Multichannel Order Management Market Size, Share & Industry Analysis, By Component (Software and Services), By Deployment (On-premises and Cloud), By Enterprise Type (Small and Medium Enterprises (SMEs) and Large Enterprises), By Application (Order Fulfilment, Centralized Inventory Management, Channel Integration, Workflow Automation, Integrated POS, Analytics & Reporting, and Others), By Vertical (Automotive, Manufacturing, Retail & E-commerce, Healthcare, and Others), and Regional Forecast, 2026– 2034

KEY MARKET INSIGHTS

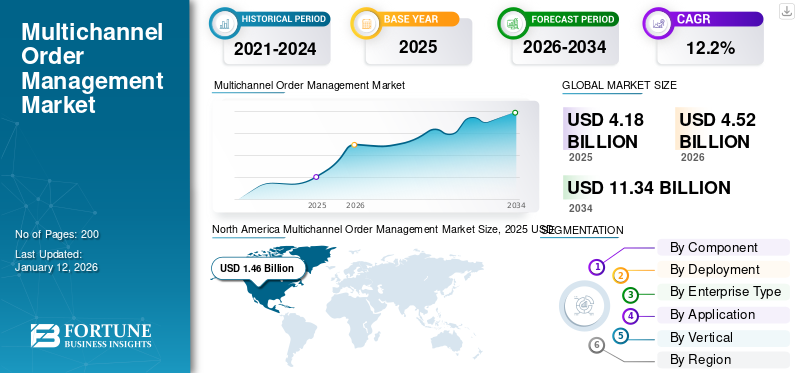

The global multichannel order management market size was valued at USD 4.18 billion in 2025 and is projected to grow from USD 4.52 billion in 2026 to USD 11.34 billion by 2034, exhibiting a CAGR of 12.2% during the forecast period. North America dominated the multichannel order management market with a market share of 34.5% in 2025.

The multichannel order management (MOM) market relates to the software and solutions ecosystem designed to consolidate, expedite, and arrange orders from many sales channels (e.g., e-commerce websites, brick-and-mortar stores, online marketplaces, mobile apps, and social media). These systems help firms align inventory, automate orders, orchestrate fulfillment from various locations, and provide a consistent customer experience across every touchpoint.

The market enables businesses to manage complex operations more efficiently with improved speed, visibility, and control as consumers continue to shop through omnichannel behaviors.

Major players such as Zoho Corporation, Salesforce, IBM Corporation, and Manhattan Associates are introducing new features to their platforms, especially real-time inventory visibility and AI-powered automation, while integrating seamlessly with other sales and fulfillment channels. For instance,

- In May 2024, Manhattan Associates launched two new generative AI solutions for its Supply Chain Commerce platform: Manhattan Active Maven and Manhattan Assist. Active Maven is a chatbot that provides enhanced customer service by handling a wide range of inquiries (such as order changes, returns, and product info) 24/7, adapting to customer tone, and handing over to human agents when needed.

IMPACT OF AI

Implementation of AI to Enhance Customer Experience Fuels Market Growth

Artificial Intelligence (AI) is heavily transforming the multichannel order management (MOM) industry by increasing efficiency, precision, and customer satisfaction throughout the supply chain.

Demand forecasting is one of AI's most significant impacts. By studying historical sales patterns, seasonal changes, and even outside factors such as weather patterns or consumer sentiments, AI allows businesses to forecast demand with much higher precision—minimizing stockouts and overstock.

AI is also responsible for automating everyday tasks such as order verification, address validation, and customer support via chatbots, thus boosting scalability and lowering human error. In addition, AI improves personalization through customer behavior analysis to customize promotions, suggest products, and provide more relevant content across channels. For instance,

- In December 2024, Fabric launched Fabric AI Order Cloud, an AI-powered retailer order management system. This centralized platform manages orders, inventory, and fulfillment across multiple channels, utilizing AI for real-time data analysis, trend detection, and intelligent recommendations.

Multichannel Order Management Market Trends

Mobile App-based Management to be a Key Trend in Market

Mobile app-based management is emerging as a key trend in the multichannel order management (MOM) space, especially among mid-sized companies and small-to-medium enterprises (SMBs).

In countries such as India, Africa, and Latin America, where mobile penetration is high and desktop connectivity can be unreliable, retailers are increasingly emphasizing mobile-first platforms that provide complete order visibility, inventory monitoring, and fulfilment capabilities on the go. For instance,

- In May 2024, Gavice Logistics, a Nigerian e-commerce firm, launched its Gavice Mobile App (GMP) to optimize supply chains with features such as real-time order tracking and inventory management. The app targets retailers, manufacturers, and logistics providers, promising efficiency and security. The company also claims to offer investors a 65% monthly ROI through its logistics services.

