Mycoplasma Testing Market Size, Share & Industry Analysis, By Testing Method (PCR-based, Culture-based, and Others), By Product (Instruments and Reagents & Kits), By Application (Cell Culture, Virus Testing, Vaccine Testing, and Others), By End-user (Biopharmaceutical & Biotechnology Companies, Cell banks, Contract Research Organizations & Contract Manufacturing Organizations, and Others), and Regional Forecast, 2026–2034

Mycoplasma Testing Market Size

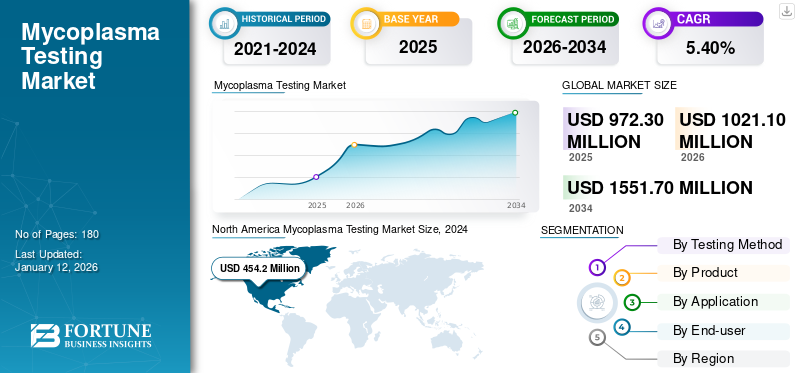

The global mycoplasma testing market size was valued at USD 972.3 million in 2025. The market is projected to grow from USD 1,021.10 million in 2026 to USD 1,551.70 million by 2034 at a CAGR of 5.40% during the 2026-2034 period. North America dominated the mycoplasma testing market with a market share of 49.20% in 2025.

Mycoplasma are the smallest free-living organisms and are considered to be the most common contaminants of cell cultures and biopharmaceuticals. These bacteria are resistant to antibiotics and antibacterial drugs due to the absence of a rigid cell wall. In addition, they can easily pass through the filtration methods owing to their ability to change shape. Therefore, mycoplasma testing is a crucial part of routine testing in biopharmaceuticals and research laboratories in order to avoid the contamination and wastage of cell cultures.

- For instance, according to a 2022 article published by the American Type Cell Culture (ATCC), mycoplasma contaminates around 15-35% of all continuous cell cultures globally.

The growing concern about cell culture contamination, along with rising R&D activities among biopharmaceutical and biotechnology companies and other research institutes, are some of the major factors contributing to the increasing demand for mycoplasma testing kits and reagents.

However, the high cost of mycoplasma testing kits is expected to lower the demand in emerging countries and limit the market growth in these countries.

Global Mycoplasma Testing Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 972.3 million

- 2026 Market Size: USD 1,021.10 million

- 2034 Forecast Market Size: USD 1,551.70 million

- CAGR: 5.40% from 2026–2034

Market Share:

- Region: North America dominated the market with a 49.20% share in 2025. This is due to an increasing number of research activities, rising initiatives by regulatory bodies and government organizations to develop new vaccines and drugs, and high R&D expenditure.

- By Product: The Reagents & Kits segment held the largest market share in 2024. The segment's dominance is attributed to the rising usage of these consumables by researchers in laboratories and research institutes, along with an increasing number of product approvals and launches by key players.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific region, growth is driven by increasing collaborations between major global players and regional research institutions, which are spurred by favorable economic factors for conducting R&D activities.

- United States: The market is fueled by a high volume of research activities and significant government funding initiatives. For example, the U.S. Department of Health and Human Services (HHS) awarded over USD 1.4 billion for Project NextGen to develop new vaccines and therapeutics, which increases the need for cell culture testing.

- China: The market is expanding due to increasing collaborations between major international companies and local Chinese entities to conduct research activities, driven by the country's economic advantages and growing biopharmaceutical sector.

- Europe: Growth is supported by rising R&D expenditures from major biopharmaceutical companies and the expansion of manufacturing facilities in the region. For example, companies are making multi-billion dollar investments to expand their manufacturing capabilities in countries like Denmark, which boosts the need for routine quality control testing.

