|

Segmentation |

By Service Type

By Enterprise Type

By Service Delivery Model

By Application

By Industry

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach USD 74,346.00 thousands by 2032.

In 2024, the market size stood at USD 56,190.00 thousands.

The market is projected to grow at a CAGR of 3.20% during the forecast period.

By service type, the software segment led the market in 2026.

Centralized management and seamless integration by support service vendors in complex IT environments are set to drive market growth.

Hewlett Packard Enterprise Development LP, Zoho Corporation Pvt. Ltd., Dell Technologies, IBM Corporation, DXC Technology, NTT Ltd., Cisco, Atos, Fujitsu, and OSI Global are the top players in the market.

North America dominated the global market with a share of 36.90% in 2025.

The Asia Pacific is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us