These companies lack large IT departments or legacy systems, making mobile-native dashboards a more pragmatic and cost-efficient solution for handling everyday operations.

MARKET DYNAMICS

Market Drivers

Rising E-commerce Sales to Drive Market Growth

The explosive growth of e-commerce is among the key drivers of demand for MOM solutions. With changing consumer behavior toward online-first shopping experiences, companies are likely to engage customers across various platforms, such as company websites, mobile apps, online marketplaces, or social commerce platforms. For instance,

- According to a Hostinger study, 62% of shoppers make online purchases weekly, and 29% shop 2-3 times each week, with both men and women exhibiting similar shopping behaviors.

Download Free sample to learn more about this report.

Image Source - Shopify, the above bar graph shows that as online sales volumes surge, retailers are increasingly burdened and require real-time inventory visibility, automated order routing, and the ability to monitor transactions from placement to delivery. Customers now expect rapid shipping, correct stock availability, and convenient returns, regardless of the channel they shop through.

Multichannel order management solutions offer an avenue to streamline and simplify operations across multiple sales channels. They allow companies to automate processes, have unified product and inventory information, and efficiently align logistics partners. This type of command is no longer a choice—it's essential for survival and expansion in today's retail landscape. As organizations expand globally or pursue hybrid retail models (online and offline), MOM systems become the backbone of agility and responsiveness.

Market Restraints

Data Privacy and Regulatory Compliance to Restrain Multichannel Order Management Adoption

Data protection and regulatory compliance have emerged as critical priorities in the multichannel order management (MOM) industry, especially as businesses grow across digital channels and geographies. For instance,

- In May 2025, Marks & Spencer reported a USD 404 million loss following a cyberattack that disrupted online sales until July. Hackers stole customer data (names and addresses) through not payment details. The breach linked to the group "DragonForce" forced M&S to pause online orders, hitting profits and causing shares to drop 2.5%.

MOM solutions process a huge volume of sensitive customer information, from contact details and payment data to purchase history, and need to be safeguarded across several data privacy laws such as GDPR in Europe, CCPA in California, and India's DPDP Act.

Non-compliance can lead to substantial fines, loss of customer trust, and damage to reputation, particularly in high-risk sectors such as healthcare and financial services. For instance,

- Under GDPR, Fines can reach USD 22.6 million or 4% of global annual turnover.

- HIPAA infractions can cost up to USD 1.5 million annually for each category of violation.

Market Opportunities

Support for Quick-commerce & Same-Day Delivery to Create Lucrative Market Opportunities

Quick commerce & same-day delivery support is becoming one of the most profitable and rapidly developing opportunities in the multichannel order management (MOM) market. With the boom of quick commerce, where consumers expect groceries, electronics, medications, or fashion products delivered within 10 to 60 minutes, the pressure on brands and retailers to deliver orders at lightning speed has never been greater.

Retailers require MOM platforms that extend beyond simple inventory syncing and provide real-time order orchestration, instant warehouse-level decision-making, and last-mile delivery coordination. To meet this demand, tech companies are collaborating. For instance,

- In May 2025, Manhattan Associates partnered with Shopify to launch a connector app for enabling seamless omnichannel order management. The integration supports real-time inventory visibility, streamlined fulfillment (BOPIS, curbside pickup, and same-day delivery), and Shop Pay. Enterprise retailers are already using it to enhance the customer experience.

SEGMENTATION ANALYSIS

By Component

Software Segment Dominates Due to Rising Need for Intelligent Systems

Based on component, the market is segmented into software and services.

The software segment holds the majority share of 68.34% in 2026 the market and is expected to grow at the highest CAGR during the forecast period. As businesses navigate complex retail ecosystems and operate across multiple sales channels, the need for centralized, intelligent, and manageable systems has become more important than ever before.

MOM software adapts to evolving businesses’ needs, from real-time marketplace visibility to artificial intelligence-driven automated fulfilment logic. Future-ready features such as integrated forecasting through AI and cloud-native deployments are accelerating software adoption and contributing significantly to market growth. For instance,

- In June 2024, Newegg launched SellingPilot, a new SaaS platform designed to help sellers manage their presence across multiple online marketplaces such as Amazon, Walmart, TikTok, eBay, and Newegg. Key features include multichannel management, AI-powered product selection, influencer marketing tools, AI customer service, AI listing optimization, and price tracking.