COVID-19 IMPACT

Increased Storage of Cell Cultures for Vaccines & Drugs during COVID-19 Pandemic Supported Market Growth

The COVID-19 pandemic impacted the market positively due to the increased testing procedures and storage of cell cultures in laboratories for the development of vaccines and other medications. The increased focus of the pharmaceutical and biotechnology companies to develop and introduce vaccines for COVID-19 required a huge amount of cell cultures and samples to be stored. The concern of contamination of these cultures and samples resulted in a strong demand for mycoplasma testing among these companies.

Moreover, the major companies witnessed a growth in their diagnostic revenues in 2020 owing to increased demand for testing kits and reagents.

- For instance, Asahi Kasei Corporation generated a revenue of USD 1,406.1 million in 2020 from its healthcare segment, witnessing a growth of around 15.8% as compared to 2019.

However, the demand for these testing products among researchers normalized in 2021, which resulted in a slower growth in the revenues of the major players as compared to the previous year.

- For instance, bioMérieux generated a revenue of USD 2,095.7 million in 2021, witnessing a slower growth of around 5.9% as compared to 2020. The company witnessed a growth of around 47.9% in 2020 due to the increased demand for the products during the pandemic.

Moreover, the increased research and development activities among pharmaceutical companies to develop vaccines and drugs for various chronic conditions are expected to drive the mycoplasma testing market growth in the future.

Mycoplasma Testing Market Trends

Increasing Partnership among Market Players for Combining Skill Sets and Technologies

The rising demand for novel technology and products used for the testing of mycoplasma contamination is resulting in an increasing focus of the market players to collaborate and introduce technologically advanced products.

- For instance, in January 2023, SD Biosensor Inc., a developer of innovative diagnostic platforms, entered into an agreement to acquire Meridian Bioscience Inc., one of the leading providers of diagnostic testing solutions.

The growing concern of researchers in laboratories and academic institutes to prevent or eliminate mycoplasma contamination in cell cultures is resulting in an increasing number of product approvals and launches by market players.

The adoption of technology that is increasing the efficiency of the test kits and procedures along with reduced turnaround time is valuable to the pharmaceutical and other healthcare facilities to cater to the rising demand for these products among healthcare researchers.

Download Free sample to learn more about this report.

Mycoplasma Testing Market Growth Factors

Growing R&D Activities among Various Healthcare Settings to Fuel the Demand for Testing Products

The increasing funding by national as well as international organizations for the production of various types of biopharmaceuticals, vaccines, and drugs is resulting in a growing number of R&D activities among biopharmaceutical and biotechnological companies and others.

- For instance, the R&D expenditure of Thermo Fisher Scientific was around USD 1,471.0 million in 2022, showing a growth of around 4.6% as compared to the previous year.

The increasing healthcare expenditure in developed as well as emerging countries is resulting in increasing research activities among pharmaceutical companies to develop and introduce various cell therapies and vaccines for chronic conditions.

Furthermore, the growing awareness regarding bacterial contamination and strict adherence to the guidelines to prevent these contaminations in laboratories and research institutes is resulting in the rising use of these testing kits and reagents by researchers and laboratory personnel.

- In April 2022, the European Pharmacopoeia, the source of official quality standards for medicines and contents in Europe, published a new draft with revised guidelines for the detection of mycoplasma by nucleic acid amplification techniques (NAT).

Thus, the increasing demand for testing kits, along with the rising number of product approvals and launches in the market, are expected to fuel market growth during the forecast period.

RESTRAINING FACTORS

High Costs Associated with Mycoplasma Testing and Lack of Trained Professionals May Hamper Adoption in Emerging Countries

The growing technological advancements are increasing the efficiency and sensitivity of the testing kits and reagents, which is raising the adoption of these kits among healthcare researchers. However, the high cost associated with these products is expected to limit their adoption, especially in the emerging countries.

Moreover, mycoplasma cell detection through the naked human eye or conventional optical microscopes is difficult. It remains undetected and untreated, leading to cell contamination and wastage of the specimens and cell cultures. The early detection of these bacteria and contamination requires advanced equipment, thus increasing the costs associated with testing equipment and kits used for the detection of contamination.

- For instance, MycoSPY, a PCR-based mycoplasma test kit manufactured by Biontex Laboratories GmbH, costs around USD 300-320.