By Deployment

Cloud Segment Leads Market Due to Its Affordability

Based on deployment, the market is segmented into on-premises and cloud.

The cloud segment holds the majority share of 72.12% in 2026, and is expected to grow at the highest CAGR during the study period due to its cost-effectiveness, ease of integration, and connections with multiple sales channels and backend systems. Cloud-based solutions offer faster deployment, seamless access to real-time data, and the flexibility to handle demand fluctuations, advantages that traditional on-premise models often lack. For instance,

- In February 2025, Katana Cloud Inventory launched an Integration Marketplace and enhanced Multisite Order Fulfillment. The marketplace connects Katana with third-party tools such as Shopify, QuickBooks Online, and TikTok Store, allowing businesses to customize their tech stack. The new multisite capabilities help manage inventory, orders, and production across multiple locations, providing real-time insights and optimizing workflows for SMBs.

As organizations demand rapid time to market and remote access to globally connected solutions, cloud deployment has become the obvious option, providing effective solutions that can support global reach and deploy the solution without large investments in infrastructure. Thus, cloud models are becoming the primary deployment model for today's commercial needs.

By Enterprise Type

Large Enterprises Segment Dominates Market Owing to Presence of Major Players

Based on enterprise type, the market is bifurcated into small and medium enterprises (SMEs) and large enterprises.

The large enterprises segment holds a majority share of 66.51% in 2026, the development of multichannel order management solutions. This is due to the presence of major players in the MOM market (IBM, Oracle, SAP, and Salesforce), all being large enterprises, whose extensive R&D budgets and worldwide infrastructure enable rapid innovation and scalability across multiple industry verticals.

These companies lead the market through feature-rich platforms, continuous product development, and a holistic approach to digital transformation. For instance,

- In June 2025, Duluth Trading Company implemented Manhattan Active Omni to enhance its omnichannel fulfilment capabilities and improve inventory efficiency. The solution helps the retailer make its inventory available across its distribution centers, stores, and digital platforms. This move is expected to support Duluth Trading's goal of reaching USD 1 billion in sales by the end of 2025.

SMEs are expected to grow at the highest CAGR during the forecast period, particularly in terms of volume. A large number of small and medium-sized enterprises are emerging as niche developers, offering modular, affordable, and cloud-native MOM platforms tailored to specific industries or regional markets. For instance,

- In February 2024, Cart.com launched its Constellation Order Management System (OMS) as a standalone product, previously part of its unified commerce and logistics solutions. The OMS allows merchants to unify orders and inventory across multiple channels, providing full visibility and control, along with merchandising and listing tools to boost sales.

These companies may not match the scale of larger players, but their agility and focus on underserved segments have significantly contributed to market expansion.

By Application

Order Fulfilment Segment Leads Market Due to Increasing Customer Expectations for Speed and Transparency

Based on application, the market is segmented into order fulfilment, centralized inventory management, channel integration, workflow automation, integrated POS, analytics & reporting, and others.

The order fulfilment segment holds the majority share in the market, as it serves the fundamental function of any multichannel order management solution. It fulfils basic objectives, such as fast delivery, updating inventory in real-time, and a consistent customer experience across all selling channels. The demand for optimized order fulfillment across warehouses, storefronts, and third-party logistics continues to mount as businesses expand and customer expectations for speed and transparency continue to increase. For instance,

- In December 2024, Amazon India expanded its Multi-Channel Fulfillment (MCF) service with two new features: an Integrations API suite and a Cash-on-Delivery (COD) payment option. The API suite allows D2C brands and ISVs to seamlessly integrate their online stores with Amazon's fulfillment network, automating order processing. The COD option addresses India’s cash-based transactions (around 70% of D2C orders), aiming to boost conversion rates.

The workflow automation segment is projected to grow at the highest CAGR over the forecast period due to enterprises’ desire to minimize manual workflow intervention and address the complexities of various workflows. By automating repetitive tasks, businesses can improve speed, accuracy, and operational efficiency, especially in high-growth, digitally transforming enterprises. For instance,

- In October 2024, Kladana, a cloud-based software solution for inventory, sales, and manufacturing management, launched its Workflow Automation feature to support MSMEs in India's festive season (Dussehra, Diwali, and Christmas). This tool automates order and inventory management using customizable workflow templates, streamlining processes, document creation, and customer communication to ensure efficiency during the peak demand periods.

By Vertical

To know how our report can help streamline your business, Speak to Analyst

Surge in Online Sales Fuels Retail & E-commerce Segment Growth

Based on vertical, the market is segmented into automotive, manufacturing, retail & e-commerce, healthcare, and others.