The detection methods of mycoplasma require trained professionals with specialized skills, and the lack of these trained professionals globally is expected to hinder market growth during the forecast period.

Mycoplasma Testing Market Segmentation Analysis

By Product Analysis

Reagents & Kits Segment Dominated Owing to Rising Usage of the Consumables among Researchers

On the basis of product, the market is segmented into reagents & kits and instruments. The reagents & kits segment segment led the market accounting for 57.85% market share in 2026. The dominance of the segment is attributed to various factors, such as the rising usage of reagents & assay kits among researchers in laboratories, research institutes, and other healthcare facilities. The increasing number of product approvals and launches by the key players in the market is another major factor supporting the growth of the segment in the market.

- For instance, in October 2022, SwiftDx, a U.K.-based molecular diagnostic company, launched a new lateral flow test for mycoplasma detection, SwiftDx Mycoplasma Detection Kit.

The instruments segment is expected to grow during the forecast period owing to the rising penetration of these testing instruments in emerging countries. The growing concern about contamination caused by mycoplasma in cell cultures is one of the major factors driving the adoption of the available tests for mycoplasma detection by researchers in these countries.

By Testing Method Analysis

PCR-based Testing Method Accounted for the Largest Market Share Due to its Various Advantages

On the basis of testing method, the market is segmented into PCR-based, culture-based, and others. The PCR-based segment is projected to dominate the market with a share of 56.92% in 2026. The high sensitivity and efficiency of this type of testing is a major factor supporting the adoption of this method in the market. The rising technological advancements and focus of key players on developing and introducing new products using PCR-based technology are some of the other prominent factors anticipated to fuel the segment growth.

The culture-based segment is expected to grow at a comparatively lower CAGR during the forecast period. The use of this technology, owing to its lower cost as compared to other methods, is one of the major factors supporting its adoption, especially in emerging countries. However, the lack of sensitivity, higher turnaround time, and others are some of the factors anticipated to slow the segment growth during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Cell Culture Segment Leads Owing to Increased Number of Research Activities among Research Facilities

On the basis of application, the market is segmented into cell culture, vaccine testing, virus testing, and others. The cell culture segment will account for 37.36% market share in 2026. The dominance of the segment is due to the rising research activities among the research facilities. The growing concern regarding the rising contamination rate and awareness regarding the available kits and products for testing are crucial factors contributing to the growth of the segment.

The vaccine testing segment is expected to grow at a nominal CAGR during the forecast period owing to the increasing R&D activities among the biopharmaceutical companies to develop and introduce vaccines for various conditions. The COVID-19 pandemic also fueled the development of vaccines for various contagious conditions among the patient population, which is another major factor anticipated to support the growth of the segment.

- For instance, in June 2022, CSL completed constructing its new manufacturing facility in North Carolina to support the production of influenza vaccine.

The virus testing segment is expected to register the highest CAGR during the forecast period. The rising prevalence of outbreaks globally is resulting in increasing activities among manufacturers to conduct tests on viral cultures. These factors are expected to augment the growth of the segment.

By End-user Analysis

Biopharmaceutical & Biotechnology Companies Segment Dominated Owing to Growing Number of Research Activities

On the basis of end-user, the market is segmented into biopharmaceutical & biotechnology companies, cell banks, contract research organizations & contract manufacturing organizations, and others. The biopharmaceutical & biotechnology companies segment is projected to lead the market with a 32.99% share due to the rising number of research activities among these facilities. The increasing prevalence of chronic conditions and outbreaks of contagious diseases is another factor contributing to the growing research activities among these facilities globally.

- For instance, in July 2023, Pfizer Inc. partnered with Flagship Pioneering, Inc. with an aim to broaden its pipeline product portfolio of innovative medicines. The companies together are to invest a total of USD 100 million for research and development activities.

The Contract Research Organizations (CROs) & Contract Manufacturing Organizations (CMOs) segment is expected to register comparatively slower growth during the forecast period. The growing collaborations among the pharmaceutical and biotechnology companies with CROs and CMOs and outsourcing of research activities are major factors anticipated to fuel the segment growth.

The cell banks segment is expected to register the highest CAGR during the forecast period. The increasing number of cell banks that collect and store potential cells, including stem cells, among others, is a significant factor in augmenting the growth of the segment.