The retail and e-commerce sector has driven rapid growth in the market, as it represents the constant need to synchronize orders, inventory, and customer data across multiple touchpoints. The fast-paced nature of this vertical, propelled by shifts in consumer behavior and increasing online sales, requires scalable, high-performance systems that maintain speed and accuracy under pressure. To meet these demands, tech companies are launching innovative solutions. For instance,

- In August 2024, Walmart launched "Multichannel Solutions," a program allowing third-party sellers to use its supply chain to fulfill orders from any e-commerce site. Sellers can choose between expedited (2 business days) or standard (3-5 days) shipping, although these timelines may vary during peak seasons or sales events. Walmart claims the service offers competitive rates, averaging 15% lower than competitors.

As companies explore newer channels such as social commerce or direct-to-consumer models, customers increasingly expect the same flexibility they experience while shopping offline. This demand has created a narrow window for retailers to respond at scale with cloud-based MOM solutions, making retail and e-commerce both the largest and fastest-growing verticals in the MOM market.

MULTICHANNEL ORDER MANAGEMENT MARKET REGIONAL OUTLOOK

By region, the market is divided into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America

Download Free sample to learn more about this report.

North America dominated the market with a valuation of USD 1.46 billion in 2025 and USD 1.58 billion in 2026. North America is likely to hold the largest multichannel order management market share, owing to its highly developed digital retail and e-commerce environment. The region, particularly the U.S., is home to global retail giants, such as Amazon, Walmart, and Target, all of which operate across multiple sales channels and rely on advanced order management software to streamline inventory, fulfillment, and customer experience. The U.S. market is valued at USD 1.17 billion by 2026.

Key regional strengths include high internet penetration, solid digital infrastructure, and sophisticated customer expectations for timely and transparent delivery. These factors continue to boost demand for effective multichannel operations. For instance,

- In November 2024, Golf retailer American Golf launched Fluent Order Management, a distributed order management system to enhance customer experience and operational efficiency. The platform replaced legacy systems to provide real-time inventory visibility, reducing cancellations and overselling. The platform enables 'endless aisle,' 'Ship from Store,' and 'Click & Collect' options to improve service and drive online growth.

In the U.S., the market benefits from strong federal infrastructure funding, rapid 5G small cell deployment, and rising demand for smart urban mobility. Cities such as Los Angeles, New York, and Chicago are actively adopting smart technologies for traffic monitoring, public safety, and connectivity.

North America Multichannel Order Management Market Size, 2025 USD Billion

To get more information on the regional analysis of this market, Download Free sample

South America

The market in South America is gaining momentum due to increasing internet adoption, mobile commerce growth, and a young, digitally connected consumer base. Online shopping is booming in countries such as Brazil, Argentina, and Colombia, prompting retailers to modernize their operations with real-time inventory visibility and streamlined fulfilment capabilities.

Europe

In Europe, the multichannel order management market growth is fueled by the region’s high focus on regulatory compliance, sustainability, and customer-focused retail models. The UK market is valued at USD 0.25 billion by 2026, while the Germany market is valued at USD 0.17 billion by 2026.

European retailers increasingly embrace MOM systems to address stringent data privacy regulations such as the GDPR while supporting effortless cross-border fulfillment in the EU. Additionally, recent regional investment to support MOM growth supports this trend. For instance,

- In May 2024, OneStock SAS, a leading provider of Order Management Systems (OMS), revealed a USD 72 million investment from global growth equity firm Summit Partners. This funding aimed to further boost its growth and become the top global leader in the OMS sector.

Moreover, the developed logistics infrastructure in the region, combined with an emerging trend toward hybrid retail models with physical and digital touchpoints, is driving wider adoption of elastic, efficient MOM platforms.

Middle East & Africa

The MOM market in the Middle East & Africa is gaining traction as digital e-commerce rapidly expands, especially in urban centers such as UAE, Saudi Arabia, and South Africa. As customer expectations increase and cross-border e-commerce becomes more popular, demand for agile and scalable order management systems is anticipated to grow tremendously. Additionally, recent strategic partnerships in the region also support this trend. For instance,

- In May 2024, Aramex revealed a strategic alliance with Omniful. This partnership aims to transform Aramex's services through the incorporation of Omniful’s state-of-the-art Order Management System (OMS), designed to meet the varied requirements of the logistics firm's e-commerce fulfillment clients worldwide, regardless of their size, industry, or business model.

Asia Pacific

Asia Pacific is expected to grow at the highest CAGR in the MOM market due to swift digitalization in emerging economies such as India, China, and Southeast Asia. The Japan market is valued at USD 0.13 billion by 2026, the China market is valued at USD 0.48 billion by 2026, and the India market is valued at USD 0.33 billion by 2026.

The region is also witnessing growth in mobile-first e-commerce, social commerce, and direct-to-consumer models, all of which require x systems. For instance,

- In October 2024, leather goods maker Hidesign teamed up with Unicommerce, a prominent e-commerce enablement SaaS platform in India, to enhance its e-commerce activities and streamline order processing for its extensive range of leather products across online and offline channels.

Competitive Landscape

KEY INDUSTRY PLAYERS

Key Players are Actively Pursuing Technological Integration, Strategic Collaborations, and Product Expansion to Stay Competitive in Market

Key players in the MOM market are consistently prioritizing digital transformation, seamless channel integration, and strategic collaborations. For instance,

- In July 2025, Beastlife, a sports nutrition brand, partnered with Unicommerce to streamline its e-commerce operations in India using Unicommerce’s multi-channel order and warehouse management systems. This will help Beastlife automate orders, manage inventory efficiently, and expand its reach.

With the growing complexity of omnichannel retail and the demand for real-time order visibility, companies are investing in AI-driven solutions, inventory optimization tools, and cloud-based platforms.

Major Players in Multichannel Order Management Market

Zoho Corporation, Salesforce, Inc., IBM Corporation, Manhattan Associates, and Unicommerce eSolutions Limited are the key players in the market.

Long List of Multichannel Order Management Companies Studied

- Unicommerce eSolutions Limited (India)

- Zoho Corporation Pvt. Ltd. (India)

- Brightpearl (U.K.)

- IBM Corporation (U.S.)

- Salesforce, Inc. (U.S.)

- Oracle (U.S.)

- Cin7 Americas, Inc. (U.S.)

- Linnworks (U.K.)

- Multiorders, Ltd (U.K.)

- Manhattan Associates (U.S.)

- Saleswarp (U.S.)

- Selro (U.K.)

- Radial (U.S.)

- Blue Yonder Group, Inc. (U.S.)

- Iptor Sweden AB (Sweden)

.... and More.

KEY INDUSTRY DEVELOPMENTS

- June 2025: Correllink introduced its new eCommerce platform, Shipperfy, which integrates order processing and shipping from various sales channels into one interface. This allows SMEs to handle orders from different platforms and marketplaces through a single platform, completely removing the necessity of toggling between different systems to process shipments.

- May 2025: Tata 1mg entered into a partnership with Unicommerce to enhance the efficiency of its e-commerce operations. The goal of this collaboration is to improve the fulfillment process for Tata 1mg’s proprietary products, which include nutraceuticals, nutrition for children and women, protein beverages, and wellness products aimed at diabetes management, pregnancy, and lactation.

- December 2024: ShipStation expanded its partnership with Adobe Commerce to offer advanced global shipping tools to retailers. By integrating ShipStation with their Adobe Commerce sites, retailers gain access to shipping options, label printing, workflow automation, order management, and insights. This partnership aims to help online businesses streamline shipping processes, save time, and provide flexible delivery options for customers.

- October 2024: JD Sports implemented Fluent Order Management to enhance its multichannel capabilities, enabling cross-region fulfillment and inventory sharing. This system proved crucial during COVID-19, allowing rapid adaptation with solutions such as Ship from Store and flexible Click & Collect, while digitizing returns.

- September 2024: Instacart upgraded its FoodStorm order management platform with new features aimed at retailers and customers ahead of the holiday season. Store associates can now mark individual order items as complete, view specific customer notes for accuracy, and search for orders more efficiently. Retailers can show customers which stores have items in stock and let customers change their preferred pickup location.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Investors in the MOM market can expect considerable investment returns, as more organizations expand their sales channels and look for integrated, smart systems to manage the complexity of their operations. The growing demand for agile, cloud-based solutions presents a strong opportunity for market disruption and the entry of new players, making MOM a highly attractive sector for strategic investment.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.2% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Deployment

By Enterprise Type

By Application

By Vertical

By Region

|

|

Companies Profiled in the Report |

|

Frequently Asked Questions

The market is projected to reach USD 11.34 billion by 2034.

In 2025, the market was valued at USD 4.18 billion.

The market is projected to grow at a CAGR of 12.2% during the forecast period.

The retail & e-commerce hold the highest share in the market.

Rising e-commerce sales is a key factor driving market growth.

Zoho Corporation, Salesforce, Inc., IBM Corporation, Manhattan Associates, and Unicommerce eSolutions Limited are the top players in the market.

North America is expected to hold the highest market share.

By application, the workflow automation segment is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us