The others segment is expected to grow during the forecast period owing to the rising research activities among academic research institutes and other facilities.

REGIONAL INSIGHTS

Based on region, the market is divided into North America, Europe, Asia Pacific, and the rest of the world.

North America Mycoplasma Testing Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America mycoplasma testing market size was valued at USD 503.2 million in 2026 and dominated the market. The dominance is due to various factors, such as the increasing number of research activities among the facilities in the U.S. and other countries. The rising initiatives by the regulatory bodies, government, and other healthcare organizations in the countries to develop and introduce vaccines and drugs are another important factor contributing to the growth of the market in the region. The U.S. market is estimated to reach USD 459.6 million by 2026.

- For instance, in August 2023, the U.S. Department of Health and Human Services (HHS) awarded more than USD 1.4 billion for the Project NextGen to develop vaccines and therapeutics for COVID-19.

To know how our report can help streamline your business, Speak to Analyst

Europe market for mycoplasma testing is expected to grow at a minimal CAGR during the forecast period. One of the major factors driving the growth of this region is the rising R&D expenditure of biopharmaceutical companies and the expansion of manufacturing facilities. The UK market is estimated to reach USD 49.3 million by 2026, while the Germany market is estimated to reach USD 37.7 million by 2026.

- For instance, in June 2023, Novo Nordisk A/S planned to invest USD 1.85 billion for the expansion of its manufacturing facility in Denmark with the aim of broadening its product portfolio.

Asia Pacific market for mycoplasma testing is expected to register the highest CAGR during the forecast period. The increasing collaborations of major players with the regional players in China, India, and others to conduct research activities owing to economic factors is a major reason contributing to the growth of the region. The Japan market is estimated to reach USD 52.4 million by 2026, the China market is estimated to reach USD 42.3 million by 2026, and the India market is estimated to reach USD 37.8 million by 2026.

The market’s growth in the rest of the world is supported by the rising demand for therapeutic drugs and vaccines among the population, leading to the increasing focus of the market players on developing and introducing novel therapies.

KEY INDUSTRY PLAYERS

Players Focus to Develop and Introduce New Mycoplasma Testing Solutions to Hold a Major Share in the Market

The market is fragmented, with several players operating with various types of testing instruments and kits. Merck KGaA, Thermo Fisher Scientific Inc., Lonza, and F. Hoffmann-La Roche Ltd. are some of the major players in the market. The rising efforts of these players to develop and introduce novel products with technological advancements is one of the major reasons contributing to the growing share of these players.

Similarly, Sartorius AG and bioMérieux SA are some of the other major players operating in the market. The rising focus of these players on collaborating and acquiring other companies to broaden their product portfolio and their geographical presence is a major factor contributing to the growing share of these players.

- For instance, in July 2020, bioMérieux SA launched the BIOFIRE mycoplasma test for mycoplasma detection for use in the pharmaceutical industry.

List of Top Mycoplasma Testing Companies:

- Merck KGaA (Germany)

- Lonza (Switzerland)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Thermo Fisher Scientific Inc. (U.S.)

- Sartorius AG (Germany)

- bioMérieux SA (France)

- Asahi Kasei Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- April 2025 – Establishment of Asahi Kasei Life Science

The company commenced operations of Asahi Kasei Life Science, aiming to provide innovative solutions in the life sciences sector.

REPORT COVERAGE

The report provides a detailed market analysis. It focuses on key aspects, such as market overview, market segmentation and its analysis, product, testing method, application, end-user, competitive landscape of the key players, and the comparative analysis of the average prices of products. Besides this, it offers insights into market dynamics, trends, and highlights key industry developments. The report further includes a COVID-19 impact analysis on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.40% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Testing Method

|

|

By Product

|

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market is projected to grow from USD 1,021.10 million in 2026 to USD 1,551.70 million by 2034.

The market is expected to exhibit steady growth at a CAGR of 5.40% during the forecast period (2026-2034).

By testing method, the PCR-based segment dominated the market in 2026.

North America stood at USD 477.9 million in 2025.

The increasing prevalence of chronic conditions, rising demand for vaccines and drugs, and the growing R&D activities among research facilities are some of the major factors driving market growth.

Merck KGaA, Lonza, F. Hoffmann-La Roche Ltd. are some of the top players in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us